ESG due diligence analyses the current state of a company, particularly with regard to its environmental and social impact, as well as the quality of its corporate governance. ESG DD is therefore an important component of both the "sell-side" and the "buy-side" in transactions.

ESG Due Diligence

Conducting objective ESG due diligence is relevant for all parties involved in a transaction in order to create transparency, identify risks and opportunities and initiate sustainable transformation processes that are of great importance to both companies and investors.

- Objective: ESG due diligence focusses on the status quo of a company. The aim of ESG (vendor) due diligence is to focus on the risks and at the same time highlight the opportunities and value drivers of the transaction object that may be relevant for sellers and buyers.

- Risks and opportunities: The early identification of risks and opportunities is already crucial in the first phase and for the successful continuation of a transaction. When conducting ESG due diligence, international and national regulations and standards in particular play an important role in determining the basis for analysing a company's ESG performance. The relevant ESG issues for companies depend on the industry and sector as well as the products, services and locations.

Elements of ESG Due Diligence

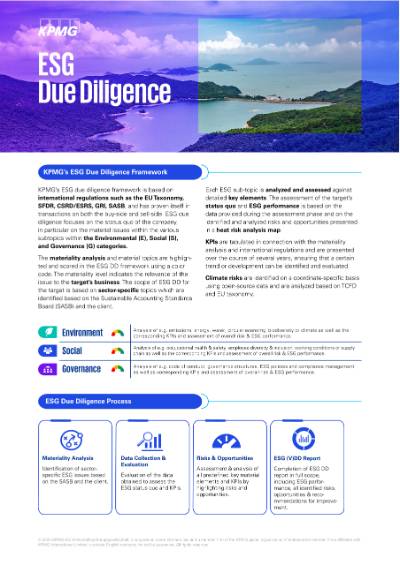

Conducting ESG due diligence not only includes qualitative analysis and presentation, but also the consideration of important KPIs of a potential target company in the transaction business, which are essential for corporate and financial investors or private equity (PE) firms. The most important key performance indicators (KPIs) or principal adverse impact indicators (PAIs) are based on the applicable regulations, such as the CSRD, EU taxonomy or Sustainable Finance Disclosure Regulation (SFDR). In addition, analysing climate protection and climate adaptation in connection with the Task Force on Climate-Related Financial Disclosures (TCFD) and the EU Taxonomy is one of the most important elements of ESG due diligence.

Valuable Insights from the ESG Due Diligence Study

We asked around 150 experts and consultants what role ESG already plays for a company as part of due diligence and what future trends they expect. We have summarised the results in the publication "2022 EMA ESG Due Diligence Study". Further information is available in the dashboard and in the webinar.

In the following publication, we have compiled the worldwide results from the global ESG due diligence study 2024.

Sebastian Pöhler

Partner, ESG Due Diligence, Deal Advisory

KPMG AG Wirtschaftsprüfungsgesellschaft

Elsa Stetinger

Senior Manager, ESG Due Diligence, Deal Advisory

KPMG AG Wirtschaftsprüfungsgesellschaft

Our ESG due diligence for your company or next transaction project

The integrated ESG due diligence framework created by KPMG serves to support private equity firms and companies in the transaction context and supports the sustainable development of ESG profiles of portfolio companies through the recurring ESG assessment. The framework includes both the assessment of the legally required qualitative requirements and the recording of the legally required quantitative KPIs and PAIs.

The robust and flexible ESG DD framework offers the possibility to assess and present a company in a transparent and holistic manner, while at the same time providing a clear framework for both a high-level and a deep-dive ESG due diligence assessment.

Your advantages at a glance

- Identification of ESG risks and opportunities: The early identification of ESG risks and opportunities in buying and selling processes makes it possible to take targeted measures to optimise key value factors and identify potential for value creation.

- Risk minimisation: Mitigation and minimisation of legal, financial and reputational risks identified in connection with ESG factors within the company, suppliers and partners.

- Fulfilment of requirements: Identification of the requirements to be fulfilled and complied with by investors or companies and their suppliers and partners that are subject to increasing ESG regulations and are increasingly influenced by ESG factors.

- Creation of transparency: Creating or increasing transparency by disclosing the necessary ESG key figures and implemented measures.

- Improved decision-making: Informed decision-making through a comprehensive assessment of a company's ESG performance and in the selection of suppliers and partners.

- Improved reputation: Improved image of a company through visible initiatives with ESG factors and commitment to sustainability.

- Increased value creation: Identifying opportunities and value creation potential of ESG factors, designing sustainable value creation approaches and increasing the value creation of companies. Ensuring ESG standards among suppliers and partners in order to minimise risks in the supply chain.

- Increase the chance of a deal: ESG due diligence can help make transactions easier and more likely to close.