KPMG International conducted a global survey of over 200 bank executives, supported by extensive benchmarking and 1–1 interviews with executives who are leading the next wave of strategic investments. This research brings to light some of the key challenges and drivers of success. Following the survey, we created the report Beyond savings: Strategic cost optimization for the modern bank. This report has been compiled globally by KPMG professionals who are working side by side with transformation teams in many banks.

Are banks focusing on the right metrics for sustainable cost improvements?

Their key insights are explored throughout this report with deeper dives into several functional and thematic areas, including:

Enterprise alignment on strategy — an enduring strategic North Star that is cascaded from the top down to drive alignment, and from the bottom up to build commitment to targeted metrics that are real drivers of efficiency.

Cultural reinforcement of value and efficiency — breaking big aspirations into achievable accountabilities and creating a ’if this was your own money’ mindset that enables supporting divisions, functions and individuals to ‘engineer’ solutions that drive maximum value and efficiency.

Enterprise agility and executive problem solving — even when there is a detailed strategy, things happen. Management’s ability to see around corners, react swiftly and problem solve to reach the ultimate goal of the North Star is critical — even if external factors may change the route over time.

Adopting a cost-culture mindset

In the KPMG Banking cost transformation survey, 82 percent of respondents identified deep cultural challenges in achieving sustainable cost reductions, despite significant technology investments. Most banks aim to reduce costs, but their cost-reduction objectives often do not align with their broader ambitions, and a cost-culture mindset is not embedded throughout the organisation.

Cost transformation in banks does not always permeate the entire organisation, even when executives are compensated for meeting cost objectives. Some banks have implemented horizontal and vertical cost structures to align business needs with spending. Executives responsible for a vertical, such as retail banking, are also responsible for its associated costs.

Get ready for the next wave of cost transformation

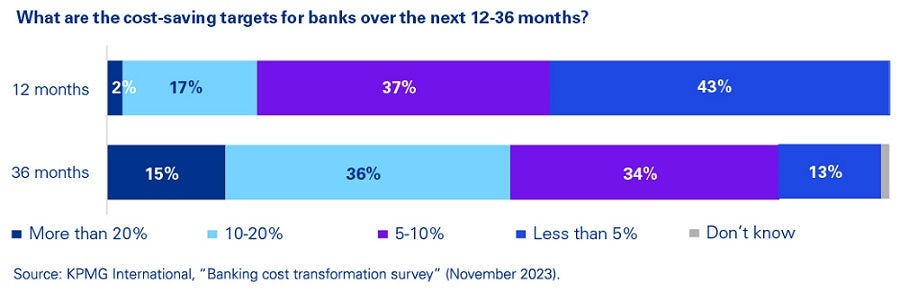

The KPMG Banking cost transformation survey showed that despite recent improvements in CIR, there is a clear need to deliver additional value — and at a greater pace — in the next wave of cost transformation investments. Research suggests that this will be in the region of 10 percent in cost efficiencies over the next 12 months and as high as 20-30 percent over the next three years. Set against an inflationary headwind, these will be significant targets to achieve.

Based on the foundational work that many banks have already put in place, leaders are more confident about where the costs sit. Eighty-six percent of bank executives feel they have strong cost-base mapping in place, with three out of four believing they have the right incentives in place for leaders to achieve their targets.

In KPMG professionals’ experience working with bank executives, many examples point to the impact of these executives’ investments on the operating expenses of contact centers and branches that shift to digital channels, the front-to-back digitisation of core value streams such as personal lending and mortgages, and the consolidation of functions to drive scale. However, unanticipated headwinds, changes in customer demands and the challenges of stopping to do certain things means that all too often the gains made are reversed as other costs are added.

As banks look at the next wave of cost transformation investments, the themes are consistent as the strategy begins to extend beyond traditional frontline functions into the FTE base in corporate-headquartered departments and functions such as Finance, Risk and Compliance and Marketing.

How KPMG can help

KPMG has developed a 12-lever model that sits alongside Value Analysis/Value Engineering thinking and provides banks with an opportunity to consider their options for increasing value and reducing the cost to serve. With most banks endeavoring to drive value with one or more of the levers, it continues to maintain its relevance.

The broad learnings gained from KPMG professionals’ experience with banks and other financial services organisations leads to three steps for banks to consider in developing their cost transformation strategies and assessing, funding and executing the supporting business cases.

- Value and cost are the primary objectives. In some banks, there is more investment in contact centers or relationship managers to drive differentiated service and increase market share. When tied with AI supported co-pilots, this can be a powerful resource for banks to invest in.

- Design the cultural mechanisms that will have the biggest impact for your organisation. For some, this can be top-down cost boards and cost management units tied to zero-based budgeting concepts. For others, more value may be achieved through a Hoshin Kanri-style concept to fully align your organisation around the highest-impact investments.

- Measure the real costs that exist across entire value chains and the options you have to deploy the 12 levers in a way that will move the value equation in the right direction vs. just cutting costs, leaving the functional elements underdeveloped and finding that costs begin to creep back into the business over time.

KPMG firms have an international team of cost transformation professionals who have worked with the world’s leading global, regional and local banks. We can help assess potential earnings improvements, define functional cost-saving strategies and develop an execution plan tailored to your organisation.

Related content

Our People

Antony Ruddenklau

Partner, Head of Financial Services, Global Head of Fintech and Innovation, Financial Services, KPMG International and Head of Payments, Asia Pacific

KPMG in Singapore