2025 - Key Highlights

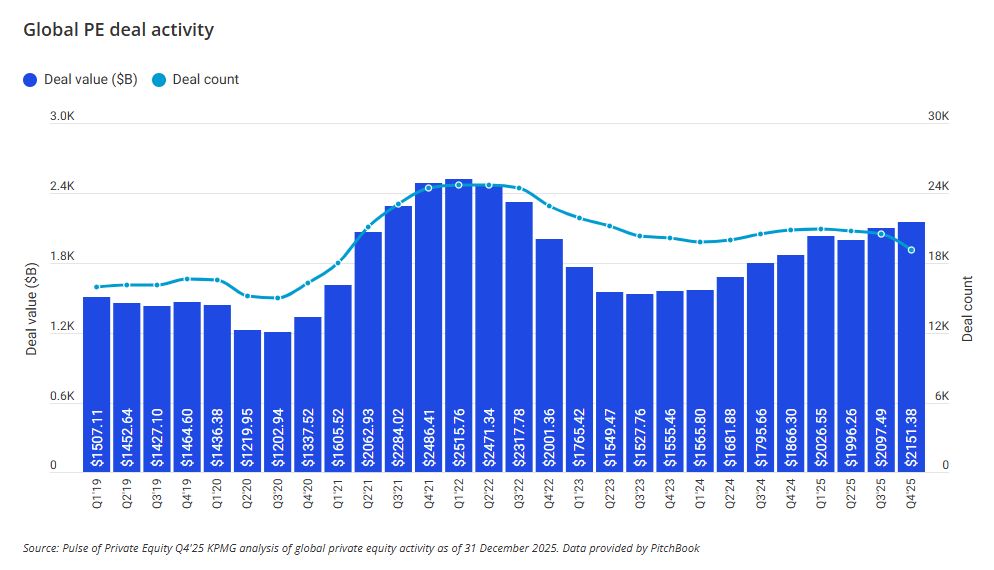

- Global PE investment rose from $1.8 trillion in 2024 to $2.1 trillion in 2025, despite a decline in deal volume from 20,836 to 19,093.

- The Americas accounted for more than half of global PE investment, with $1.2 trillion deployed across 9,118 deals; this total approached the $1.4 trillion peak seen in the Americas in 2021 - previously viewed as an outlier year - even as deal volume declined to a five-year low. The US attracted $1.1 trillion of this total across 8,232 deals.

- Global PE exit value totalled $1.2 trillion in 2025, marking the second-highest annual level in the past decade, trailing only 2021.

- The sectors that saw the most PE investment globally in 2025 were Technology, Media & Telecommunications (TMT) at $654 billion, Industrial Manufacturing at $328 billion, and Energy & Natural Resources at $276 billion.

- Global PE fundraising was the weakest in recent memory, with just $407.6 billion raised across 543 funds - down from the $608.8 billion raised across 1,025 funds in 2024.

EMA and local activity overview

PE investment in the EMA region rose from $649.3 billion in 2024 to $729.8 billion in 2025, despite the number of deals falling from 8,922 to 8,278. The strong investment highlights that while PE investors in the region remained very cautious with their capital, they continued to be willing to invest large sums to acquire high quality assets.

The UK accounted for the largest share of both PE investment and deal volume in the EMA region during 2025, attracting $204.6 billion across 1,862 deals. Germany came a distant second with $84.9 billion across 858 deals, followed by France with $84 billion invested across 1,009 deals.

The buyout of Channel Islands fund administration services company JTC Group by Permira for $6.6B, featured in the top 10 largest global deals of Q4’25.

Global PE investment surged to a four-year high of $2.1 trillion in 2025, despite a continued slowdown in deal activity, according to KPMG’s Q4’25 Pulse of Private Equity report. While the uptick in investment was positive, ongoing global geopolitical uncertainties and a large inventory of aging assets in need of exit kept many PE investors highly selective over the course of the year.

In contrast, deal volume declined for a second consecutive year, falling from 20,836 in 2024 to 19,093 in 2025 - well below historical norms. This divergence reflects the clear shift in market dynamics, with PE firms prioritizing fewer, larger transactions over broad-based dealmaking. In Q4’25 in particular, the global PE market saw ten megadeals valued at $6.5 billion or more, including five transactions in the US alone.

The Americas attracted the largest share of PE activity during 2025, accounting for more than 55% of total global PE investment ($1.2 trillion) and just under half of all PE deals (9,118). The US attracted the vast majority of this activity ($1.1 trillion across 8,232 deals), reinforcing its position as the primary engine of global PE investment. The EMA region ranked a distant second, attracting $729.9 billion across 8,278 deals during the year, while the ASPAC region saw $144.8 billion invested across 1,162 deals.

The Technology, Media, and Telecommunications (TMT) sector accounted for the largest share of global PE investment in 2025 ($654 billion) - the second-highest annual total on record for the industry after 2021. Industrial Manufacturing ranked second with $327.6 billion in investment, followed by Energy & Natural Resources with $276.5 billion. The Consumer and Retail sector also saw good traction with PE investors, attracting $262.2 billion in investment over the year.

5 key trends we saw in 2025 and predictions for 2026

Exit value improves in 2025, with momentum building heading into 2026

Global PE exit value reached $1.2 trillion in 2025 - the second-highest level in more than a decade - highlighting a solid year despite a very selective exit environment. Meanwhile, exit volume dropped to a five-year low of 3,162 during the year - which is concerning given the large inventory of aging assets in need of exit and the amount of capital stuck in the market as a result.

The strong uptick in exit value suggests improved pricing, increased buyer confidence, and a willingness to invest in high-quality assets. Looking ahead to 2026, there is optimism that momentum for exits is building and that the year will see the bounce back that is needed to see capital returned to LPs, and help unlock the funding currently stuck in the market to renew the PE investment cycle.

Global exit value from public listings reached $324 billion in 2025 - its highest level since 2021. The US and Europe accounted for the majority of this activity, contributing $149.6 billion and $100.8 billion, respectively. While the ASPAC region saw a resurgence in its IPO activity generally in 2025, this momentum has yet to translate into a meaningful recovery in PE–backed IPO exits - which remained quite constrained throughout the year.

PE investment in Americas remains resilient — focused on largest deals

PE activity in the Americas remained very selective in 2025, with PE investors across the region focusing primarily on making fewer, larger, and more strategic deals, including scale-driven add-ons; during the year, the region saw total PE investment rise to $1.2 trillion even as deal volume fell to a five-year low of 9,118 deals. The US dominated this activity, accounting for $1.1 trillion in investment and nearly all of the region’s largest deals.

Canada and Latin America both showed resilience in PE investment despite lower deal counts, supported by growing interest from global investors, stronger government-business alignment, and rising activity in sectors linked to AI, the energy transition, and infrastructure - setting a solid foundation for investment heading into 2026.

EMA sees solid uptick in PE investment as PE investors focused on buy-and-build strategies

PE investment in the EMA region increased from $649.4 billion in 2024 to $729.9 billion in 2025, even as deal volume declined to 8,278 transactions - highlighting a continued focus on high quality deals centered around top of the market assets. The UK led the region in both investment and deal activity, while Germany, France, and Spain saw higher deal values, and India and Italy stood out with rising deal volumes. Buy-and-build strategies remained key throughout the region, with add-on investment reaching a four-year high as PE firms focused on making larger, more strategic acquisitions. While the EMA region saw a modest rise in exit value, exit volumes remained subdued, driven by valuation gaps and a weak IPO environment.

ASPAC region sees PE investment hold steady, driven by record PE investment in Japan

The ASPAC region saw steady PE investment in 2025, attracting $144.9 billion in investment across 1,162 deals; this resilience was driven largely by a sharp increase in PE activity in Japan, where PE investment more than doubled year-over-year - to a record $51.8 billion. In contrast, China saw both PE investment and deal volume fall to multi-year lows as PE investors remained cautious amid macroeconomic and geopolitical uncertainties. In Australia, deal flow remained quite resilient, despite lower total PE investment.

Across the ASPAC region, PE investors took a more defensive, wait-and-see approach to deal-making given global uncertainties, focusing primarily on domestic-oriented sectors such as healthcare, financial services, and digital infrastructure.

Improving exit conditions and AI-driven sectors set to shape PE activity in 2026

Heading into 2026, there is cautious optimism that exit volumes will continue to improve as market conditions improve, valuation gaps narrow, and some global uncertainties stabilize. The US IPO market opening in 2025 - at least for high-quality, resilient assets with proven performance - bodes well for exit activity heading into 2026. As exits ramp up and an increasing amount of capital is returned to investors, PE deal activity will likely begin to pick up more broadly.

Looking ahead, AI-related infrastructure and energy are expected to be hot areas of PE investment, in addition to healthcare and financial services.

In 2025, the EMA region remained a magnet for global private equity investment, with US funds drawn to the more affordable assets. As we enter 2026, we’re seeing early signs of market conditions beginning to rebalance, with narrowing valuation gaps in the M&A space, prompting PE firms to accelerate some of the long delayed exits. Looking ahead to the first half of the year, we expect the strongest growth in PE activity across AI driven infrastructure, energy transition, healthcare and financial services sectors, offering resilient fundamentals and long term structural demand.

2025 was a standout year for global PE deal values, powered by a surge in large cap transactions. It was fantastic to see a Channel Island headquartered business sit among the Top 10 global deals Q4’25 - with Permira's take-private of JTC Group in a £2.3 billion deal. This also marked one of the UK's largest take-private deals of 2025. But deal volume lagged well below historical norms. In 2026, we expect volumes to rebound as financing becomes more accessible and more buyers-sellers meet on price - while sellers, under growing pressure to transact, adjust expectations. This alignment should help close valuation gaps and unlock a renewed wave of exit activity.

Trends to watch for in Q1’26

Heading into 2026, private equity sentiment is cautiously optimistic. As valuation gaps continue to narrow and the U.S. IPO market - while selective - shows openness to high-quality, resilient assets, exit volumes are expected to gradually improve. Stronger exit activity should, in turn, help rebuild investor confidence and support increased investment levels.

With a record $1.7 trillion in dry powder at the end of 2025, easing financing conditions, and a growing inventory of assets needing to be exited, PE firms will be under pressure to deploy capital. Investment activity is expected to remain strong, particularly across AI-related infrastructure and energy, as well as healthcare and financial services. Continued government funding in AI, infrastructure, and defence is likely to further reinforce these trends.

Fundraising, however, is expected to remain subdued in 2026. The significant capital already in the market and ongoing pressure to return capital to LPs will likely limit new fund formation, with capital increasingly concentrated among larger, more diversified firms. Smaller funds may face growing challenges in raising follow-on vehicles, increasing the risk of prolonged capital stagnation across parts of the market.