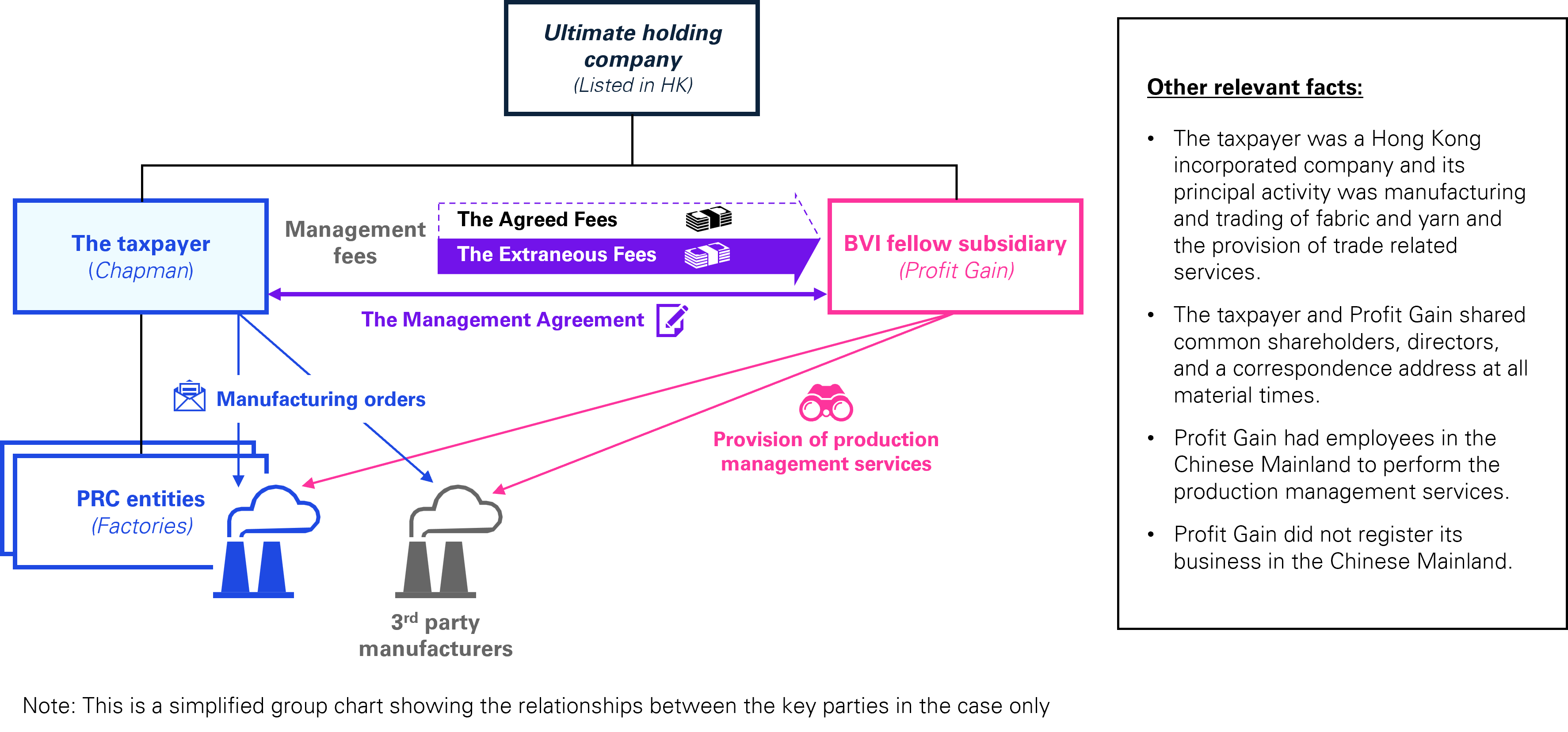

The Court of Appeal (COA) recently upheld the lower court’s judgment in the Chapman case. The COA reaffirmed that a portion of the management fees paid by a Hong Kong SAR (Hong Kong) company to its related company in the BVI are not deductible under the general expense deduction rule, while the remaining portion is disallowed under the general anti-avoidance rule.

In this news alert, we summarise the COA judgment and share our observations from the case.