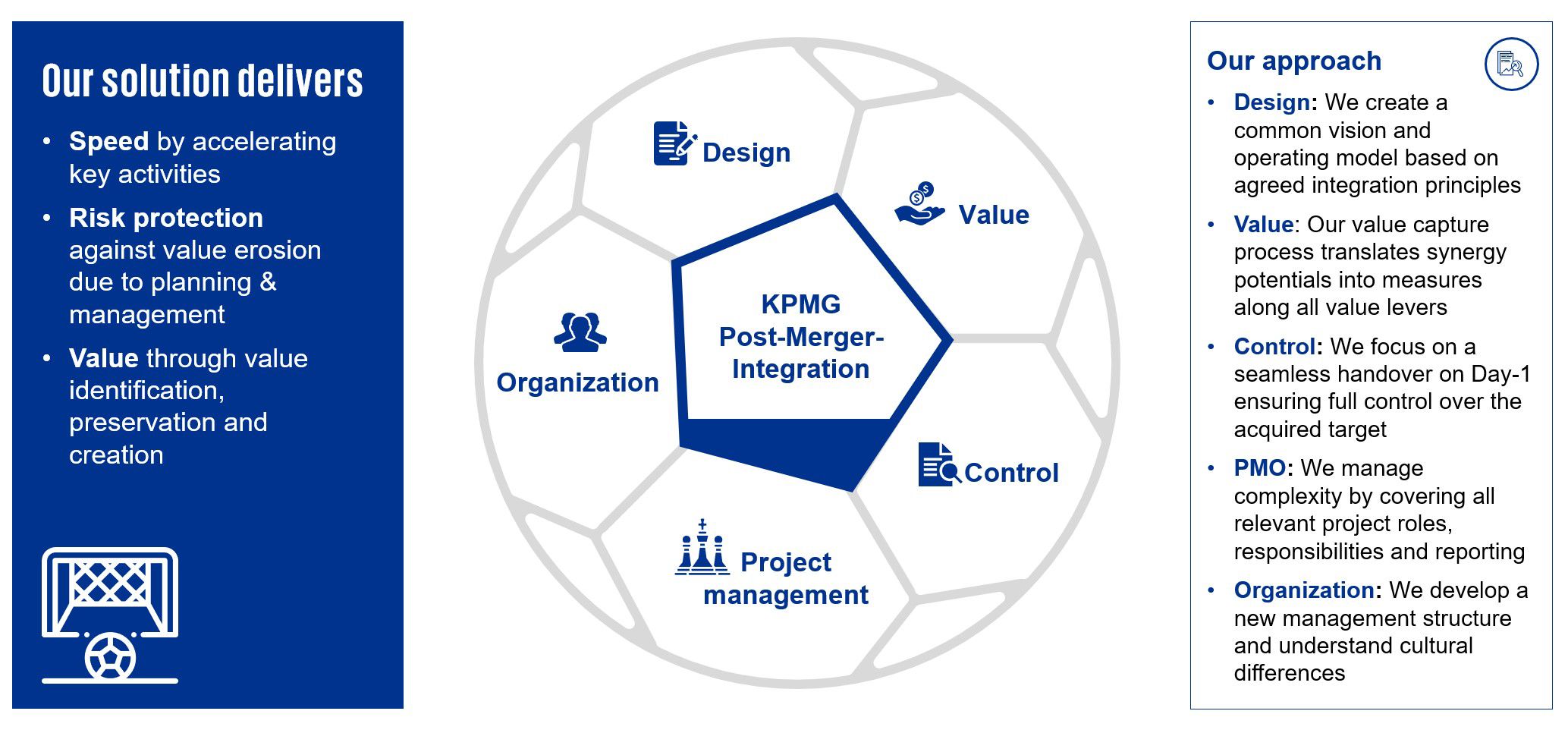

All dimensions are crucial to ensure a successful integration

In the process of acquiring or merging with another company, many companies experience massive upheaval. Having focused heavily on the transaction, firms tend to neglect the importance and complexity of the post-merger integration (PMI) phase - the crucial phase to realise and maximise deal value.

At KPMG, we understand the importance of PMI to realise and maximise deal value, and have years of experience managing the complexities arising from merging companies. Our team works closely with owners and top management to successfully drive, coordinate and complete their post-merger integrations.

The upheaval is a natural part of most mergers, as key functions and employees are to be integrated in a cohesive manner across multiple areas of the business, including but not limited to supply chain, production, back-office functions and more, while the cultures of the organisations are to find common ground.

In addition to the complexities arising from a merger, the integration phase is typically characterised by heavy time pressure, critical decisions and a multitude of stakeholders to consider and involve. All dimensions are crucial to ensure a successful integration, while limiting any disruptions to business continuity during the integration phase.

Common post-merger integration pitfalls to be avoided:

Based on our experience we have defined six common pitfalls that must be avoided and managed properly to safeguard the deal to create the required value.

1. Integration vision and strategy

Underestimate the importance of articulating the integration vision and strategy - in-line with the deal rationale – in order to provide structure for the integration.

2. Value realization and performance management

Calculate synergies on ‘the back of a napkin’ combined with poor performance management resulting in failure to realize the deal value.

3. Integration planning and governance

Commence integration planning and setup of governance too late, often due to focusing solely on deal negotiations.

4. Integration capabilities and resourcing

Allocate too little time for resources’ integration activities and mismatch between integration employees’ capabilities and required role’s capabilities.

5. Company culture and internal communication

Ignore cultural differences and lack of structured communication.

6. IT complexity

Underestimate IT complexity resulting in delayed timelines and significant overruns in one-off costs.

Our framework covers our clients' challenges and delivers true integration:

In addition to mastering the business perspective, our cross functional team includes also tax and legal experts that are well equipped to assist in planning cross border structures and potential restructuring measures so that they are tax effective and in compliance with ever evolving requirements within international tax rules and principles. Our network of legal advisors can provide you with legal implementation of mergers and other restructuring measures, while you can stay focused on the business and have one centralized team to carry out also the legal work that may be required for completing the integration.

Our latest insights

Contact us

Max Aro

Advisory Director - M&A Integration and Separation

KPMG in Finland

Jani Karjalainen

Tax & Legal Partner

KPMG Suomi