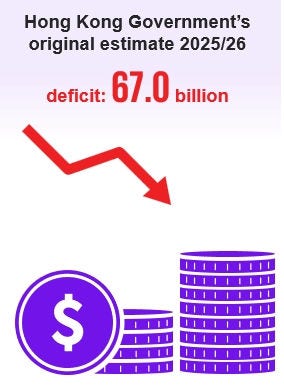

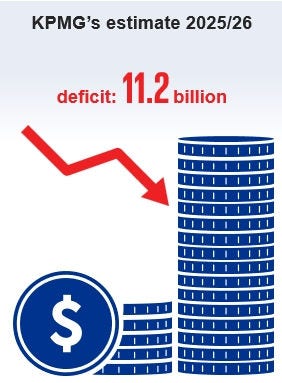

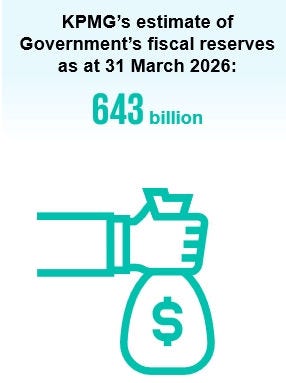

In Hong Kong dollars

Narrowed deficit compared to the original Government estimate

KPMG's proposed new measures for 2026-2027 Budget

Capitalise on the National 15th Five-Year Plan and strengthen Hong Kong as an international financial, shipping, trade and innovation and technology centre

- Attract more family offices to set up in Hong Kong – enhance the existing tax incentive regime for family offices, expanding their eligible investment scope to include digital assets and precious metals, to be attractive and effective

- Promote family offices to manage assets in Hong Kong - provide stamp duty exemption for asset transfers from high net worth individuals to their family-owned investment holding vehicles

- Support key industries – Revisit existing tax incentives for corporate treasury centre, aircraft / ship leasing and maritime services to ensure Hong Kong enterprises enjoying such tax incentives will remain competitive under BEPS 2.0 Pillar 2

- Encourage innovation and R&D activities – Expand the coverage of R&D tax deduction to include R&D activities outsourced to a Hong Kong company and performed in Hong Kong to encourage R&D activities

Strengthen Hong Kong's role as a “super connector” and attract multinational corporations and Chinese Mainland companies expanding overseas

- Reduce the costs of financing – revisit the existing stringent interest expense deduction rules to be more competitive compared to other jurisdictions

- Align with international practices – Consider introducing a withholding tax on interest income paid by non-financial institutions to non-Hong Kong residents to align with global tax standards

- Market Hong Kong as the ideal base for regional headquarters – Provide substance-based tax incentive (for example, an 8.25% preferential tax rate) for qualified profits derived from regional headquarters in Hong Kong to enhance Hong Kong's competitiveness in the Asia-Pacific region and attract foreign investment and create local job opportunities

- Enhance global competitiveness and attract multinational corporations – Revisit the tax relief available for overseas tax paid in jurisdictions with and without a double tax treaty with Hong Kong

- Promote the development of NM – Provide special policy package to the key enterprises located in NM, including but not limited to tax incentives and talent matching to promote comprehensive development

- Encourage fixed asset investment in NM – Provide accelerated tax depreciation for fixed assets located and used in NM

- Flexibly adopt public-private partnership approaches – Explore public-private partnership approaches such as joint ventures, build-operate-transfer to leverage combined expertise and share risks and costs in the development of NM

- Develop emerging industries – Develop a cross-border drone logistic network: Select pilot routes and areas to establish a cross-border low-altitude logistics network for creating new business opportunities and high-value jobs for the logistics industry

- Provide certainty and clarity on taxation of virtual assets market – Work with the industry players and tax profession to modernise the tax rules and provide greater clarity / certainty on taxation of virtual assets

- Support the development of virtual assets market – The Hong Kong SAR Government to identify suitable real world assets (RWA) (e.g. public infrastructure, commodities) and undertake a pilot RWA tokenisation project in Hong Kong

- Provide tax incentives – Introduce a general tax deduction for expenditure incurred on acquisition of intangible assets and allow a tax deduction where the intangible asset is acquired from related parties

- Foster talent and expertise – attract talents to Hong Kong to provide IP related professional services, and cultivate local expertise in IP management

- Ease the caretaking burden of working families – Provide working parents with an allowance of HK$60,000 who look after children aged 16 or below or disabled dependents through grandparents, or who employ domestic helpers through recognised institutions

- Address changing demographics and reduce financial burden of working families – Extend dependent parent and dependent grandparent allowances to eligible Hong Kong elderly who reside in the GBA

- Keep pace with the times – Adjust Salaries Tax rate bands and allowances with reference to consumer price index

- Support homebuyers – Increase the basic deduction for home loan interest from HK$100,000 to HK$120,000 per year of assessment

- Encourage charitable activities – Expanding the current tax rules regarding the deductibility of charitable donations to non-cash donation (e.g. donation of food)

- Relief for citizens and business – 100% Tax rebate capped at HK$6,000 for Profits Tax, Salaries Tax and tax under Personal Assessment

- Enhance competitiveness – Increase the cap of the Continuing Education Fund from HK$25,000 to HK$30,000, providing support for professional development and retraining for employees

- Allow the use of MPF for first home purchases – Under certain conditions, allow the use of part of MPF as a down payment for purchasing first home, providing more options for home purchase and retirement financial planning