Is data the new gold, or is data the raw material from which gold (customer value) must be extracted? Many organisations seem convinced of the former and are collecting data rampantly, as much as they can. We call this behaviour 'Data-Obsessed'. But collecting as much data as possible is not what an organisation needs. What is more important is that the organisation needs to have the right data to deploy it successfully and achieve strategic customer goals.

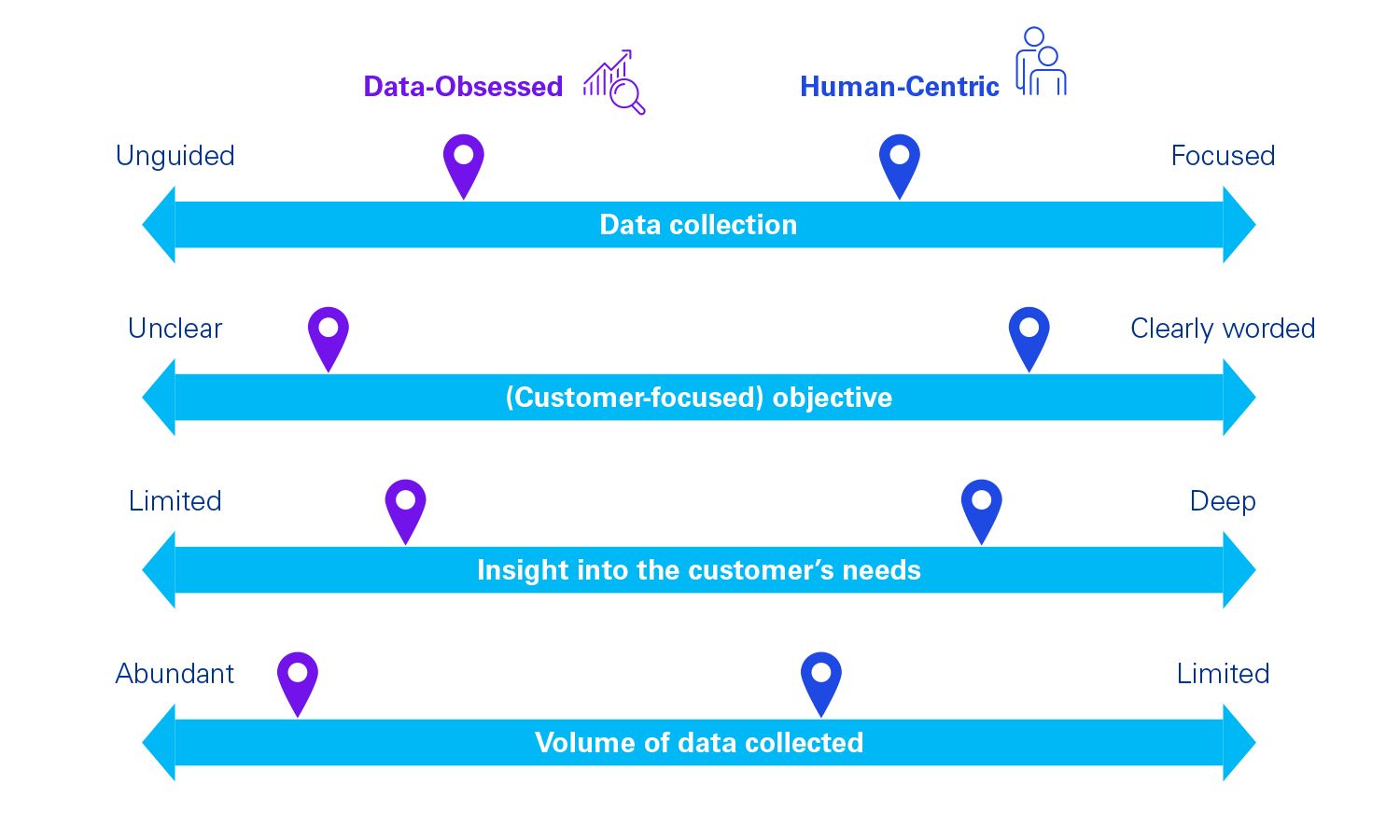

The sheer volume of data available makes it difficult to see the wood for the trees. Datasets from which companies now collect data can no longer be counted on one hand: market data, demographic data, web/mobile data, transaction and interaction data (including customer journey data), behavioural data and attitudinal data. Every byte of data collected ideally delivers value, both for the organisation and the customer. But the GDPR and the AVG set limits on data collection. Organisations should have value-add towards the customer as their starting point when collecting data. We call this 'Human-Centric' data collection. With this in mind, the amount of data is not important and invalidly collected data is limited. Data-Obsessed organisations and Human-Centric organisations each have their own characteristics, which can be seen in the chart:

A great example of a Human-Centric organisation is ANWB. The organisation uses data not only to improve customer service with faster service, lower costs and a better experience, but also to contribute more broadly in society. For example, it alerts ANWB members and municipalities about changes in traffic. The 'connected car' initiative goes even further from protection to prevention, using the car's data to inform members about maintenance issues or their driving style.

Advantages and disadvantages

In both a Data-Obsessed and Human-Centric approach, there are advantages and disadvantages. The advantage of a Data-Obsessed approach is the availability of data to make data-driven decisions and quantitatively support choices. However, organisations can also go overboard with their focus on data. Not only does all the data that is collected also need time to be retrieved, cleaned and analysed, there is also a danger that organisations may overshoot their original goal because they can no longer see the forest for the trees. The advantage of a Human-Centric approach, then, is that it works from a specific goal – adding value for the customer – and allows for the targeted selection of dataset(s).

A disadvantage of Human-Centric data collection can be that organisations focus so much on certain target groups or characteristics that they lose sight of the holistic view. In addition, the question is whether, as an organisation, you can meet all the customer requirements that emerge from the data. It is therefore important that, as an organisation, you stick to the core and that the collective goal is not lost.

Achieving strategic objectives with customer data

So what is that collective goal? In a Human-Centric approach, an organisation's strategic goals go hand in hand with customer needs and applications of customer data. We generally see three goals on which organisations deploy strategies using customer data:

- Attract new customers based on analytics to date from current customer base

- Generate more revenue from existing customers by cross-selling and/or up-selling

- Improve products and services

Determining these objectives helps provide direction in selecting the right dataset(s) and setting KPIs and metrics to measure and monitor these strategic goals.

1. Attract new customers

Data from existing customers can be used to identify the needs and expectations of (potential) customers. Based on these insights, the products or services offered can be adjusted to make them even more attractive. Through this optimisation, more customers can be attracted. Customer data can also translate into insights to improve the customer journey, resulting in fewer customers dropping out during the process and higher conversion rates.

An example is an organisation which applied a new segmentation model based on the customer data it had collected. This gave the organisation insight into which customers it was not yet serving, but who could fall into its customer group based on their characteristics.

Example key performance indicators — Newly generated revenue — Number of new customers — Number of new accounts — Brand awareness or ‘branding’ — CAC (customer acquisition cost) — Win rate |

Example metrics — Number of ‘first-time’ customers — Number of unique visitors — Time from order to shipment — ‘Out-of-stock’ items — Click frequency |

2. Generate more revenue from existing customers

The next strategic goal may be to generate more revenue from the current customer base. This can be done by using customer data to cross-sell and/or up-sell. As customers start buying other products from the organisation or use a particular service more often, more revenue is ultimately generated from existing customers.

An example of the strategic goal mentioned above is a supermarket chain that has insights into the buying patterns of individual consumers through a loyalty programme and makes personalised offers on a number of products. This uses transaction data linked to personal loyalty cards that are scanned during checkout.

Example key performance indicators — Customer churn — Customer lifetime value — Average revenue per customer — Cross-/up-selling — Customer engagement |

Example metrics — Personal data linked to profile — Tracking of phone — Average transaction amount

|

3. Improve products and services

In the last strategic goal, customer data insights are used to provide better service. Whereas with the first goal above, this data is deployed to attract more customers, with this goal the starting point is to improve the customer relationship. The data can generate insights that otherwise would not have emerged. Those insights can be used to better support the customer and to recognise and understand them better and better; in short, to provide a better customer experience. At KPMG, we work with six pillars that characterise a successful customer experience: personalisation, time & effort, expectations, integrity, resolution and empathy.

Paying more attention to the right (selection of) pillars in the customer journey will create a better customer relationship, preventing customers from switching to competitors out of dissatisfaction. Should customers be very satisfied with what they experience, they can also become promoters and thus form a loyal customer base.

An example of using data to improve service is an organisation that created an online application process. Based on data insights, it concluded that a significant group of people were lingering or even dropping out at a certain process step. That process step was then optimised (Time & Effort) and customers' progress in the process was made clearer (Expectations).

Example key performance indicators — NPS (net promoter score)/CSAT (customer satisfaction) — Customer retention — Referrals — Customer intimacy |

Example metrics — Survey results — Average time spent on site — Social media activity — Brand mentions |

In short, in organisations where there is no consensus on what purpose is being pursued, or where it is not thought through, the risk of collecting unnecessary data and not doing the right analyses increases. This risk is mitigated by collecting data with clear strategic goals in mind and from a Human-Centric perspective. The three strategic objectives that can be used for this purpose are: attracting new customers, getting more revenue from existing customers and improving products and services. Drawing up a data strategy is an important first step and we advise our clients to link the collection of (customer) data directly to the organisation's strategic objectives. In this manner, data is successfully used as a raw material and the gold is mined to actually add value.