Taking stock: Performance in Q1

Optimism seeps back

The first quarter of the year was marked by what the Retail Think Tank (RTT) panel called “cautious optimism” in the retail sector.

As the cost-of-living squeeze began to ease slightly for some consumers, demand picked up throughout the first three months of the year – with an early Easter providing an additional boost in March.

Overall, a jump in food sales outweighed a fall in non-food, leaving year-on-year numbers slightly up.

Q1 was marked by cautious optimism. Increased food sales outweighed a fall in non-food, while Easter provided an additional boost.

That said, we might have expected a sharper uplift, given the backdrop of improving economic fundamentals in the UK – as James Sawley, head of retail and leisure at HSBC, pointed out.

“Economic conditions are recovering,” he said. “Retailers are hoping it’s enough for the tide to start turning, and for demand to return to levels that will bring the sector back to good health.”

Sadly, the upturn has come too late for some high-street stalwarts. Q1 saw The Body Shop and Ted Baker enter administration; and in April, Superdry proposed delisting from the London Stock Exchange as part of a restructuring plan.

Demand constraints persist

So why didn’t the forecast of a brighter economic climate lead to stronger demand in Q1? The panel identified a number of factors that continue to hold spending back.

Consumers extended themselves over the Christmas period, spending on the festivities despite financial conditions remaining tough for household incomes. As such, Q1 was affected by what James called a “Q4 hangover” – exacerbated by persistent wet weather keeping people away from the shops.

And while inflation and bills are declining, households’ outgoings are still far higher than they were before the inflationary shock.

As a result, consumers are waiting for interest rates to fall before opening their wallets too wide; and prioritising their financial health over discretionary spend. In March, a regular Consumer Pulse survey (commissioned by KPMG) found people four times more likely to save spare money than to spend it.*

Consumers are waiting for interest rates to fall, and thinking more about their financial resilience than discretionary spend.

“Economic conditions are recovering. Retailers are hoping it’s enough for the tide to start turning, and for demand to return to levels that will bring the sector back to good health.”

James Sawley, head of retail and leisure at HSBC

Looking forward: The prospects for Q2

Demand is on the up

The RTT panel explored the conflicting drivers likely to affect retail demand in Q2.

Wage inflation is falling more slowly than price inflation, leading to rising disposable incomes, said Charles Burton, Executive Director, Oxford Economics. Plus, April’s minimum-wage increase will ease some of the burden for those on the lowest incomes. All of which should leave household finances in a better place than they were a year ago.

However, restraint remains consumers’ watchword. People are reluctant to spend until interest rates fall, and inflation dips closer to the government’s 2% target. February figures (announced in April) revealed a smaller reduction in inflation than expected (from 3.4% to 3.2%). Ultimately, how quickly food prices come down will be crucial to consumers’ willingness to spend.

Household incomes are improving. But people are reluctant to spend until inflation falls further, and interest rates come down. How quickly food prices drop will be crucial to consumers’ willingness to spend.

It's also worth noting that there will be no Easter boost during Q2. An early Easter can dampen April retail sales by 5% or more.

All things considered, the panel anticipates a slight improvement in demand across the sector as a whole – with food sales up and non-food numbers largely unchanged. Big-ticket items look set to flatline until the end of the year.

As such, retailers may have to wait until Q3 for a real resurgence in demand. Come the summer, warmer weather, the Olympics, and the Euro 2024 football tournament should encourage consumers to spend (particularly on food).

Retailers may have to wait until Q3 for a real resurgence in demand – driven by warmer weather, the Olympics and Euro 2024.

Cost inflation lingers

Frustratingly for retailers, the benefits of recovering demand are at risk of being offset by stubborn cost inflation during Q3.

While inflation and energy costs should continue to come down, this will be cancelled out by a number of upward pressures. Top of the list being business rates, which increased by some 6.7% in April.

“The business rate rise is a real issue for retailers, as they can’t pass it on to their customers in the current climate,” warned Miya Knights, Publisher of Retail Technology. “For retailers still struggling with the impact of the cost-of-living crisis, an almost 7% spike could be the difference between survival and closure.”

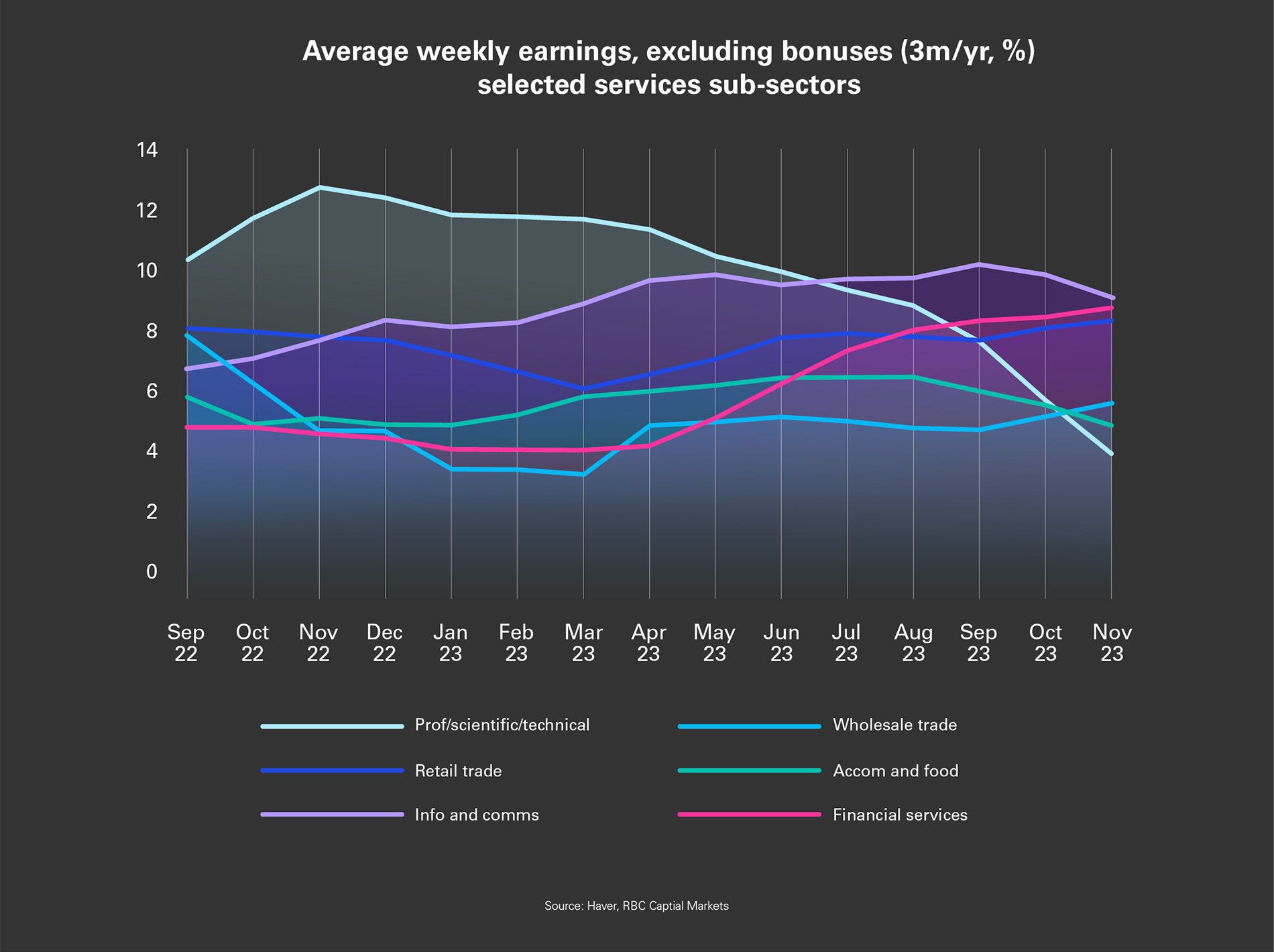

Miya also underlined the effects of wage inflation. On top of the minimum-wage increase, a continuing labour shortage is still driving salaries up in the sector – especially for information, communication and technical professionals.

A further inflationary factor is supply-chain disruption, according to Jonathan De Mello, founder and CEO of JDM Retail. Conflict in the Red Sea has led to retail stock arriving late and/or damaged, and to growing competition for freight capacity. Heightened demand from fast-growing online marketplaces in China has intensified this competitive dynamic.

Finally, security costs are on the rise, Linda noted. Retailers are increasingly having to invest in CCTV systems, facial recognition technology and security staff, to protect against rising theft levels and ensure the physical safety of their staff.

The benefits of improving demand are at risk of being offset by rising costs: higher business rates, wage inflation, supply-chain disruption and increased security investments.

“Retailers are revisiting cost reduction in light of a rising cost base,” said Mike Watkins, head of retailer and business insight at NeilsenIQ. “An uplift in demand is needed sooner rather than later, to keep the sector moving in the right direction.”

Mike warned that when price inflation settles, it may be at a higher rate than many in the industry expected. That could prompt more frequent pricing conversations – and potentially a battle over price points between producers and retailers.

The Retail Thing Tank’s quarterly performance tracker

Food

Non-Food

Q1 2024 overall performance

Flat

Q2 2024 – Demand

Improved

Flat

Q2 2024 – Costs

Increased

Increased

Q2 2024 overall performance

Improved

Getting ready for growth

Retailers face a nuanced landscape in 2024, with conflicting forces influencing their fortunes in the short to medium term. But overall, the RTT’s view was that they should now start preparing for better times.

“Inflation and interest rates will fall this quarter, and real incomes are rising,” Charles outlined. “We can expect people to start feeling more confident about spending. Now’s the time for retailers to get ready for that.”

We can expect people to start feeling more confident about spending. Retailers should start preparing for better times.

Inevitably, though, competition for any additional spending will be fierce – among retailers, and with other discretionary options, such as leisure. In Linda’s view, retailers must therefore focus ruthlessly on their margin and market share. Which product line, locations and customer segments will be key? That’s where they should target their investments and pricing strategies.

In such a competitive environment, a compelling proposition will be critical, as retail consultant Maureen Hinton pointed out.

For Maureen, that will mean investing in products, pricing, stores, channels, operations and technology. Linda also highlighted the importance of “tapping into consumers’ love of entertainment” – either directly through the retail experience, or by working with partners.

Where technology is concerned, Miya emphasised the need to identify how robotics, automation and AI can help retailers work better, smarter and faster.

But first, they must lay the groundwork for these technologies. That means getting the basics right in terms of being digitally enabled and data-driven: knowing who their customers are, what they’re selling and where their inventory is.

Retailers will need to think carefully about where all this investment will come from. Maureen advised.

Will they raise it through revenue growth, cost savings, borrowing, asset sales, or a combination of these sources? Or, as James suggested, must they also improve liquidity, inventory management and capital structures, to generate the financial resources needed to seize the opportunities on the horizon?

In the food space, portfolio optimisation will be critical, according to Mike. Food retailers should move towards making big stores smaller, and small stores bigger.

“Consumers are shopping more often, and buying less each time – driven by an interest in health and wellness, and in provenance and sustainability,” he explained. In his view, the sweet spot for food stores over the next five years will be around 10,000-15,000 sq. ft.

*KPMG survey of 3000 nationally representative UK consumers; March 2024.

Our consumer insights

Something went wrong

Oops!! Something went wrong, please try again

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.