Valuing banks in resolution

Exploring the SRB’s new consultation on its expectations on Valuation Capabilities

Exploring the SRB’s new consultation on its expectations on Valuation Capabilities

The Single Resolution Board (SRB) has launched a public consultation on its draft "Expectations on Valuation Capabilities" (EoVCs). The EoVCs aim at enhancing banks' preparedness for producing timely and robust valuations during resolution events.

The EoVCs build upon the existing foundation laid by the SRB's Expectations for Banks (EfB) Principle 5.2 and the SRB Valuation Data Set (VDS) published in December 2020, incorporating market feedback and lessons learned from practical experience. The new guidance introduces a substantially more demanding and operational approach for valuation capabilities.

A new integrated framework: Raising the bar for valuation readiness

The EoVC guidance consolidates and expands upon the current approach, detailing expectations regarding the necessary data, the systems to store and share it with the SRB, and the documentation required to understand banks’ valuation models. The SRB emphasises that the expectations align with the SRM Vision 2028 strategy’s focus on improving crisis readiness. The guidance seeks to leverage existing data and solutions where possible, while ensuring banks develop robust, actionable valuation capabilities for resolution scenarios.

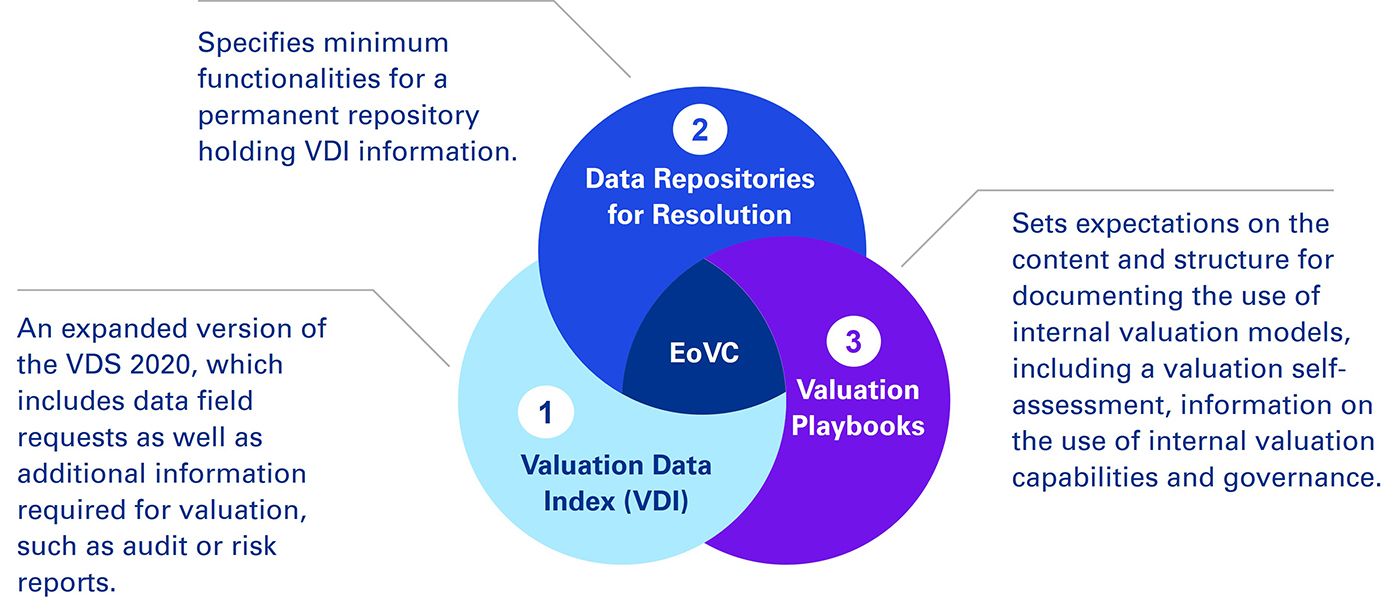

According to the SRB's guidance under consultation, the EoVCs encompass three core pillars:

Key innovations and specifications

The new operational guidance introduces a more integrated and operational approach to valuation capabilities:

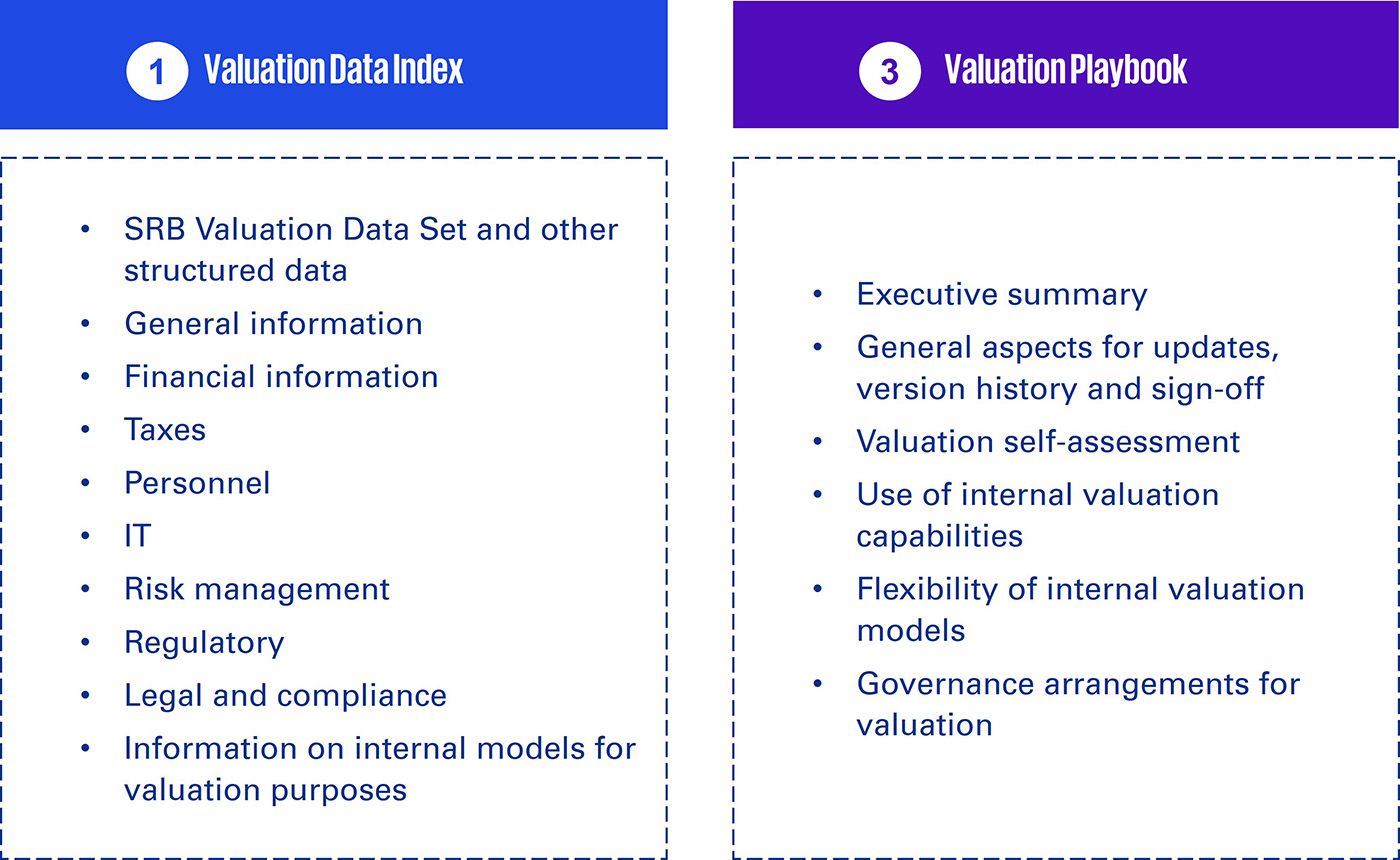

• Valuation Data Index (VDI): As a new concept, the VDI mandates an expanded index covering both the enhanced structured Valuation Data Set (VDS) and an extensive list of unstructured documents (detailed across 10 subject areas in Annex 1). While aiming to leverage existing bank data "as far as possible", mapping internal sources to this prescribed, minimum VDI structure will present a considerable data governance challenge. It incorporates industry feedback to the SRB and aims to be a comprehensive information index.

A key innovation is the explicit aim to build the VDI upon documents already available within banks, avoiding duplication with public or supervisory information accessible to the SRB. This signals a potential streamlining, although mapping existing data to the new VDI structure will require effort.

Implication: Banks should analyse the new VDI requirements (detailed across the EoVCs’ chapters and annexes) against current data holdings and the VDS 2020 framework, performing gap analyses and mapping exercises.

• Data Repositories for Resolution (DRR): The EoVCs mandate a permanent, functionally specified DRR – a significant infrastructure requirement. This requires meeting rigorous standards for accessibility (including continuous IRT access and rapid external granting), usability (including searchability and specified folder structures,), and security (including encryption, authentication).

Minimum functionalities define the baseline capabilities these repositories must possess. Banks retain flexibility in choosing technical solutions (in-house vs. vendor) that fit their MIS architecture, but the repository must exist and meet standards. DRRs are expected to be populated with VDI information at predefined frequencies. This necessitates strategic decisions regarding IT infrastructure and potential investments.

• Valuation playbooks: This new, formal deliverable requires banks to document their valuation capabilities in greater detail. It goes beyond describing models to include a complex valuation self-assessment, demanding stratification of the entire balance sheet into homogenous (sub)clusters linked to VDS data; proving internal model flexibility (ability to re-run with valuer inputs quickly); and outlining detailed, robust governance arrangements including VDI collection and management or senior management oversight and sign-off.

Regarding the Valuation Data Index and the playbook, the following key subjects/components need to be prepared in order to comply with the SRB’s expectations:

Key takeaway: A significant undertaking

This consultation introduces a comprehensive framework designed to operationalise and enhance banks' valuation capabilities for resolution. Key takeaways include:

· Improved VDS: Streamlined structure with a strong focus on data quality and mandatory reporting (Data Quality Report).

· Integrated Data (VDI): Combines enhanced structured data (VDS) and defined unstructured information.

· Formalised DRRs: Requirement for permanent, accessible repositories with defined standards.

· Standardised Playbooks: Mandating documentation of self-assessment (clustering), internal model use (incl. flexibility), and governance.

· Harmonisation Goal: Consistent and high level of valuation readiness across banks under SRB's remit.

The EoVCs further include Annexes 1 through 5, providing detailed descriptions of the information required in the VDI, technical instructions for the DRR, and the data fields and definitions for the Valuation Data Set. Annex 4 contains technical descriptions and validation rules, while annex 5 offers a template for the data quality report. Both Annexes 4 and 5 are available as excel files, which can be downloaded from the SRB consultation page.

As the introduction of the EoVCs brings new expectations for banks, they will be given a gradual phase-in period to adapt their existing capabilities. Until the phase-in is completed, the measures that banks have implemented to produce the SRB VDS 2020 on an ad-hoc basis remain in place.

The SRB emphasises that the expectations on valuation capabilities will serve as a blueprint for further work in resolution planning, including the operationalisation of transfer strategies and the mobilisation of collateral.

The SRB intends to refine the guidance based on stakeholder feedback received during the consultation period. The final Operational Guidance on Expectations on Valuation Capabilities is anticipated following the consultation closure on July 2, 2025, accompanied by insights into how feedback shaped the final document.

For further details, please contact our experts.

More information: