Initial impressions of proposed regulations under section 163(j)

Impressions of regulations under section 163(j)

The Treasury Department released proposed regulations (REG-106089-18) relating to section 163(j) as amended by the new U.S. tax law, on Monday, November 26, 2018. In the following discussion, the regulations are referred to as the "Proposed 163(j) Package."

Read the text of the Proposed 163(j) Package [PDF 1.5 MB] as published on the IRS webpage.

This report provides initial impressions and observations about the Proposed 163(j) Package. Subsequent reports will contain more in-depth analysis of various aspects of the rules.

KPMG hosted a webcast on December 6, 2018, that covered, in part, the international aspects of the proposed section 163(j) rules. View a replay of the webcast here. KPMG will also host a webcast on December 20, 2018, focusing on the domestic applications of the proposed rules. Register for the webcast here.

Read a printable version [PDF 356 KB] of this report

Background

The new U.S. tax law (Pub. L. No. 115-97, enacted December 22, 2017) amended section 163(j) to disallow a deduction for business interest when net business interest expense exceeds 30% of adjusted taxable income (ATI) plus floor plan financing interest for taxable years beginning after December 31, 2017. ATI is computed without regard to deductions allowable for interest, depreciation, amortization, or depletion for taxable years before January 1, 2022. For taxable years beginning thereafter, only interest deductions are added back in computing ATI. Business interest expense that is disallowed under section 163(j) is treated as paid or accrued in the succeeding taxable year and may be carried forward indefinitely. New section 163(j) does not, however, permit excess limitation to be carried forward.

The IRS issued Notice 2018-28 on April 6, 2018, in which it confirmed, among other things, that the section 163(j) limitation would be applied on a consolidated group basis.

Effective date

Significantly, the proposed rules do not relate back to the enactment of section 163(j). Rather, the rules would be applicable for taxable years ending after the date on which the final regulations are published in the Federal Register.

Reliance

Taxpayers and related parties (determined under sections 267(b) and 707(b)(1)) have the discretion to apply the proposed rules retroactively to a taxable year beginning after December 31, 2017, but must apply such rules on a consistent basis. Therefore, retroactive application would be binding on the taxpayer and all its related parties (or shareholders in certain cases). Further, although there are separate effective date provisions within the proposed rules, taxpayers cannot pick and choose which provisions of the proposed rules they want to apply retroactively because the proposed rules require that to make an election, the taxpayer must “consistently apply all of the section 163(j) regulations.”

| KPMG observation: Whether this election should be made will depend on the taxpayer’s particular facts and circumstances; however, taxpayers should consider the time and resources necessary to update their systems and models to accommodate the relatively complex calculations required by these rules. |

Comment period and hearing

The preamble to the proposed rules includes over 60 requests for comment, and any comments must be submitted within 60 days after the date of publication in the Federal Register. A public hearing has been scheduled for February 25, 2019.

Generally applicable provisions: Sections 1.163(j)-1 through -3 & -9 through -11

Interest for purposes of section 163(j)

Overview

The proposed rules would adopt a broad definition of interest (expense and income) by including not only amounts that would be interest under general tax principles, but also items that would not otherwise be treated as interest for U.S. federal income tax purposes. The preamble explains that the proposed rules would treat as interest “certain amounts that are closely related to interest and that affect the economic yield or cost of funds of a transaction involving interest, but that may not be compensation for the use or forbearance of money on a stand-alone basis.” The proposed definition of interest includes general principle-based rules, a number of specifically enumerated items that are treated as interest, and an anti-abuse rule.

The preamble notes that the drafters rejected a narrow definition of interest to increase certainty and to prevent avoidance of the rules. Therefore, the proposed rules provide a definition of interest “that addresses all transactions that are commonly understood to produce interest income and expense, including transactions that may otherwise have been entered into to avoid the application of section 163(j).” The preamble notes that treating items that are closely related to interest as interest income or expense “when appropriate to achieve a statutory purpose is not new.”

KPMG observation: The broad definition of interest for purposes of section 163(j) raises at least two questions. One is an authority issue. Given that section 163(j) limits the deduction for business interest expense, arguably Congress intended that the rule apply only to business interest, which itself must be a subset of what is considered interest under general tax principles or other provisions of the Code. In addition, section 163(j) does not provide a specific grant of authority for Treasury to issue regulations addressing the scope of “interest” or to capture what might be considered “interest equivalents.” The second question is whether the definition of interest in the proposed rule would be limited to section 163(j) or would spread to other areas of the Code, including other parts of section 163. Pending the resolution of these issues, the broad scope of “interest” will likely influence many taxpayers’ analyses of whether to elect to apply the proposed section 163(j) regulations to tax years ending prior to finalization. |

Summary of the definition of “interest”

The proposed rules would define interest by reference to four general categories, with certain specific defined items identified in the third category:

- In general: The proposed rules would treat as interest an amount that is treated as paid, received, or accrued as compensation for the use or forbearance of money on indebtedness, or an amount treated as interest under other provisions of the Code or the regulations thereunder. The definition includes examples of such items: original issue discount (OID) (adjusted by a holder for acquisition premium or amortizable bond premium); amounts treated as OID under various statutory or regulatory rules; qualified stated interest (adjusted by an issuer for bond issuance premium or a holder for amortizable bond premium); market discount to the extent includible in income by a holder; repurchase premium to the extent deductible by the issuer; deferred payments treated as interest under section 483; amounts treated as interest under a section 467 rental agreement; amounts treated as interest under section 988; forgone interest under section 7872; redeemable ground rent treated as interest under section 163(c); and amounts treated as interest under section 636.

- Swaps with significant nonperiodic payments: The proposed rules would treat as interest the time value component of a swap with significant nonperiodic payments, other than a cleared swap with significant nonperiodic payments. The proposed rules would treat such swaps as two separate transactions consisting of an on-market, level-payment swap and a loan that must be accounted for by the parties independently of the swap. The preamble explains that the proposed rule would apply in the same manner as section 1.446-3(g)(4) before it was amended on May 8, 2015, by T.D. 9719, except it would not apply to a collateralized swap that is cleared by a derivatives clearing organization or by a clearing agency.

- Other amounts treated as interest. The items treated as interest include:

- Premium:

- Any ordinary income for an issuer under section 1.163-13(d)(4) (under the bond issuance premium rules) would be treated as interest income.

- Any amount of premium that is deductible by a holder under section 1.171-2(a)(4)(i)(A) or (C) (under the rules if a holder elects to amortize bond premium) would be treated as interest expense of the holder.

- Ordinary income or loss on certain debt instruments:

- Amounts treated as ordinary income by an issuer of a contingent payment debt instrument subject to the noncontingent bond method of section 1.1275-4(b), a nonfunctional currency contingent payment debt instrument subject to section 1.988-6, or an inflation-indexed debt instrument subject to section 1.1275-7 would be treated as interest income to the issuer.

- A holder’s ordinary loss on a contingent payment debt instrument subject to the noncontingent bond method of section 1.1275-4(b), a nonfunctional currency contingent payment debt instrument subject to section 1.988-6, or an inflation-indexed debt instrument subject to section 1.1275-7 would be treated as interest expense by the holder.

- Substitute interest payments: A substitute interest payment described in section 1.861-2(a)(7) would be treated as interest (but not tax-exempt interest).

- Section 1258 gain: Any gain treated as ordinary under section 1258 (conversion transactions) would be treated as interest income.

- Amounts affecting a taxpayer’s effective cost of borrowing: Income, deduction, gain, or loss from a derivative, as defined in section 59A(h)(4)(A), that alters a taxpayer’s effective cost of borrowing with respect to a liability of the taxpayer would be treated as interest expense of the taxpayer. Thus, payments made or received on an interest rate swap, or any gain or loss resulting from a termination of a swap, would be treated as an adjustment to interest expense, subject to the timing rules of section 1.446-4.

- Yield adjustments: Income, deduction, gain, or loss from a derivative, as defined in section 59A(h)(4)(A), that alters a taxpayer’s effective yield with respect to a debt instrument held by the taxpayer would be treated as an adjustment to interest income of the taxpayer.

- Certain amounts labeled as fees: Commitment fees (fees in respect of a lender commitment to provide financing) would be treated as interest if any portion of such financing is actually provided.

- Debt issuance costs: Any debt issuance costs subject to section 1.446-5 (borrowing costs required to be capitalized under section 1.263(a)-5(b)) would be treated as interest expense of the issuer.

- Guaranteed payments: Any guaranteed payments for the use of capital under section 707(c) would be treated as interest.

- Factoring income: The excess of the amount that a taxpayer collects on (or realizes on the sale or other disposition of) a factored receivable over the amount the taxpayer paid for the factored receivable would be treated as interest income.

- Premium:

| KPMG observation: A guaranteed payment for the use of capital may represent a payment for the use of property other than money. The regulation as currently drafted could apply to limit any guaranteed payment for the use of capital deduction – even if for the use of property. The treatment of guaranteed payments as interest would not be subject to a transition rule and may impact partnerships that currently have guaranteed payments. |

- Anti-avoidance rule for amounts predominately associated with the time value of money: Any expense or loss, to the extent deductible, incurred by a taxpayer in a transaction or series of integrated or related transactions in which the taxpayer secures the use of funds for a period of time would be treated as interest expense of the taxpayer if such expense or loss is predominately incurred in consideration of the time value of money.

Interaction with other provisions affecting the deduction of interest expense

The proposed rules address the relationship between section 163(j) and certain other provisions of the Code (section 1.163(j)-3).

In general, section 163(j) and the proposed rules would apply only to business interest expense that would be deductible in the current taxable year without regard to section 163(j). Thus, subject to certain exceptions, the section 163(j) limit would apply after provisions that otherwise subject interest expense to disallowance, deferral, capitalization or other limitation.

- Disallowance provisions: Business interest expense would not include interest expense permanently disallowed as a deduction under another provision of the Code: for example, section 163(e)(5)(A)(i) (disqualified portion of OID in the case of an applicable high yield discount obligation (AHYDO), or section 265 (interest relating to tax-exempt income).

- Deferred interest provisions: Other than sections 461(l), 465, and 469, Code provisions that defer the deductibility of interest expense (for example, section 163(e)(3) or section 267(a)(2) or (3)) would apply before section 163(j). For purposes other than sections 465 and 469, interest expense would be taken into account for section 163(j) purposes in the taxable year when it is no longer deferred under another section of the Code.

- At risk rules, passive activity loss provisions, and limitation on excess business losses of noncorporate taxpayers: Section 163(j) would apply before sections 461(l), 465, and 469.

- Capitalized interest expenses under sections 263A and 263(g): Sections 263A and 263(g) would apply before section 163(j). Capitalized interest expense under those rules would not be treated as business interest expense for purposes of section 163(j).

- Reductions under section 246A: Section 246A would apply before section 163(j). Any reduction in the dividends received deduction under section 246A would reduce the amount of business interest expense taken into account under section 163(j).

- Other types of interest provisions: Except as otherwise provided in the proposed rules, provisions that characterize interest expense as something other than business interest expense, such as section 163(d), would govern the treatment of that interest expense, and such interest would not be treated as business interest expense for purposes of section 163(j).

Adjusted taxable income

General rules

The proposed regulations would define adjusted taxable income (“ATI”) as the taxable income of the taxpayer for the tax year with certain adjustments.

Taxable income would be computed in accordance with section 63, but computed without regard to the application of the section 163(j) limitation (i.e., taxpayers would treat all business interest expense as deductible for purposes of calculating taxable income). In addition, if a taxpayer is allowed a deduction under section 250(a)(1) for a portion of its foreign-derived intangible income (FDII) and global intangible low-taxed income (GILTI), and that is properly allocable to a non-excepted trade or business (“excepted trade or business” is defined below), taxable income would be determined without regard to the taxable income limitation in section 250(a)(2).

| KPMG observation: This provision would eliminate the section 250 / section 163(j) circularity problem caused by the taxable income limitation contained in section 250(a)(2) which arises because section 163(j) is dependent on taxable income and taxable income is dependent on knowing the amount of deductible interest. Notwithstanding the simplicity provided by this approach, the proposed rules may result in a lower section 163(j) limitation amount for certain taxpayers depending on their profile. |

ATI would then be adjusted by adding the following to taxable income:

- Any business interest expense;

- Any net operating loss (NOL) deduction under section 172 (including NOLs arising in tax years before the proposed rules and carried forward);

- Any deductions under section 199A;

- For tax years beginning before January 1, 2022, any deduction for depreciation, amortization, and depletion (including special allowances under section 168(k));

- Any deduction for a capital loss carryback or carryover; and

- Any deduction or loss that is not properly allocable to a non-excepted trade or business.

ATI would also be adjusted by subtracting the following:

- Any business interest income;

- Any floor plan financing interest expense for the tax year; and

- Any income or gain that is not properly allocable to a non-excepted trade or business.

The proposed rules would also clarify that any amount incurred as depreciation, amortization, or depletion, but allocated to and capitalized with respect to inventory property under section 263A and included in cost of goods sold, is not a deduction for depreciation, amortization, or depletion for purposes of determining ATI.

| KPMG observation: Depreciation expense attributable to manufacturing facilities is considered allocable to inventory whether the inventory is on hand at year end or not, so even depreciation allocable to current sales may not be added back to ATI. |

Furthermore, the proposed rules would provide for adjustments for sales and dispositions of certain property for tax years beginning before January 1, 2022, to avoid double counting. In particular, because deductions for depreciation, amortization, and depletion for tax years beginning after December 31, 2017 and before January 1, 2022 (the “Potential Double Counted Deductions”) are added back to taxable income in computing ATI, the proposed rules would provide that with respect to the sale or other disposition of property, any Potential Double Counted Deductions with respect to such property (capped at any gain recognized on the sale or other disposition of the property) must be subtracted from ATI.

Similar rules would apply to avoid a double benefit in the context of a sale or other disposition of stock of a member of a consolidated group that includes the selling member with respect to the investment adjustments (as defined under section 1.1502-32) with respect to such stock that are attributable to any Potential Double Counted Deductions, as well as a sale or other disposition of an interest in a partnership with respect to the taxpayer’s distributive share of any Potential Double Counted Deductions with respect to property held by the partnership at the time of sale or other disposition, to the extent such Potential Double Counted Deductions were allowable under section 704(d).

Rules specific to certain entities

For partnerships, the proposed rules would provide that, for purposes of computing the partnership’s ATI, its taxable income is determined under section 703(a) and includes any items described in section 703(a)(1) to the extent otherwise included under the general ATI rules described above (section 1.163(j)-6). A partnership would also be required to take into account items resulting from adjustments made to the basis of its property pursuant to section 734(b) for purposes of calculating ATI, but “partner basis items” (defined as items from a section 743 adjustment or the operation of section 704(c)(1)(C) used in a non-exempted trade or business) and remedial items are not taken into account in determining the partnership’s ATI.

The ATI of a partner in a partnership would be determined under the general ATI rules described above without regard to such partner’s distributive share of any items of income, gain, deduction, or loss of the partnership, and is increased by such partner’s distributive share of the partnership’s excess taxable income. Partner basis items and remedial items would be taken into account by the partner in determining the partner’s ATI. In addition, if a partner disposes of an interest in a partnership that owns only non-excepted trade or business assets, any gain or loss on such disposition would be included in the partner’s ATI.

For regulated investment companies (RICs) and real estate investment trusts (REITs), ATI is computed without any adjustment that would be made under sections 852(b)(2) or 857(b)(2). Thus, taxable income of a RIC or REIT is not reduced by the deduction for dividends paid, but is reduced by the dividends received deduction (section 1.163(j)-4).Certain additional rules would apply governing the ATI of C corporations, tax-exempt corporations, consolidated groups, S corporations and S corporation shareholders, controlled foreign corporations (CFCs) and U.S. Shareholders of CFCs, specified foreign persons and foreign partners, and certain beneficiaries of trusts and estates. Some of these rules are described in more detail below.

Exempt entities and businesses

Section 163(j) provides mandatory and elective exemptions for certain businesses. The proposed regulations would provide rules implementing the small business exception in section 163(j)(3) for certain taxpayers meeting the $25 million gross receipts test of section 448(c), including rules for the application of section 448(c) to individuals in their own capacity and as owners of interests in flow-through entities. The proposed rules would also implement the exceptions for employee services and for certain regulated utility trades or businesses. Finally, the proposed rules provide mechanics for electing into the exceptions for certain real property trades or businesses and farming businesses. Other than qualifying small businesses, the other exempt businesses are termed “excepted businesses.” The import of such term is that taxpayers that do not qualify for the small business exemption and that have excepted and non-excepted businesses must allocate their interest expense and other attributes between such businesses to determine the application of section 163(j) to the non-excepted businesses.

Electing excepted business status

Section 1.163(j)-9 of the proposed regulations contains mechanics for making an irrevocable election to be an electing real property trade or business or an electing farming business (each, an “excepted business”). The proposed rules would make it clear that a taxpayer can separately choose to make an election for each excepted business operated by the taxpayer, including a partnership or a consolidated group. The election by a partnership would not impact any excepted businesses operated outside of the partnership by a partner.

The election would be made by attaching a statement titled “Section 1.163(j)-9 Election” to the taxpayer’s timely filed tax return, including extensions, which includes the taxpayer’s name, address, social security number or employer identification number, a description of the taxpayer’s electing trade or business (including the principal business activity code), and a statement that the taxpayer is making an election under section 163(j)(7)(B) or (C), as applicable.

The proposed rules also would address terminations of the election as a result of a taxpayer ceasing to engage in the electing trade or business along with anti-abuse rules to prevent inappropriate election terminations where the taxpayer or related party subsequently resumes operation of the trade or business within 60 months of the termination. In general, a taxpayer would cease to engage in an electing trade or business if the taxpayer sells or transfers substantially all of the assets of the trade or business to an unrelated party in a taxable asset transfer.

The proposed rules would include an anti-abuse rule to prevent a real property trade or business from being treated as an excepted business if it leases 80% of the value of its real property to a 50% commonly controlled trade or business.

Certain REITs would be given a safe harbor to qualify as an electing real property trade or business.

- If a REIT holds real property, interests in partnerships holding real property, or shares of other REITs holding real property, the REIT would be eligible to make the election. For REITs, section 1.856-10 would apply to define “real property.”

- If 10% or less of the value of a REIT’s assets consist of “real property financing assets” at the close of the applicable taxable year, then all of the REIT's assets would be treated as assets of an electing real property trade or business.

- If more than 10% of a REIT's assets consist of “real property financing assets” at the close of the taxable year, then the REIT would be required to allocate interest expense, interest income, and other items of expense and gross income to the electing real property trade or business and to non-excepted trades or businesses. “Real property financing assets” would include interests in mortgages, deeds of trust, REMIC regular interests, among others.

| KPMG observation: The proposed rules make it clear that a taxpayer, including a partnership, can have more than one excepted business and can choose to make a section 163(j)(7) election for each business separately. This may be beneficial, for example, in circumstances where one excepted business would not be subject to a limitation while another would be, and the taxpayer wants to avoid any adverse consequences of making the election (for example, alternative depreciation system (ADS) depreciation, loss of bonus on qualified improvement property to the extent otherwise allowable in technical corrections to H.R. 1). |

| KPMG observation: The safe harbor for REITs could be helpful for debt incurred directly by a REIT. In our experience, most publicly traded UpREITs borrow at their operating partnership rather than at the REIT level. In those cases, the safe harbor would not apply. However, as discussed below, to the extent there is a lower-tier REIT in the ownership structure, the borrowing operating partnership would likely be able to look-through such REIT for purposes of allocating its debt to an excepted business, provided it owns at least 80% of the vote and value of such REIT stock. |

Rules for allocating interest expense, interest income, and other items of expense and gross income to excepted businesses

The amount of a taxpayer’s interest expense that is properly allocable to excepted trades or businesses is not subject to limitation under section 163(j). The amount of a taxpayer’s other items of income, gain, deduction, or loss (including interest income) that is properly allocable to excepted trades or businesses is excluded from the calculation of the taxpayer’s section 163(j) limitation. Section 1.163(j)-10 provides rules for allocating interest expense, interest income, and other items of expense and gross income to excepted businesses if a taxpayer has items attributable to excepted and non-excepted businesses.

These allocation rules would not be used to determine if interest expense or interest income is properly allocable to a trade or business and would only be applicable to the extent that a taxpayer has determined that the taxpayer has interest expense or interest income that is properly allocable to a trade or business (for example, by applying section 1.163-8T to determine which items of interest expense are investment interest under section 163(d).)

Allocation of business interest expense and business interest income

In general, the proposed rules would allocate business interest expense and business interest income to excepted and non-excepted businesses based on the relative amounts of the taxpayer’s adjusted basis in the assets used in its excepted or non-excepted trades or businesses. For this purpose, the adjusted basis of a tangible asset for which depreciation is allowable is determined by using the ADS under section 168(g). Generally, a taxpayer’s basis in cash and cash equivalents and customer receivables is not taken into account. A taxpayer making an allocation must attach a statement to its timely filed federal income tax return for the taxable year that includes information about the adjusted basis of the assets and the method(s) used to determine the basis. Failure to file the statement, or filing a statement that does not comply with the requirements, enables the IRS to treat the taxpayer as if all of its interest expense is properly allocable to a non-excepted business, unless the taxpayer shows that there was reasonable basis for failing to comply with the requirements.

| KPMG observation: An electing real property trade or business must use the ADS for all real property and qualified improvement property. While not explicitly addressed, we understand from informal discussions with the government that it is intended that the transition for property placed in service prior to the year of election would be subject to the pre-existing rules applicable to a change in use. |

The basis determinations must be made quarterly and the average basis for such assets for the taxable year would determine the allocation. However, if 90% of the taxpayer’s basis in its assets is allocable to either excepted or non-excepted trades or businesses, then all of the taxpayer’s business interest expense or business interest income is allocated to such category.

| KPMG observation: The basis rules, and particularly those relating to tangible assets, closely resemble the basis rules used to determine qualified business asset investment (QBAI) for purposes of applying the section 951A GILTI rules and the section 250 “FDII” rules. It is reasonable to expect that many of these regulatory provisions would be carried over in future guidance implementing the QBAI determinations. |

Interest expense and interest income look-through rules

The proposed rules contain look-through rules for interests in partnerships and S corporations which would allow partners and shareholders to treat their own interest expense as allocable to an excepted business conducted by a partnership or corporation.A taxpayer generally may choose to look through its partnership interest or S corporation stock to determine the extent of the taxpayer’s adjusted basis in the partnership interest or stock that is allocable to an excepted or non-excepted business. The taxpayer would take into account the taxpayer’s share of the partnership’s or S corporation’s adjusted basis in its assets, taking into account any adjustments under sections 734(b) and 743(b) as well as other specified adjustments. A taxpayer must look through a partnership or S corporation in which it holds directly or indirectly 80% or more of the partnership’s capital or profits or S corporation’s stock by vote and value.

If at least 90% of a partner’s share of a partnership’s basis in its assets is allocable to either excepted businesses or non-excepted businesses (without regard to assets not properly allocable to a trade or business), the partner’s entire basis in its partnership interest is treated as allocable to either excepted or non-excepted trades or businesses, respectively. A corresponding rule applies to S corporation shareholders.

Similarly, the stock of a domestic C corporation that is not a member of the taxpayer’s consolidated group and of a controlled foreign corporation (CFC) is treated as an asset of the shareholder.

- Look-through treatment would apply to such a domestic C corporation or CFC if the shareholder satisfies the ownership requirements of section 1504(a)(2) (for example, 80% of vote and value). If look-through treatment applies, the shareholder must look to the corporation’s basis in its assets to determine the extent to which the shareholder’s basis in the stock is allocable to an excepted or non-excepted trade or business.

- If at least 90% of such a domestic C corporation’s basis in its assets is allocable to either excepted businesses or non-excepted businesses, the shareholder’s entire interest in the corporation’s stock is treated as allocable to either excepted or non-excepted businesses, respectively.

The proposed rules provide guidance for the treatment of assets that are used in multiple businesses. Basis may be allocated based upon either the relative amounts of gross income that an asset generates, or for land or an inherently permanent structure, the relative amounts of physical space used by the trades or businesses, or the relative amounts of output of those trades or businesses. A taxpayer is required to use the same allocation methodology from one determination period to the next or from one taxable year to the next. In order to change its method of allocation, a taxpayer must submit a letter ruling request, and consent only will be granted in extraordinary circumstances.

| KPMG observation: Given the need for a letter ruling, it is important to carefully select an initial allocation method for excepted and non-excepted businesses. |

Notwithstanding the rules described above, the proposed rules would require that a taxpayer with qualified nonrecourse indebtedness, within the meaning of section 1.861-10T(b), must directly allocate interest expense from the indebtedness to the taxpayer’s assets as provided under section 1.861-10T(b).

Allocation of other items to compute ATI

For purposes of determining a taxpayer’s ATI, a taxpayer’s gross income other than dividends and interest income would be allocated to the trade or business that generated the gross income. If a taxpayer looks through a corporation for purposes of allocating business interest expense or business interest income, as described above, then dividends from, and gain from the disposition of, such stock that is not held for investment is allocated to excepted or non-excepted businesses based on the relative amounts of the payor corporation’s adjusted basis in its assets that is allocable to such businesses. If at least 90% of the corporation’s adjusted basis is allocable to either excepted or non-excepted businesses, all of the taxpayer’s dividend income or gain is treated as allocable to either excepted or non-excepted businesses, respectively. If the taxpayer does not look through the corporation for this purpose, then all of the dividend income or gain would be treated as allocable to a non-excepted trade or business.

Similarly, if a taxpayer recognizes gain or loss from the disposition of a partnership interest or stock in an S corporation that owns non-excepted assets and excepted assets, investment assets, or both, the taxpayer would determine the proportionate share allocable to non-excepted businesses in accordance with the partnership and S corporation look-through rules described above.

The proposed rules provide additional guidance to allocate expenses other than interest expense.

| KPMG observation: Oddly, if the applicable ownership threshold is met, it appears that the look-through rule for allocating business interest expense and business interest income of a taxpayer would apply even with respect to stock that is held by an individual as an investment asset and could distort the allocation of business interest expense if such investment stock basis is allocated to non-excepted businesses. In contrast, for purposes of allocating dividend income and stock disposition gain, the look-through rule is only applied if the stock is not held as an investment asset. This rule appears to be inconsistent with the preamble, which does not limit the application of this rule to stock not held for investment. |

Definition of a real property trade or business

The proposed rules include proposed amendments to section 1.469-9(b) to provide rules relating to the definition of a real property trade or business under section 469(c)(7)(C). The proposed rules would define “real property” to include land, buildings, and other inherently permanent structures that are permanently affixed to land, and exclude from the definition other items, such as machines and equipment that serve an active function and may be permanently affixed to real property. This definition would be narrower than that applied in the REIT context and applicable to the REIT safe harbor described above.

The proposed rules also would define “real property operation” and “real property management,” but reserve on the other categories of businesses that qualify as real property trades or businesses under section 469(c)(7)(C). The preamble indicates that the categories of real property trades or businesses under section 469(c)(7)(C) may be defined to not include trades or businesses that generally do not play a significant role in the creation, acquisition, or management of rental real estate.

In addition to the proposed rules, Treasury and the IRS issued Rev. Proc. 2018-59, which provides a safe harbor that allows taxpayers to treat certain infrastructure trades or businesses as real property trades or businesses solely for purposes of qualifying as an electing real property trade or business. The revenue procedure allows taxpayers to treat certain trades or businesses that are conducted in connection with the designing, building, managing, operation, or maintaining of certain core infrastructure projects as real property trades or businesses.

Treatment of corporations and consolidated groups: Sections 1.163(j)-4, -5

General C corporation rules

The proposed rules take the position that for purposes of the section 163(j) limitation, all interest expense and interest income of a C corporation per se is business interest expense and business interest income and allocable to a trade or business (however, note that business interest expense allocated to an excepted trade or business is not subject to limitation under section 163(j)). In addition, the proposed rules generally would recharacterize investment interest income and expense of a partnership that is allocable to a C corporation partner as business interest income or expense that is properly allocable to a trade or business of the C corporation (though this latter rule would not apply to the extent a C corporation partner is allocated a share of a domestic partnership’s subpart F or GILTI gross income inclusions that are treated as investment income at the partnership level).

| KPMG observation: The definition of business interest expense in section 163(j) excludes investment interest as defined in section 163(d). Large C corporations, however, are not subject to the section 163(d) investment interest limitation. Thus, the proposed rules would prevent such a corporation’s interest expense from being within the section 163(d) investment interest definition (although not limited under section 163(d)) and thereby prevent such interest expense from escaping the section 163(j) limitation. Hence, the proposed rules, as presaged in Notice 2018-28, categorically assert that all interest income and expense of a C corporation is per se business interest expense and business interest income. This position may be debatable and potentially conflicts with the statutory provision that states that section 163(j) is to be applied at the partnership level, but it is consistent with footnote 688 of the Conference Report. |

A C corporation’s earnings and profits (E&P) for a taxable year would be calculated without regard to any disallowance of interest expense under section 163(j). Thus, a C corporation with disallowed interest expense for a particular year would calculate its current E&P by subtracting its interest expense for the year, including the disallowed interest expense; the corporation’s subsequent deduction of its disallowed interest expense in a later year would not affect its E&P calculation for that later year.

| KPMG observation: The E&P rule can be expected to complicate tax attribute studies, though it is consistent with the rule in the proposed regulations under “old” section 163(j). However, because the scope of section 163(j) has been broadened considerably and now includes interest expense on third-party and controlled foreign corporation indebtedness, the rule will be encountered more often. |

Special E&P rules, in lieu of these general rules, would apply to RICs and REITs, and with respect to excess business interest expense allocated from a partnership to a C corporation partner.

Consolidated return rules

The proposed rules generally take a broad, single-entity approach. Consistent with Notice 2018-28, a consolidated group would be subject to a single section 163(j) limitation. Additionally, the proposed rules would require a group’s ATI to be calculated on a consolidated basis (though partnerships wholly-owned within the group would not be aggregated with the group). Thus, the group’s current-year business interest expense and business interest income would be the sum of the current-year interest items of the members. However, intercompany obligations (indebtedness between members of the same consolidated group) generally would be disregarded for purposes of determining the group’s business interest expense and business interest income, as well as its consolidated ATI. Moreover, intercompany items and corresponding items (within the meaning of section 1.1502-13) would be disregarded for purposes of calculating consolidated ATI to the extent they offset in amount. The proposed rules also would provide that, for purposes of calculating consolidated ATI, the FDII/GILTI deduction allowed under section 250(a)(1) would be determined (i) as if it were not subject to the taxable income limitation under section 250(a)(2) and (ii) without regard to the application of section 163(j).

| KPMG observation: The proposed rules would impose complexity by requiring additional, new consolidated adjustments for purposes of determining the consolidated section 163(j) limitation, calculations that are not currently required. Consolidated corporations with state filing requirements will encounter further compliance complexity, as noted in the state and local tax discussion below. |

For purposes of the stock basis/investment adjustment rules of section 1.1502-32, rules similar to those applicable to the absorption of losses would apply. In particular, a member’s basis in the stock of a member with disallowed current-year business interest expense would be adjusted only when the disallowed interest expense is absorbed (and not when initially disallowed).

| KPMG observation: The proposed consolidated section 163(j) rules would increase the importance of maintaining good intercompany transaction accounts and tracking basis in member stock. |

Any amount of business interest expense (including carryforwards) not deductible under the above rules generally would be carried forward to subsequent tax years.

The proposed regulations would provide that a “separate return limitation year” (or “SRLY”) limitation applies to disallowed business interest expense carryforwards. A section 163(j) SRLY limitation would not apply to the extent of an “overlap” in the application of section 382 and the SRLY limitation under the principles of section 1.1502-21(g) (the current rules applicable to loss carryovers).

| KPMG observation: The helpful overlap rule can be expected to apply to a group’s acquisition of a previously unrelated target with disallowed business interest expense carryforwards. However, the section 163(j) SRLY limitation would remain a trap for the unwary in situations not covered by the overlap rule. |

The current SRLY limitation for NOL carryovers employs a “cumulative register” concept, meaning that SRLY losses can be deducted to the extent of the SRLY member’s cumulative contribution to consolidated taxable income for all years in which it is a member of the group. In contrast, the proposed section 163(j) SRLY limitation would be annual rather than cumulative.

| KPMG observation: The preamble justifies the annual section 163(j) SRLY limitation based on the repeal of the excess limitation carryforward provisions from former section 163(j). Nevertheless, this approach is arguably in contrast with the consolidated return neutrality principles underlying the SRLY loss rules. |

A member with disallowed business interest expense that departs a consolidated group generally would take its carryforwards with it. However, as is the case with NOLs, the group would have the priority claim to deduct the member’s business interest expense items, to the extent available under section 163(j), including both the departing member’s current-year business interest expense (through the date of departure) as well as the departing member’s disallowed business interest expense carryforwards from prior years.

Also, consistent with the rules applicable to NOLs, a departing member’s disallowed business interest expense carryovers would be potentially subject to attribute reduction under the consolidated unified loss rule of section 1.1502-36(d). A departing member’s carryforwards of disallowed business interest expense that survive this gauntlet of rules would be carried forward to its first separate return year, albeit potentially subject to section 382 limitation (or, if applicable, to the section 163(j) SRLY limitation in an acquiring group).

Section 381(a) transactions

An acquiring corporation in a section 381(a) transaction (generally, a tax-free section 368(a)(1) asset reorganization or a section 332 subsidiary liquidation) can succeed to the disallowed business interest expense carryforwards of a target corporation. The proposed rules include provisions which generally would limit the amount of the target’s disallowed business interest expense that the acquiring corporation could deduct in the acquiring corporation’s first taxable year ending after the acquisition. These rules are similar to the current rules in sections 1.381(c)(1)-1 and -2 that apply to an acquiring corporation’s use of a target corporation’s losses in the acquisition year.

Sections 382 and 163(j)

Congress provided in section 163(j) that disallowed business interest expense carryovers are subject to the section 382 loss limitation rules following an ownership change (generally, a cumulative greater-than-50-percentage-point change in the stock ownership of a corporation over a three-year period). The proposed rules would require for a taxable year in which an ownership change occurs, the pro rata allocation of business interest expense between the pre- and post-ownership change periods based on the number of days in each period, regardless of whether a closing of the books election is made under section 1.382-6(b).

| KPMG observation: Often an ownership change of a target entity occurs in the context of a leveraged acquisition. In this situation, the proposed rules would artificially increase the amount of business interest expense subject to limitation, by allocating a disproportionate amount of post-acquisition interest expense to the pre-acquisition period (thus subjecting it to limitation under section 382). |

Section 1.383-1 would modify the existing ordering rule governing the absorption of pre-change losses and tax credits subject to limitation under sections 382 and 383, to provide that disallowed business interest expense carryforwards should be absorbed after pre-change capital losses and all recognized built-in losses, but before NOLs, other pre-change losses, and pre-change credits.

Transition rules regarding former section 163(j) (section 1.163(j)-11)

The proposed rules would provide a transition rule for disallowed disqualified interest, which is the special term used to define interest expense for which a deduction had been disallowed under former section 163(j) (referred to as “old section 163(j)” in the proposed rules) in the taxpayer’s last taxable year beginning before January 1, 2018, and that was carried forward pursuant to old section 163(j).

Disallowed disqualified interest would be carried forward to the taxpayer’s first taxable year beginning after December 31, 2017, and would be subject to disallowance as a disallowed business interest expense carryforward, except to the extent the interest is properly allocable to an excepted trade or business as would be defined in the proposed rules. In general, any business interest expense disallowed under the proposed rules or any disallowed disqualified interest that is properly allocable to a non-excepted trade or business would be carried forward to the succeeding taxable year as business interest expense that is subject to the new section 163(j) limitation on business interest expense (Note that Notice 2018-28 states that this interest will be subject to the section 59A base erosion and anti-abuse tax (BEAT) provisions in the same manner as interest paid or accrued in a taxable year beginning after December 31, 2017).

Earnings and profits: A taxpayer would not be permitted to reduce its E&P in a taxable year beginning after December 31, 2017, to reflect any disallowed disqualified interest carryforwards to the extent the payment or accrual of the disallowed disqualified interest reduced earnings and profits of the taxpayer in a prior taxable year.

Joining a consolidated group with a different taxable year: A special rule would apply to the disallowed business interest expense of a target corporation with a taxable year beginning after December 31, 2017 (and thus subject to the new section 163(j) rules) that joins a consolidated group with a taxable year that started before that date (e.g., a group with a taxable year ending November 30, 2018). In this narrow circumstance, any disallowed interest expense of the target corporation would be carried forward to the acquiring group’s first taxable year beginning after December 31, 2017.

Treatment of partnerships: Section 1.163(j)-6

Section 163(j) is applied to partnership indebtedness at the partnership level. To the extent a partnership’s interest deduction is limited, the deferred interest (“excess business interest expense”) must be allocated to the partners, which reduces the partners’ bases in their partnership interests. Section 163(j)(4) provides that the excess business interest expense is then treated as paid or accrued by the partner to the extent the partner is allocated “excess taxable income,” which is adjusted taxable income of the partnership in excess of the amount the partnership requires to deduct its own interest under section 163(j). The proposed rules address many of the issues created as a result of the application of section 163(j) at the partnership level.

As noted above, the proposed rules would provide that a guaranteed payment for the use of capital is treated as interest.

| KPMG observation: A guaranteed payment for the use of capital may represent a payment for the use of property other than money. The proposed rule as currently drafted could apply to limit any guaranteed payment for the use of capital deduction – even if for the use of property. The treatment of guaranteed payments as interest would not be subject to a transition rule and may impact partnerships that currently have guaranteed payments. |

Section 163(j) specifies that excess business interest expense and excess taxable income are allocated to partners in the same manner as “nonseparately stated taxable income or loss of the partnership.” As the term nonseparately stated taxable income or loss is not defined by statute or regulations, the proposed rules would provide a complex eleven-step computation for determining a partner’s share of partnership excess business interest expense, excess business interest income (the amount of business interest income in excess of the partnership’s business interest expense), and excess taxable income for purposes of section 163(j) referred to as “excess items”). This determination would not have an impact on the partnership’s allocations under section 704(b).

| KPMG observation: The stated goal of this computation is to ensure that the total amount of deductible business interest expense and section 163(j) excess items allocated to each partner will equal the partnership’s total amount of deductible business interest expense and section 163(j) excess items. The examples provided in the proposed rules are focused on special allocations of items that cause these amounts to differ; however, regulatory allocations, 704(c) allocations, and varying interest may have the same result. |

The proposed rules would provide that excess business interest income allocated to a partner from a partnership would allow excess business interest expense from the partnership to be treated as paid or accrued in that year to the extent of such excess business interest income.

| KPMG observation: This rule addresses a concern that if a partnership only generates business interest income, it would not be able to cause excess business interest expense to be treated as paid or accrued. Under section 163(j)(4)(B)(ii)(I), only excess taxable income can cause excess business interest expense to be treated as paid or accrued by a partner and excess taxable income does not include business interest income. Despite this statutory language, the proposed rules would treat business interest income like excess taxable income for this purpose. |

Regarding the treatment of excess business interest expense, the proposed rules would clarify that, to the extent a partner receives an allocation of excess taxable income or excess business interest income from a partnership in a taxable year, such partner’s excess business interest expense is treated as paid or accrued in that year, in an amount equal to the partner’s share of the excess taxable income. When the excess business interest expense is treated as paid or accrued, it becomes business interest paid or accrued by the partner and may be deducted by the partner, subject to any partner-level section 163(j) limitation and any other applicable limitations.

The proposed rules would also make it clear that, to the extent a partnership’s business interest expense is allowed to be deducted under section 163(j) (that is, it is less than or equal to the partnership’s section 163(j) limitation), such business interest expense is not subject to further limitations under section 163(j) at the partner level.

The preamble notes that for partnerships that are engaged in non-passive activities, partners who do not materially participate may be subject to interest limitations under both section 163(j) and section 163(d) for the partnership’s business interest expense. In these circumstances, the partnership would be subject to a section 163(j) limitation on the partnership’s business interest expense. In addition, section 163(d) would apply to such partner to the extent interest is deductible by the partnership and allocated to the partner, or excess business interest expense allocable to such partner is treated as paid or accrued by such partner. The preamble notes that Treasury and the IRS determined that this is the result of existing statutory provisions, and, therefore, are not providing any additional rules to address this issue.

Partner-level adjustments (for example, section 743(b) adjustments, built-in loss amounts under section 704(c)(1)(C), and remedial allocations of income, gain, loss or deduction to a partner pursuant to section 704(c)), would not be taken into account when computing ATI for purposes of the partnership’s section 163(j) limitation. Rather, these partner-level adjustments would be taken into account at the partner level as items derived directly by the partner in determining its own section 163(j) limitation.

The proposed rules would also incorporate the double counting rule set forth in Notice 2018-28 that a partner may only include business interest income from a partnership in its section 163(j) calculation to the extent that business interest income exceeds business interest expense determined at the partnership level under section 163(j). As indicated above, this excess amount would be referred to as excess business interest income. The proposed rules would further provide that a partner may not include its share of the partnership’s floor plan financing for purposes of determining the partner’s section 163(j) limitation for business interest expense.

The proposed rules would provide guidance on the interaction between the section 163(j) partnership excess business interest expense rules and the section 704(d) suspended loss rules. In particular, any excess business interest expense from a prior taxable year that was suspended under section 704(d) would not be treated as excess business interest expense in any subsequent taxable year until it is no longer suspended under section 704(d). Consequently, an allocation of excess taxable income or excess business interest income would not result in such excess business interest expense being treated as business interest expense paid or accrued by the partner.

An ordering rule would also require section 163(j) to be applied before the loss limitation rules in section 465 and section 469, and the application of section 461(l).

The proposed rules would provide that, if a partner disposes of all or substantially all of its partnership interest (by sale, exchange, or redemption), the partner’s basis in its partnership interest would be increased immediately before the disposition to the extent the partner’s excess business interest expense has not been deemed paid or accrued by the partner. If the interest was previously deemed paid or accrued, but has not been deducted as a result of the partner’s section 163(j) limitation, the basis would not be recovered.

| KPMG observation: The proposed rules would clarify that partial disposition by a partner, that is, a disposition of less than substantially all of a partner’s partnership interest, would not result in a basis increase to the partner’s partnership interest. It is unclear what percentage constitutes “substantially all” for purposes of this rule. |

| KPMG observation: The proposed rules would clarify that a disposition would include a “redemption.” |

In the event a partnership allocates excess business interest expense to one or more of its partners, and in a later taxable year becomes not subject to the requirements of section 163(j), the proposed rules would provide that excess business interest expense from prior taxable years is treated as paid or accrued by the partner in such later taxable year. Thus, the excess business interest expense may be deducted by the partner, subject to any partner-level section 163(j) limitation and any other applicable limitations.

| KPMG observation: The examples make it clear that this proposed rule would apply to exempt partnerships (partnerships that qualify for the small business exemption). It is not clear whether this rule is intended to apply to excepted businesses, such as an electing real property trade or business. |

Investment interest expense, investment income, and investment expense paid or accrued by a partnership and allocated to a C corporation partner are treated by the C corporation as properly allocable to a trade or business of the corporation.

| KPMG observation: These items do not appear to be “siloed” to the partnership. Rather, they are treated as items of business income earned or expense paid or accrued directly by the C corporation partner and are taken into account in the C corporation partner’s own section 163(j) limitation. |

The treatment of business interest income and business interest expense with respect to lending transactions between a passthrough entity and an owner of the entity (self-charged lending transactions) is reserved in the proposed rules. The preamble notes that Treasury and the IRS intend to adopt rules to re-characterize, for both the lender and borrower, the business interest expense and corresponding business interest income arising from a self-charged lending transaction to prevent such business interest income and expense from entering into the section 163(j) limitation calculations for the lender and the borrower.

The treatment of excess business interest expense in tiered partnerships is also reserved in the proposed rules. Treasury and the IRS requested comments on how carryforwards and basis adjustments should be taken into account by upper-tier partnerships.

International implications of section 163(j): Sections 1.163(j)-7, -8

Application to CFCs

The preamble to the proposed regulations under the former section 163(j) described its purpose as “prevent[ing] erosion of the U.S. base by means of excessive deductions for interest paid by a taxable corporation to a tax exempt (or partially tax exempt) related person.” Consistent with that view, those proposed regulations would have limited the application of former section 163(j) to only those foreign corporations that were engaged in a U.S. trade or business. New section 163(j) abandons any focus on the tax status of the recipient of interest and expands its scope to non-corporate taxpayers. Therefore, new section 163(j) clearly has a broader focus than its predecessor. The proposed rules reflect this broadening by providing that section 163(j) now applies to CFCs in addition to foreign persons engaged in a U.S. trade or business.

Notice 2018-28 provided that a domestic corporation’s earnings and profits should not be adjusted to reflect any amount of business interest expense disallowed under section 163(j). The proposed rules would clarify that the earnings and profits of foreign corporations would also not be adjusted to reflect any disallowed business interest expense.

| KPMG observation: If E&P of a CFC is not adjusted to reflect the disallowed amount, the subpart F income of the CFC may be subject to the E&P limitation under section 952(c) because its E&P will be lower than its net subpart F income to the extent it has any business interest expense that is disallowed under section 163(j). There is no E&P limitation for GILTI inclusions, and so this rule should not affect the amount of a U.S. shareholder’s GILTI inclusion. |

The proposed rules would set forth two available methods for applying section 163(j) at the CFC-level:

- The default CFC-by-CFC method (the “Default Method” as provided in section 1.163(j)-7(b)); and

- The elective CFC Group method for highly-related CFCs (the “CFC Group Method”) as provided in section 1.163(j)-7(b)(3), (c), and (d)).

The default method

The default method would require the section 163(j) limitation to be calculated on a CFC-by-CFC basis with no netting of business interest income of one CFC against the business interest expense of another CFC. This can result in a double counting of GILTI at the U.S. shareholder level when there is intercompany lending between CFCs and the lending CFC has interest expense that is disallowed under section 163(j). This double counting is caused by the fact that interest expense at the borrower CFC that is disallowed under section 163(j) may increase the debtor’s GILTI inclusion, while the corresponding interest income is also likely to give rise to an additional GILTI inclusion for the lender.

The CFC Group Method

Recognizing the potential unfairness of this double counting (which is addressed in the purely domestic context by the rules for consolidated groups), the proposed regulations provide an alternative, elective method to compute a CFC Group’s section 163(j) limitation. In general, the CFC Group Method provides two distinct benefits to CFC Groups in the application of section 163(j). First, the proposed rules would permit CFCs to net intercompany interest income and interest expense within the applicable CFC Group. Thus, under the CFC Group Method, no member of an applicable CFC Group would be subject to the section 163(j) limitation if a CFC Group has only intra-CFC Group debt. Any net business interest expense that remains after the netting of intercompany business interest income and business interest expense, that is, third-party debt or debt from entities outside of the CFC Group, would be subject to limitation under section 163(j), and this calculation would be done at the separate CFC level.

The second benefit is that lower-tier group members can “share” their excess taxable income with upper-tier CFCs. For this purpose, excess taxable income is computed under a complex set of nested definitions. The result is related in concept but distinct in application from a partnership’s “excess taxable income” as explained more fully above in the discussion of the partnership rules in section 1.163(j)-(6). The excess taxable income would be calculated at the lowest-tier CFC with the excess limitation and then tier up through the chain of CFCs, becoming a component of ATI at each level.

| KPMG observation: The determination of the excess taxable income requires a multi-step, complex calculation. In public comments in advance of the promulgation of the proposed rules, government officials questioned whether the complexity was worth the benefit taxpayers would receive from the provision. |

If the CFC Group Method is used, a CFC’s section 163(j) limitation calculation would not include interest income (as this amount has already been taken into account in deriving net business interest expense) or floor plan financing interest. Therefore, the section 163(j) limitation would be just 30% of ATI. Apart from the excess taxable income adjustments, ATI would be calculated based on section 1.952-2 principles, and dividends from related persons (as defined within the meaning of section 954(d)(3)) would be excluded in calculating the recipient CFC’s ATI.

| KPMG observation: The CFC Group Method does not eliminate the need for CFC-by-CFC computations if the CFC Group has any interest expense paid to non-CFC Group members, and so should not be viewed as a simpler compliance exercise than under the Deficit Method. |

The CFC Group Method would be an election that is “made by doing” – that is, by applying the method in calculating a CFC group member’s deduction for business interest expense. The filing of a separate statement or form would not be required. Absent such an election, the Default Method applies. The proposed rules would require that the election be consistently applied by all members of the CFC Group and would be irrevocable.

Definition of CFC Group

A “CFC Group” is defined as two or more applicable CFCs (that is, CFCs with one or more section 958(a) shareholders), if at least 80% of the stock measured by value of each CFC member is directly or indirectly owned within the meaning of section 958(a) by a (1) a single U.S. shareholder or (2) certain related U.S. shareholders that own stock of each CFC member in the same proportions. For this purpose, members of a consolidated group would be treated as single person. Thus, CFCs in separate chains owned by different U.S. shareholders may nonetheless be members of the same CFC Group if the U.S. shareholders are members of the same consolidated group.

If CFC members of the CFC Group own more than 80% of an interest in the capital or the profits of a partnership, such partnership would be treated as a CFC Group member, and the partnership interest would be treated as stock for this purpose. Foreign corporations and controlled partnerships engaged in a U.S. trade or business would not be members of an applicable CFC Group (but would be considered part of the CFC Group for purposes of applying the ownership aggregation rules).

Special rules would apply to CFCs that conduct a financial services businesses, which would be treated as a separate CFC subgroup (a “financial services subgroup”) and ring-fenced from the remaining CFC Group for purposes of applying the section 163(j) computation at the CFC-level.

Effect of CFC inclusions and attributes on U.S. shareholder ATI

For purposes of calculating the U.S. group’s ATI, there would be subtracted any amounts included in the gross income of the U.S. shareholder under sections 78, 951(a) or 951A(a) allocable to a non-excepted trade or business of a CFC, and increased by the amount of deduction allowed under section 250(a)(1) with respect to such amounts. Effectively this reduces from ATI the net impact of subpart F and GILTI inclusions from CFCs.

| KPMG observation: The purpose of this provision is to prevent the double counting of deemed inclusions at the CFC and U.S. shareholder level. Thus, if the US shareholder holds the majority of the debt, this rule may be disadvantageous because the ATI will essentially be trapped in entities that have excess limitation. |

If, however, a CFC Group Election is made, the U.S. shareholder would be allowed to include in ATI a certain amount of CFC Group extraterrirorial income not to exceed the U.S. shareholder subpart F and GILTI inclusions (without regard to the section 78 amount) with respect to the CFC Group. For the limited purpose of calculating the add-back to a U.S. corporate partner’s ATI, a domestic partnership that is a U.S. shareholder would be treated as a foreign partnership such that the add-back would flow through to the U.S. corporate partner, thereby increasing its ATI.

| KPMG observation: Taken together, it appears that the ability to 1) tier limitation up a CFC chain and ultimately into the U.S., and 2) offset business interest expense with business interest income between different CFCs, with little apparent downside, will make the CFC Group Method the preferred approach for many U.S. multinational groups. One contrary consideration might be complexity, but in many circumstances, administering the Default Method would be only marginally easier. |

| KPMG observation: The proposed rules address how much interest expense a given CFC can deduct, but do not address how to associate any such deductions with the CFC’s subpart F, GILTI, and exempt income in the new international regime. Such rules may be addressed in the forthcoming foreign tax credit proposed regulations package, which will apparently also address amendments to the existing section 861 regulations. (Such regulations are expected imminently.) Of critical importance is the interest expense of a holding company and whether it is associated with the tested income of a lower-tier CFC, so to potentially create a tested loss. |

Application of section 163(j) to foreign persons with effectively connected income (ECI)

Foreign persons are subject to net basis U.S. taxation only on their income that is effectively connected with a U.S. trade or business. Accordingly, the proposed rules would modify the application of section 163(j) to “scale” the limitation to the applicable U.S. tax base.

| KPMG observation: The decision to scale the section 163(j) limitation employs a complex computational approach that is layered over the application of the general section 163(j) rules. |

Generally, section 882 principles would apply for purposes of determining the foreign person’s ATI, with separate computational methods for CFCs with U.S. effectively connected income versus non-CFC foreign persons with U.S. ECI.

The definitions for ATI, business interest, business interest income, etc. are modified to limit such amounts to U.S. ECI and expenses properly allocable thereto. A non-CFC foreign corporation would first determine its interest expense under section 1.882-5 and then determine the amount of disallowed business interest expense under section 163(j). Consistent with the overall theme of treating partnerships as entities for purposes of section 163(j), different rules apply for foreign persons earning at least some of their ECI through partnerships than for those all of whose ECI is earned directly.

A CFC with U.S. ECI would first apply section 163(j) general rules and then apply section 1.882-5 only if such CFC would have disallowed business interest expense under the first step. For non-CFC foreign persons that are partners in an ECI partnership, the proposed rules would employ similar modifications with respect to excess taxable income, excess business interest expense, and excess business interest income of the partnership to take into account the limitation of such foreign person’s liability for U.S. tax to its ECI.

Consistent with other provisions relating to E&P, the proposed rules would provide that the section 163(j) limitation does not affect the determination of U.S. effectively connected E&P (“ECE&P”) or U.S. net equity for purposes of applying the branch profits tax under section 884.

State implications of section 163(j) interest limitation proposed regulations

The proposed rules answer many key federal questions and raise some new ones, but in large part do not clarify how the states that conform to section 163(j) will apply the limitation.

| KPMG observation: At this point, there are about five states that have specifically acted to decouple from 163(j); about ten states have not yet updated their conformity to the Code or have not adopted any of the tax reform changes for 2018. Still, there are numerous states that will conform to the federal limitation through their conformity to Code with no specific section 163(j) decoupling provisions (absent further legislative action). |

From a state perspective, one of the key provisions in the proposed rules is confirmation that a federal consolidated group would have a single section 163(j) limitation. In the calculation of the consolidated group’s limitation, intercompany obligations between members of the same consolidated group would be disregarded for purposes of determining business interest expense and business interest income. However, the section 163(j) limitation for members of an affiliated group not filling a federal consolidated return would not be aggregated and intercompany obligations would not be disregarded in determining the limitation. While providing some clarity for federal taxpayers, this approach would create compliance headaches in many states. For state purposes, a member of the federal consolidated group may be required to file a separate company state return and calculate state taxable income beginning with federal taxable income determined as if the corporation had not elected to file a federal consolidated return. This is the general approach in states that require separate company return filing, and in certain states that require combined group filing but start the calculation of the group’s state taxable income with each group member’s separate company federal taxable income. For taxpayers filing federal returns on a consolidated basis, this could result in significant differences in the applicable section 163(j) limitation from what is computed on the taxpayer’s federal consolidated income tax return (and any associated carryovers of disallowed interest deductions).

Even in states that generally conform to the federal consolidated return rules, the application of the proposed rules could create state-specific issues. For example, some states require or permit groups of related taxpayers to elect a combined or consolidated filing method that often consists of more or less members than the federal consolidated group (e.g., where the ownership threshold for group membership is greater than 50% rather than the 80% ownership requirement for a federal consolidated return group). In those cases, the section 163(j) limitation may need to be recomputed using the proposed rules for consolidated groups as applied to the state group. Absent state guidance, the way in which these calculations would be done is far from certain.

Interest deductions disallowed under section 163(j) generally may be carried forward indefinitely. In states that require the calculation of the section 163(j) limitation to be done on a separate company basis, the carryforwards of disallowed interest deductions may be significantly different than those calculated for federal purposes. With respect to those carryforwards, the proposed rules include guidance on the application of section 382 limitations and SRLY-type rules for federal consolidated groups. In states that require corporations to file on a separate company basis or use their own rules for allocating tax attributes to members of a combined group, a complicated analysis may be required to determine which entities may carry forward unused section 163(j) interest deduction carryforwards and whether any limits apply to the use of those carryforwards in the state, especially in situations where there is a merger or acquisition.

Over 20 states currently have rules that disallow the deduction of interest or intangible-related interest paid to related parties. Coordinating the state and federal rules in the states that conform to section 163(j) will likely also present complications. For example, it will be necessary to determine whether the character of the interest allowed to be deducted after applying the limitation computed under the state filing method is “related party” interest subject to further state limitations. The proposed rules do not provide any guidance to assist in this state-specific issue.

Complications can also arise when applying state addback rules in a year where the taxpayer deducts interest previously disallowed under section 163(j). The taxpayer in that case would potentially need to trace which portion of the federal limitation related to interest subject to the state addback provision in the year it was limited by section 163(j) and whether it would have been eligible for an exception to that state addback provision.

| KPMG observation: Only one state, New Jersey, has addressed this issue directly. The state legislature enacted a provision that applies the section 163(j) deduction limitation on a pro rata basis to interest paid to related and unrelated parties. |

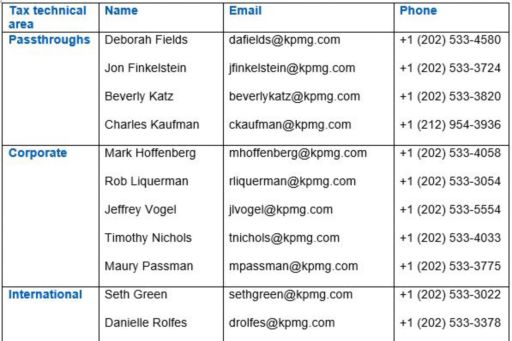

KPMG contacts

For more information on any of the provisions discussed in this booklet, please contact a professional in KPMG’s Washington National Tax office.

© 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.