GBS 3.0: Who? What? How?

Businesses are currently facing various risks, not least of which is the currently evolving polycrisis. Ongoing military conflicts and economic headwinds are factors to consider when making business decisions. However, the Global Business Services (GBS) sector’s investments do not show any sign of deceleration, neither globally nor in the CEE region.

To help companies navigate these turbulent times, we have created a research called GBS 3.0. Several decades ago, SSCs began investing in the CEE region, bringing with them their own decentralized processes (phase 1.0). In the 2010s, companies attracted to the region adapted to become global business services, entering the phase 2.0 period. Currently, we are heading towards a digitally-enabled, global capability concept that we call 3.0.

Key Trends We See in the Market:

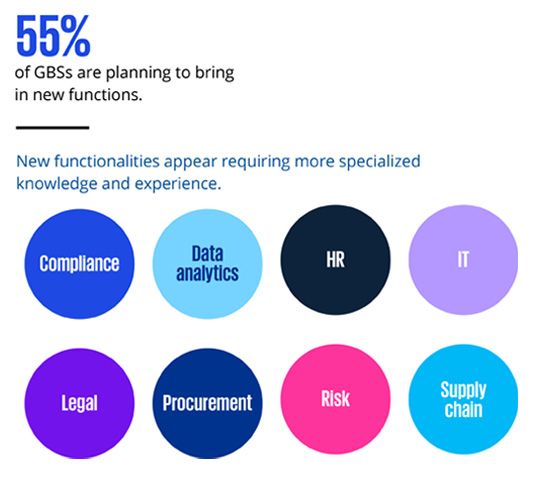

- In the GBS sector, transactional and operational activities are outsourced or automated. These are being replaced by strategic activities due to the tendency of GBSs to emerge from delivery centers into business partnering capability hubs, which then become transformational engines for entire companies.

- Companies which were previously finance-focused organizations have developed into multi-process centers supporting functions such as procurement, IT, legal, compliance, risk, data analytics, supply chain and HR. In addition, GBSs are gaining authority in corporate-wide processes and becoming providers in internal control functions for entire organizations, and are even combating business and cyber security risks.

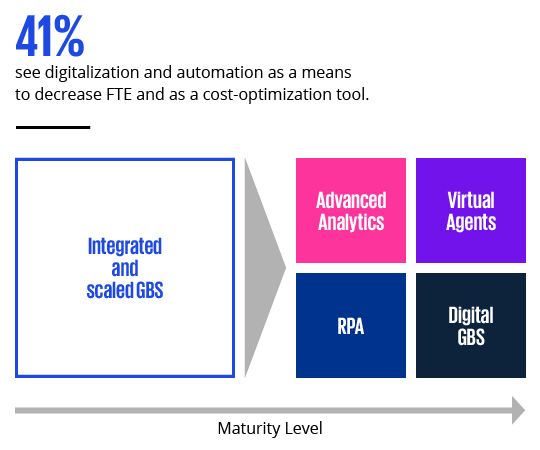

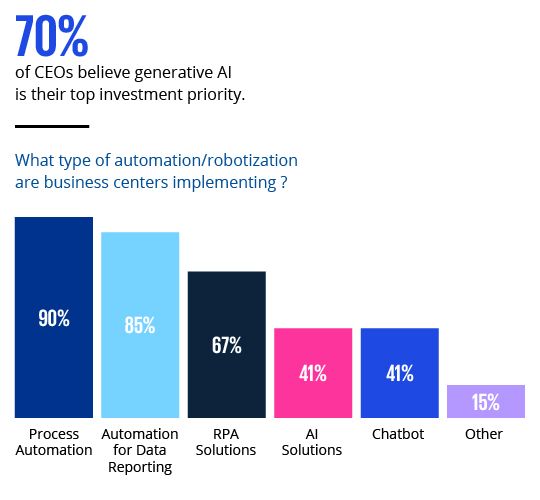

- GBS digital capabilities have been evolving. Given the maturity and the large quality data sets available at the centers, it puts GBSs in a position to become labs for early adopting generative AI and other technologies into their processes.

- Following the evolution of the sector, there is a requirement to upskill the workforce to fulfill the roles of digitally capable strategic advisors and trusted business partners.

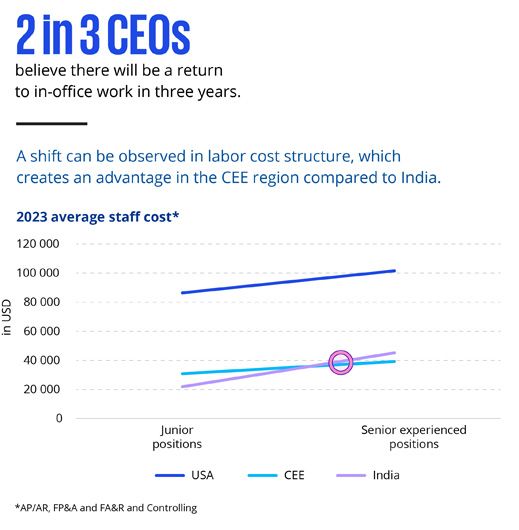

- While there is still a cost advantage in India for low complexity roles, senior and managerial positions are landing in the CEE region. This trend is strengthened by the fact that salary costs have increased in India over the last few years; therefore, the CEE region has become a reasonable choice, since it provides the best cost setup for GBSs.

- Nowadays, the awareness and preparedness of ESG compliance requirements is becoming critical for organizations. GBSs could have a prominent role in implementing and operating mature ESG processes.

- After some hesitance in recent years and changes in working environments, we see that the hybrid working model has become the preferred choice for GBSs, although two out of three CEOs expect that workers will return to the office in the next three years.

The 6 trends demanding action to reach GBS level 3.0

GBS processes are evolving from being simple and transactional to be more complex and knowledge-intense, adding value to the business operations.

GBSs are becoming trusted business partners as subject matter expertise is concentrated into CoEs, multi-tower, multi-disciplinary competence centres. GBSs are ready for the next level in digital transformation.

The one who will use the AI’s full potential first will get ahead of their competitors. GBSs have the potential to be early adopters in the latest technologies.

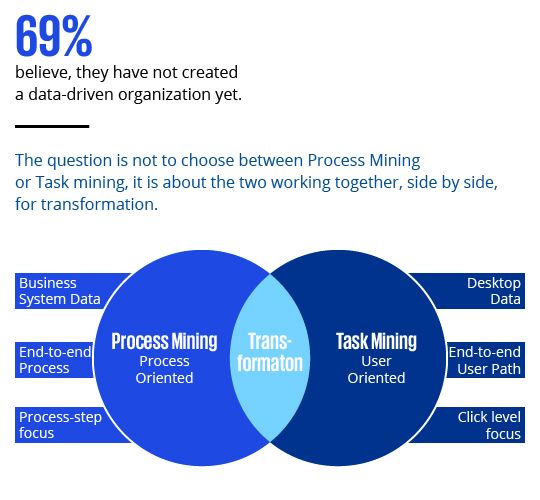

The growing number of detective control functions and the upgrade in the conventional processes bring a higher demand for process & task mining and MDM solutions in the future.

Learn more about Process Mining here.

GBSs have a strong potential to incorporate ESG processes in their activities and there is an increasing demand for doing so. ESG functions would fit well in the value added processes of the GBS sector.

Learn more about ESG here.

CEE offers a competitive cost advantage on Senior roles.

There is a continuous shift from Home Office to the mix of WFH and Office work. Finding the right balance is key in the top talents competition process efficiency.