In today's dynamic market, organizations must be willing to transform or risk irrelevance. Strategic and operational transformation is driven by external triggers such as disruptive forces impacting financial, business and operating models; or internal motivations such as driving synergies and efficiencies within and between business units and aligning stakeholder interests.

We help organizations determine whether or not and to what extent transformation is genuinely required.

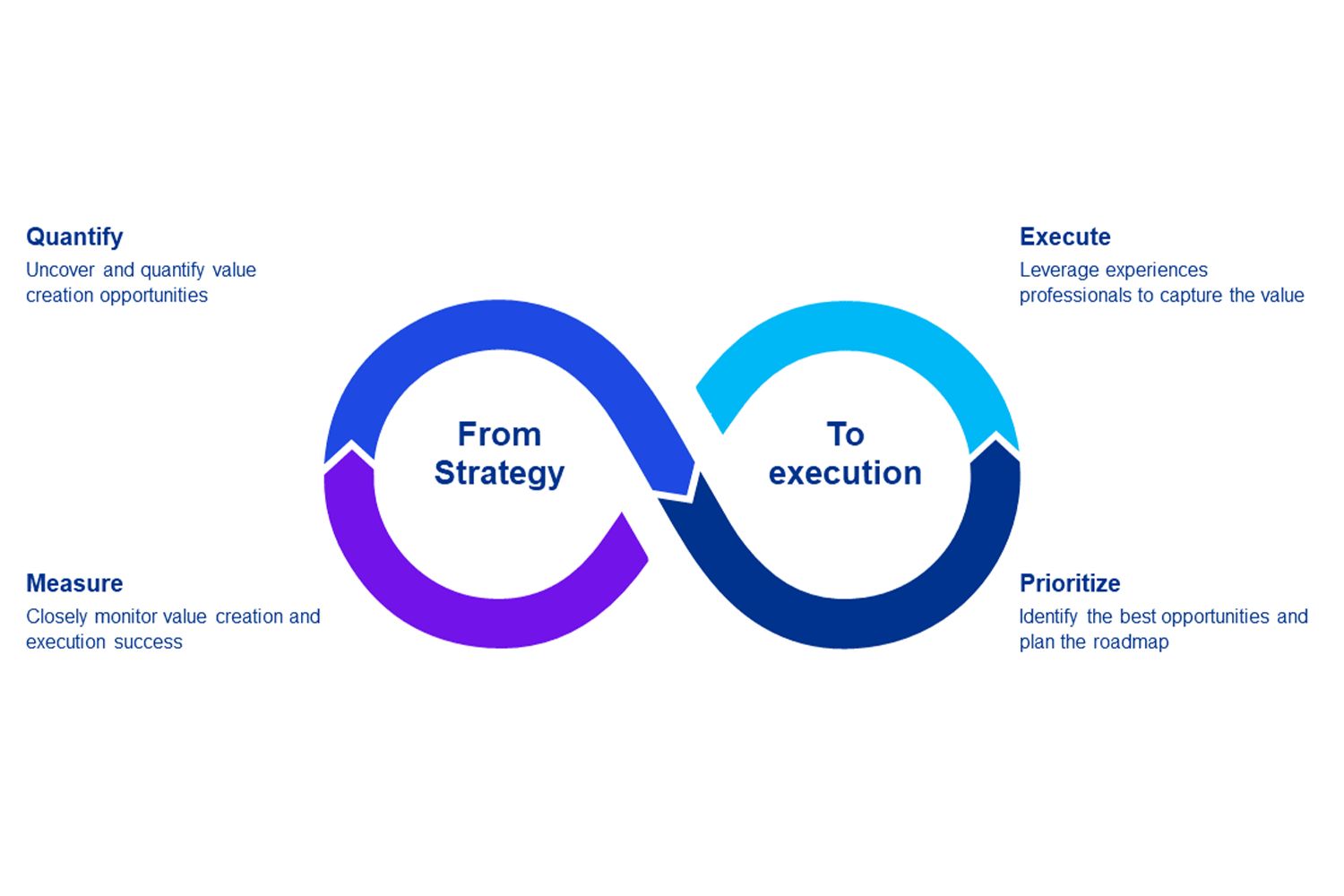

From strategy through to execution, we can help you quickly and confidently achieve measurable improvements to your customer value creation and internal efficiencies, impacting positively on your revenue and operating margin. We also consider how these changes in operating model and value chain affect tax and transfer pricing models.

Bringing strategic thinking and the hands-on skillsets to deliver on transformation, we have a distinctive in its ability to enact, rather than merely design or plan for enterprise-wide change. We help organizations address the following questions in designing, planning and implementing new strategy or operating model:

- How to refresh or shift the company's strategy, considering recent changes in market dynamics, external threats, and emerging technologies like AI, among other factors?

- How to improve internal/external perception of the business and alignment between the ambition, business and operating models?

- How do the changes in the operating model align with the transfer pricing model?

- How to manage the portfolio and improve the role of the corporate center?

- What are the intended and unintended consequences to the wider whole of decisions in each unit or in one part of the business or operating model?

- How strong is the company's readiness to execute transformation and what challenges likely await on that journey?

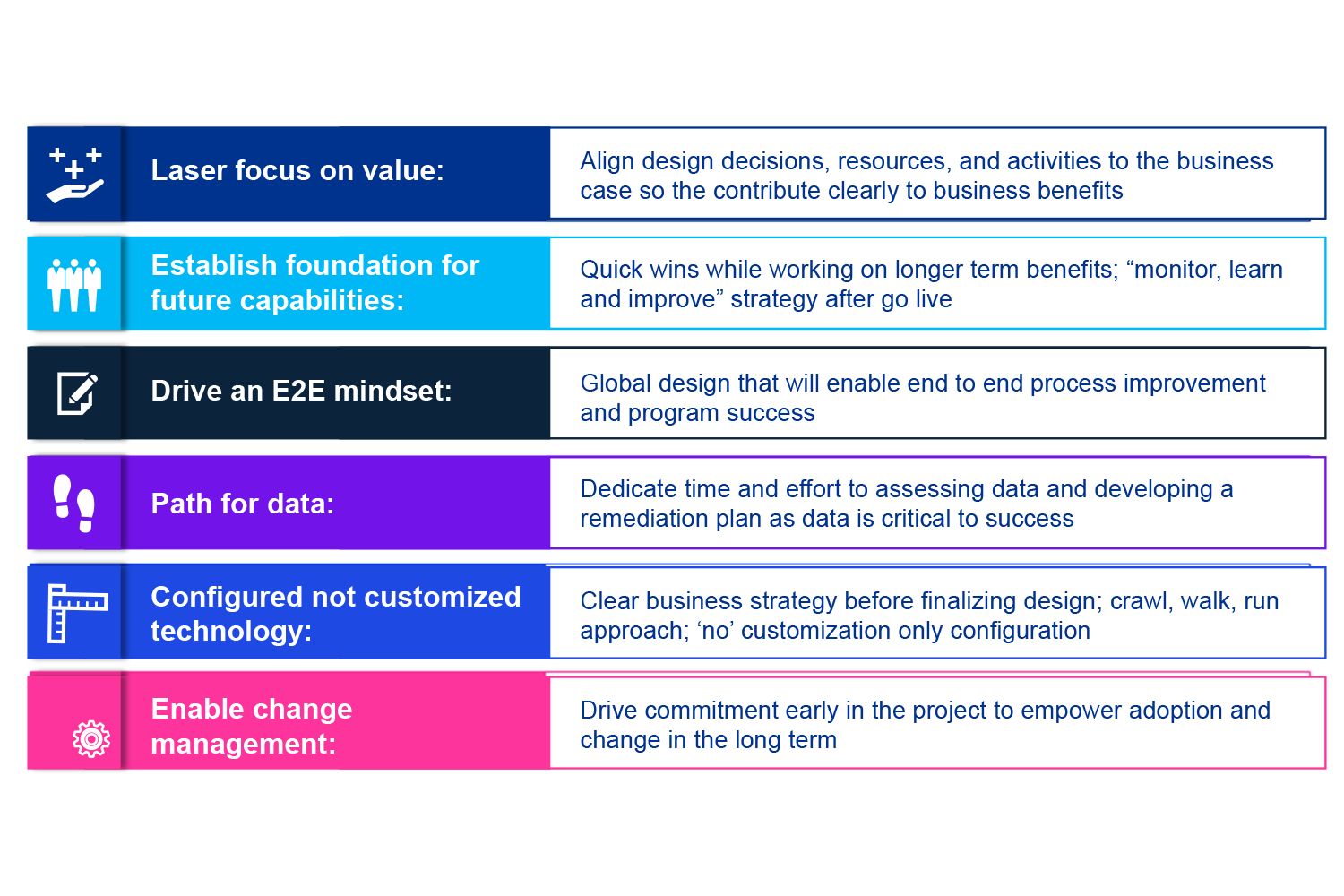

Our transformational approach is build around the following guiding principles

Our approach provides the overarching framework for multi-year strategic planning, capital allocation, portfolio and synergy assessments, scenario planning, corporate center redesigns, tax and transfer pricing model optimization and other modularized enterprise-wide services.

Take a look at our end-to-end service offering:

With the help of our systematic approach, we identify the most significant growth challenges for each organization and the most promising growth blanks, through which it is possible to create significant growth and profit. We help to solve the following questions:

- How to access new and unmet revenue and profit pools?

- How to profitably enter new markets and segments in a short timeframe?

- How to develop and commercialize innovative products in order to grow?

- How to attract new customers and enhance loyalty?

Our approach helps business leaders re-evaluate their operational strategy, and balance short term cost improvements with long-term change. We help clients generate value by challenging strategic decisions and by aligning their operating model to their business strategy and financial targets by:

- Developing and testing a range of alternative operating model options to identify the optimal solution for their business, balancing opportunities and risks

- Identifying, quantifying and prioritizing efficiency opportunities, to drive cost reduction and free up funds for investment

- Identifying opportunities to leverage relevant emerging technology and digital capabilities to embed agility and efficiency in current processes

- Streamlining and aligning processes, organizational structures, management information, decision rights and incentives

- Designing and sequencing a change program to successfully deliver the required changes

Needless to say, strategic choices and especially any changes in operating model should not be a separate discussion from related tax implications. Business operating model should always be aligned with tax model. This alignment is necessary to implement an economically supportable transfer pricing policy. It also enables the business to respond to questions raised by tax authorities who want to look at the big picture of the whole value chain of a business, not just the specific transactions of a legal entity.

We at KPMG have an integrated approach combining strategic and operational intelligence together with tax aspects. When considering strategies and operative changes, tax implications should be considered early stage to understand the future profit allocation and prepare to align the tax and transfer pricing models accordingly in order to avoid possible time consuming tax audits with accumulating costs, e.g. exit tax and penalties in different jurisdictions.

Due to our wide network we hold a strong local experience in 143 countries. With the help of KPMG your organization is able to reduce controversy, limit double taxation as well as align tax and business operating model. Any major restructuring in the value chain has a serious impact on the taxation of, both on a one-off and ongoing basis. There is a need to consider the following tax aspects:

- One-off exit tax in the event of cross-border transfers of assets (“something of value”)

- New transfer pricing policies for the altered value chain and operating model

- Undesirable cross-border taxable presence (permanent establishment)

- Indirect tax, e.g. VAT and customs duties, due to changes in physical and invoicing flows or in the nature of products

KPMG Elevate helps you to unlock value – quickly. From strategy through to execution, we can help you quickly and confidently achieve measurable improvements to your revenue, operating margins, cost structures and working capital positions.

Our approach provides a comprehensive reference framework for multi-year strategic planning, capital allocation, portfolio and synergy review, scenario work, development of group functions and other needs related to transformation planning and implementation.

We support our customers through the transformation. In our approach, the combination and utilization of strategic thinking and a practical way of working is especially emphasized. We help in identifying the key questions of the transformation:

- How to renew the organization's strategy to reflect the changes in market dynamics

- How to reconcile financial goals, business model and operational activities?

- How to develop and manage a business portfolio?

- How to develop group function?

- What is the organization's readiness and ability to implement the transformation and what kind of challenges are likely to await it along the way?

Read more about KPMG Elevate here.

In the process of acquiring or merging with another company, many companies experience massive upheaval. Having focused heavily on the transaction, firms tend to neglect the importance and complexity of the post-merger integration (PMI) phase - the crucial phase to realise and maximise deal value. We support the integration journey:

- understand the importance of PMI to realise and maximise deal value

- have years of experience managing the complexities arising from merging companies

- our team works closely with owners and top management to successfully drive, coordinate and complete their post-merger integrations

Our global network of strategy professionals provide specialist support, ideas and insight in-sector, cross-sector and cross-border. We draw on KPMG’s broad industry experience across large-scale transformation, change management, mergers and acquisitions, corporate and finance restructuring, value chain management and transfer pricing planning, tax structuring and risk management situations.

Contact us

Berndt Wickholm

Advisory Partner, Head of GSG

KPMG Suomi

Kati Rantanen

Tax & Legal Partner

KPMG Suomi