KPMG’s cryptoasset framework

KPMG’s cryptoasset framework

Read about KPMG’s Cryptoasset Framework and learn how our Cryptoasset practice can help your crypto project or business.

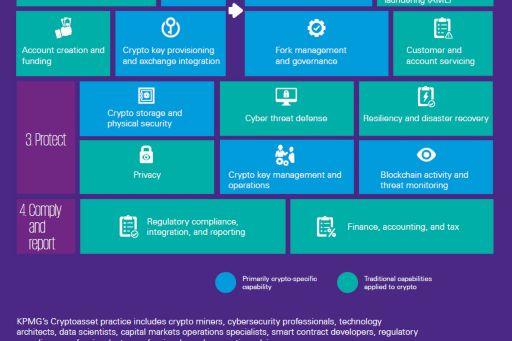

In working with startups, exchanges and large financial services organizations, KPMG's Cryptoasset practice has developed a crossfunctional framework that helps a crypto business scale while addressing the key challenges discussed previously.

KPMG's framework that has been applied successfully to several advanced crypto projects and businesses. This framework comprises of key capabilities required for a crypto business covering strategy, technology, operations, cybersecurity, risk management, finance and compliance to help them on the road to institutionalization.

The framework categorizes these capabilities under five pillars:

Pillar 0 Plan: Strategize the products and services to be provided and establish product-market fit

Pillar 1 Onboard: Onboard the cryptoasset and the customer

Pillar 2 Service and deliver: Provide support for the servicing andmanagement of cryptoassets

Pillar 3 Protect: Secure cryptoassets, protect client confidentiality andmonitor the blockchains

Pillar 4 Comply and report: Comply with the applicable regulatory frameworks, financial reporting requirements and taxreporting obligations

© 2025 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.