The number of effective double taxation treaties between Serbia and other countries has not been changed in relation to the previous year.

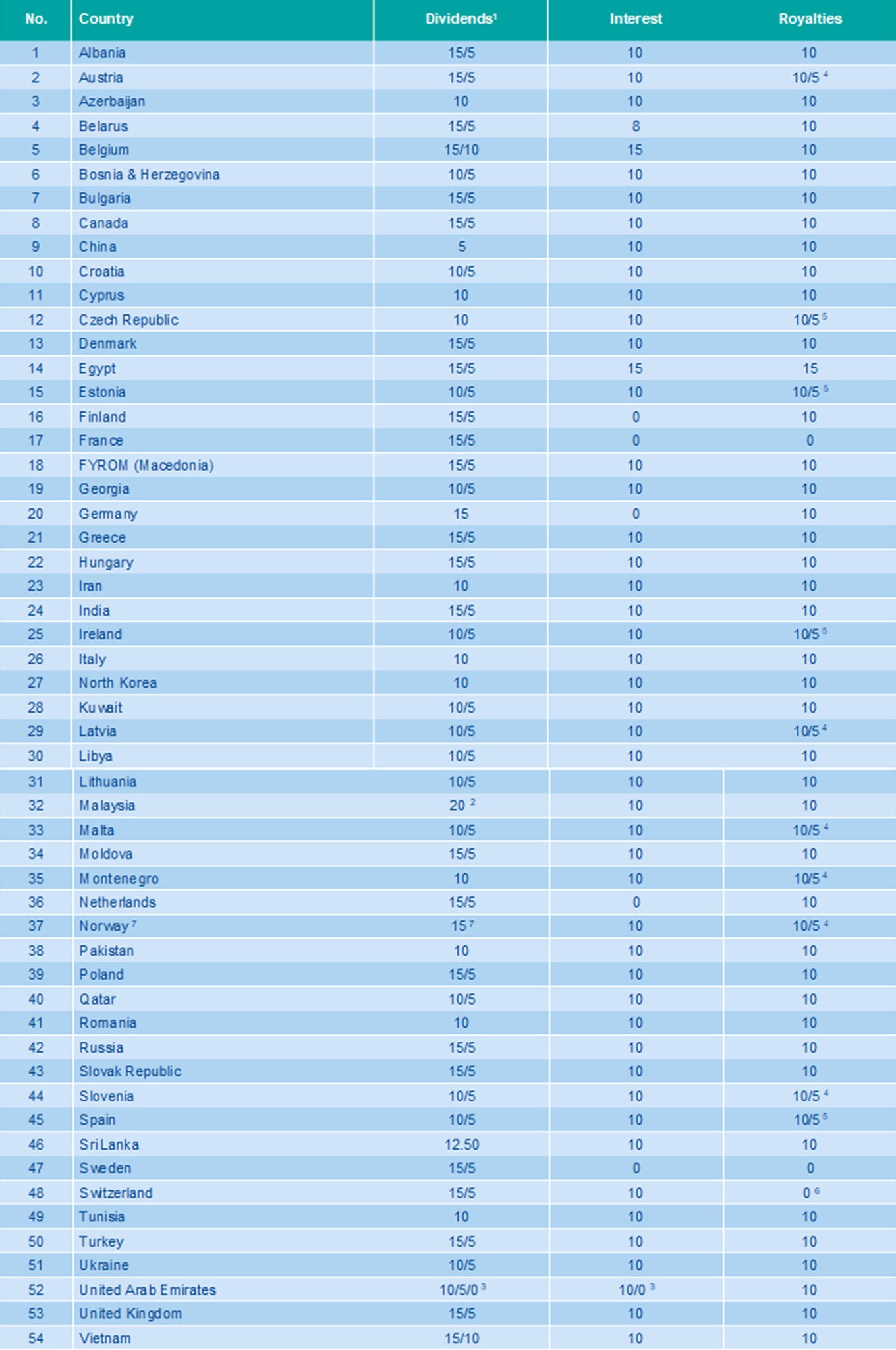

The list of 54 double taxation treaties of Serbia effective as at 1 January 2016 is presented below. Please note that the DTT with Norway has been replaced by a new DTT providing different tax rates.

- If the recipient company holds at least 25% (20% in DTT with Switzerland, 5% in DTT with UAE) of the paying company, the lower of the two rates shown applies.

- 10% rate applies if payer is resident of Malaysia, 20% if resident of Serbia.

- 0% rate will apply if paid to the government of the contracting state (or political subdivisions or local authorities). In the case of payment of dividends by Serbian tax residents to tax residents of the United Arab Emirates, the Protocol provides specific list of entities to which 0% rate on dividends is applicable.

- For the use of, or the right to use, any copyrights of literary, artistic or scientific work, including cinematography films, films and tapes for television and radio, the tax shall not exceed 5% of the gross amount of the royalties.

- For the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process, or for the use of, or the right to use, industrial, commercial or scientific equipment or for information concerning industrial, commercial or scientific experience, the tax shall not exceed 10% of the gross amount of the royalties.

For the use of, or the right to use, any copyright of literary, artistic or scientific work except for computer software and including cinematography films or films or tapes used for radio or television broadcasting, the tax shall not exceed 5% of the gross amount of the royalties.

For the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process and computer software, or for the use of, or the right to use, industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience, the tax shall not exceed 10% of the gross amount of the royalties. - Provided by the Protocol to the treaty between Serbia and Switzerland. Valid until Switzerland imposes withholding tax on royalties.

- Provided by the original version of DTT between Serbia and Norway text in English language. Namely, in article 10, paragraph 2, point 2 of the Serbian translation of DTT, adopted on 17 June 2015 by the Assembly of the Republic of Serbia, instead of having the 10% tax rate on gross amount of dividends, the tax rate should be 15% as indicated in the prevailing English text of DTT.

Foreign Tax Residence Certificates

Tax residence status of a recipient of income is proved by the POR-2 form (which needs to be certified by foreign competent authorities) or some other document certified by foreign competent authorities translated into Serbian language.

Double Taxation Treaties Situation as at 1 January 2016

Download and save the PDF version of this Tax Alert

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Tax Alerts

Our regular newsletter provides you with updates on the latest changes of tax and accounting regulations as soon as a new rule is being approved.