The Serbian Parliament adopted the Law on Amendments to the Law on Excise Duties which was published in the Official Gazette of the Republic of Serbia no. 103 on 14 December 2015.

Law on Amendments to the Law on Excise Duties (hereinafter: the Law) went into effect on 22 December 2015, and is to be applied starting on 1 January 2016.

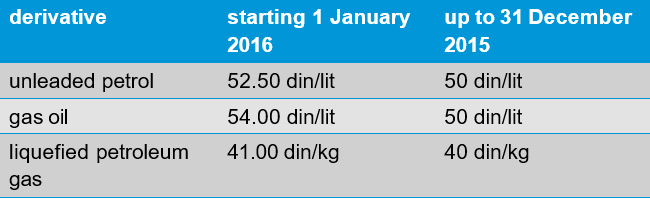

Oil derivatives

Starting as of 1 January 2016 new, higher excise duties are applicable to oil derivatives:

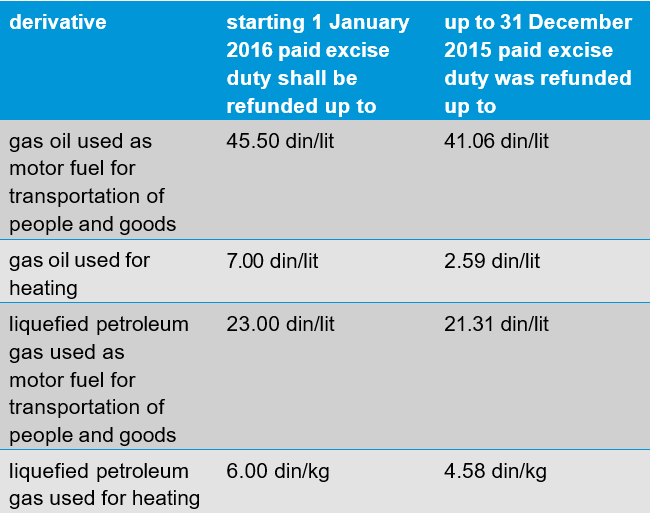

Also, on 1 January 2016 new amounts are applicable for refund of excise duties paid by the end customer for oil derivatives:

Refund of excise duty paid on gas oil used as motor fuel for freight ships in domestic river transport is cancelled.

The exemption from payment of excise duty on oil derivatives is extended up to 31 December 2016 for:

- liquefied petroleum gas (tariff codes for nomenclature CT: 2711 12 11 00 do 2711 19 00 00) and other oil derivatives produced from oil fractions with a distillation range up to 380°C (tariff codes for nomenclature CT: 2710 12 11 00, 2710 12 15 00, 2710 12 21 00, 2710 12 25 00, 2710 12 90 00, 2710 19 11 00, 2710 19 15 00, 2710 19 29 00, 2710 19 31 00, 2710 19 35 00, 2710 19 99 00, 2710 20 90 19 and 2710 20 90 99), which are used as raw materials and fuel in fraction distillation processes for further polymerization, steam cracking and butadiene extraction, as well as products which are generated from the fraction distillation process for further polymerization, steam cracking, butadiene extraction and production of MTBE (Methyl Tertiary Butyl Ether);

- liquefied petroleum gas for light liquefied hydrocarbons from the tariff code nomenclature CT: 2711 19 00 00 when they are used as raw materials in the production of liquefied petroleum gas and primary benzene in separation processes.

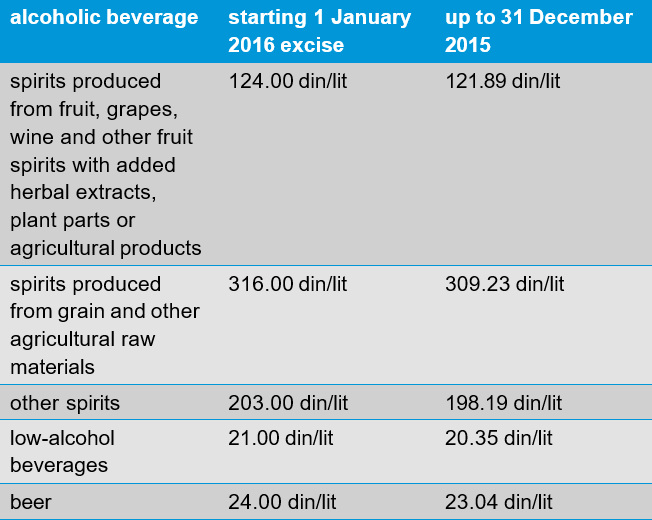

Alcoholic beverages

The law defines low alcohol beverages as beverages which have alcohol content above 1.2% and at most 15%, which are produced from fruit juices or refreshing non-alcoholic beverages, with addition of refined ethyl alcohol or alcohol beverages or herbal extracts or alcohol beverages produced through fermentation (wine, apple cider, perry, etc.), where the quality of fruit juices, refreshing non-alcoholic beverages, refined ethyl alcohol, alcoholic beverages, wine and alcoholic beverages produced through fermentation must be compliant with regulations that relate to their quality. Accordingly, the range of non-alcoholic beverages which are subject to excise duty has been expanded.

Starting as of 1 January 2016 excise duty on alcoholic beverages is payable as follows:

Producers of low-alcohol beverages who as at 31 December 2015 have in stock produced low-alcohol beverages which have an alcohol content above 1.2% and at most up to 5%, are required to perform a stock count and to submit stock count lists to the Tax Authority by 15 January 2015. Starting as of 1 January 2016 these producers are required to submit to the Tax Authority information about their stocks on the last day in the month for each month, until such stocks are exhausted.

Such low-alcohol beverages are not marked with excise duty stamps.

Electricity

The Law specifies that the base for calculation of excise duty on electrical energy should include costs which are not dependent on electricity consumption and the fee for privileged electricity producers.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Tax Alerts

Our regular newsletter provides you with updates on the latest changes of tax and accounting regulations as soon as a new rule is being approved.