Digital assets have exploded in recent years and evolved into an alternative asset class, with a market capitalisation of more than US$1 trillion.

The huge growth has attracted mainstream attention, with institutional investors entering the space. Family offices (FOs) and high-net worth individuals (HNWIs) have also moved into the digital asset sphere. Yet, volatility in the market continues to be a feature with significant crypto gains — and losses — dominating headlines. With the global regulatory landscape still catching up with the rapid development of the sector, there remains uncertainty around how digital assets will be treated.

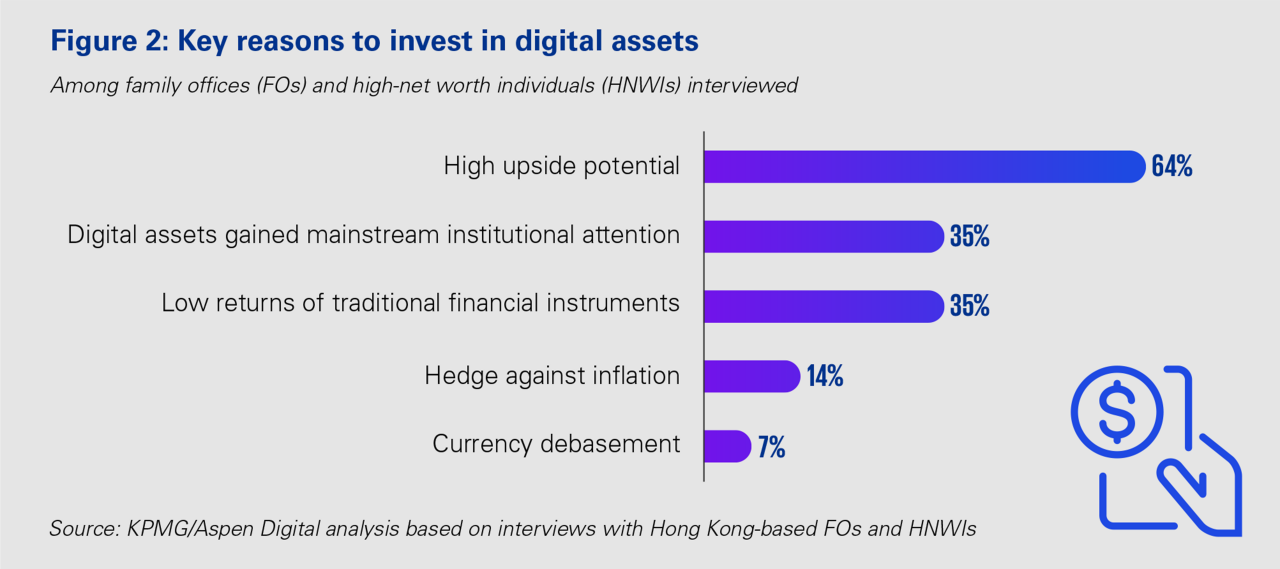

What are the key opportunities and challenges facing FOs and HNWIs in the digital assets ecosystem? To better understand the landscape, KPMG in China and Aspen Digital have joined forces to gain insights into their current activity in the market and plans for future investment.

Their report, Investing in digital assets, provides an in-depth look at where and how FOs and HNWIs in Hong Kong and Singapore are investing, the key drivers behind their choices, as well as the main challenges they see to investing in the sector. It also explores the key tax and regulatory concerns of investors around digital assets.