SRB’s testing guidance is designed to ensure that banks are adequately prepared to manage resolution scenarios effectively. It highlights the importance of resolvability testing, which allows banks and Internal Resolution Teams (IRTs) to confirm that banks have developed key capabilities in line with the SRB's Expectations for Banks (EfB) and to ensure these capabilities are fully operational.

Comprehensive framework for resolvability testing

With the consultation of the operational guidance, the SRB publishes a comprehensive framework for testing exercises in various intensities carried out by banks under the resolution remit. The guidance consolidates information on testing areas and sub-areas, the SRB’s multi-annual testing programme, testing methods, internal governance, test environments, preparation and conducting of a test, the involvement of external consultants, and deliverables.

The SRB highlights the importance of feedback loops between resolvability assessment and testing, where testing priorities are shaped by assessment results, and the operational effectiveness of banks’ capabilities is confirmed through testing. The guidance seeks to harmonise the implementation of SRB’s multi-annual testing programme and bank-led resolvability testing, defining the execution of tests over a three-year period.

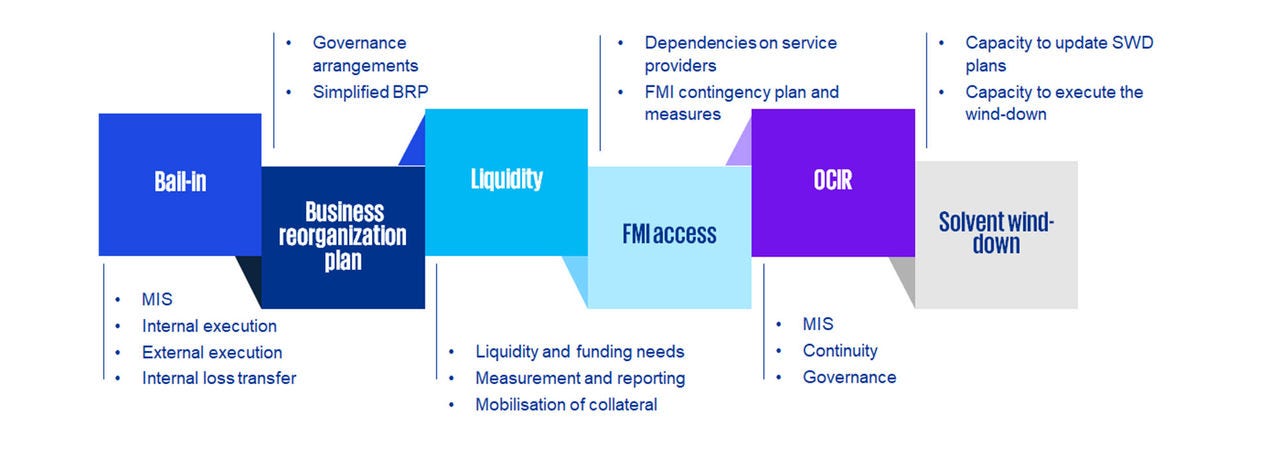

According to the SRB's guidance under consultation, resolvability testing encompasses the following areas:

In addition, the SRB indicates that further testing areas, such as valuation, separability and transfer strategies, and communication, will be introduced in accordance with upcoming policy updates.

Key innovations

The new operational guidance introduces a more structured approach to resolvability testing, emphasising the importance of internal governance structures and the involvement of senior management in resolution planning. The guidance highlights the need for banks to have management information systems (MIS) and respective test environments that enable realistic simulations. The consultation further specifies the use of external consultants in alignment with the overarching objectives of testing exercises in the context of resolution planning. Assistance in preparing internal documents, being facilitators during desktop exercises and walkthroughs by encouraging dialogue and posing questions, and acting as independent observer are lined out as typical roles for external consultants.

The multi-annual testing programme involves annual updates and testing to ensure continuous improvement in the bank's resolvability. Further key specifications by the SRB are:

- Testing areas: As shown in the figure above, testing areas are introduced by the SRB. Bail-in, Business Reorganisation Plan, FMI access, Liquidity, OCIR, and Solvent wind-down are in scope of the guidance.

- Data and information requirements: The SRB introduces more stringent requirements for data provision, including the ability to deliver data at non-standard reference dates. Furthermore, only when additional flexibility is granted by the IRT, the expected 24-hour time limit for the Minimum Bail-in Data Template (MBDT) can be split up into three business days. This does not apply for other testing areas (e.g. FMI).

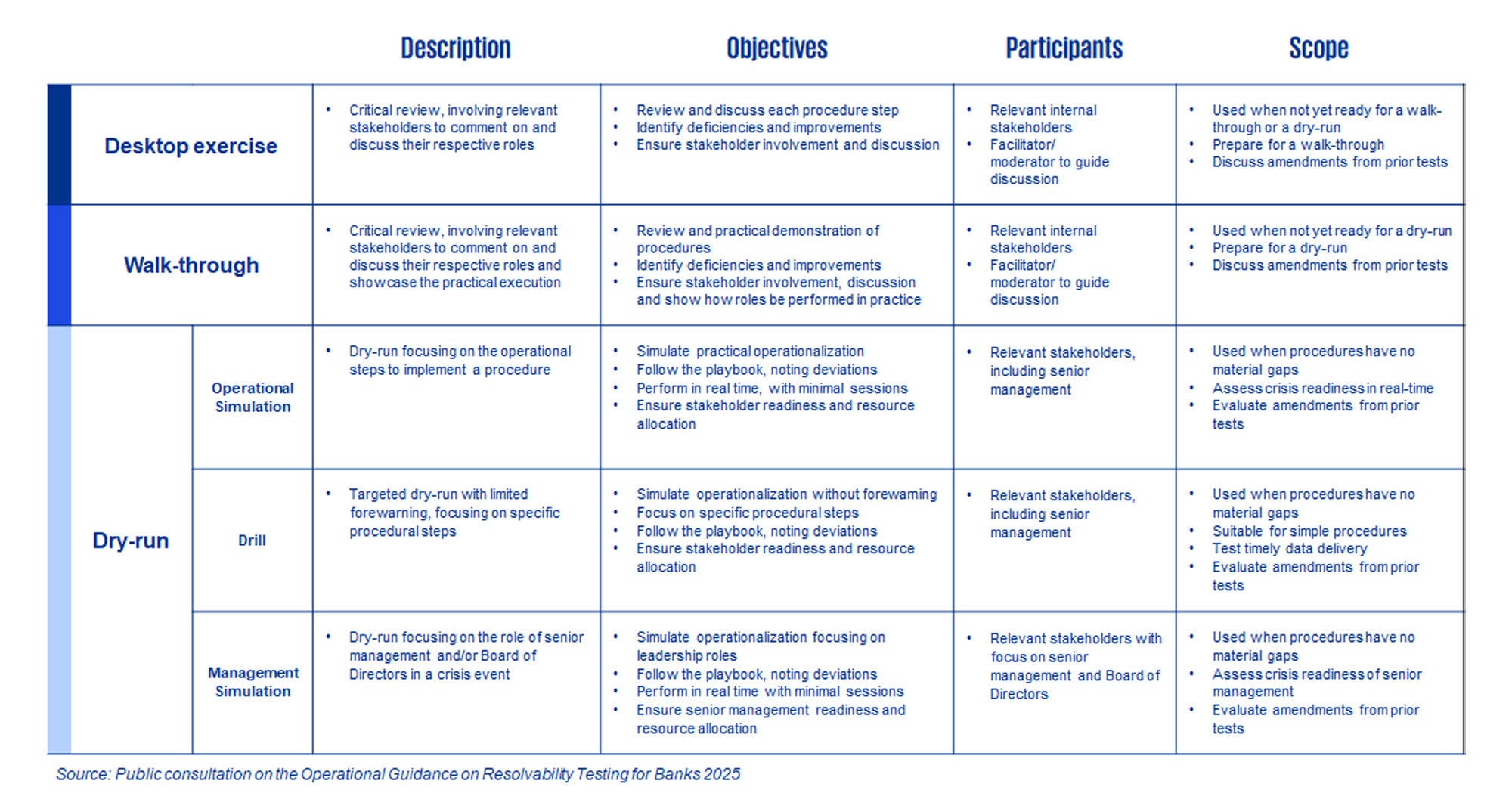

- Testing methods: In the consultation, testing intensities are defined in detail. The following table illustrates the framework of testing methods that is indicated to be used for testing purposes.

Deliverables

This consultation includes generic templates for outcome documents that banks are expected to use (partly already embedded in the working priorities letters 2025 banks received in late 2024). After conducting testing exercises, banks must submit several deliverables: an outcome report, an independent observer report, and amendments to relevant bank deliverables (e.g. playbooks) to incorporate lessons learned. Templates are provided for both the outcome and observation reports. Other than that, there are also specific deliverables that need to be provided by the banks. Depending on the testing area, these can include documents like the MBDT report, tax impact reports or specific summary tables of the produced information.

Key takeaways

This consultation paper introduces a comprehensive framework designed to enhance the effectiveness of resolution planning and testing. Key takeaways include the establishment of testing (sub-)areas, strict data provision standards, timing restrictions, expectations on testing environments and increased testing of governance arrangements.

The guidance specifies testing methods and clearly defines rules for the involvement of external consultants and Internal Audit. Additionally, it outlines deliverables (including testing area specific deliverables) required from banks after a testing exercise, supported by templates provided by the SRB to ensure consistency. Overall, the SRB aims to harmonise resolvability testing across banks and to continuously improve resolution capabilities.

After reviewing consultation contributions, the SRB plans to refine its guidance to address key concerns. The finalized Operational Guidance on Resolvability Testing for Banks is set to be published in Q3 2025, accompanied by a summary of stakeholder feedback and explanations of how it was incorporated.

The consultation phase is open until 5 May 2025. For further details, please contact our experts.