Hong Kong: Changes to issuance of certificate of residence status and application forms

The Inland Revenue Department revisited its approach to issuing Hong Kong certificate of resident status

Changes to issuance of certificate of residence status and application forms

The Inland Revenue Department (IRD) on 8 June 2023 revisited its approach to issuing Hong Kong certificate of resident status (HK CoR). The process is now adjusted such that the IRD will base its decision of whether an HK CoR can be issued on the plain definition of “Resident of Hong Kong” stipulated in the relevant Hong Kong income tax treaty.

For most of the Hong Kong income tax treaties, “resident of Hong Kong” is defined to include a company incorporated in Hong Kong and any other person constituted under the laws of Hong Kong. An exception being the Hong Kong-Japan income tax treaty, under which “resident of Hong Kong” is defined as a company or any other person having a primary place of management and control in Hong Kong.

There is also a note on the IRD’s website indicating that an applicant incorporated or established in Hong Kong is in general not required to provide full details of its establishment and business activities in the HK CoR application form.

Major changes to the HK CoR application forms

Effective 12 June 2023, the HK CoR application forms for non-individual applicants (i.e., company, partnership, trust, body of persons) have been revised to:

- Reflect the change in the IRD’s approach to issuing HK CoR

- Formalise the existing administrative facilitation measures with respect to HK CoR applications under the income tax treaty between Hong Kong and China (China-Hong Kong income tax treaty) and relating to the Circular of the State Taxation Administration on Matters Concerning “Beneficial Owners” in Tax Treaties (STA Circular 2018 No. 9)

Under the IRD’s existing administrative facilitation measures, a bundled HK CoR application can be made to cover (1) the treaty benefit applicant (e.g., the Hong Kong special purpose vehicle that is the immediate recipient of the dividends from China) and its ultimate / intermediate 100% shareholder(s) under the “safe harbor rule,” (2) the treaty benefit applicant and its ultimate 100% shareholder that qualifies as a beneficial owner of the dividends under the “same jurisdiction rule,” or (3) the treaty benefit applicant and its intermediate 100% shareholder(s) under the “same treaty benefit rule” under STA Circular 2018 No. 9.

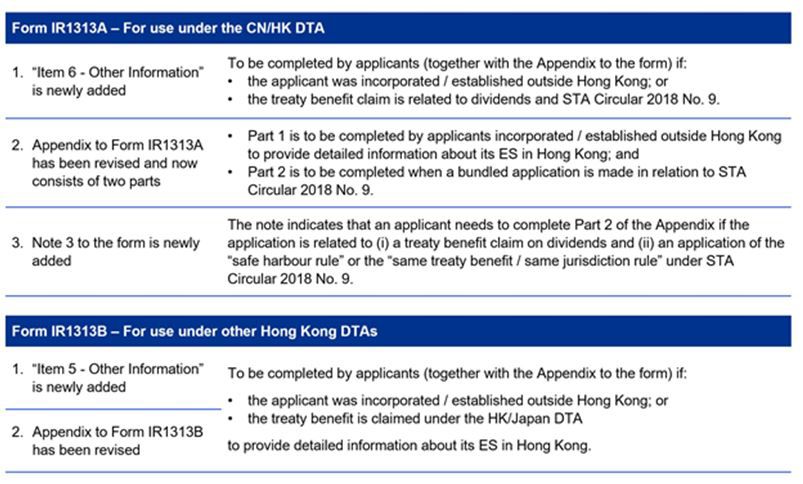

Major changes to the revised applications forms (i.e., Form IR1313A and Form IR1313B) are set out in the table below:

For more information contact a KPMG tax professional:

David Ling | davidxling@kpmg.com

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. For more information, contact KPMG's Federal Tax Legislative and Regulatory Services Group at: + 1 202 533 3712, 1801 K Street NW, Washington, DC 20006.