The consultation outlines how banks should structure and operationalise communication across pre‑, in‑ and post‑resolution phases, aligned with preferred and variant resolution strategies.

Factors like fast payment technologies and social media influence and potentially accelerate bank runs in resolution. Subsequently it is important that communication plans consider multiple platforms and are ready to respond to different events. Therefore, communication is a crucial resolvability capability. The SRB’s Expectations for Banks (EfB) include communication as a key dimension, requiring banks to plan, coordinate and execute communication to limit contagion effects and support orderly resolution.

The consultation of the operational guidance translates these high-level expectations into concrete planning and execution requirements moving communication from principle to practice.

General Information

General Information

Overview of specific information and requirements for banks

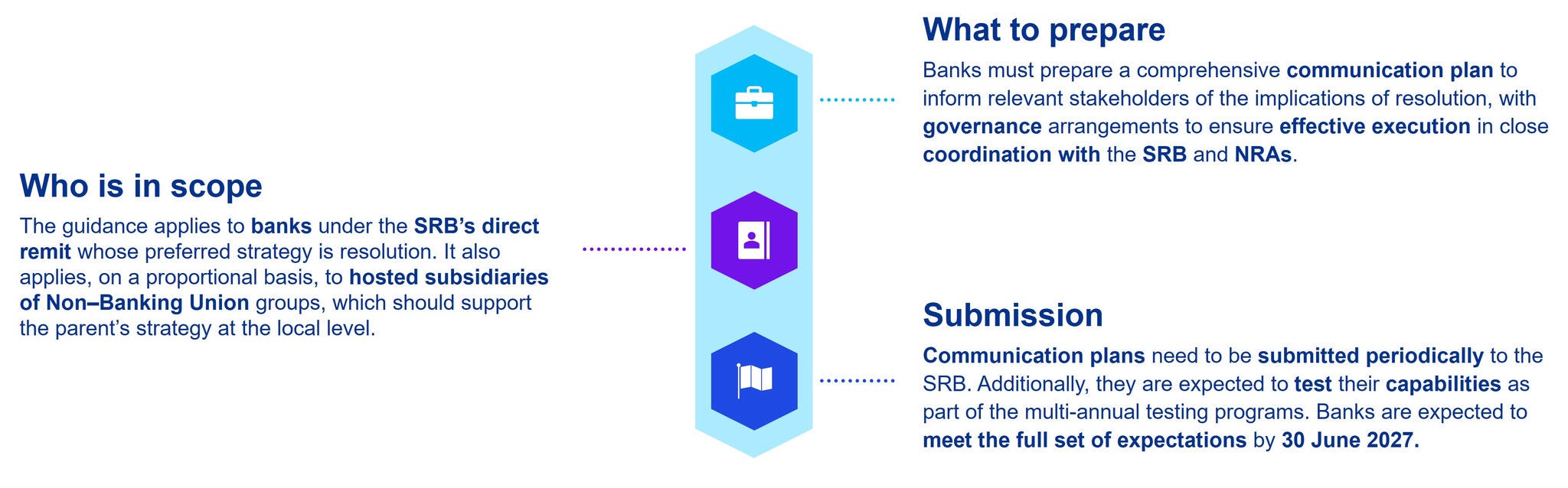

Scope of the Communication Plan Framework

Banks must maintain up-to-date, fully-fledged and operational plans that are user-friendly under stress and cover different phases of resolution, namely: the pre‑resolution, in‑resolution and post‑resolution phase (including at least a six-month stabilization period post‑resolution).

In Annex 1 of the document the SRB provides a proposed structure for the whole Communication Plan Framework (this not only includes the communication plan itself but also the communication governance).

Banks are expected to either build entity-/group-specific plans or a single group plan that addresses different levels (including language), with documented group-level coordination. Multiple Point of Entry (MPE) banks should prepare plans per resolution group.

Following the guidance the plans of banks should address the Preferred Resolution Strategy (PRS) and (if defined) the Variant Resolution Strategy (VRS). They may also be asked to analyze communication differences if a tool other than PRS/VRS is used.

Stakeholders and targeted messaging

The SRB expects that banks use the minimum stakeholder set of the Delegated Regulation 2016/1075 as a starting point, then expand and refine to the bank’s specifics. The communication plan should offer sufficient granularity to ensure targeted strategies and aligned execution (objectives, owners, channels, key personnel).

Following the guidelines, banks should classify stakeholders by potential negative reaction and their impact on resolution execution. For example, internal staff communications that hint at resolution (e.g., activation of confidentiality, retention/succession plans) should be treated as “high” risk.

Furthermore, they are expected to prepare accurate, consistent and understandable messages tailored to strategy and stakeholders’ needs, with processes and timeframes for adapting them to an actual event.

The guidance proposes a practical Communication Plan Framework (including governance) and flashcard templates per stakeholder to operationalize objectives, owners, messages, channels, sign-offs, and resources.

Channels, infrastructure, and resources

Following the consultation on communication, the SRB expects the banks to consider a broad set of internal and external channels, rely on established BaU channels where possible, and describe any additional or more secure channels needed under crisis conditions.

The expectations for crisis-ready infrastructure and resources include dedicated crisis-communication facilities and increased call-center capacity and hotlines. Banks are also expected to have sufficient resources for systems to monitor social media. Preparing Q&A/scripted materials and maintaining an updated website with resolution information needs to be considered.

The guidelines require a designated, experienced, and trained spokesperson who is knowledgeable about resolution frameworks and the bank’s strategy.

Coordination with authorities and execution discipline

Banks should coordinate media strategies and plan deployment in accordance with resolution authorities (including any SRB-appointed expert consultants). This includes defining who is responsible for communicating with the SRB/NRAs.

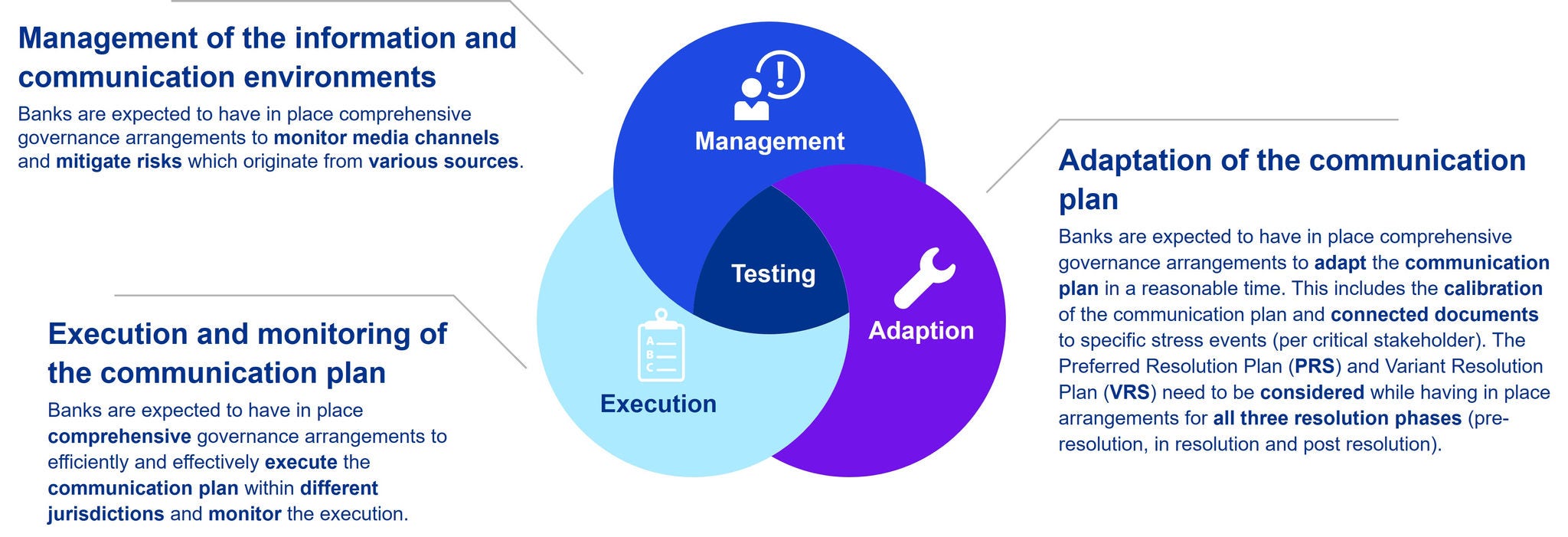

The Communication Plan Framework is expected to include multiple governance arrangements. This includes activation protocols, roles and responsibilities (across group entities and, for MPE, across resolution entities), resource mobilization, secure information exchange, execution in multiple jurisdictions, monitoring and reporting on the information environment and adaptation of the plan to the actual event.

Disclosure and confidentiality

The SRB expects banks to consider the Market Abuse Regulation (MAR). Pre‑resolution disclosures can trigger contagion or reduce authorities’ options. Plans should identify disclosure requirements across relevant jurisdictions, assess ability to delay under MAR or obtain waivers, and define processes/timelines to use them. Where disclosures cannot be delayed, ensure close coordination with authorities and an aligned strategy.

Furthermore, it is expected that banks will put in place arrangements to prevent and address leaks, meet confidentiality/disclosure requirements, and inform the SRB where disclosure could excessively impact the strategy.

Managing the information environment and market reaction

There are several expectations regarding monitoring and responding. Banks should establish governance and tools to monitor traditional and non-traditional media for sentiment, leaks and misinformation. Additionally, the expectation is to be ready to respond quickly with evidence-based narratives.

It is also expected that they will include a method to prioritize incidents (e.g., leaks/misinformation) and trigger senior-level engagement and mitigation strategies in accordance with the impact.

The plan is expected to include strategies and procedures to mitigate negative market reactions from a communication perspective (e.g., rumors/misinformation).

Operationalization, training, and testing

Banks are expected to provide detailed process descriptions across all three phases with clear timeframes (e.g., hours), resource mapping, and timelines per critical stakeholder.

In the consultation it is stated that the banks should name the owner(s) drafting/defining messages and, if different, the function executing dissemination. This includes sign-off responsibilities and contact details.

It is expected that banks will review training and triggers. This includes reviewing plans regularly and ad‑hoc after material changes. It is expected to set triggers to update plans under stress in both slow- and fast-moving scenarios. Staff awareness needs to be ensured with training (testing exercises can be considered as part of the training program).

The SRB expects the banks to ensure their ability to disseminate reliable information urgently (e.g., mid‑week FOLTF), including processes for out‑of‑hours stakeholder reach. This includes execution across jurisdictions, language and time zones.

Testing areas specified in the supplement document

Testing areas specified in the supplement document

Implications for banks

- Banks need a crisis-usable, authority-aligned Communication Plan Framework that is stakeholder-specific, risk-based and execution-ready across all resolution phases and jurisdictions. Strong governance, clear ownership and sign-offs, robust disclosure/confidentiality controls, misinformation defenses, and timely adaptation mechanisms are highly important.

- Banks need to identify barriers and mitigations. Execution depends on people, processes, technology and external coordination, plans should assess risks to communication and set mitigating actions to ensure effective implementation under stress.

- The SRB expects completion of these capabilities by 30 June 2027. In specific cases there can be transitional arrangements (particularly in cases of newly authorized banks).

The consultation runs until 12 December 2025.

For further details, please contact our experts.