In today’s market, innovative disruptions and external disturbances change the market in an ever increasing pace. Many companies are therefore venturing into new markets, start experimenting with new technologies or look at new revenue streams outside of their core business. In reality however, turning these new venturing opportunities into concrete results is often expressed as a major challenge. Often required capabilities to properly execute a venturing strategy can be significantly different from running and growing the core business. Our KPMG Venture Services team understands these challenges like no other and is here to help you with a pragmatic approach for realizing new, innovative value. We assist where the uncertainty factor is high, but the drive for growth and results is strong.

A structured approach to accelerate new ventures

To boost revenue from venturing, companies need to consider three conditions:

- How the new products and propositions are connected to the growth strategy;

- How the right tools, skills and techniques are build up to recognize and develop new opportunities;

- How to keep focus and control over the new products and propositions.

Companies who fail to apply these conditions increase the risk of setting up innovation initiatives only to signal the presence of innovation instead of using it as a means for significant business impact. These ‘innovation theatres’ have shown to upset key stakeholders, such as the CFO, in the longer term. Some of them ask us on how other companies have tackled and overcome constraints to get value out of their venturing. Based on experience, we have identified three pillars to help companies in:

- Venture development: Creating the right environment, context and conditions for the venture to thrive. Including the co-development of new products and propositions, from concept to launch.

- Managing the venture portfolio: Managing and improving the conditions for ventures to thrive. Maturing the product and portfolio functions and providing focus and control for leadership.

- Optimizing venture performance: Optimizing the operations of new, non-core growth areas (e.g. e-commerce), by refinement of the portfolio, including white spots and performance assessments.

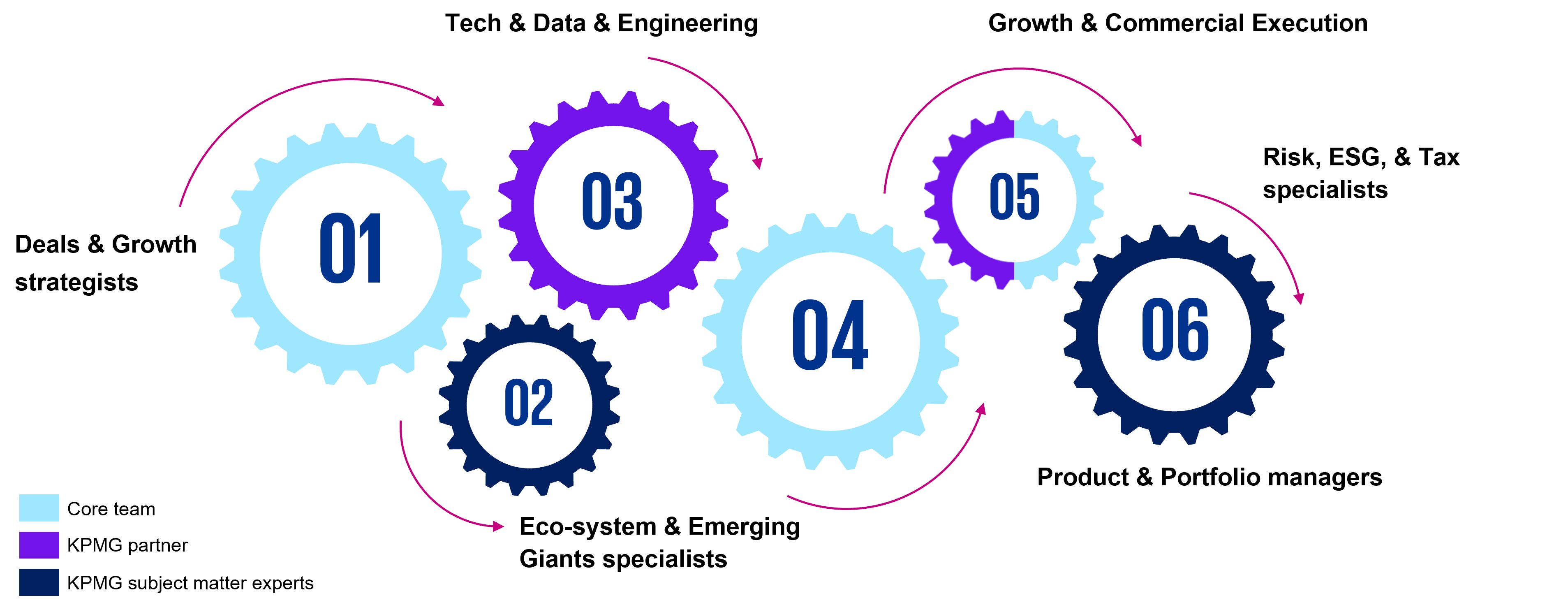

Applying the right combination of capabilities at the right time is key

Venturing requires a significant different set of capabilities than running and growing the core business. The KPMG Venture Services team consists of various specialists that can help you discover and eliminate bottlenecks in your venturing process. These specialists work side-by-side with our product and portfolio management strategists who continuously ensure that all activities are in line with the strategy, needs of the market and the wider organization and portfolio.

Ready to create and capture new value? Ready to venture?

KPMG Venture Services supports you, using the right insights and genuine solutions. Please contact Ton van Dijk or Maurits Krijnen for more information.

Latest Insights

We will keep you informed by email.

Enter your preferences here.