The UK Government is introducing a Carbon Border Adjustment Mechanism, or CBAM, to help address carbon leakage and support the UK’s net zero journey.

In March 2024, the previous Conservative Government launched a consultation on the introduction of a UK CBAM from 1 January 2027. The new Labour Government have stated that they are committed to its introduction, and we therefore expect the consultation process to continue to progress, with further details of the proposals being published over the coming months. On this page, you can find more information about the proposals; the risks and opportunities associated with the introduction of the CBAM regime; and the practical and commercial impact for businesses – in particular, for those operating in the affected market sectors of iron and steel, aluminium, fertilisers, cement, hydrogen, glass and ceramics.

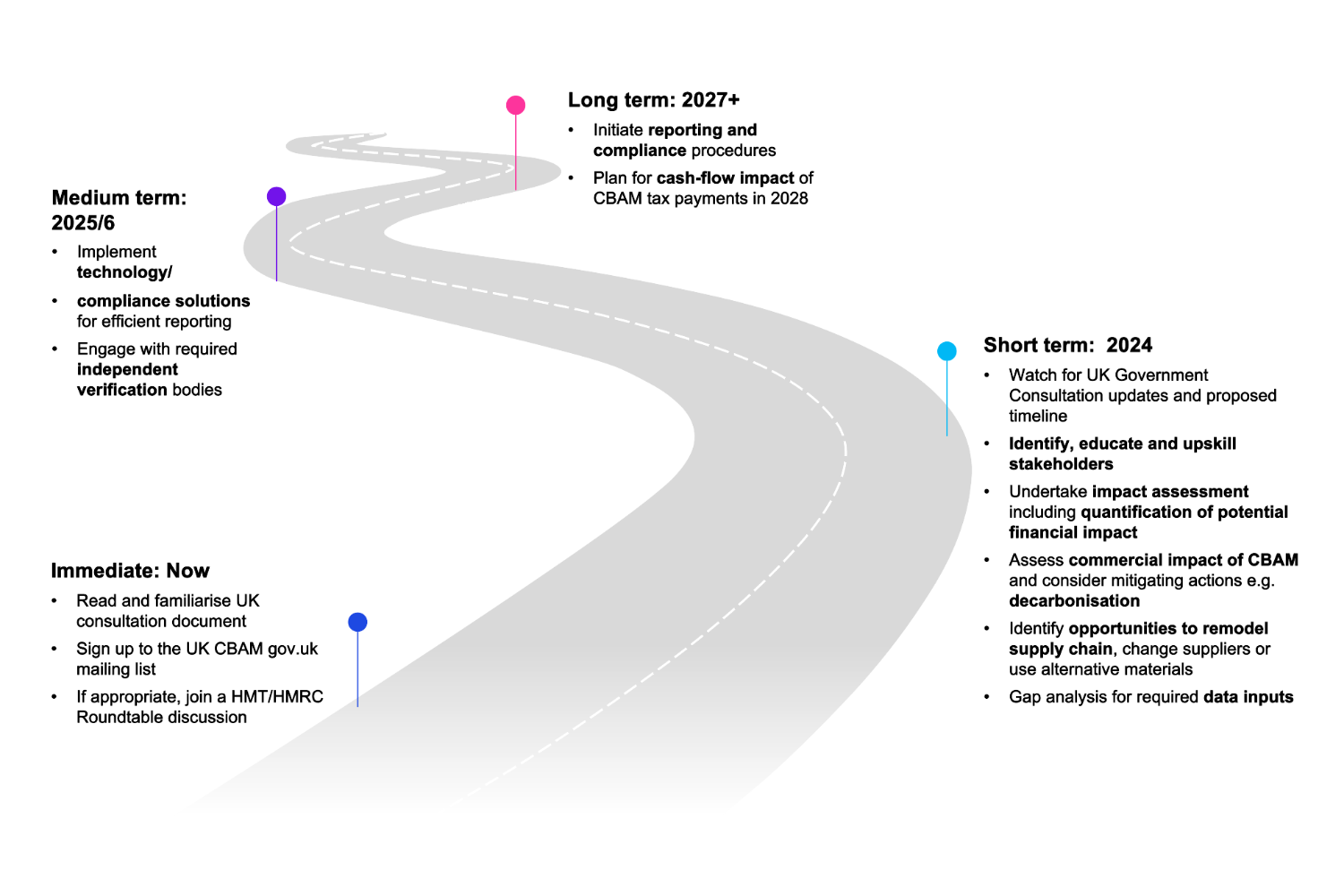

Prepare for the UK CBAM now

In this video, Sarah Beeraje explores the three steps tax leaders should consider now when preparing for the UK CBAM.

- Undertake an impact assessment based on the most recent import data set you have.

- Consider a governance review of your customs coding, and

- As the underlying policy intent of CBAM is to encourage decarbonisation, are there corresponding opportunities to make changes to your business model and supply chain?

UK CBAM consultation

The UK Government is consulting on the introduction of a UK CBAM, from January 2027. The most recent consultation document can be accessed here.

The consultation ran from 21 March until 13 June 2024, and the government is now analysing the responses received. At this stage, there is no information on the expected timing of next steps.

UK CBAM: The headlines

- Effective from 1 January 2027

- Immediate financial impact, no transitional period

- De minimis of £10,000 per rolling 12-month period

- Credit for verified carbon prices already paid

- Embedded emissions – two options:

a. actual emissions, independently verified (preferred) or

b. default values, published by UK Government

- Designed as a “tax”, to be administered by HMRC

- Quarterly reporting from 2028

- For 2027, one 12-month return and payment period

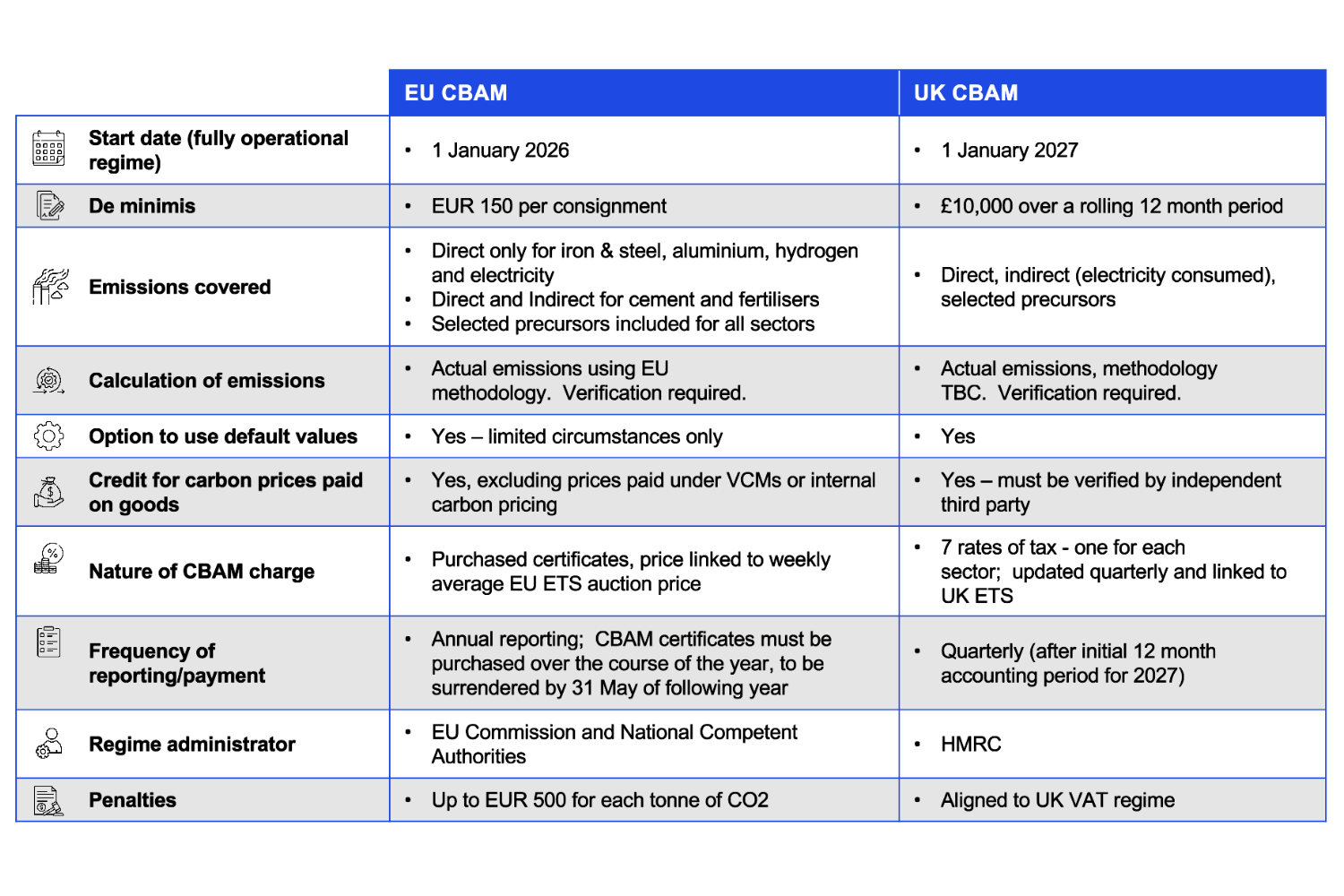

UK vs EU CBAM: A comparison

UK CBAM: What does it mean for business

Businesses should lay plans today, in order to mitigate the potential for CBAM to erode margin through supply chain costs.

The threat from CBAM really comes from unmanaged margin erosion within the supply chain. Businesses therefore need to get ahead of the incoming tide to minimise the impact. Key levers to mitigate those impacts include:

Steps to take now to prepare for UK CBAM

How can KPMG help?

Get in touch

For more information, or to discuss the potential impact of UK CBAM on your business, please get in touch:

We can also support you with EU CBAM – whether assessing the impact, support with compliance and filing, or restructuring your business to accelerate decarbonisation. We have an extensive EU Network of CBAM specialists who have hands on experience of supporting clients across multiple sectors.

Our sustainability insights

Something went wrong

Oops!! Something went wrong, please try again

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.