Digital taxes (especially along the lines of the EU draft directive of 21 March 2018) seek to capture business models where user activity is the essential element of value creation.

The EU has identified three basic digital business models that could not exist without the contribution of users and their data. According to the digital tax states, the value contribution of users via so-called digital multi-sided platforms is not adequately captured by the traditional taxation system. In particular, there is usually no physical connection point of the platform operators in the user's state of residence.

The states that have already introduced a digital tax are often guided by the business models identified by the EU. In detail, however, the unilateral definitions of the taxable elements deviate in part considerably from the “basic case” due to a broader/narrower interpretation.

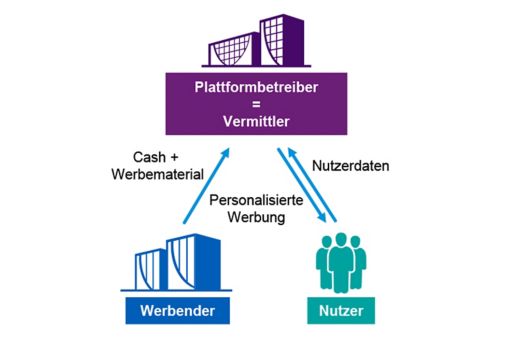

1. Provision/delivery of personalised online advertising services

Advertising is ubiquitous these days and, especially in the digital sphere, is increasingly personalised and targeted to the respective users.

The basis for personalised advertising is the user data collected by operators of digital platforms (see also 2./3.). By knowing the behaviour and activities of users, platform operators are able to create significant value through the placement of advertising on the digital platform.

The placement of a customer's advertising or their own advertising on the digital platform constitutes an opportunity for operators to exploit user traffic and the data generated from it.

In the context of digital taxes, this is the rental of digital advertising space, which constitutes a taxable transaction in the country of the user who receives and displays the advertising.

Chart (in German only)

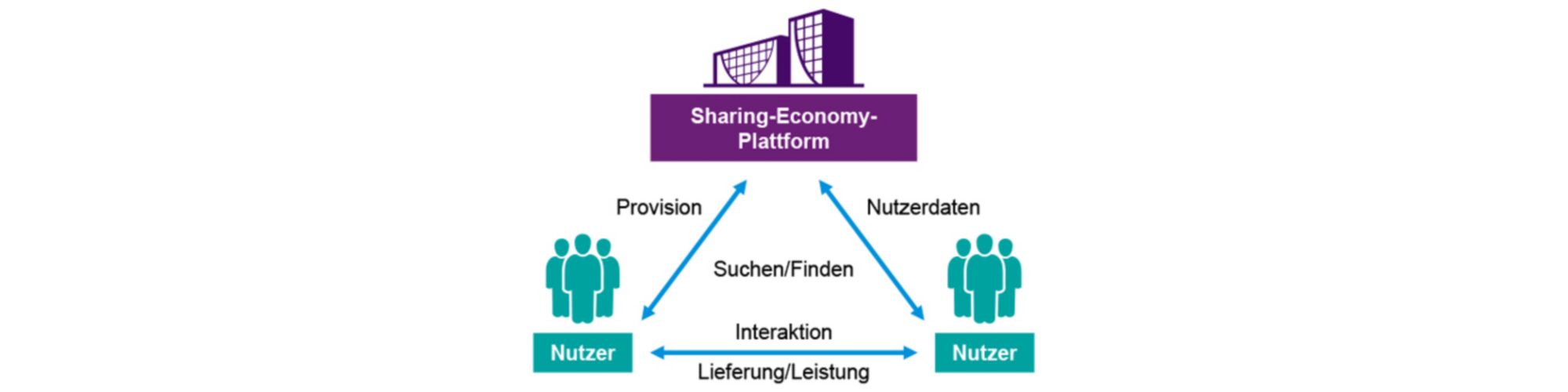

2. Provision of a multi-sided platform (sharing economy platforms)

Many of the large digital corporations use multi-sided digital platforms as a key element of their business model. Through network effects and the interaction of as many users as possible with each other, a steadily increasing added value is to be generated.

Multi-sided platforms are characterised by the fact that the main contribution to value creation is made by the users themselves. With an increasing number of users and increasing interaction with each other, the value of the services provided by the operator itself also increases (greater reach, better offer, higher advertising revenue, etc.).

The operator of a multi-sided platform can provide a wide variety of services to its users. For example, the service can consist of the arrangement of housing or in the initiation of supply/service relationships between the private users. On the other hand, the service can also consist of the exchange of information or digital content (texts, videos, audios, etc.).

The service provided by the operator of the digital multi-sided platform essentially consists of bringing together users who want to interact with each other and exchange items/services or digital content. One feature of such a digital business model is always that it could not exist without the direct participation of the users. Pure e-commerce retail platforms that intend to directly deliver goods/services to end customers are in principle not to be considered as a multi-sided platform, like classical streaming services, where the interaction among the users is only of secondary value.

The services are provided exclusively online and can be provided both in exchange for a fee (e.g. commissions) and free of charge. In the absence of a fee, the platform operators use the knowledge gained about the users (user data) to either provide personalised advertising services for a fee (see 1.) or to exploit the user data for a fee (see 3.).

To the extent that the intermediary service is provided to users for a fee (e.g. on a commission basis), digital taxes define these revenues as taxable services consisting of the provision of the multi-page digital interfaces to users. Basically, these are intermediary services that allow users to find other users, interact with them and exchange items or services directly with each other.

The local determination of the taxable revenue is always based on the place of the user. The digital tax thus attempts to ensure a certain taxation of the value added in the user's state of residence from the user's behaviour.

3. Trading user data

“Big Data” and “Data Analytics” are frequently used terms related to the digital economy.

Via the multi-sided digital platforms (sharing economy platforms), large amounts of user data are generated by the operators. This includes, in particular, data on the behaviour and activities of platform users and their personal preferences.

The collected data is used and monetised by the platform operators in different ways. User data can be used by operators for internal purposes, e.g. to improve their product portfolio and its presentation. In addition, monetisation through the provision and delivery of personalised advertising (see 1.) or through the transfer/exploitation of the collected data to a third party (e.g. a data analyst) for a fee is also conceivable.

Taxable income in the context of many digital taxes is therefore considered to be that which arises from the paid transfer of user data generated from user activities on digital platforms. The place of taxation is determined by the place where the user used the digital platform at the time of data collection.

Your contacts

Dr. Andreas Ball

Partner, Corporate Tax Services, Tax Lead of Branch Office

KPMG AG Wirtschaftsprüfungsgesellschaft

Dr. Oliver Buttenhauser

Partner Tax, Indirect Tax Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Prof. Dr. Gerhard Janott

Partner, Indirect Tax Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Dr. Kai Reusch

Partner, Tax, International Transaction Tax

KPMG AG Wirtschaftsprüfungsgesellschaft