What impact may this have on your business?

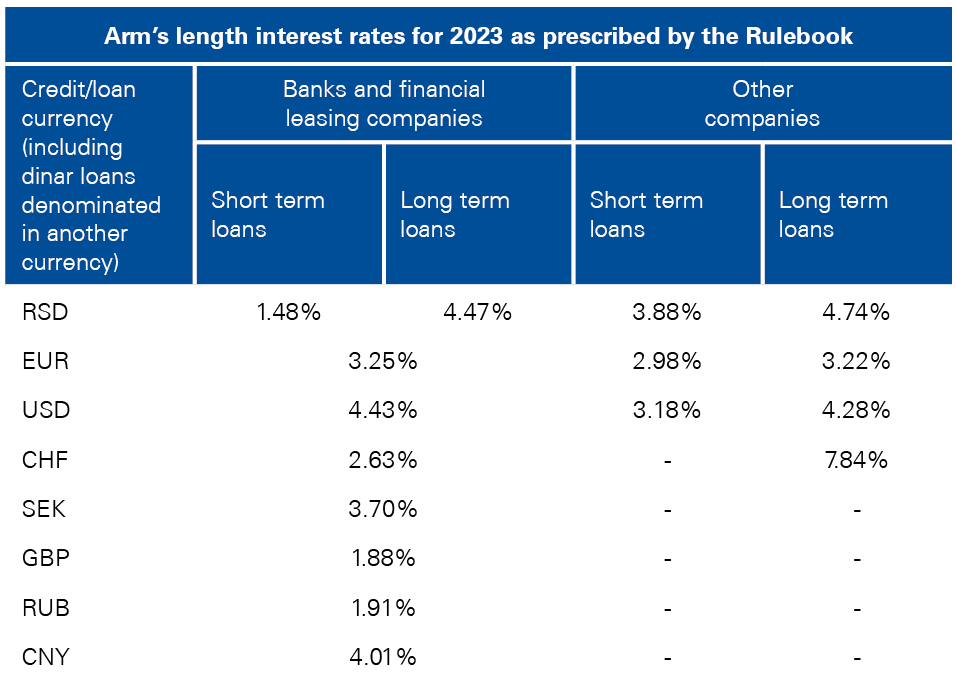

In general, increasing trend of interest rates when compared to 2022 is present according to the Rulebook, which is in line with the increasing average borrowing costs in the economy.

It is necessary to review if new interest rates for 2023 are aligned with interest rates currently applied in your related party financial instruments. In addition, companies exposed to significant / long-term related party financing should consider applying general OECD based methods for assessment of arm’s length interest as prescribed by the CIT Law, as such approach may be more beneficial and provide increased level of certainty in relation to future tax treatment.

Impact of the Rulebook on the application of beneficial withholding tax rates on interest in accordance with double tax treaties requires detailed review.