The global discussion about the digital tax or digital service tax is increasingly occupying business entities outside the digital economy. Recent examples show that the digital tax no longer focuses only on original digital business entities, but that companies from all sectors can potentially be affected. For example, any business entity that sells goods or services via an intra-group ordering platform can, in principle, be subject to digital taxes.

The situation is further complicated by the fact that, on the one hand, the OECD is looking for a global and fair solution for a fundamental reorganisation of international tax distribution, taking into account digital business models (BEPS 2.0), and, on the other hand, there are corresponding efforts at EU level. However, a common solution is not yet foreseeable. National differences therefore often make it difficult for business entities to keep track of everything.

Why a digital tax?

The global economy has changed and continues to change. However, many established tax regulations up to now do not capture the new, often digital business models, or the importance and value of users and their data. The main criterion for taxation is currently still the physical presence in a market. The intended reorganisation is intended to take into account the increasing digitalisation of the economy regardless of the sector. However, monetary considerations, resulting from the need for state financing due to the COVID-19 pandemic, among other things, are also fuelling the discussions on “new taxes”.

Unilateral solo efforts

Many states do not want to wait for a consensus solution from the OECD, as the work on BEPS 2.0 keeps stalling. The result is unilateral digital taxes by individual states on certain types of revenue. Although the various approaches all pursue the same goal of “more tax base in market states”, they do so by fundamentally different means.

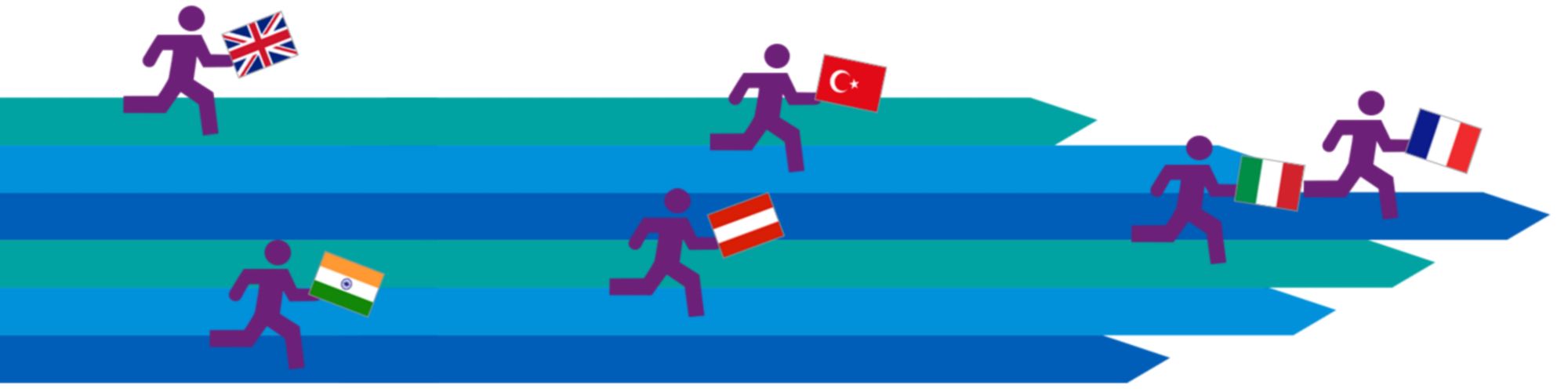

1 April 2020: United Kingdom

- Digital taxes based on the EU draft directive

- Focus on original digital companies that have also exceeded a certain revenue amount worldwide

1 March 2020: Turkey

- Digital tax with the widest scope and highest rate in Europe

- The provision of digital content (books, magazines, audio/video material, etc.) is also covered by the scheme

1 January 2019: France

- Digital taxes based on the EU draft directive

- Focus on original digital companies that have also exceeded a certain revenue amount worldwide

1 April 2020: India – “Equalisation Levy”

- No digital tax in the sense of the EU draft directive

- Very broad understanding of digital services (sale of goods, ERP transactions, intra-group services, etc.)

- Not a tax in the strict sense, but an additional “special levy” without the possibility of offsetting against income tax.

1 January 2020: Austria

- Digital tax

- Very limited scope of application to revenues from advertising services on a digital platform (e.g. banner advertising, search engine advertising etc.)

1 January 2020: Italy

- Digital tax on revenues from

- personalised advertising on a digital platform

- the provision of a multi-sided digital platform (buying/selling of goods and services among users)

- the transfer of user data generated via a digital platform

Digital business models

Many digital taxes in Europe are based on the EU Commission's proposal of 21 March 2018 for an EU-wide regulation. Accordingly, revenues from three digital business models should be covered by digital tax:

- Provision/delivery of personalised online advertising services

- Provision of a multi-sided platform (sharing economy platforms)

- Trading user data

In part, other digital services may also be affected, e.g. streaming, downloading of software or certain content and online goods trade.

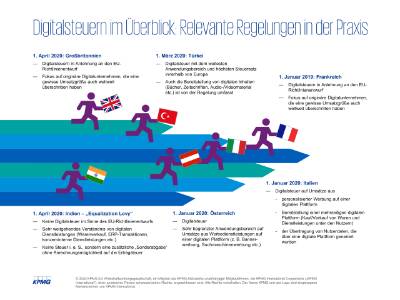

Thresholds

In addition to defining certain digital revenues, digital taxes often include a threshold system. The tax liability arises when a certain revenue amount is exceeded. For this purpose, the countries usually define two different thresholds: One takes into account the worldwide (digital) revenue at group level, the second value targets the digital revenue in the respective market. In most cases, tax liability begins as soon as both thresholds are exceeded in the respective year.

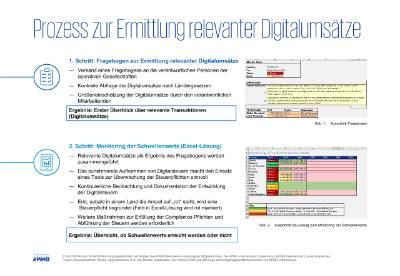

Identification of digital revenues in relevant countries

Business entities face a number of new tasks with regard to digital taxes:

Digital revenues in relevant countries must be identified

Collection and assessment of corresponding accounting data (at group level, if applicable)

Monitoring of thresholds when corresponding transactions are available

Fulfilment of the compliance obligation

Analogous to the EU Commission's proposal of 21 March 2018, exceptions are also repeatedly found in the regulations of individual countries. For example, certain sectors or business models are often exempted from the digital tax (e.g. financial services, online sales of goods, streaming, downloading digital content).

Many countries have a sunset clause built into their individual regulations. This ensures that the country-specific regulations only exist until there is a common solution. This illustrates the direct connection between the BEPS 2.0 project or the EU proposal on the one hand and the individually introduced national digital taxes on the other.

Digital taxes affect companies in all industries, not just the digital economy. Maintaining the corresponding tax compliance poses major challenges for companies.

You can watch the recording of Dr Andreas Ball and Dr Oliver Buttenhauser’s webinar on “New Digital Taxes – What Companies You Need to Watch” from 1 July 2020.

Stay up to date

Due in part to the constantly changing regulations in many countries around the world, it is a challenge for business entities to keep track of digital taxes. In our international KPMG network, we will collect relevant data for you and make it available to you regularly via app or on our Digital Economy News website.

Your contacts

Dr. Andreas Ball

Partner, Corporate Tax Services, Tax Lead of Branch Office

KPMG AG Wirtschaftsprüfungsgesellschaft

Dr. Oliver Buttenhauser

Partner Tax, Indirect Tax Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Prof. Dr. Gerhard Janott

Partner, Indirect Tax Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Dr. Kai Reusch

Partner, Tax, International Transaction Tax

KPMG AG Wirtschaftsprüfungsgesellschaft