Private equity (PE) has traditionally relied on picking the right investment to release value through business transformation post-deal.

PE returns have traditionally had a component of financial leverage, multiple arbitrage and value creation — usually considering a combination of all these factors whilst surfing a wave of low interest rates and natural market expansion.

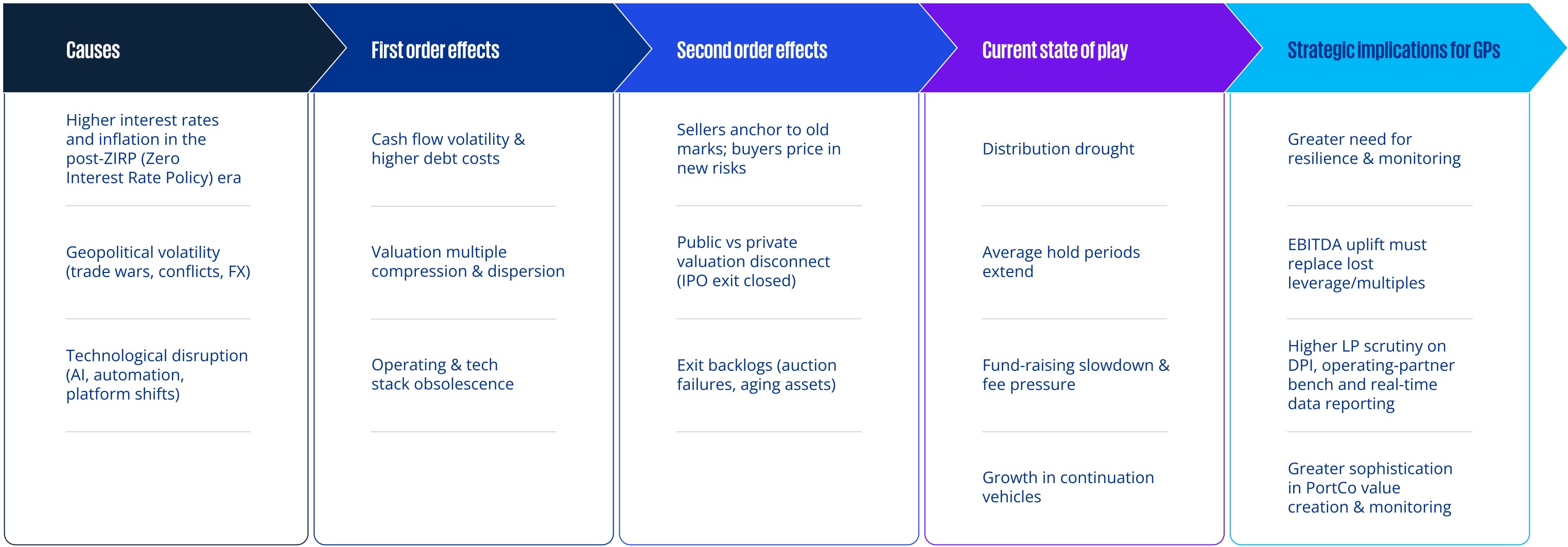

As those factors seem to evolve and fade — base rates have normalized, dry powder tops US $1.0tn, and there is more than US $3.0tn backlog of unsold assets in the exit pipeline — it becomes clear that the industry will need to evolve into looking for more sophisticated ways of creating tangible value in ever increasingly disputed markets.

In this sector, data is power. Hedge funds turned quant a decade ago. Public-market active managers quickly followed with factor signals and alternative data. Yet most buy-out houses still prefer to trust a more traditional approach towards value creation, based on expert judgment and financial analysis.

We believe that as market tailwinds fade, operational alpha — built on stochastic modeling, outside-in signals and predictive intervention — will likely become a real source of competitive advantage and a systemic and repeatable investment edge. We believe that the next decade belongs to houses that can manufacture operational alpha – systematic EBITDA uplift, delivered quickly and at scale.

In this paper we set out a five-capability blueprint for value creation next-gen alpha and illustrate — with data and case studies — how leading General Partners (GPs) are now tilting their models to becoming the next-gen ‘quant PE house’.