SAF-T Gap Analysis

Easier Submission?

Norway's SAF-T reporting standard, which aimed to streamline accounting data provision and simplify data requests and transfers for companies conforming to national accounting standards, was launched on January 1st, 2020. Despite its implementation over three years ago, businesses are still incurring penalties for failing to comply with the regulations.

What?

The SAF-T-format is based on the standard Norwegian chart of accounts and requires that accounts must be mapped to the standard Norwegian account chart. The file should contain the data based on the underlying ERP-system, no more or less.

Who?

From January 1. 2020 tax payers are responsible for ensuring that the accounting data is delivered in the correct format upon request by the tax authorities, usually with a two week notice.

How?

The file is supposed to contain information such as General Ledger Data, Chart of Accounts, Customer Data, VAT Data, Analysis Data and Tax payer Data.

Common Mistakes

Even firms that have adopted Norway's SAF-T reporting standard are facing queries and challenges when the file request and upload procedures fail to meet expectations. The most frequent errors observed include:

- Outdated chart of accounts or tax code application, leading to missing account mappings, erroneous assessments, or comments from tax authorities.

- Ad-hoc solutions, usually Excel-based, that can cause delays in the typical two-week timeline from audit request to submission.

- Complex ERP systems that require all reportable data to be included in the files, but subledger data kept in a separate system is often excluded or not reconciled correctly, resulting in questions and fines.

- Failure to comply with Norway's accounting regulations, which demand that companies keep their Norwegian accounting in a separate ledger or number circle, which should reconcile with their local financial statement. Companies often disregard this rule when only a few transactions are posted within an entity that relate to Norway, resulting in reporting all transactions, even those not relevant to Norway, when the SAF-T request is raised.

- Manual out-of-system adjustments causing discrepancies between the data in the SAF-T file and the submitted returns for the period.

How to implement?

Over 200 clients have received support from KPMG regarding SAF-T, for which three implementation approaches were identified: ERP native solution, SAF-T as a Service, and manual file preparation.

The optimal approach and implementation method depend on several factors, such as source system accessibility and the number of postings.

Native SAF-T-solution

Various ERP-systems can create SAF-T-reports complient with set requirements.

Manual Data Preparation

KPMG offers a standardized SAF-T-Exceltemplate containing all the required information to populate the file.

SAF-T as a Service

For complex IT-landscapes, KPMG offer to perform all steps from data extraction to file creation for our clients.

How to ensure compliance?

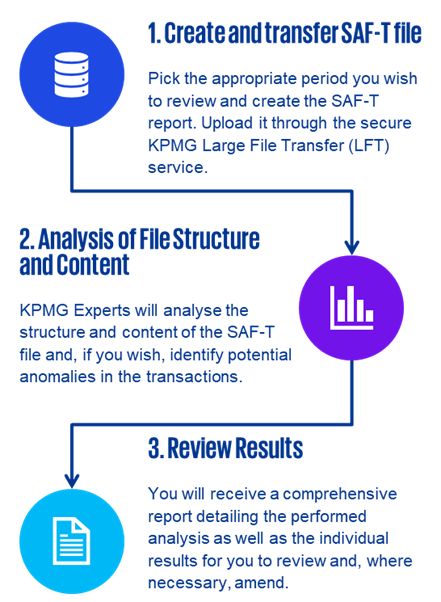

A validation tool on the Tax Authority website tests the general submission ability of a file, but only confirms its structural compliance, not its internal reconciliation or mapping adherence. For our clients and others seeking file compliance assurance, KPMG's SAF-T Gap Analysis allows for the investigation of both structural and content requirements.

1. File Structure

- XML elements adhere to tax authorities requirements

- File encoding matches expectations

2. Reconciliation

- Informatin within the files matches (items vs totals)

- Individual SAF-T-files match to each other

3. Mapping

- Application of correct mapping standards for both accounts and tax codes

4. Transactions

- Application og subledger links

- Application of tax codes on tax bases

Beyond SAF-T Gap Analysis

The SAF-T Enhanced VAT Health Check provides more profound insights into the SAF-T file and its contents beyond the standard consistency checks. This tool utilizes automatic analytics to reconcile VAT returns and SAF-T information, uncovering potential underclaimed VAT recoveries and identifying potential compliance risks in VAT code application.

Moreover, the file format can also provide insights into a company's performance, for example with working capital, liquidity of supplier analytics.

Contact Us

If you have any questions related to the file format, feel free to reach out to the KPMG team. We are happy to help!

Jan Ove Fredlund

Partner | Advokat

KPMG Law Advokatfirma AS

Jo Sigurd Pedersen

Partner | KPMG Lighthouse

KPMG in Norway