Navigating Global Shifts in the Boardroom

ENRC CEOs remain cautiously optimistic despite mounting geopolitical and economic risks. Geopolitical tensions pose the greatest risk, but leaders are focusing on agility and strategic foresight to navigate the future.

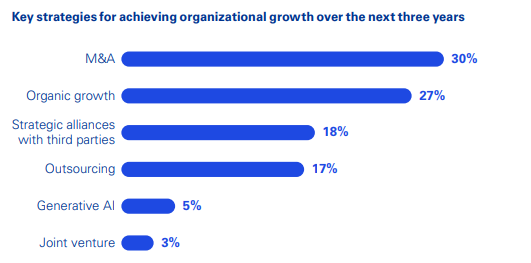

Strategies for Growth

With energy prices strong and demand high, ENRC CEOs are adjusting strategies to keep pace with market demands, showing a strong commitment to growth despite a complex risk environment.

Economic Outlook and Business Confidence

Confidence among ENRC CEOs remains high, with many planning strategic acquisitions and partnerships to fuel future growth.

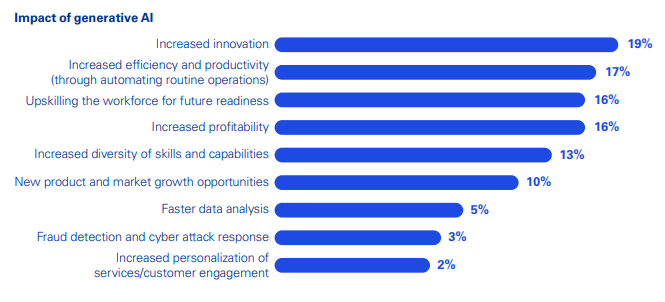

Accelerating Innovation and Navigating Generative AI

Generative AI is firmly on the CEO agenda, but leaders are taking a cautious and structured approach to avoid risks, while planning significant investment in AI-driven transformation.

As cyber risks evolve with the rise of AI, ENRC CEOs are prioritising investment in security measures to safeguard operations.

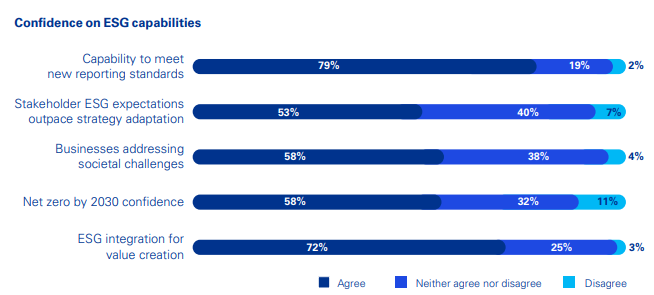

Future Landscape of ESG Strategies

ESG remains a crucial agenda item, with ENRC CEOs taking proactive steps toward net zero and sustainability. The growing focus on ESG as a driver for capital allocation and partnerships marks a significant shift in business strategy.

Evolving Workforce Dynamics

Workforce dynamics are shifting, with CEOs balancing the integration of new technologies like AI with efforts to foster an in-office working culture.