Key findings

Permanent staff appointments post further decline

Lowest increase in permanent salaries since February 2021

Further rises in candidate availability

Data collected September 12-24

Summary

The KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, indicated a further reduction in permanent placements during September, extending the current run of contraction to two years. According to recruitment consultants, clients were cautious in their assessment of the outlook and reluctant to hire staff. Temp billings were also lowered for a third successive month.

Although finding suitable candidates remained challenging, a general expansion of staff availability and reduced demand weighed on permanent salary growth during September. Latest data showed the weakest rise in salaries for over three-and-a-half years. Temp rates were fractionally lower. Vacancy numbers meanwhile declined for an eleventh successive month during September, with falls recorded for both permanent and temp workers.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Staff appointments continue to fall

The latest KPMG/REC Report on Jobs survey indicated a further fall in the number of permanent staff placements. The downturn in appointments now extends to two years, although the latest contraction was slightly softer than August’s five-month record.

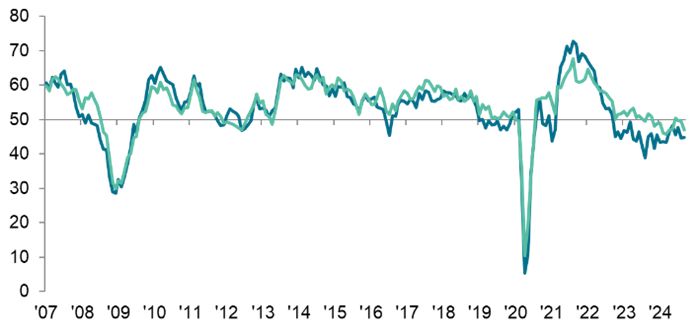

Permanent Placements Index

Temporary Billings

50.0 = no-change

Sources: KPMG, REC, S&P Global PMI.

Uncertainty in the outlook, including around government policy ahead of late October’s Budget, meant companies were cautious in their hiring activity. Temp billings also declined in September, and at the steepest rate since April.

Permanent pay inflation softens in September

Although there remained reports of shortages in suitable candidates, which helped to boost pay rates, permanent staff salary growth eased again in September. It was the third month in a row that salary inflation has fallen, and September’s reading was the lowest since February 2021. A greater number of candidates and reduced demand helped to limit pay growth, according to panellists. Temp rates meanwhile were fractionally lower, putting an end to a three-and-a-half-year run of inflation.

Vacancy numbers continue to decline

Latest survey data showed an eleventh successive monthly fall in staff vacancies. Moreover, the pace of contraction accelerated to the steepest since March. Both permanent and temp vacancies declined at similarly modest rates during September.

Staff availability rises markedly

Amid reports of increased redundancies and lower demand for workers, the overall availability of staff to fill positions increased again in September. Overall growth was again steep, despite easing to its lowest level since February. Similar trends were seen for both permanent and temporary workers.

Regional and Sector Variations

The reduction in permanent placements was common across all regions of England. The steepest decline was seen in the South of England, the smallest in the Midlands.

London recorded by far the steepest reduction in temp billings of the four English regions covered by the survey. In contrast, there was a marginal increase in the Midlands.

Permanent vacancies declined across six sectors during September, with the steepest fall seen for retail workers. Where growth was registered, the best performance was recorded for Nursing & Medical Care.

Except for Blue Collar, which recorded further modest growth in September, temp vacancies declined across all categories. There was some variance in rates of contraction. Executive & Professional posted the most pronounced contraction, with the slowest seen in Hotel & Catering.

Comments

Commenting on the latest survey results, Jon Holt, Group Chief Executive and UK Senior Partner KPMG, said:

“While some sectors are still finding it difficult to recruit people with the right skills, the overall pool of available candidates is growing as companies are still faced with tough decisions on their headcount. This has led to a softening of salary inflation, which dropped to its lowest point since February 2021. The Bank of England will likely be encouraged by this easing in pay pressures, which could strengthen the case for a further cut in interest rates in the upcoming November meeting.

“The slowing of hiring activity seen in September is to be expected as businesses apply the brakes on recruitment ahead of the Budget and wait for clarity on future taxation, business, and economic policy. The Government needs to continue to give chief execs confidence in the UK’s macroeconomic conditions and the country’s route to stronger growth.”

Commenting, Neil Carberry, REC Chief Executive, said:

“This is a picture of a jobs market waiting for a signal. Recruiters report that projects in client businesses are ready to go, but confidence is not yet high enough to push the button. The market for permanent jobs declined in September but more slowly than in the month before, while the temporary hiring market was more resilient and grew in some places. Private sector vacancies are close to flat, which also suggests businesses are holding position.

“Pay continues to moderate and is now below its long-term trend. This should add to the willingness of the Bank to become more activist on interest rate cuts, as the Governor hinted last week. This would be a big boost to business.

“But eyes are also on the government. The Chancellor has a huge opportunity at the Budget to drive confidence in our economy. Firms want a clear industrial strategy that goes beyond a sector-by-sector approach, focusing on key growth enablers such as the workforce, infrastructure, access to capital, and the tax system. They also need clarity on the changes to employment law that are planned – as uncertainty in this area is also slowing employer confidence right now.”

Jonathan Holt

Group Chief Executive, KPMG in the UK and Switzerland and Senior Partner

KPMG in the UK

Contact

KPMG

Tanya Holden

Deputy Head of Media Relations

+44 (0) 7874 888656

REC

Hamant Verma

Communications Manager

T: +44 (0)20 7009 2129

S&P Global

Andrew Harker

Economics Director

S&P Global Market Intelligence

T: +44 (0)1491 461 016

Sabrina Mayeen

Corporate Communications

S&P Global Market Intelligence

T: +44 (0) 7967 447030

Methodology

The KPMG and REC, UK Report on Jobs is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the survey methodology, please contact economics@spglobal.com.

Full reports and historical data from the KPMG and REC, UK Report on Jobs are available by subscription. Please contact economics@spglobal.com.

About KPMG UK

KPMG LLP, a UK limited liability partnership, operates from 20 offices across the UK with approximately 18,000 partners and staff. The UK firm recorded a revenue of £2.96 billion in the year ended 30 September 2023.

KPMG is a global organisation of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 143 countries and territories with more than 273,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

About REC

The REC is the voice of the recruitment industry, speaking up for great recruiters. We drive standards and empower recruitment businesses to build better futures for their candidates and themselves. We are champions of an industry which is fundamental to the strength of the UK economy. Find out more about the Recruitment & Employment Confederation at www.rec.uk.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today. www.spglobal.com.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.