- If the recipient company holds at least 25% (20% in DTT with Switzerland, 5% in DTT with UAE) of the paying company, the lower of the two rates shown applies.

- 0% rate will apply if paid to the government of the contracting state (or political subdivisions or local authorities). In the case of payment of dividends by Serbian tax residents to tax residents of the United Arab Emirates, the Protocol provides specific list of entities to which 0% rate on dividends is applicable.

- For the use of, or the right to use, any copyrights of literary, artistic or scientific work, including cinematography films, films and tapes for television and radio, the tax shall not exceed 5% of the gross amount of the royalties.

For the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process, or for the use of, or the right to use, industrial, commercial or scientific equipment or for information concerning industrial, commercial or scientific experience, the tax shall not exceed 10% of the gross amount of the royalties. - For the use of, or the right to use, any copyright of literary, artistic or scientific work except for computer software and including cinematography films or films or tapes used for radio or television broadcasting, the tax shall not exceed 5% of the gross amount of the royalties.

For the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process and computer software, or for the use of, or the right to use, industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience, the tax shall not exceed 10% of the gross amount of the royalties. - Provided by the Protocol to the treaty between Serbia and Switzerland. Valid until Switzerland imposes withholding tax on royalties.

- 0% rate is provided by the article dealing with business profits.

- Gains from the alienation of shares of the capital stock of a company the property of which consists directly or indirectly principally of immovable property situated in Serbia may be taxed in Serbia by 20% rate.

- Gains derived by a resident of other Contracting State from the alienation of shares or comparable interests deriving more than 50 per cent of their value directly or indirectly from immovable property situated in the other Serbia may be taxed in Serbia by 20% rate.

- In case of gains from the alienation of shares or other rights participating in the profits of a company, the capital of which is wholly or partly divided into shares and which is a resident of the Contracting State, derived by an individual who is a resident of the other State and has been a resident of the first-mentioned State in the course of the last five years preceding the alienation of the shares or rights, each of the States has the right to levy according to its own law a tax on such gains.

- Gains from the alienation of rights from a contract on investments in a Yugoslav organization of associated labor may be taxed in Yugoslavia.

- 0% rate will apply if paid to: 1) the government of the contracting state (or political subdivisions or local authorities), 2) the Central or National Bank of the contracting state or 3) a financial institution controlled or mainly owned by the Government of the other Contracting State or political subdivisions or local authorities thereof.

- Gains derived by a resident of a Contracting State from the alienation of shares or comparable interests, such as interests in a partnership or trust, may be taxed in the other Contracting State if, at any time during the 365 days preceding the alienation, these shares or comparable interests derived more than 50 per cent of their value directly or indirectly from immovable property (real property) situated in that other Contracting State.

- Double Tax Treaty is changed by MLI.

- 5% rate is provided only if the ownership conditions for at least 25 per cent of the capital are met throughout a 365 day period that includes the day of the payment of the dividends (for the purpose of computing that period, no account shall be taken of changes of ownership that would directly result from a corporate reorganization, such as a merger or divisive reorganization, of the company that holds the shares or that pays the dividends).

- 0% rate will apply if paid to: 1) Hong Kong government (Special Administrative Region), 2) Monetary Authorities of Hong Kong and 3) Stock Exchange Fund.

- 0% rate applies to dividends distributed to: 1) Central Bank of Norway, 2) Government Global Pension Fund and 3) any entity wholly or predominantly owned or established by Norwegian Government as agreed by relevant authorities of the treaty countries.

- 5% rate is provided only if the ownership conditions for at least 25 per cent of the capital are met throughout a 365 day period that includes the day when decision on dividend is made (for the purpose of computing that period, no account shall be taken of changes of ownership that would directly result from a corporate reorganization, such as a merger or divisive reorganization, of the company that holds the shares or that pays the dividends).

- 0% rate will apply if paid to or paid based on receivable which is guaranteed, secured or separately financed by: 1) the government of the contracting state (or political subdivisions or local authorities), 2) the Central or National Bank of the contracting state or 3) any other institution owned by the Government of the other Contracting State (or political subdivisions or local authorities thereof).

- Gains derived by a resident of a Contracting State from the alienation of shares or comparable interests, such as interests in a partnership or trust, may be taxed in the other Contracting State if, at any time during the 365 days preceding the alienation, these shares or comparable interests derived more than 50 per cent of their value directly or indirectly from immovable property (real property) situated in that other Contracting State, except if the respective shares or comparable interests are traded on recognized stock exchange, and resident and its related parties own 5% or less of the class of respective shares or comparable interests.

- 0% rate will apply if paid to 1) the Government of Morocco i 2) the Central Bank of Morocco.

- 0% rate will apply if paid/distribute to: 1) the government of Singapore (or political subdivisions or local authorities), 2) the Central or National Bank of Singapore, 3) statutory body, 4) entities, including specific investment fonds or arrangements with special purposes which (directly or indirectly) are owned by the government of Singapore, which are established for investing and governing of assets of the government of Singapore and, when paid dividend is related to that assets.

The network of effective double taxation treaties between Serbia and other countries applicable as of 1 January 2023 has been increased to 64 for the treaty with Morocco.

In addition, as a result of Multilateral convention to implement tax treaty related measures to prevent base erosion and profit shifting (MLI), treaties with the following countries are amended: Albania, Austria, Belgium, Bosnia & Herzegovina, Bulgaria, Canada, China, Croatia, Cyprus,

Czech Republic, Denmark, Egypt, Finland, France, Georgia, Greece, Hungary, India, Indonesia, Ireland, Kazakhstan, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Pakistan, Poland, Qatar, Russia, Slovakia, Slovenia, South Korea, Spain, Ukraine, United Arab Emirates and United Kingdom.

The list of 64 double taxation treaties of Serbia effective as at 1 January 2023 is presented below (treaties with countries amended by MLI are in bold font):

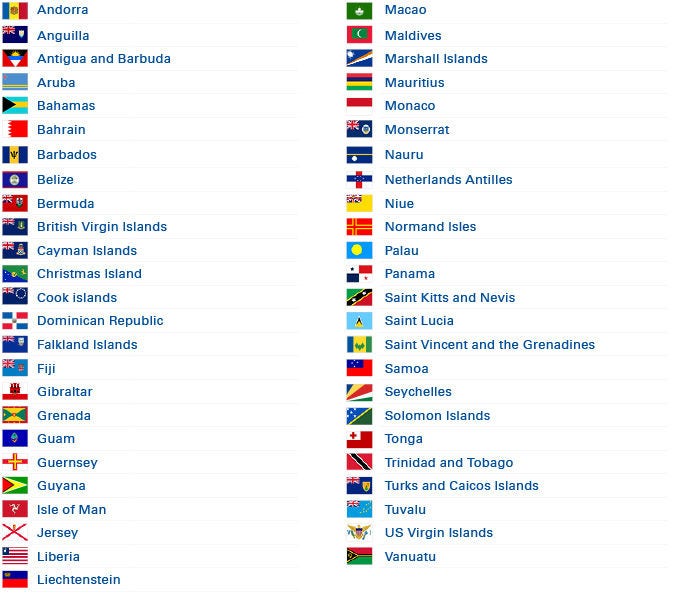

Jurisdictions with a preferential tax system

If a foreign legal entity is located in a jurisdiction with a preferential tax system, the tax rate is 25%.

In addition, the tax is paid on fees paid to a foreign person for all services, regardless of the place of delivery or use.

The list of jurisdictions with a preferential tax system applicable as of 1 January 2023 is presented below:

- Serbian Network of Double Taxation Treaties, List of Tax Havens and Withholding Tax on Services

Download and save the PDF version of this Tax Alert

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Tax Alerts

Our regular newsletter provides you with updates on the latest changes of tax and accounting regulations as soon as a new rule is being approved.