Discover the latest insights into consumer retail trends and the dynamic landscape of retail M&A as we dive into a broad market analysis for 2025. With the retail industry facing significant challenges, our analysis reveals that major shifts in valuations, due diligence, and post-merger integration are on the horizon.

Having navigated the complexities of post-covid supply chain shocks and input inflation which required significant pricing action, Consumer and Retail (C&R) CEOs are back to focusing on delivering much-needed volume growth.

Yet, for many sub-sectors, volume growth will come second to volume preservation. Facing pressure on consumer spend from declines in disposable incomes, shifts towards unbranded products and waning product loyalty, many consumer goods companies are struggling to arrest declining volumes.

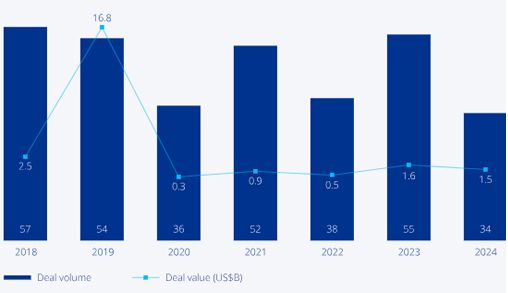

Looking ahead, we expect 2025 to be characterized by a more ruthless review of dilutive and non-core businesses as organizations focus on their core. However, activity will vary by region and by sector. Alongside strategic divestments, expect to see significant bolt-on activity as organizations look for lower-risk, above-average growth opportunities.

This report provides valuable insights to help dealmakers act with confidence in what we expect to be a more active year for M&A ahead.

Download the full report to read our round up of 2024 and our predictions for 2025.

Here are five key trends that should drive dealmaking in 2025.

- Core is the deal

C&R companies will look at evaluating their portfolios and divesting non-core assets, product lines and subsidiaries that do not align with their long-term strategic objectives. - Change in leadership

2024 saw leadership changes at many large players in the C&R space and our analysis suggests these new leaders are particularly keen on bolt-on acquisitions. - Bolt-on acquisitions

Anticipating continued economic uncertainty and where risk appetite is limited, expect to see an uptick in bolt-on acquisitions. - Activist pressure

Expect more activist investor attention on the C&R sector in 2025 as activists look at other players with unaddressed value creation opportunities. - Emerging direct investors

With new direct investors such as Sovereign Wealth Funds moving more aggressively into deal markets, expect greater competition for deals

While all these factors point to a more active M&A environment in 2025, the big wild card is uncertainty surrounding the impact of geopolitics and ESG policies on the C&R sector.

Sector outlooks

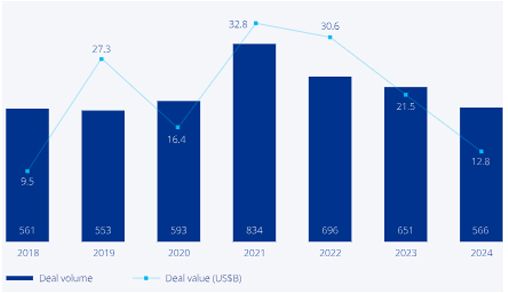

Food and beverage

Anticipate a flurry of new deals to come to market as C&R players refocus on the core and divest of non-core categories and geographies. Some of this activity will be to achieve cost optimization and shore up margins. But many will also be trying to adjust their footprints to reflect new international trade dynamics, unlock market access and reduce their geopolitical risk.

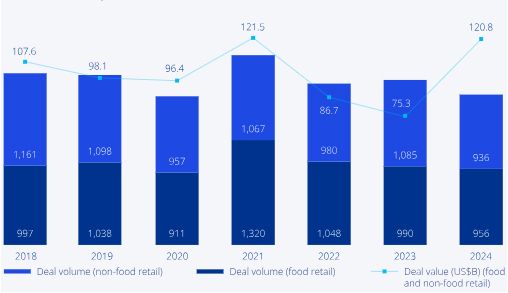

Retail

Despite lower deal volumes in 2024, 2025 should bring a further wave of strategic acquisitions as companies and investors look to enhance their digital and omnichannel capabilities (primarily focused on integrating AI and improving e-commerce offerings) and drive seamless integration between online and physical store experiences, especially in the non-food retail sector.

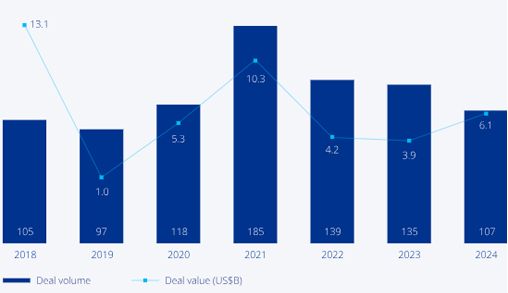

Home and personal care

Compared to other C&R sectors, dealmaking in the home and personal care segment may remain slow in the first half of 2025 as investors and PE managers focus on higher growth sub sectors. But expect 2025 to be a turnaround year, characterized by measurable growth in both deal volumes and values.

Pet care

Despite many consumers having lower disposable income, spending on pets increased among high-income households. The trend towards the humanization of animals leads to a greater desire to provide them with high-quality, nutritious foods. Expect to see growth in demand and in deal activity for assets offering fresh, frozen and freeze-dried premium products to high-end customer segments.

Luxury goods

Ultimately, the deal outlook for the luxury goods segment is largely dependent on the macroeconomic environment. Few sectors are as exposed to economic disruption as luxury goods. The prospect of trade wars (which often hit luxury goods first), increased geopolitical tension and slow economic growth in 2025 will likely keep investors cautious.

Moving forward with confidence

Given the rapid pace of change, both within the sector and across the global economy, understanding the trends will be key to unlocking value, driving growth and enabling transformation for dealmakers. We hope this report provides valuable insights to help dealmakers act with confidence in what we expect to be a more active year for M&A ahead.

Given the rapid pace of change, both within the sector and across the global economy, understanding the trends will be key to unlocking value, driving growth and enabling transformation for dealmakers. We hope this report provides valuable insights to help dealmakers act with confidence in what we expect to be a more active year for M&A ahead.

Why work with KPMG in Thailand

KPMG in Thailand, with more than 2,500 professionals offering Audit and Assurance, Legal, Tax, and Advisory services, is a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.