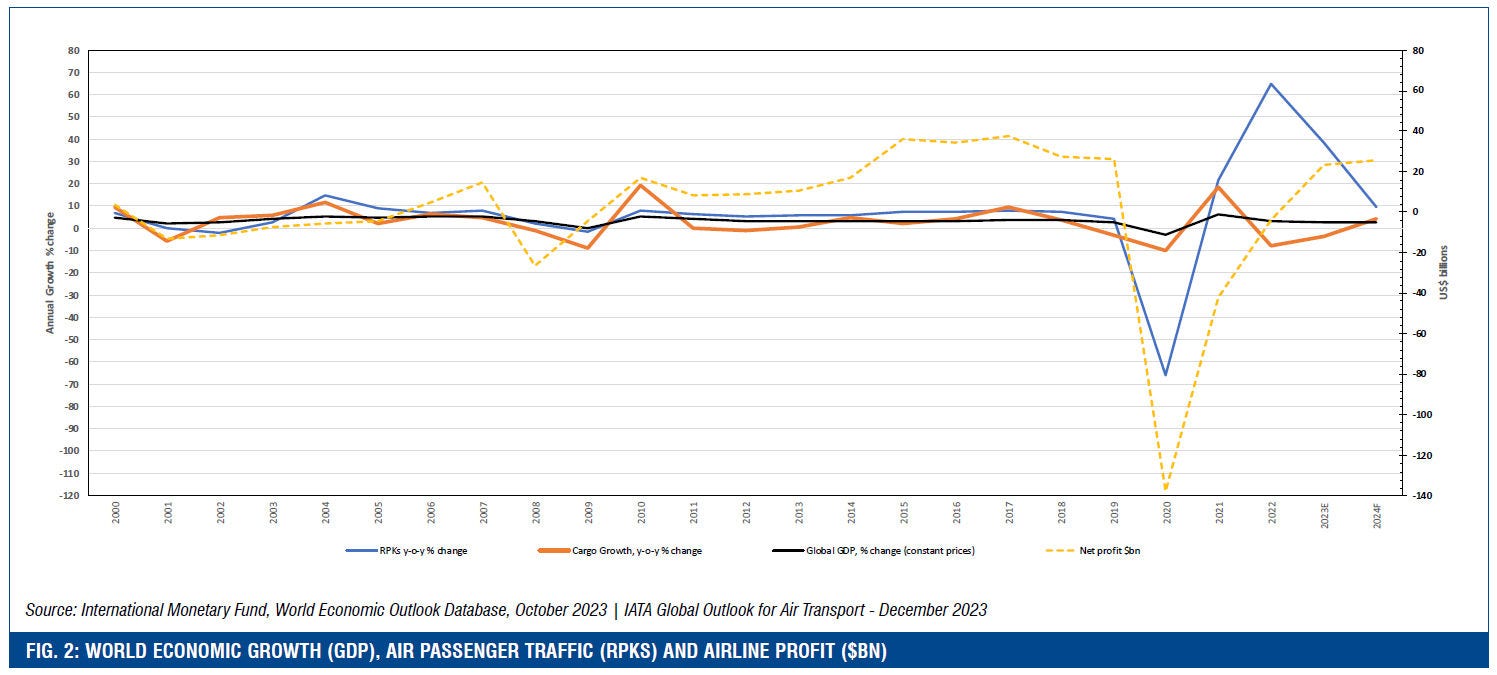

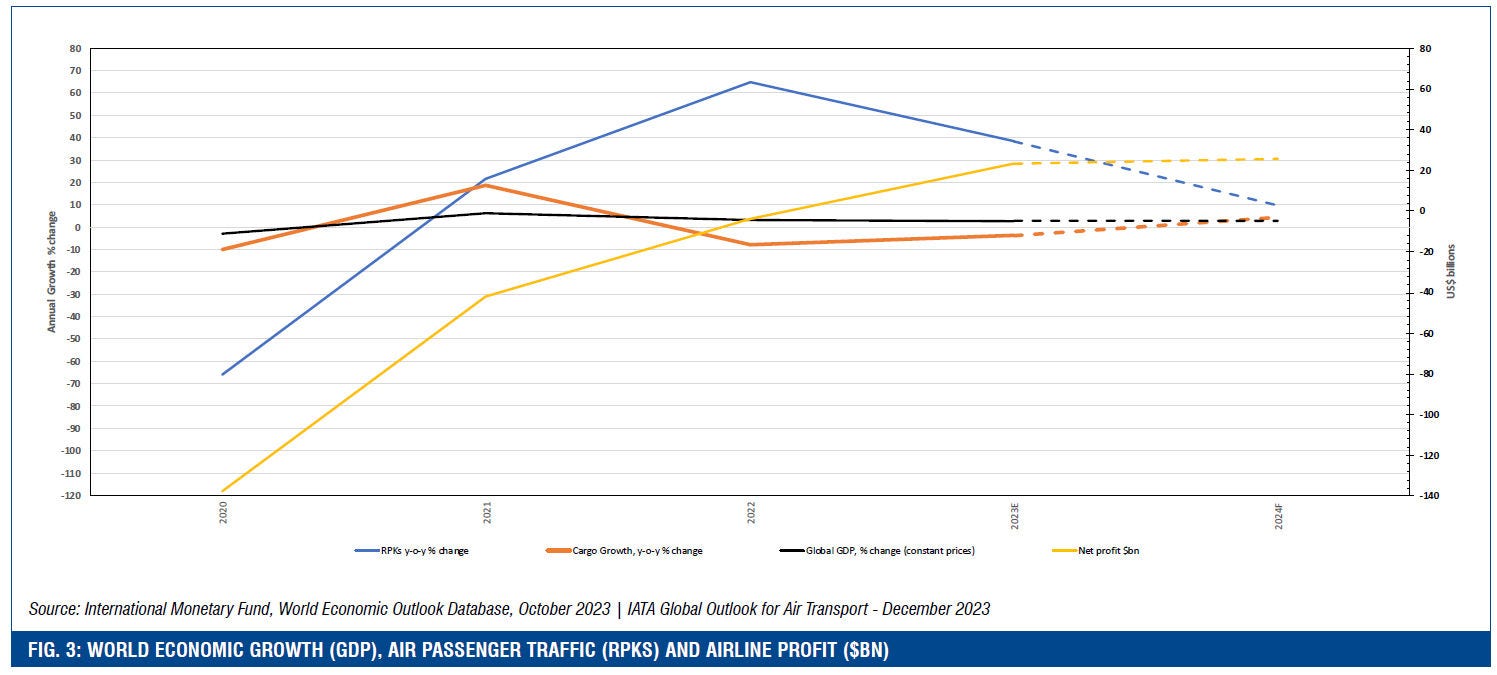

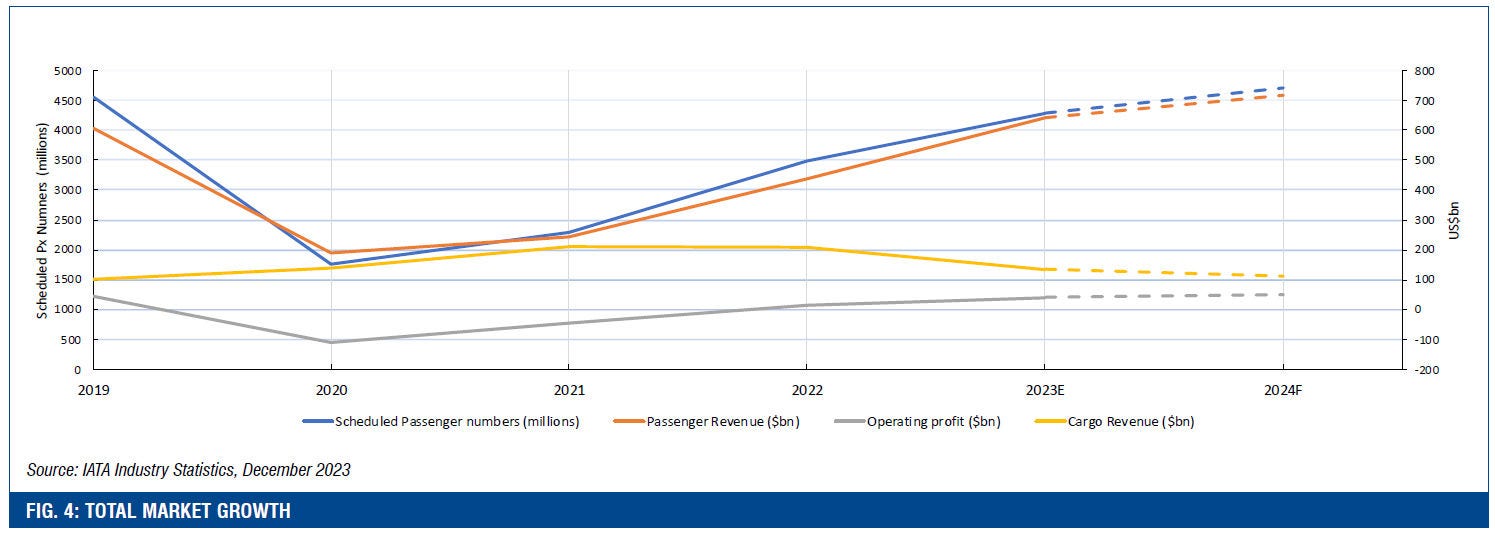

The North American market has been the major driver of traffic growth and profitability for the global industry over the last year, which is expected to continue into 2024 despite some softening of domestic demand seen in the latter half of 2023. The region accounts for 56% of IATA’s total industry profit forecast for 2024 amounting to $14.4bn – about the same as the $14.3bn estimated for full year 2023.

The region was the first to emerge from the crisis and was back to profitability in 2022 much earlier than other jurisdictions and in summer 2023 demand also returned for transatlantic travel.

“Airlines have done really well, especially in North America,” says TD Cowen’s Becker. “Over the past three years, we have seen a predictable recovery… locally, domestically, regionally and now internationally. This summer [2023] we saw very strong demand on the North Atlantic routes as people looked to recreate experiences they had pre- pandemic or just that pent-up demand for not have been able to travel for so long.”

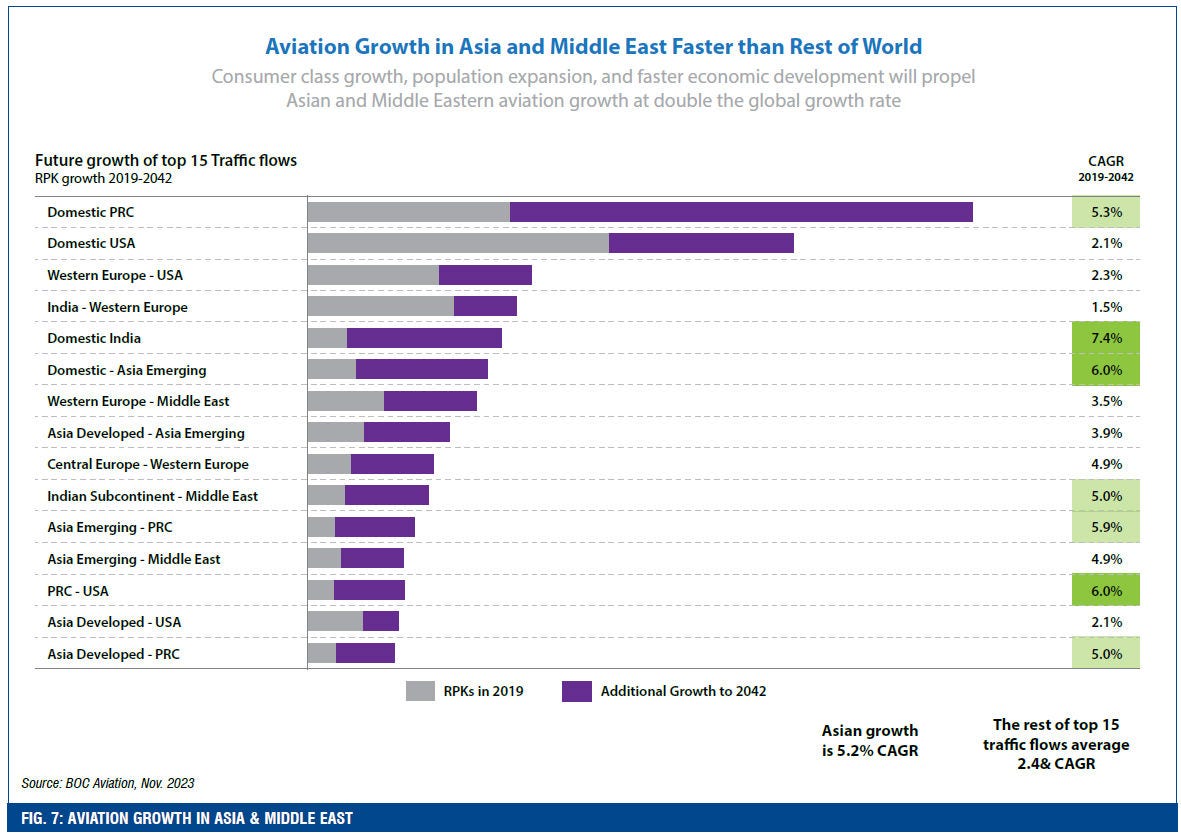

Becker characterises 2021 and 2022 as years where domestic markets recovered, specifically in North America and European markets, with Asia-Pacific being slower to recover. International traffic recovered throughout 2022 and into 2023, and she regards 2023 and 2024 as the year of transatlantic recovery.

“2025 is probably the first year where we get a normalised, balanced travel year,” she says. Low-cost carriers (LCCs) benefitted from that early return of domestic travel, especially in the North American market, but over the past year a new phenomenon has emerged where travellers appear to be willing to spend more to travel further afield and for better service, which has translated to increased traffic and yield for the legacy carriers.

“What we’re seeing is almost a tale of two cities,” says Greg Lee, Global Head of Transportation Banking at Goldman Sachs. “Some of the larger airlines with significant international operations, premium business, long haul services, have been performing better than airlines with more of a domestic and low-cost carrier model. In the most recent series of earnings calls, we have seen a divergence between premium and the front of the cabin and the lower cost side of the cabin.”

“We are seeing something different happening than we would have seen previously,” agrees Betsy Snyder, S&P Global Ratings. “Typically low-cost airlines have done well due to their lower cost base and they did do well in the beginning when short-haul traffic started to come back after the pandemic. But in 2023 we have seen a change with the pent-up demand for international travel. The big three airlines – United, Delta and American – all have global operations and have been the beneficiaries in terms of demand.

Whereas the other airlines that focus on domestic travel have seen demand reduce… they also have exposure to higher fuel prices and labour costs have been increasing and there is a shortage of pilots that have been leaving smaller airlines for the larger carriers. They have been adding more capacity than some of the larger airlines so their earnings have been under pressure. Earnings for smaller airlines like Spirit and JetBlue have been subpar relative to the big three network carriers.”

The flip in fortunes for the LCCs with the legacy carriers is due to a number of factors, primarily cost convergence. LCCs historically had a lower cost base than legacy carriers but following the pandemic, there has been an increase in labour costs across the board, as well as pilot shortages bumping up their salaries which has led to operating costs of LCCs and legacy carriers converging eliminating that traditional “low-cost” advantage.

Aengus Kelly also notes that the fixed cost base for airlines has been increasing rapidly, particularly noting that the industry now has the first “million-dollar pilots”, with captains of widebody aircraft earning base pay of over $400 an hour in addition to pensions and healthcare benefits.

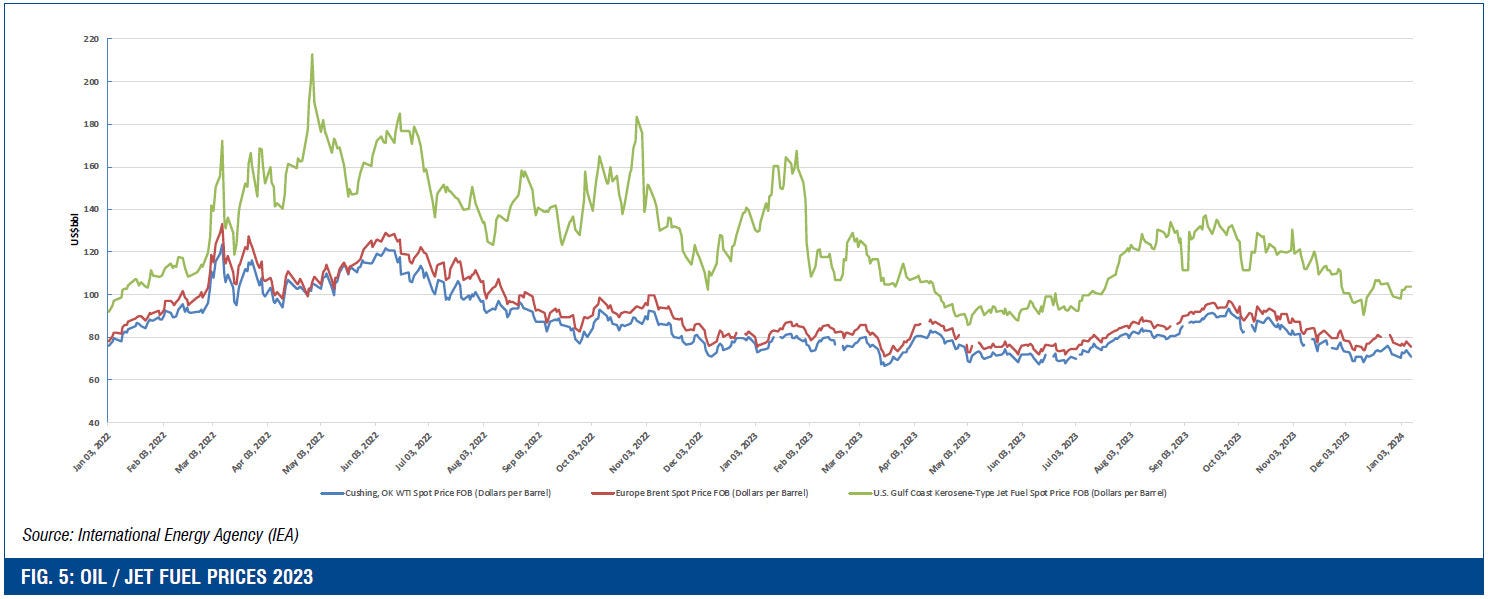

Rising fuel costs are an ever-present issue for all airlines but the collective increase in labour costs has severely challenged many carriers and continues to be a concern, with most agreements having been resolved recently with substantial increases.

The macroeconomic environment has also contributed to this reversal in fortunes for the US LCCs, since as Betsy Snyder suggests, they have a different customer base than legacy carriers whose “disposable income is not growing as fast as other segments of the economy”, which she says has been hurting LCC demand.

In the airline’s third quarter earnings call on October 31, 2023, Joanna Geraghty, JetBlue president and chief operating officer (now announced as the next CEO to take over on February 12, 2024), noted that the airline had suffered from a “softer than expected off peak and close in leisure demand in September” although she called the airline’s premium Mint offering a “bright spot” in the third quarter results with year-on-year revenue improving by 4.5%.

“We continue to see strength in Mint, even with our Mint capacity up 19% year-over-year”, said Geraghty. JetBlue was able to benefit from its transatlantic services using its A321LR aircraft to London and Amsterdam, expanding to Dublin and Edinburgh.

Spirit Airlines also reported a loss for the third quarter of 2023 amid “softer demand” for its services. Chief executive Ted Christie commented that the airline had not seen the “anticipated return to a normal demand and pricing environment for peak holiday periods”.

The airline also referred to challenges caused by higher fuel prices and Neo engine availability issues leading to a lower than expected margin for the fourth quarter.

Frontier and Allegiant echoed their LCC competitors reporting softening of demand for the fourth quarter and increasing operating challenges including elevated fuel and labour costs, as the financial impact from adverse weather and capacity constraints.

But the low margin airlines are not flying empty – load factors remain healthy but the differential for lower cost carriers has always been a focus on high aircraft utilisation, which has been hampered by adverse weather earlier in the year, airport/ATC delays and capacity constraints as aircraft are grounded due to engine issues.

The key for low margin airlines going forward into a more difficult operating environment will be balancing load factors with price.

The picture is different for US legacy carriers that have all reported increased demand for premium products as well as their basic offerings as travellers who can afford to pivot to more premium services.

United Airlines, Delta and American Airlines have all posted strong third quarter 2023 numbers and yields for their premium products and are also benefitting from a return of business travellers.

In its third quarter earnings, United Airlines chief executive officer Scott Kirby said that passenger numbers were up, from its basic economy product all the way to more premium products, including first class, on both its domestic and international routes, serving both business travellers and increasingly leisure customers.

The continued success of airlines to attract leisure flyers to premium products has endured past the point where many had expected so-called “revenge travel” to have petered.

Delta’s Bastian believes there is enduring demand for premium air travel; he says that the post pandemic premium cabin passenger is the same person but who is travelling for different reasons. He commented that people who had travelled in premium for business reasons pre-pandemic were continuing to do so for leisure reasons now and that the airline had seen “incredible stickiness” for its premium products.

For this reason, Bastian notes, that Delta is trying to keep premium travel affordable so people can use it for business and leisure travel.

Delta has rolled out a premium economy product on long-haul international routes, which Bastian described the revenue generation as “above our expectations”. Delta is also seeing an increase in corporate sales, which accelerated by the end of the year, including double-digit year-over- year growth in December.

The US carrier said that technology and financial services business were driving momentum for business travel. “We are finally starting to see tech companies traveling again,” said Bastian. “The return to office that is driving some of growth.”

The large US carriers have had the biggest recovery in both specialty and profitability and have been able to fill the front of their aircraft with premium leisure passengers. ORIX Aviation’s Meyler observes that this trend has continued “very resiliently throughout 2023”.

He noted though that there is an East-West divide on this current trend toward premium travel with Asian carriers not observing a growth in premium traffic potentially as a consequence of the lag in the recovery in Asia, which he adds is now beginning to change.

The change in fortunes for the traditional LCCs has led to a new moniker for the group – namely low margin airlines (LMAs) – although Allegiant has revised this for its business model to Profitable Leisure Focus Carrier or PLFC, according to chief Barry Biffle in the airline’s November earnings call.

North American airlines have been seeking mergers to strengthen their offerings. The JetBlue-Spirit merger however has been stymied by the ruling of US District Judge William

G. Young on January 16, 2024 that the merger – first announced in July 2022 – would substantially damage competition.

Alaska Airlines announced its intention to merge with Hawaiian Airlines on December 3, to resounding support from the industry but with the usual concerns over the reaction of regulators. TD Cowen’s Becker, said at the time of the announcement that she expects the regulators to approve this deal noting that the combination “makes a lot of sense, and it should be approved”.

JP Morgan’s Streeter also said at the time that due to Hawaiian’s relatively small size and the fact that after the merger Alaska would only by a quarter the size of the big three, he did not expect any regulatory issues.