Prioritising risk

Risk remains the one constant in business leadership. What has shifted in 2025 is the degree of interconnection between risks — and the speed with which one can trigger another. According to our survey, CEOs in both Northern Ireland (NI) and the Republic of Ireland (ROI) are most attuned to AI workforce readiness, cybercrime, and inflationary pressures as the trends shaping their organisations’ prosperity over the next three years.

The Central Bank of Ireland has noted that while headline inflation has fallen close to target, pressures persist in areas such as services, transport, and food. Wage growth and borrowing costs are also proving sticky. For ROI firms, these pressures are compounded by cost pressures, the continued challenge of tariff risk and an economy challenged by capacity constraints.

According to Tom Woods, Head of Clients and Markets at KPMG in Ireland: “The business risks that CEOs have contended with over the last number of years have evolved and changed. Operational and technological resilience are firmly in focus and have been added to the other macro challenges management teams face. Efforts by Government to alleviate some of these risks through policies to help unlock infrastructural bottlenecks, help plug the skills gaps and make Ireland more competitive are welcome.”

Meanwhile, for NI businesses, UK fiscal volatility and post-Brexit trade arrangements remain material uncertainties. Within this environment, AI integration leads the agenda. Nine in ten (91) percent of NI CEOs and 69 percent of ROI CEOs prioritise it as essential for business success.

This aligns with global findings where 71 percent of CEOs worldwide now view AI as a top investment priority (up sharply from 52 percent in 2024), with 69 percent planning to allocate 10–20 percent of their budgets on AI over the next year.

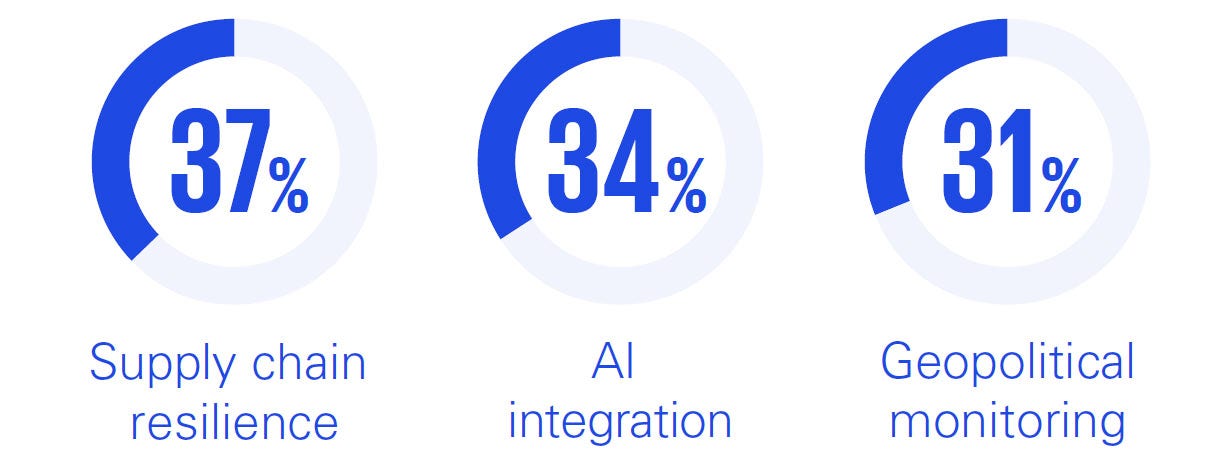

Priority areas of investment to mitigate risks in next three years (ROI)

Other technology-related issues feature prominently. The cost of technology infrastructure is a risk for 69 percent of ROI CEOs and 63 percent of NI CEOs, while cybersecurity is cited by 83 percent of ROI leaders and 77 percent of their NI counterparts. These concerns highlight a fundamental paradox: the same digital tools that promise innovation are also perceived as sources of exposure.

Environmental risks, including climate change, are prioritised by 43 percent of NI CEOs and 34 percent of ROI CEOs. Survey data on risk mitigation investments underscores these contrasts. CEOs in the Republic are directing spend towards supply chain resilience and operational continuity (37 percent), geopolitical monitoring and analysis (31 percent), and technology innovation for business expansion (31 percent). Leaders north of the border by contrast, are investing heavily in cybersecurity and digital risk resilience (46 percent), as well as climate and sustainability initiatives (37 percent) and supply chain resilience (29 percent).

According to Patrick Farrell, Head of KPMG Ireland’s Risk and Regulatory Consulting practice; “Rising levels of public and regulatory scrutiny and the constantly evolving risk landscape are amongst the push factors focussing the minds of business leaders. CEOs are also increasingly focussed on the benefits of developing a more robust risk culture within their organisations. An enhanced risk culture will assist to reduce fraud and regulatory risk and improve public reputation and financial performance.”

The KPMG Ireland Board Leadership Centre has made a similar point: boards are being urged to refresh their risk profiles more frequently, stress-test assumptions, and ensure supply chain resilience considerations are elevated to strategic level. Boards that institutionalise this discipline are better positioned to anticipate shocks rather than react to them.

In short, CEOs are facing interconnected pressures — a cyber-attack can morph into reputational damage; inflationary shocks can derail investment in sustainability; regulatory divergence can fragment supply chains. Leadership is about anticipating these linkages, not just tracking apparently singular issues.

Planning for growth

Despite this risk intensity, many CEOs are planning for growth. 80 percent of NI CEOs expect earnings to rise over the next three years, compared to 57 percent in ROI. Similarly, 86 percent of NI CEOs and 94 percent of ROI CEOs forecast headcount increases. At the same time, 69 percent in ROI and 66 percent in NI confirm they have adapted their growth strategies due to recent challenges.

This reflects the well-established optimism gap: leaders remain confident about their own organisations but are less sanguine about the broader economy. Global data shows the same paradox: only 68 percent of CEOs are confident in the global economy’s growth prospects — the lowest level since 2021 — yet 79 percent remain confident in their own organisation’s outlook. CEOs worldwide are proving resilient and opportunistic at the micro level, while recognising fragility in the macro environment — from trade fragmentation and geopolitical rivalry to persistent inflationary undercurrents.

The Central Bank of Ireland has reinforced this duality. It forecasts GDP growth of 3.5% in 2025 and 3.7% in 2026. This is down from previous estimates due to increased economic uncertainty, which is expected to impact consumer spending. The bank anticipates a slight increase in unemployment and notes that while exports have been strong, this could change, due to trade tensions.

Nevertheless, CEOs in the Republic remain cautiously optimistic about the prospects for their own businesses, even as they voice concern about the broader economy. Ireland’s economy continues to benefit from strong foreign direct investment, EU membership and market access, and a young, educated workforce, but growth also depends in part on fostering home-grown entrepreneurship and ensuring the right conditions for scaling domestic firms.

According to Orla Gavin, Head of Tax with KPMG in Ireland: “In an uncertain and changing global environment, business leaders need to be focused on what is within their control and flexible to adapt to new risks and opportunities.

Policy makers need to ensure Ireland’s strategy is competitive, clear and connected - focusing on entrepreneurship, investment, innovation and attracting and retaining highly mobile global talent.”

For Northern Ireland, the UK context is critical. The Bank of England has highlighted that private-sector wage growth remains elevated, running at around 5.1 percent annually. At the same time, Danske Bank forecast NI’s economy to grow by just 1.0 percent in 2025 and 1.1 percent in 2026 — modest figures that underline structural fragility. High costs, restrictive monetary policy, and inflation above target combine to squeeze margins and limit investment confidence. For NI CEOs, this makes navigating the balance between ambition and caution even more complex.

Reflecting the challenges, Johnny Hanna, KPMG’s Partner in Charge in Northern Ireland says: “We’re seeing essentially cautious optimism. CEOs are committed to AI adoption, enhanced cybersecurity, and sustainability investment that makes business sense. However, the backdrop of modest growth, elevated costs, and wage pressures are pushing business leaders to think carefully about where their priorities should lie.”

Regardless, Hanna remains highly positive about the business environment: “Northern Ireland offers genuine appeal in terms of market access, a relatively attractive cost base, talent and quality of life.”

Technology captures this balancing act vividly. AI is viewed by 91 percent of NI CEOs and 69 percent of ROI CEOs as a strategic imperative. Yet two-thirds of ROI CEOs also highlight technology infrastructure costs as a significant constraint. This tension underscores the economic reality: innovation requires both capital and patience.

Boards should therefore demand clarity on where AI adoption will genuinely create advantage rather than allowing every function to pursue fragmented pilots.

The M&A outlook

Looking ahead, M&A appetite among business leaders remains strong in both jurisdictions. Almost all (98 percent) of CEOs in ROI plan acquisitions in the next three years, with 89 percent reporting the same in NI. These numbers reflect optimism, despite some perceived levels of global uncertainty, and broadly in line with research presented in the annual M&A Outlook report, published by KPMG in Ireland earlier this year.

According to Mark Collins, Head of Deal Advisory with KPMG “Through 2025 we have seen confidence build steadily in M & A and the outlook for the balance of the year and into 2026 is very positive, reflecting the sentiment expressed by the CEO community. This is very much the case for both financial and strategic buyers, fuelled by the availability of lower cost capital together with an increasing supply of high-quality assets coming to market”.

As strategic players seek routes to innovation and long-term growth, deal-making remains a critical lever, Collins continues; “Buyers are increasingly focused on strategic acquisitions that provide transformative capabilities, enabling them to innovate, diversify, and maintain a competitive edge.”

Cyber defence strategies

CEOs in both ROI and NI believe cybercrime and cyber security will impact their firm’s prosperity in the next three years (83 percent and 77 percent respectively). Business leaders across the island also report concerns on fraud detection and prevention amid growing security challenges. Concerns about cyber-attacks, identity theft, and data privacy are also high on the agenda.

Yet when it comes to strategic investment, less than a quarter (23 percent) of organisations in ROI, and half (46 percent) in NI are prioritising cybersecurity and digital risk resilience. This compares to a global average of 39 percent of CEOs who are prioritising cybersecurity investment as a top means of mitigating risk — suggesting that businesses in the Republic in particular may be under-allocating relative to their global peers.

For Dani Michaux, Dublin-based EMA Cyber Leader at KPMG, this highlights the undeniable fact that technology alone is not enough to address these complex threats. “True cyber resilience is not just about technology, but also about culture, governance, and preparedness – all of which are people-driven. Humans will remain an important part of resilience strategies in combating cyber-crime. It’s our collective awareness, strategic decision making, vigilance, and adaptability that create the strongest line of defence.”

Michaux also emphasises the importance of company culture in cyber resilience. “In the end cyber response is a collective effort and team sport – everyone has a role to play.”

Supply chain fragility

Supply chain risk is in large part a function of geopolitical upheaval. According to Stefano Moritsch, Global Geopolitics Lead, KPMG: “We’re in the middle of a ‘geopolitical recession’. Boards are waking up to the reality of geopolitical risk being very high on their agenda and are now working to increase their resilience.” For CEOs that global trend is made concrete through investments in geopolitical monitoring, supply chain continuity, and digital defence.

ROI CEOs are investing in resilience at 37 percent and in NI at 29 percent. Meanwhile globally, 34 percent of CEOs identify AI integration, 39 percent cybersecurity, and 36 percent regulatory compliance/reporting as the top measures to strengthen resilience against disruption.

Strengthening leadership

Risk is not only a technical or economic challenge — it is a leadership one. When asked which qualities define effective leadership in today’s volatile climate, CEOs north and south of the border offered revealing contrasts. In the Republic, four in ten business leaders prioritise the ability to identify, prioritise and manage risks. In Northern Ireland, by contrast, 38 percent emphasise the importance of leading transformation and driving cultural change, pointing to the deep adjustments organisations are making in the wake of technological disruption and shifting trade patterns.

Our survey also shows how digital capabilities are moving from technical domains into the boardroom- albeit somewhat slowly. Almost a third (31 percent) of Northern Ireland’s leaders and a quarter of those in the Republic highlighting digital and technological literacy as critical traits. One in four CEOs in Northern Ireland see an understanding of AI as a key leadership attribute, while in the Republic, one in five emphasise empathy and communication. Our CEO Outlook paints a picture of leadership under pressure — where CEOs are expected to be strategists, technologists and communicators, as comfortable engaging on AI and cyber as they are in managing crises or maintaining employee trust.

Leadership roles are evolving accordingly. Over half of CEOs — 51 percent in ROI and 54 percent in NI — report that their role has changed significantly in recent years. The expectation now extends well beyond financial results. CEOs must often function as public figures, ethical decision-makers, and cultural stewards, demonstrating resilience under pressure and credibility in their communication.

The changing risk environment also forces a reassessment of what makes for effective leadership. Technical expertise in every area is neither feasible nor desirable for a CEO, yet increased specialisation means CEOs must know enough to ask the right questions and integrate specialist insights into a coherent narrative.

Our advisory work shows that boards are increasingly diversifying their composition, bringing in expertise in cybersecurity, climate science, geopolitics, and economics. This broadening ensures that resilience is not left to chance but is embedded at the highest level. Boards that recruit for breadth of expertise are better able to connect disparate risks into a coherent strategy.

Actions to consider

Ireland’s CEOs are ready.

Are you?

Chat with our leadership team about how the trends uncovered in CEO Outlook 2025 apply to your business and sector - connect with us to turn insight into action.