This SRB publication aims to guide banks under the SRB's direct remit in their resolvability self-assessments, ensuring banks are prepared for crisis management and can effectively implement resolution strategies.

With the conclusion of the phase-in period for the Expectations for Banks (EfB) at the end of 2023, the SRB is updating its resolvability assessment methodology, referred to as the Heatmap, which specifies the capabilities that banks must sustain over time to be considered resolvable. These capabilities will be incorporated into the annual self-assessment that banks are required to complete, promoting consistency and fairness across the sector. The consultation aims to enhance the operationalization of resolution strategies by providing more detailed instructions on the resolvability assessment process and capabilities relevant for each resolvability dimension.

The bank’s self-assessment report will be the starting point of the yearly resolvability assessment, informing the Internal Resolution Team (IRT) on how well the bank has implemented the resolvability capabilities. In addition, it will guide the calibration of the multi-annual testing programme performed by the IRT starting 2026. Finally, the self-assessment report, supported by evidence provided by the bank, including outcomes of testing and deep-dives or on-site inspections, will confirm whether the bank’s capabilities are in place and are operating effectively. Based on this information, the IRT will assess the extent to which each bank meets the resolvability capabilities and will reflect the results of this assessment in the heatmap. Furthermore, the resolvability assessment also considers the impact of each resolvability capability on the successful execution of the resolution strategy (low, medium, high). This assessment applies proportionality by taking into consideration the business model characteristics of banks as well as their specific resolution strategies and tools.

Definition & Scope of Resolvability Self-Assessment

To ensure that banks structure and perform their self-assessment in a consistent way, the SRB has provided a template for the self-assessment, which has been developed regarding to the EBA Guidelines on improving resolvability. The self-assessment template takes the form of a structured questionnaire covering each of the seven resolvability dimensions set out in the EfB, namely:

- Governance

- Loss absorption and recapitalization capacity

- Liquidity and funding in resolution

- Operational continuity in resolution (OCIR) and access to Financial Market Infrastructure (FMI) services

- Information systems and data requirements (MIS)

- Communication

- Separability and restructuring

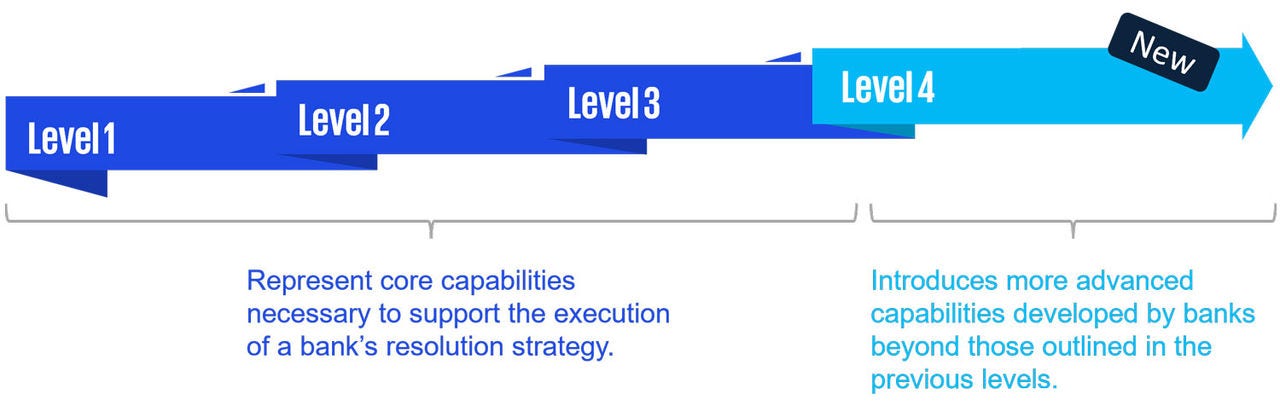

The self-assessment template breaks down the seven dimensions of the EfB mentioned above into principles, which are further substantiated by a set of capabilities that banks are expected to meet to demonstrate resolvability. Capabilities are grouped in three levels, where capabilities between levels 1 and 3 represent core capabilities necessary to support the execution of a bank’s resolution strategy. An additional level 4 is envisaged, aiming to introduce more advanced capabilities developed by banks beyond those outlined in the previous levels.

Through this approach the self-assessment aims to notably improve resolvability in:

- The bank’s understanding of its role in the execution of the resolution strategy.

- How well resolution planning is integrated into the bank’s business as usual (BaU) and its interplay with the recovery planning.

- The quality assurance and testing frameworks in place to ensure resolvability capabilities are adequately maintained over time.

For each capability that is still not fully met, the bank is expected to specify the actions it intends to undertake within a corresponding deadline.

In a similar way to the EfB, this operational guidance applies to banks under the SRB’s direct remit that are earmarked for resolution, each resolution entity within the BU as the entity heading the resolution group is requested to carry out the resolvability assessment at the resolution group level.

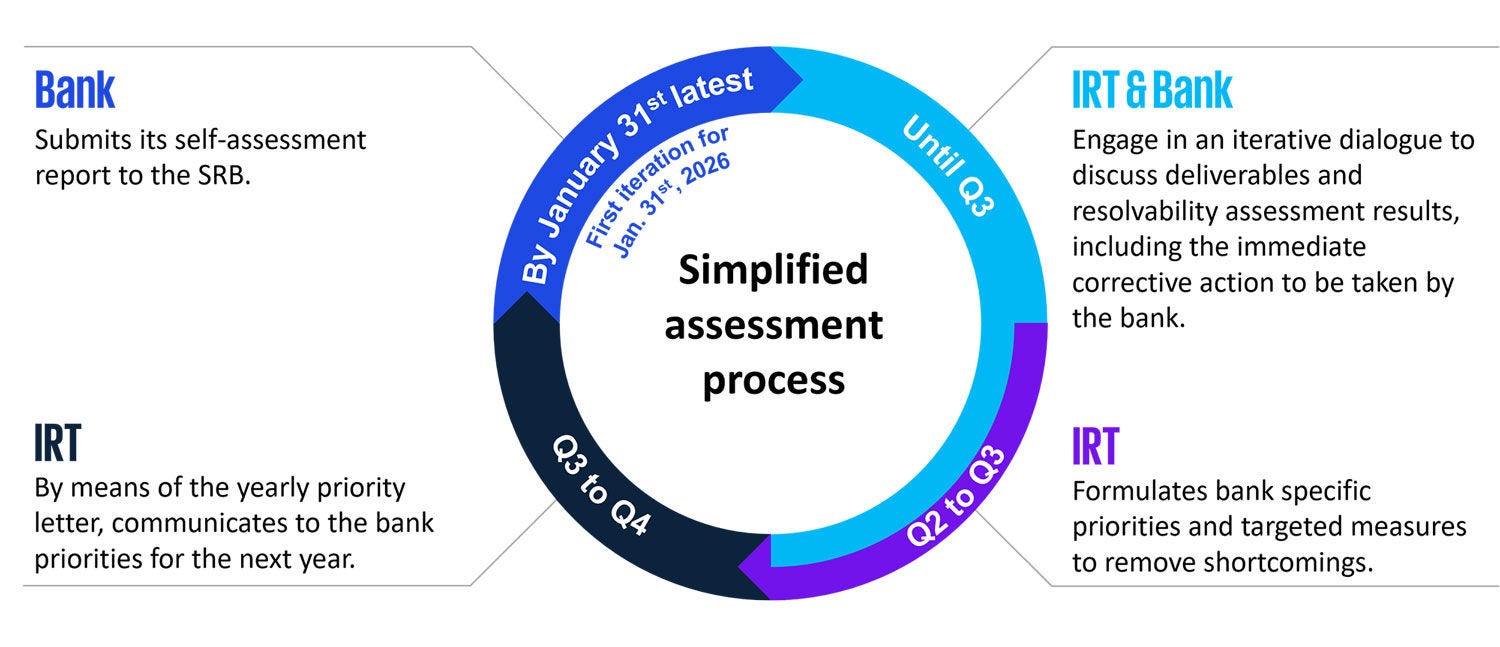

The resolution entity is expected to submit an executive summary of the self-assessment and the self-assessment template itself. Unless indicated otherwise by the IRT, the submission of the self-assessment report to the SRB will be yearly by 31 January at the latest, with the first iteration being expected to be submitted by 31 January 2026 at the latest.

Resolvability Assessment Process & Resolution Planning Cycle

To ensure consistency, the resolution entity coordinates the resolvability assessment process, aligning it with its overarching role in resolution planning, across each resolution group. The resolution group, rather than individual banks within a group, submit the self-assessment report to the Single Resolution Board (SRB). The IRT reviews the reports, identifies areas needing improvement, and communicates the results through a resolvability assessment (Heatmap) and a yearly priority letter. The IRT also formulates bank-specific priorities and actions for the upcoming year. If significant shortcomings are found, the IRT will work with the bank to address them promptly. Finally, leveraging on the bank’s self-assessment report and the resolvability assessment conducted by the IRT, they either confirm or revise the multi-annual resolvability testing programme for the bank.

This iterative process involves annual updates and testing to ensure continuous improvement in the bank's resolvability.

Transitional agreements for phase-in periods may apply in the cases of switch banks, newly authorized banks or bank changing remits.

Self-Assessment Methodology

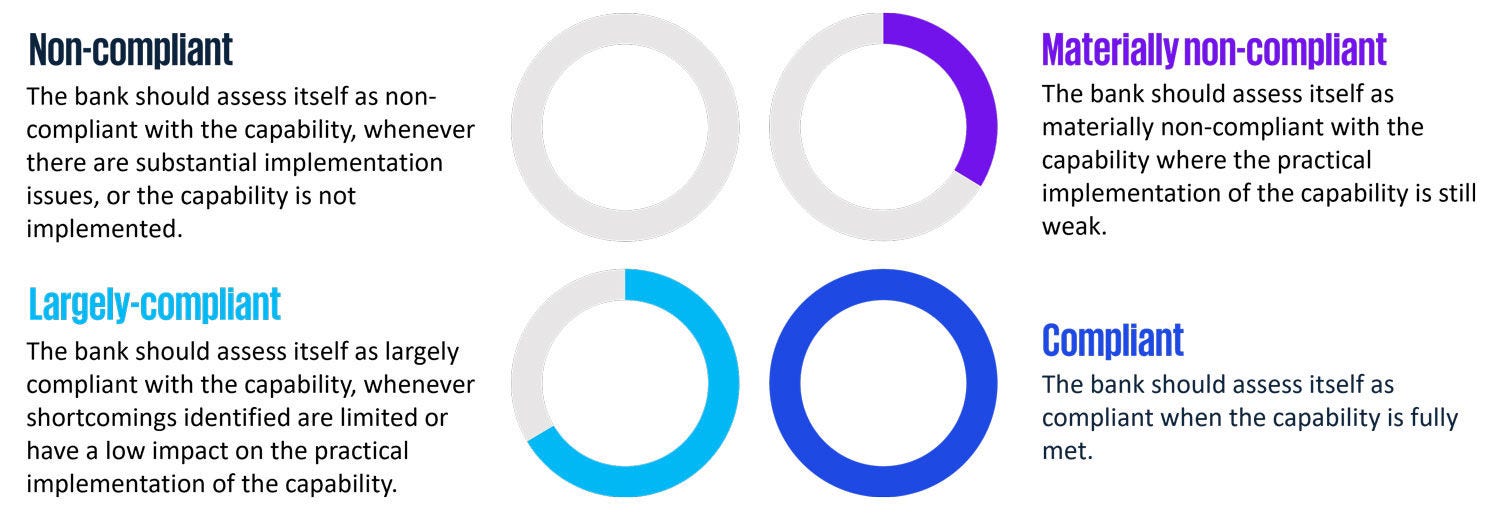

The methodology of the newly revised resolvability self-assessment template is based on a four-point self-assessment grading scale with the categories:

Some capabilities may only be assessed as being met or not, therefore assessment is limited to “compliant” or “non-compliant”.

The grading in the self-assessment should not be seen as a checklist. Instead, the bank should apply a qualitative approach in its assessments, considering data gathered and analyses conducted for resolution planning. Where relevant it should also include analyses conducted by non-resolution entities of the respective resolution group to reflect how the resolution group itself, including all entities, meets the EfB.

Following the review of the contributions to this consultation, the SRB will reflect again on its resolvability assessment methodology and address any issues raised. The SRB will publish the final Operational guidance, together with a summary of the contributions from the industry and other stakeholders explaining how they were considered.

The consultation phase will run until 7 February. After reviewing the contributions to this consultation, the SRB will reconsider its resolvability assessment methodology and address any issues raised.

For further details, please refer to SRB’s publication.

If you have any additional questions, please contact our experts