The reality of the Actuarial and Finance function

The implementation of IFRS 17 has occupied many insurance companies’ Finance change agenda over the past years. As the implementation programs have come to an end, it is now up to the regular ‘business as usual’ line function to run the IFRS 17 closing process. The Finance team needs to be able to explain the figures and the movements, as this is critical information for steering the insurance company and informing the capital markets. Management wants these figures available as soon as possible to facilitate decision-making. Moreover, since implementation budgets are closed, the responsibility for any IFRS 17 backlog items and issues (often arising from quick work-arounds during implementation) has been transferred to the line organization.

Most insurers have already encountered challenges along the way, reflected in operational or financial risks in reporting with respect to the opening balance sheet, determining the comparable figures for FY 2022, or preparing interim 2023 statements. One of the key challenges is the accounting for unexplained or inaccurate items in the Analysis of Change (AoC) of the insurance liabilities. At the same time, insurers struggle with the role of the second line. Whereas the Actuarial Function is a prescribed role in the Solvency II reporting process, this function often remains out of scope in IFRS17 as it contains increasing demands on the quality and controls of the first line. For the first line, since IFRS 17 is based on market valuation, most European insurers have rather sought alignment with their Solvency II reporting chain, given the similarities between the two requirements in underlying principles. Theoretically, this should induce synergy and efficiency. In practice, this implies that the same teams are now responsible for two extensive reporting frameworks (as opposed to Solvency II and IFRS 4).

Dilemma: quality, lead time and expenditure

These challenging requirements for the reporting teams raise an important dilemma within the Actuarial and Finance departments of insurance companies, namely the need to balance quality, lead time and expenditure. Quality relates to the ability of explaining and understanding the figures, lead time to the speed of the reporting process and analysis, and expenditure to the underlying internal or external support required to operate. These factors of the dilemma affect each other since a shortcoming of one has an increasing effect on the other. In trying to solve this dilemma, there is a tendency to revert to silo thinking, while IFRS 17 really needs the Actuarial and Finance departments to work together more than ever before.

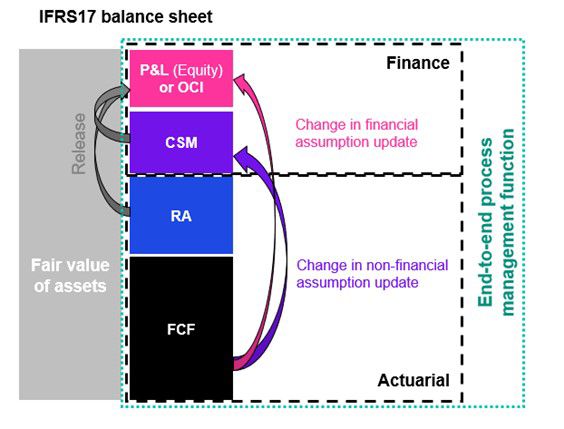

The key metrics reported under IFRS 17 have a direct relation with the underlying Actuarial assumptions, more than under Solvency II. For example, any changes in underlying assumptions will either adjust the CSM, P&L or OCI (if opted for). Which metric is being affected depends on the nature of the assumption. For example, under GMM a split should be made for financial and non-financial impacts. This includes identifying movements based on locked-in discount rates and on current discount rates. IFRS 17 reports produced by Finance require more technical understanding to adequately explain movements of key metrics. This asks for close collaboration with the Actuarial department, and the need to pursue a culture across the reporting chain in which complexity is acknowledged and collaboration is regarded as part of the solution in solving this, supported by a clearly defined reporting governance and final ownership towards an auditor. In the graph below in which the IFRS 17 balance sheet is depicted, the relationship between the basis, provided by the Actuarial department (FCF and RA), and the final report (on CSM and P&L) by Finance is graphically described.

Since IFRS 17 contains a direct dependency between the Finance and Actuarial team, this also translates to the dilemma: when one component within the reporting chain falls short in either quality, lead time or expenditure, the remainder of the chain will be required to compensate this shortfall.

Turning IFRS 17 challenges into opportunities to solve the dilemma triangle

With the implementation of IFRS 17, insurers are noticing that they need to think more in an end-to-end approach in order to streamline their operational activities. This invites them to re-evaluate the organizational design and to consider an end-to-end process management function. This function secures process alignment, coordinates changes and prevents teams from falling back into their silos. Its focus should be on improving the total reporting chain with regard to the dilemma triangle factors ‘quality’, ‘lead time’ and ‘expenditure’. Even though it is not a hierarchical line, it establishes reporting chain ownership. While bridging the operational gap between the Actuarial and the Finance department, this function is well-positioned to identify opportunities for improvement that benefit the whole reporting chain.

To ensure the function is being supported, it can consist of 1) representatives from each stakeholder, 2) a subset of each functional team, or 3) a separate taskforce with similar capabilities. The function must empower clarity on roles and tasks, promoting responsibility, on condition that the culture of collaboration is nurtured, driven by Finance and Actuarial leaders, where everyone in the reporting chain feels included, understands each other’s challenges, and is willing to help each other. Therefore, the end-to-end process management function must include people management skills to enable this in order to realize the required culture change to achieve the desired synergy and efficiency.

The end-to-end process management function can serve as a tool: increasing the representation of either the Actuarial or Finance function can shift the focus to the part of the reporting chain concerned. At the same time, the function could be tasked to specifically focus on one of the three aspects of the dilemma. And with that, the end-to-end process management function does not only enable an improved reporting chain, it can also act as an instrument for management to align with the organization’s strategic agenda.

More information

For more information, please contact Victor Vincent, Erik-Jan van Workum and Vincent Slewe.