At its session held on 17 December 2020, Serbian Parliament adopted the Law on Amendments to the Law on Excise Duties (Law). The Law is published in the Official Gazette of the Republic of Serbia no. 153 dated 21 December 2020.

The Law enters into force on 29 December 2020 and is applicable as of 1 January 2021, unless explicitly prescribed otherwise for particular provisions.

Important amendments are presented below.

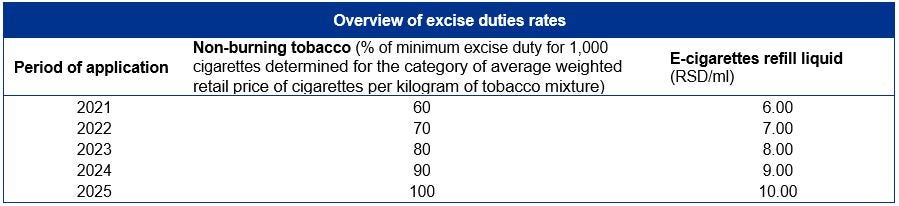

Increase of excise duties on non-burning tobacco and e-cigarettes refill liquid

Starting from 1 January 2021 excise duties on non-burning tobacco and on e-cigarettes refill liquid will be increased as presented in the table below:

Increase of excise duties on cigarettes

Starting from 1 January 2021 until 30 June 2021, instead of the current 75.25 RSD/pack, excise duty will be calculated in the amount of 76.75 RSD/pack.

Excise duties will increase by 1.5 RSD/pack each subsequent six months until 1 July 2025, when the excise duties on cigarettes will amount 90.25 RSD/pack.

Extension of excise refund right

The Law prescribes refund right for paid excise to:

- buyer of confiscated excise goods that are exported and obtained in Serbia from authorized legal entity,

- buyer of excise goods that are exported and confiscated in audit or forced collection procedure and which are obtained in Serbia from authorized entity,

- buyer of excise goods that are exported and obtained in Serbia from entity which is selling the excise goods procured in accordance with legislation and is recorded in business books.

The KPMG team is at your disposal for all your questions in respect to application of the Law.

Amendments to the Law on Excise Duties adopted

Download and save the PDF version of this Tax Alert

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Tax Alerts

Our regular newsletter provides you with updates on the latest changes of tax and accounting regulations as soon as a new rule is being approved.