The HKSAR Government is currently conducting a stakeholder consultation on its proposals to enhance the intellectual property (IP) tax deduction regime in Hong Kong SAR (Hong Kong). In this tax alert, we summarise the proposals put forward by the government and share our observations on how the IP tax regime in Hong Kong can be further enhanced.

Summary

Background

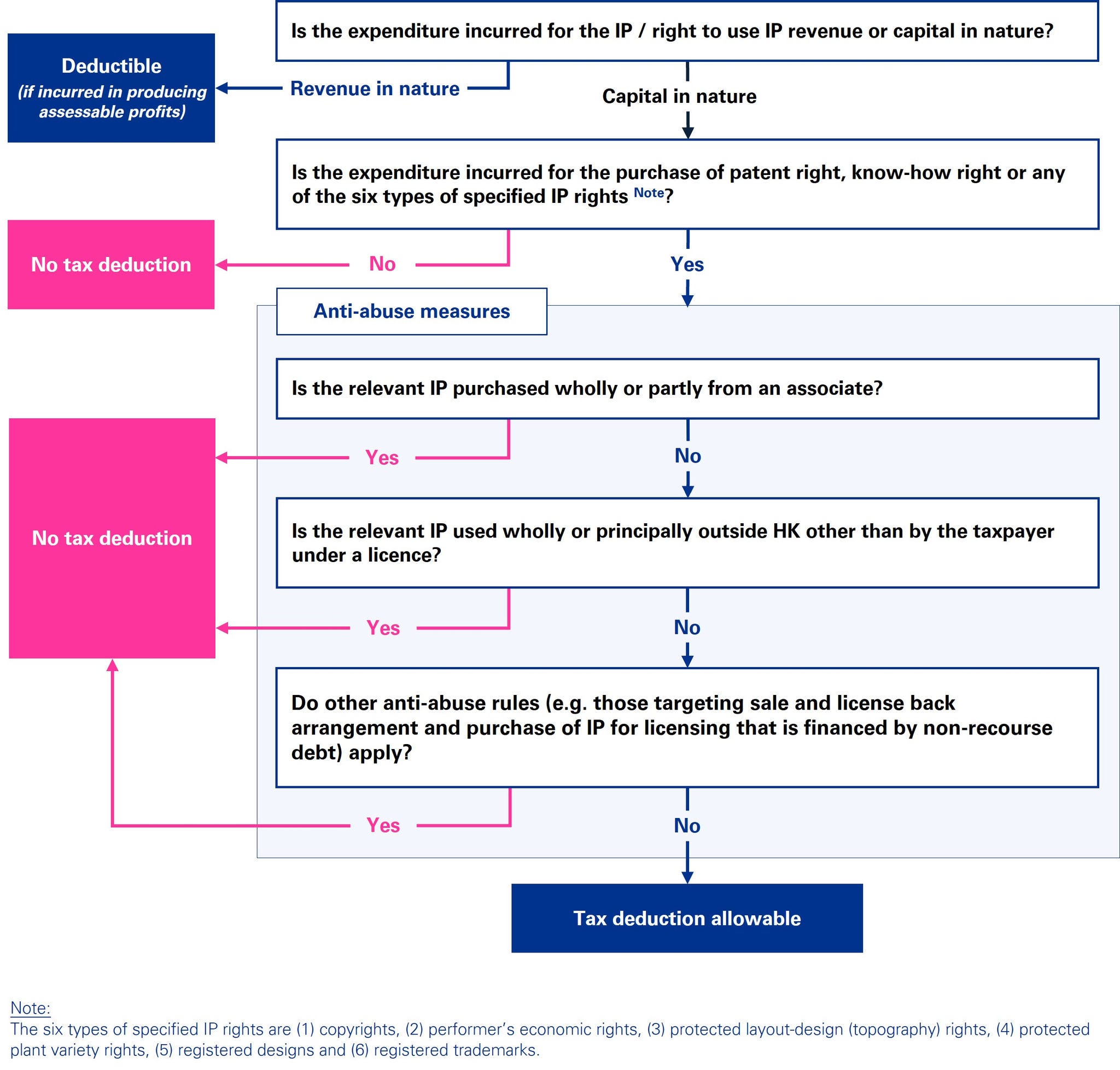

For Hong Kong profits tax purposes, expenditures incurred in acquiring IP or rights to use IP are generally non-deductible, as they are considered capital in nature. A tax deduction may be available if the acquired IP or IP rights fall within one of the specified categories for which special tax deductions are allowed under the Inland Revenue Ordinance (IRO). However, numerous anti-abuse rules exist, which may deny tax deductions in various circumstances. This effectively increases the business costs of engaging in IP-related activities in Hong Kong.

To further promote IP trading and licensing activities in Hong Kong, the HKSAR Government announced in the 2025-26 Budget that it will review the tax deduction regime for IP-related expenditures.

Existing IP tax deduction regime

The flowchart below provides an overview of the existing IP tax deduction regime in Hong Kong.

The proposals to enhance the IP tax deduction regime

Further to the 2025-26 Budget, the government has recently launched a stakeholder consultation on the following proposals to enhance the IP tax deduction regime:

1. Proposals regarding tax deductions for acquisition costs of IP purchased from associates

- Scope – Tax deductions are available for the acquisition costs of patent rights, rights to know-how and the six types of specified IP rights purchased from associates, subject to various anti-abuse measures.

- Existing anti-abuse measures – The existing anti-abuse provisions mentioned above, including the one that disallows deduction in case the IP is used by someone (other than the taxpayer) under a licence wholly or principally outside Hong Kong, remain applicable1.

- New main purpose test – This test will be introduced to disallow deduction if the main purpose or one of the main purposes of the IP acquisition is to obtain a tax benefit.

- Transfer pricing (TP) requirements – Domestic intra-group IP transfers (e.g. transfers between two group companies, both of which are a Hong Kong taxpayers) will be subject to the TP rules and TP documentation requirements under the IRO. That is, the domestic transaction exemption provided under the existing TP rules will not apply to such transfers.

- Taxation of sales proceeds – For domestic intra-group IP transfers, the full amount of sales proceeds received by the IP transferor, less any amount of deduction for IP acquisition costs not yet allowed to it, will be treated as taxable trading receipts. The claw-back will not be capped at the IP tax deduction previously allowed.

- Third-party independent valuation report – A valuation report from a valuer (with the relevant qualifications and independent of any party to the transaction) would be required if the acquisition cost of the IP acquired from an associate is equal to or greater than HK$3 million. The valuation report should be provided upon request by the IRD subsequent to the filing of a tax return.

2. Proposals regarding tax deductions for upfront licence fees for the rights to use IP

- New deduction – Tax deductions will be allowed for upfront licence fees incurred for the rights to use IP in licensing arrangements, even if they are capital in nature, provided they are incurred in producing assessable profits.

- Forms of licence covered – Deductions will apply to exclusive, sole, and non-exclusive licences.

- Types of IP covered – The scope will be confined to patent rights, rights to know-how, and the six types of specified IP rights under the existing regime.

- Deduction period – Deductions will be spread evenly over the licensing term, in line with the accounting treatment on amortisation of the licence. Special rules will apply to any subsequent amendments to the licensing arrangement.

- Claw-back arrangement – If the licensing right is terminated or assigned in whole or in part, any excess of the proceeds from the termination or assignment over the tax deduction amount not yet allowed will be recouped. The recouped amount will however be capped at the amount of tax deduction previously allowed.

- Deeming provision – Upfront licensing income not otherwise chargeable to profits tax received by a Hong Kong licensor will be deemed as taxable trading receipts on the basis that deduction has been allowed to the licensee.

- Anti-avoidance measures – The Commissioner of Inland Revenue will be empowered to determine arm’s length pricing, request a valuation report and allocate the consideration in relation to an IP licence when assessing a tax deduction claim.

Legislative timeline

The in-charge government policy bureau is the Commerce and Economic Development Bureau. Its target is to introduce a bill on implementing the above proposals into the Legislative Council within 2026.

KPMG Observations

We welcome the government’s initiative to enhance the IP tax deduction regime in Hong Kong, which demonstrates its commitment to responding to feedback from the industry and tax profession.

As one of the stakeholders, we will provide our comments on the above high-level proposals to the government as part of the current consultation exercise. We will also make a submission when the draft tax legislation with the detailed rules is published. As with other existing tax incentives and concessions in Hong Kong, we believe that any anti-abuse measures or deeming provisions premised on the tax symmetry principle proposed for the new IP tax deduction regime should be carefully formulated and administered to ensure that the deduction regime remains business-friendly and pragmatic. Business groups in Hong Kong operating in IP-intensive sectors should also take this opportunity to share their views with the government and stay informed about further developments in this area.

Separately, to further enhance the overall IP tax regime in Hong Kong, we recommend that the government consider the following issues: (1) addressing the tax mismatch where foreign-sourced IP income may be taxable in Hong Kong but the related IP expenditure is not deductible; (2) introducing a tax deduction for accounting amortisation expenses for intangible assets in general rather than allowing a tax deduction for expenditure incurred on specified types of IP and IP rights only; (3) enhancing the current super tax deduction for R&D expenditure; and (4) exploring possible reforms to the existing patent box tax incentive in light of the impact of Pillar 2 of BEPS 2.0.

If you have any questions or require assistance regarding the above developments, please feel free to contact us via taxservicesenquiry@kpmg.com.

1 However, a Hong Kong taxpayer would still be eligible for tax deduction if the IP is used by both the Hong Kong taxpayer and a party outside Hong Kong in producing taxable profits in Hong Kong – e.g. where a Hong Kong taxpayer grants a licence for using a trademark (registered both in Hong Kong and the Chinese Mainland) owned by it to a manufacturer in the Chinese Mainland for producing goods bearing the trademark and the goods are then sold by the Hong Kong taxpayer in Hong Kong producing taxable trading profits.