Mongolia Tax Newsletter | 21 June 2023

Home › Mongolia Tax Newsletter › Mongolia Tax Newsletter | 21 June 2023

Welcome to our June tax newsletter which we hope keep you updated on the recent regulation changes and other important updates. Should you have any questions as to how these changes may impact you or your business, then please get in touch.

Amendments to the Investment Law of Mongolia

Originally constituted in 1993, the Investment Law of Mongolia underwent major updates in 2013. It has been 10 years since the last change and with the extensive changes in economy the law is being amended again with substantial updates. The draft proposal of a newest amended version of the law introduces the following major updates:

- Elimination of prohibitions and restrictions in relation to investment activities;

- Review of the issues of the investment sections related to the Land Law;

- Provision of legal framework for investment protection such as involvement of international arbitration in investment disputes;

- Clear roles or responsibilities of the government agencies;

- Elimination of duplicated government audits and monitoring programs;

- Avoidance of investment discrimination in terms of tax obligations; and

- Developing simplified procedures for immigration permits and visas

With the introduction of the newly amended Law on Investment, the following laws would be affected and amended:

- Law on State Registration of Legal Entities of Mongolia;

- Land law of Mongolia;

- Corporate Income Tax law of Mongolia;

- Stamp Duty law of Mongolia;

- Law on Nuclear Energy of Mongolia;

- Law on State Inspection of Mongolia;

- Law on Legal Status of Foreign Nationals of Mongolia;

- Law on Infringement;

- Law on Licensing of Mongolia;

- Law on Audit of Mongolia;

- Law on Asset Valuation of Mongolia;

- Law on Environmental Impact Assessment of Mongolia;

Law on Water of Mongolia; and

- Law on Natural Plants of Mongolia.

Ministry of Ecnomy and Development (MED) is currently requesting investors to submit their comments and recommendations to the draft proposal of the Law on Investment. To review revisions and submit your comments, please follow this link.

Amendment to the Law on Corporate Income Tax

The amendment proposal to the CIT Law in connection with thermal and electric power production has been submitted to the Parliament of Mongolia on 1 June 2023. In the proposal as per Parliament website it states that income from manufacturing primary and auxiliary equipment or machinery that produces a 1.5 megawatt or more thermal power and/or 5 megawatt or more electric power shall receive a tax credit of 90% until 31 December 2029. KPMG shall share an update as soon as this change is approved.

Personal Income Tax Reporting

Individual ID number for tax reporting

Since March 2023, the Mongolian Tax Authority (MTA) has initiated the system integration with the Immigration Agency and PIT reporting now requires a 13-digit ID code for both Mongolian nationals and expatriates to ensure data privacy. This code can be found on the following documents and platforms:

- For the expatriates, this code (which contains the alphabet and numbers) is to obtained at the Immigration when the residence permit is issued. The ID code to be issued on the permit card;

- Alternatively, the 13-digit ID code also can be found on the top left corner of the Ebarimt mobile application;

- For Mongolian nationals, the code is revealed after scanning the QR code on their National IDs; and

- The 13-digit code is also available on the E-Mongolia system or the Immigration website.

Therefore, for the PIT reporting purposes the previously used Taxpayer numbers are no longer in use and the tax returns are submitted only using the 13-digit unique ID codes. However please also note that the system is still in the implementation and transition stage and please expect certain issues including being unable to identify the individual with the ID code or a tax certificate is not being accurately issued in the individual’s E-tax account with this new ID code.

Law on Mining Products Exchange

The Law on Mining Products Exchange was approved by Parliament in December 2022 as a means to organize fair, open and transparent mining trade in Mongolia. The law shall help to establish fair market prices by regulating exports and to increase investment in the mining sector through integrated policies. The newly passed law shall come into effect on 1 July 2023. In this respect, a joint working group of related agencies and institutions has been set up at the Mongolian Stock Exchange to undertake preparatory work. This working group is responsible for:

- registration and trading of mining products and derivative financial instruments based on them;

- creation of transport, warehouse and laboratory accreditation system;

- development of draft regulations following the law to clearly rule the issues such as settlement of payments etc.;

- ensuring the readiness of trading and clearing systems;

- creating a quality control system.

Upon enforcement of the Law on Mining Products Exchange, the export of mineral products will become more transparent, and as a result, the number of buyers would increase, enabling market prices to be set fair on the principle of competition.

Immigration Updates

Reference available for Resident permit of foreign nationals

Electronic reference for Resident permits is now available on the Immigration Authority website. With the passport number and nationality information of the individuals, their resident permit can be electronically obtained. Although an electronic resident permit is valid to present within the country, the original resident card is required to exit and enter the border.

As you all know by now, a unique 13-digit ID code is provided by Immigration upon obtaining a residence permit which is the ID number that foreign nationals shall use when receiving services from Authorities. Starting from 1 April 2023, this 13-digit ID code is issued on the residence permit card. Those who obtained the resident card before 1 April 2023 do not have to apply for a replacement new card unless the foreign nationals wish to do so.

Please visit the Immigration website for this news in the Mongolian language.

E-balance platform change

Kindly note that the E-balance platform is changed to https://ebalance.mof.gov.mn/ for the 2023 Financial statements.

In connection with this change, in order to access the lodgment platform only the individual who is registered as an Executive Director (i.e. CEO) with the State registration office is able to sign-up. Once the Executive Director logged-in the E-balance, he/she can grant access to other authorized individuals such as Chief accountants and Finance managers.

As second quarter of 2023 lodgment deadline is approaching, we would like to advise you to check and sort out the company access in the new E-balance at your earliest convenient time in order to ensure smooth lodgment in July 2023. Especially if the Executive Director of your company is a foreign national who is based outside of Mongolia, please bear in mind that it may take time to get the individual signed up in the new portal.

MTA system digitalization

In the last couple of years, most of the services provided by the MTA became digitalized and taxpayers could receive all necessary tax services electronically in a much easier and more convenient way. Today, with the implementation of the “E-Mongolia” integrated system, “e-immigration” system, and electronic system of social insurance, the administration matters such as registering to the system, paying taxes and social contributions, receiving tax and social insurance related services are becoming easier than ever for all taxpayers, local and foreign alike. The tax systems have improved significantly since their introduction, morphing into a single integrated system and enabling taxpayers to effortlessly switch through each system.

Risk assessment and Tax audit

Starting this month, the tax risk assessment and tax scoring feature becomes available for the taxpayers in their E-tax platform, and entities are now able to review their risk level which previously was not disclosed and shared with the taxpayers.

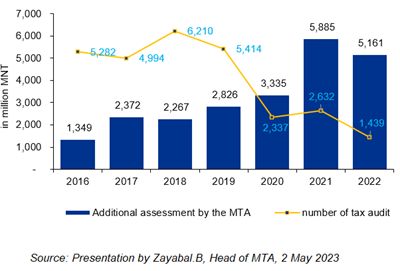

In a recent presentation by Mr. Zayabal, Head of MTA at the annual meeting of the tax advisory firms, it was mentioned that since the introduction of the risk assessment approach of tax audit in 2020, the number of tax audits has been dramatically reduced while additional assessment during tax audits has been increased by over 50%. Mr. Zayabal was commenting that the undergoing digital transformation enables the MTA to efficiently monitor tax compliance and risk levels of the taxpayers.