Comprehensive support for the MDR identification and reporting process - Due diligence on tax scheme reporting (MDR) has never been easier

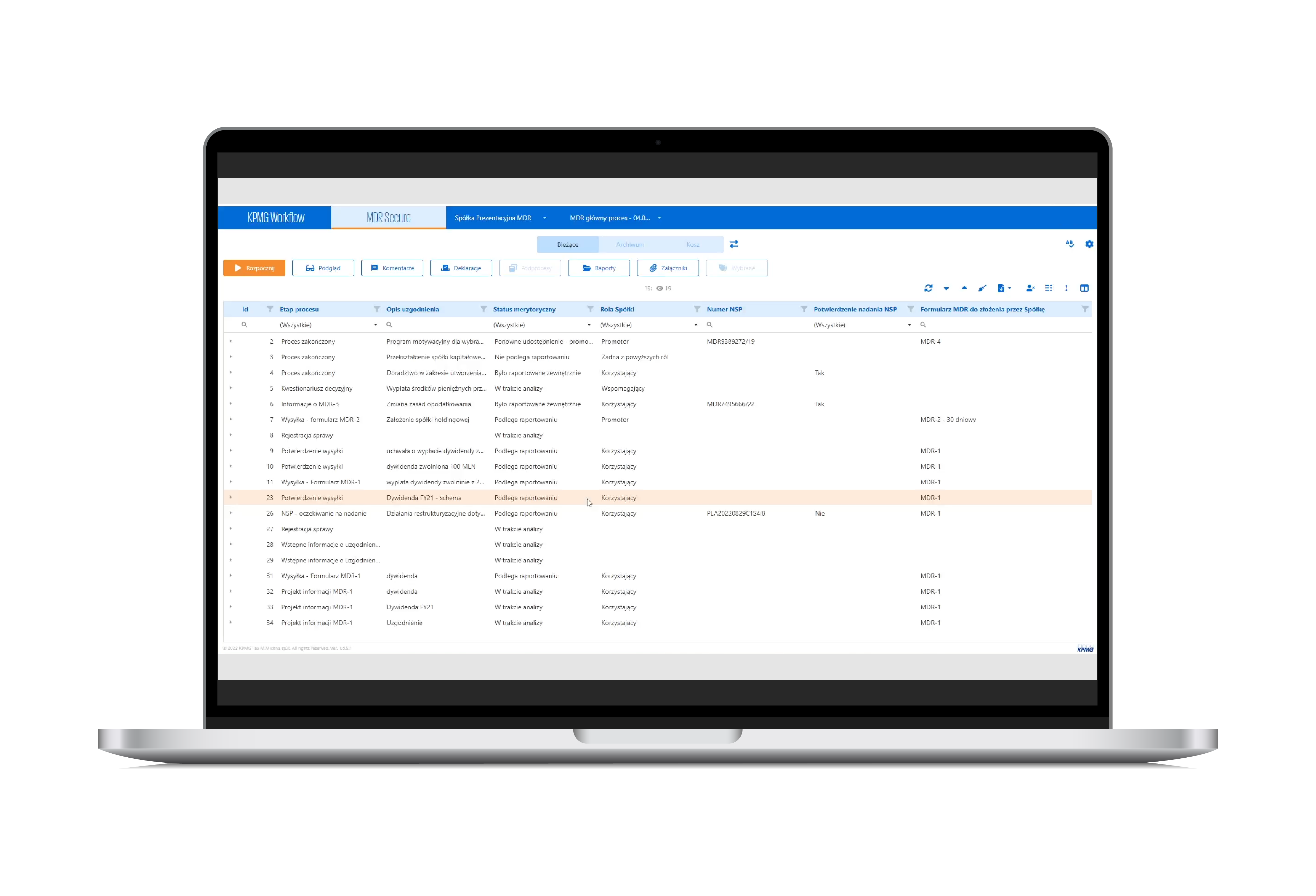

KPMG MDR Secure is an MDR reporting application developed by KPMG experts that comprehensively supports the management of an organization's tax scheme reporting process. With KPMG MDR Secure, both the reporting decision-making, information collection, technical reporting process and oversight of all MDR reporting activities are done in a single tool.

What are the benefits you will gain from the KPMG MDR Secure application?

KPMG MDR Secure was recognized as one of the three most innovative tax technology solutions on the Polish market

according to the 16th Tax Advisory Ranking of “Rzeczpospolita” newspaper.

PMG MDR Secure – features and capabilities

Convenience of entering and reading data

- Personalized dashboard

- Division of users into roles and cases into stages

- Ease of data entry by individual users, communication within ongoing cases

- Comments, prompts, extracts from regulations

Accessibility of case analysis

- Ease of analysis through intuitive questionnaires

- Clear result and guidance for further action

Transparency of control of the MDR process

- Possibility of in-depth supervision of cases by responsible persons

- Monitoring of deadlines, notification of events

One tool to meet all MDR reporting obligations

- End-to-end MDR reporting support: data entry and analysis, identification, analysis, control, xml file upload, event archiving

- All 4 MDR forms available (MDR-1, MDR-2, MDR-3, MDR-4)

KPMG MDR Secure application deployment models

Cloud version

We provide a link, and the tool, which is updated regularly, is available on the Microsoft Azure cloud – so you don't have to make any changes to your company's systems. An additional option in the cloud model is the ability to include KPMG tax experts in the case analysis process.

Client-installed version

We implement the application in the client's environment and customize it according to individual needs. We provide support in the implementation process of the tool.

Service version

We are responsible for the substantive analysis of cases registered by the client, formal issues (keeping an eye on deadlines), contact with offices and other entities. The client has constant access to the application along with a preview of the cases. A dedicated MDR specialist is appointed from KPMG to act as MDR Officer for the client.

Contact us

Learn more about how KPMG's knowledge and technology can help you and your business.

What is tax scheme reporting and why is it so important?

Regulations introducing mandatory reporting of tax schemes into the Tax Ordinance came into force at the beginning of 2019. This was related to the implementation of the provisions of Council Directive (EU) 2018/822, also known as DAC6.

In theory, the new regulations were supposed to allow the tax administration to quickly access information about potential tax abuses. However, as practice has shown, it happens that commonly concluded and legitimate business transactions that are not tax-motivated meet the prerequisites of a tax scheme.

Taxpayers must submit to mandatory reporting when the arrangement meets the definition of a tax scheme, and in the case of a non-cross-border tax scheme – also the criterion of a qualified beneficiary.