The disruption caused by global economic concerns, ongoing geopolitical tensions and strict COVID-19 policies in China has prompted many businesses to prioritize relocating their supply chains. The Southeast Asia region is seen as an attractive destination to diversify supply chain risk in the long term due to geographic, regulatory, and economic advantages.

Thailand, as the second-largest economy in ASEAN after Indonesia, recorded a nominal GDP of USD 495.2 billion and 2.6% annual growth in 2022(1). It boasts a well-developed transport infrastructure, significant cross-border trade, and supportive governmental policies, which have led many companies, including MNCs to shift their supply chains, especially those in the electronics, chemicals, and automotive industries, to the country.

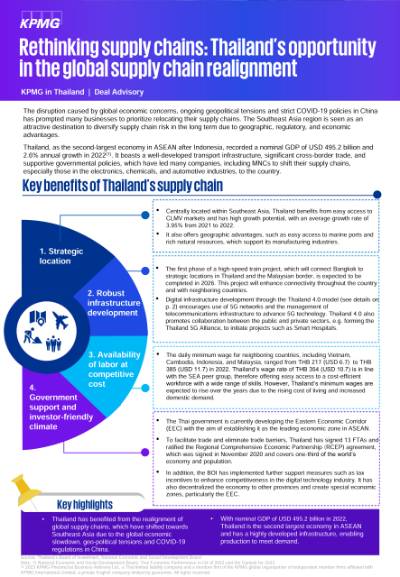

Key benefits of Thailand’s supply chain

- Centrally located within Southeast Asia, Thailand benefits from easy access to CLMV markets and has high growth potential, with an average growth rate of 3.95% from 2021 to 2022.

- It also offers geographic advantages, such as easy access to marine ports and rich natural resources, which support its manufacturing industries.

- The first phase of a high-speed train project, which will connect Bangkok to strategic locations in Thailand and the Malaysian border, is expected to be completed in 2026. This project will enhance connectivity throughout the country and with neighboring countries.

- Digital infrastructure development through the Thailand 4.0 model (see details on p. 2) encourages use of 5G networks and the management of telecommunications infrastructure to advance 5G technology. Thailand 4.0 also promotes collaboration between the public and private sectors, e.g. forming the Thailand 5G Alliance, to initiate projects such as Smart Hospitals.

- The daily minimum wage for neighboring countries, including Vietnam, Cambodia, Indonesia, and Malaysia, ranged from THB 217 (USD 6.7) to THB 385 (USD 11.7) in 2022. Thailand’s wage rate of THB 354 (USD 10.7) is in line with the SEA peer group, therefore offering easy access to a cost-efficient workforce with a wide range of skills. However, Thailand’s minimum wages are expected to rise over the years due to the rising cost of living and increased domestic demand.

- The Thai government is currently developing the Eastern Economic Corridor (EEC) with the aim of establishing it as the leading economic zone in ASEAN.

- To facilitate trade and eliminate trade barriers, Thailand has signed 13 FTAs and ratified the Regional Comprehensive Economic Partnership (RCEP) agreement, which was signed in November 2020 and covers one-third of the world’s economy and population.

- In addition, the BOI has implemented further support measures such as tax incentives to enhance competitiveness in the digital technology industry. It has also decentralized the economy to other provinces and create special economic zones, particularly the EEC.

Key highlights

- Thailand has benefited from the realignment of global supply chains, which have shifted towards Southeast Asia due to the global economic slowdown, geo-political tensions and COVID-19 regulations in China.

- With nominal GDP of USD 495.2 billion in 2022, Thailand is the second largest economy in ASEAN and has a highly developed infrastructure, enabling production to meet demand.

Source: Thailand’s Board of Investment, National Economic and Social Development Board

Note: 1) National Economic and Social Development Board, Thai Economic Performance in Q4 of 2022 and the Outlook for 2023

Key sectors in Thailand’s supply chain

Automotive

- Thailand is the 5th largest parts manufacturer for Internal Combustion Engine (ICE) vehicles in Asia and the 11th largest in the world.

- The Electric Vehicles (EVs) are seeing increased awareness as well as investment in Thailand as a part of New S-Curve development and the nation has a goal to become the EV hub for ASEAN by 2025.

- The Thai government has laid out plans to strengthen the country’s EVs manufacturing capability with the establishment of the National Electric Vehicle Policy Committee (NEVPC). Production goals have been set to 1 million EVs by 2025, 50% of total production by 2030, and 18 million EVs by 2035.

- The private sector is also investing in the EV infrastructure, with a goal of increasing the number of EV fast charging stations nationwide to 12,000 by 2030.

Food & Beverages

- Supported by rich natural resources and a skilled workforce, Thailand is popularly known as the “kitchen of the world” because it is among the world’s largest exporters of food and beverages.

- The Thai government has prioritized smart farming to revolutionize the agricultural sector by implementing the Young Smart Farmer program, which equips participants with advanced technologies such as Internet of Things (IoT) and precision farming.

- To accelerate the development of the food and beverage industry, the public and private sectors are also collaborating to develop Pathum Thani as a “food valley”, that is, an ecosystem for the food industry facilitating knowledge sharing and R&D, and centralizing an entire value chain.

Electrical & Electronics

- Electronics products accounted for approximately USD 42 billion of Thailand's exports in 2022, representing approximately 14% of Thailand’s total export value.

- In 2010, Thailand’s main electronics exports were computer components and integrated circuits (IC). However, to support Thailand 4.0 policies (see details below), the industry is being pushed to adopt 5G technology.

- The Thai government has set a goal of expanding 5G networks to cover 98% of the population by 2027.

- The government is also pushing the electronics manufacturing industry to develop smart appliances, microelectronics, IoT, and embedded systems as a part of New S-Curve development.

Future developments in Thailand

Thailand 4.0

The Thai government is promoting Thailand 4.0, an economic model that aims to create a value-based economy driven by innovation, technology, and creativity. This is viewed as a key strategy to accelerate the Thai manufacturing industry by shifting from traditional to smart manufacturing supply chains through increased automation and digitalization with a greater focus on knowledge workers and highly skilled labor.

Source: National Science and Technology Development Agency

New S-Curve industries in Thailand

Download PDF

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia