The Single Resolution Board (SRB) has published the final Operational Guidance for Banks on Resolvability Self-Assessment. This approach is a key part of the SRM Vision 2028 strategy, designed to ensure that European banks are equipped for the future and crisis-ready, based on a revised methodology encompassing lessons learnt from crisis cases, best practice and the testing of banks’ capabilities.

The guidance introduces a standardised self-assessment report designed to help banks to document their resolvability assessment in a consistent manner, promoting a level playing field, transparency and comparability across the sector. The self-assessment takes the form of a structured questionnaire covering each of the seven resolvability dimensions specified in the Expectations for Banks (EfB). It outlines the capabilities that banks should have in place to effectively execute resolution measures during a crisis. The methodology will also reflect how well banks’ resolvability capabilities work in practice through their regular testing. Following a public consultation held from December 3, 2024, to February 7, 2025, the SRB has considered the industry's feedback and introduced enhancements to the self-assessment framework, aimed at simplifying the process and reducing the administrative burden on banks.

Key updates compared to the initial consultation paper at a glance:

- The SRB requests about 20% fewer resolvability capabilities, streamlining scope and effort.

- The self-assessments move from annual to every two years. IRTs may still request an interim self-assessment and/or additional evidence where needed.

- Preferred Resolution Strategy (PRS) vs. Variant Resolution Strategy (VRS): Progress will be shown in two separate assessments within the template; see additional Template 8 for the cross-dimensional VRS assessment.

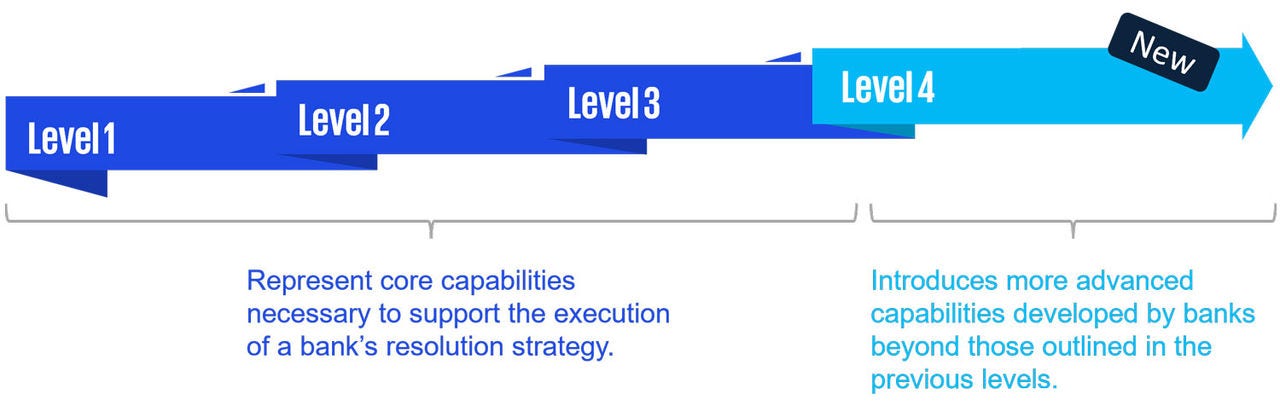

- Despite the industry's opposition to Level 4, advanced capabilities are retained as bank-specific and proportionate. They are set by IRTs for monitoring purposes and are requested only where necessary. After the first cycle, some capabilities may migrate to Level 3.

- Even though stakeholders proposed excluding non-resolution entities, the SRB kept them in scope to reflect their role in group resolution planning.

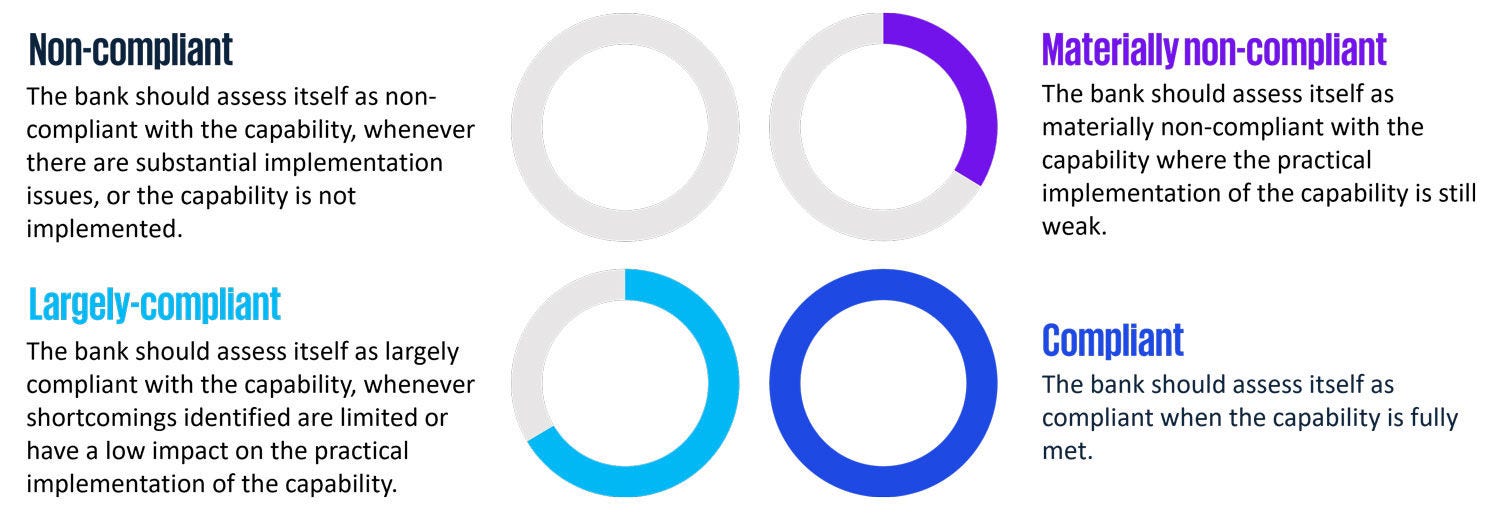

- Proposals to replace the SRB grading with “High/Medium-High/Medium-Low/Low” were not adopted. The SRB keeps its four-point scale: Compliant, largely compliant, materially non-compliant and non-compliant.

Definition & Scope of Resolvability Self-Assessment

To ensure consistency in the way banks structure and perform their self-assessments, the SRB has provided a self-assessment template. This template was developed in line with the EBA’s Guidelines on improving resolvability. The self-assessment template takes the form of a structured questionnaire covering each of the seven already known resolvability dimensions set out in the EfB, namely:

- Governance

- Loss absorption and recapitalisation capacity

- Liquidity and funding in resolution

- Operational continuity in resolution (OCIR) and access to financial market infrastructure (FMI) services

- Information systems and data requirements

- Communication

- Separability, transferability and restructuring

The self-assessment template breaks down these dimensions of the EfB into principles, which are further substantiated by a set of capabilities that banks are expected to meet in order to demonstrate resolvability. These capabilities are grouped into three levels, with those between levels 1 and 3 representing the core capabilities necessary to support the execution of a bank’s resolution strategy. An additional level 4 is envisaged, aiming to introduce more advanced capabilities developed by banks beyond those outlined in the previous levels.

Through this approach the self-assessment aims to notably improve resolvability in:

- The bank’s understanding of its role in the execution of the resolution strategy.

- How well resolution planning is integrated into the bank’s business as usual (BaU) and its interplay with the recovery planning.

- The quality assurance and testing frameworks in place to ensure resolvability capabilities are adequately maintained over time.

When filling in the self-assessment template, the bank is expected to assess to what degree each capability is met and to provide a justification. A justification is also necessary should one or more capabilities not apply to the bank. For each capability that is still not fully met, the bank is expected to specify the actions it intends to undertake within a corresponding deadline.

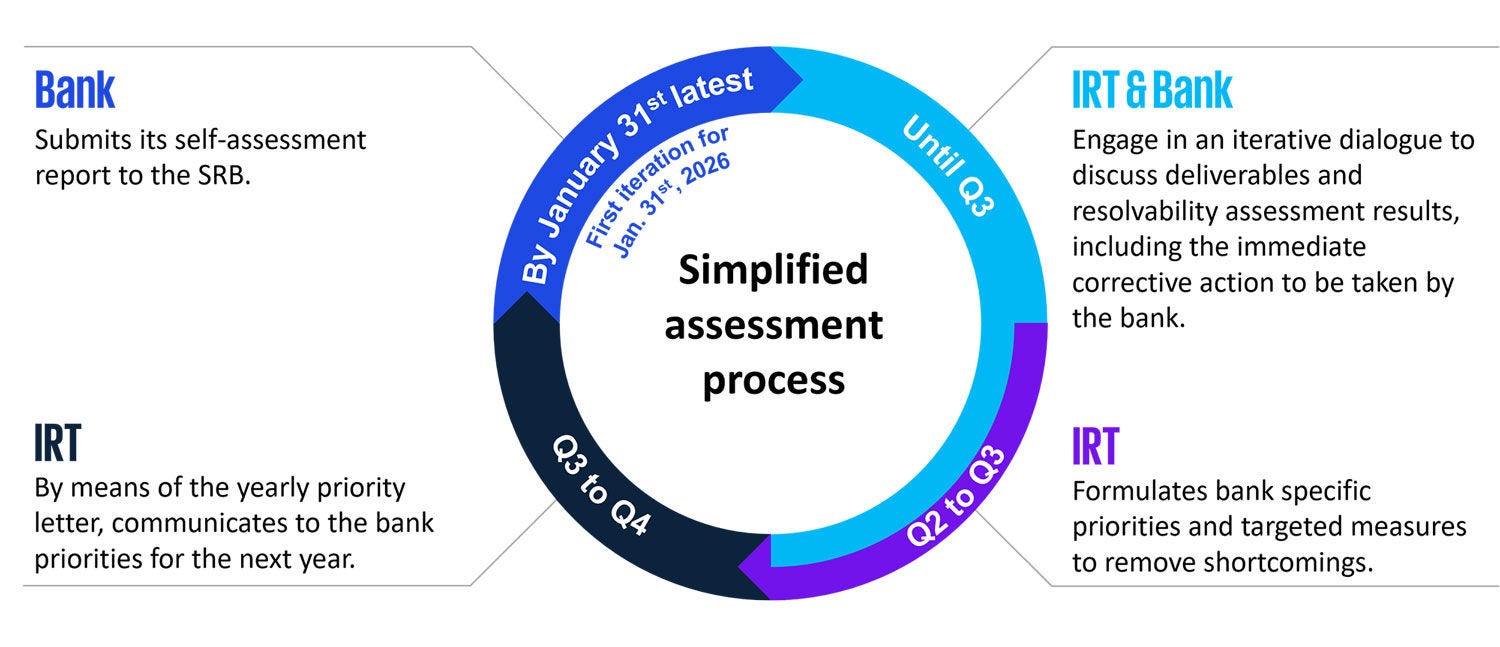

All banks under the SRB’s direct remit must conduct this self-assessment regularly. The report is to be produced at least every two years, reflecting the bank’s resolvability status as of each 31 December, with submission due by 31 January of the following year. Nevertheless, in line with the EBA Guidelines on improving resolvability, the IRT (Internal Resolution Team) may request an interim self-assessment and/or additional evidence in areas where work is still outstanding. Banks may choose to report annually if there are material changes, but the default cadence is biennial to reduce reporting burden. The first self-assessment under the new guidance is due by 31 January 2026, capturing the resolvability position at end 2025.

Resolvability Assessment Process & Resolution Planning Cycle

The self-assessment process involves banks actively evaluating their own resolvability and provides the SRB with evidence-based input for resolution planning. Each cycle begins with the bank submitting its report and supporting evidence. The SRB’s Internal Resolution Team reviews these materials and records the outcome in a resolvability Heatmap, which is communicated to the bank via the resolution plan summary. Based on these findings and discussions with the bank, the IRT issues a yearly priority letter setting out remedial actions specific to the bank. The IRT also formulates bank-specific priorities and actions for the upcoming year. If significant shortcomings are found, the IRT will work with the bank to address them promptly. Finally, leveraging on the bank’s self-assessment report and the resolvability assessment conducted by the IRT, they either confirm or revise the multi-annual resolvability testing programme for the bank.

* This step occurs every two years unless agreed otherwise with the IRT.

Transitional agreements for phase-in periods may apply in the cases of switch banks, newly authorized banks or bank changing remit.

Self-Assessment Methodology

A central element of the self-assessment is evaluating the bank’s resolvability capabilities against a clear four-level compliance scale. For each capability the bank must assign one of four ratings :

As already proposed in the consultation paper, some capabilities can only be assessed as either met or not met; therefore, assessment is limited to “compliant” or “non-compliant”.

The grading in the self-assessment should not be seen as a checklist. Instead, the bank should apply a qualitative approach in its assessments, considering data gathered and analyses conducted for resolution planning. Where relevant it should also include analyses conducted by non-resolution entities of the respective resolution group to reflect how the resolution group itself, including all entities, meets the EfB.

The final guidance allows for evolution. It acknowledges that the self-assessment template can be adapted as new policies and guidance are introduced. Banks should therefore stay alert to updates before each reporting cycle. Indeed, the SRB plans to issue separate operational guidance on the resolvability testing framework later in 2025. Together, these tools form a comprehensive regime in which banks assess themselves, implement improvements and prove their resolvability periodically through tests overseen by the authorities.

For further details, please refer to SRB’s publication.

If you have any additional questions, please contact our experts