Over a year on from the initial outbreak of COVID-19 and declaration of a global pandemic, the economic effects are still being felt across the globe. In Thailand, whilst there are positive signs of recovery in exports, the continued absence of international tourists and outbreak of a 3rd wave of COVID-19 is still weighing heavily on many domestic businesses.

The economic packages provided by the Thai government and continued support from commercial banks has meant that many businesses have been able to continue to operate.

However, with many of the support measures now finished and the need for fresh working capital for businesses to ramp up activity to previous levels we are seeing a liquidity crunch for many. This has led to an increase in the number of rehabilitation applications, with a total of 16 in 2020 compared to seven in 2019, nine in 2018, and already nine in 2021 to date.

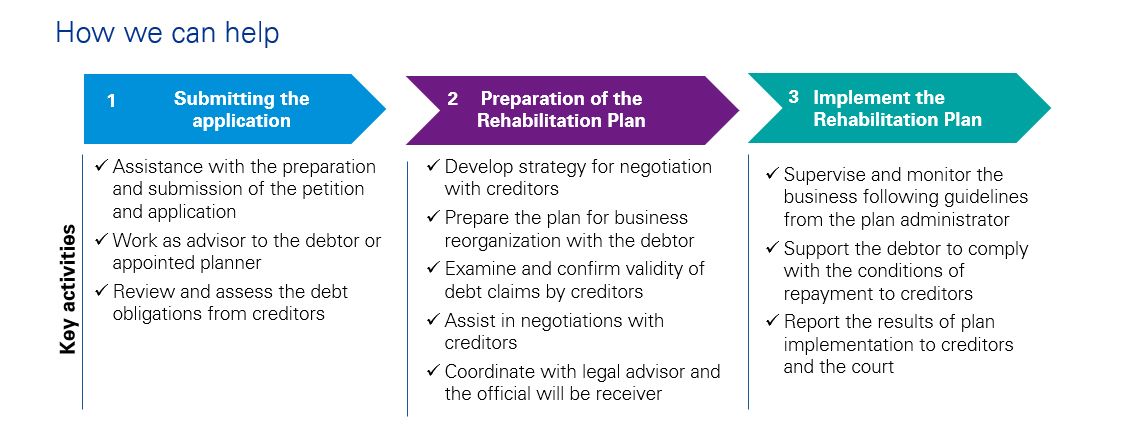

Whilst the formal court rehabilitation process is not the only option for companies in distress, it is likely to be a route more businesses consider in the months ahead. We outline below a high-level introduction to the process and key considerations.

What is business rehabilitation?

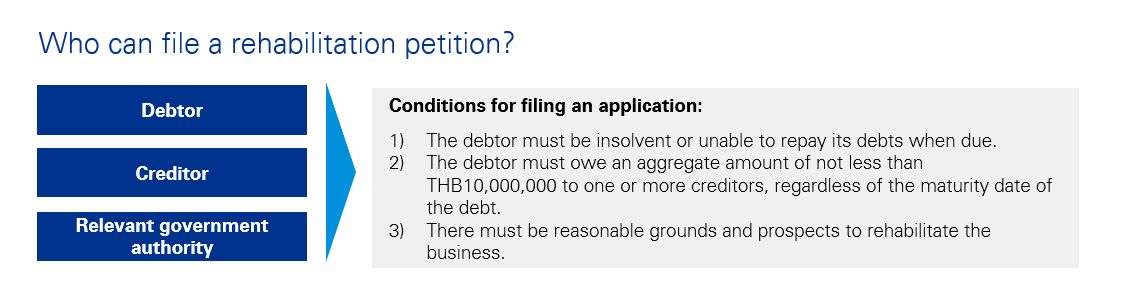

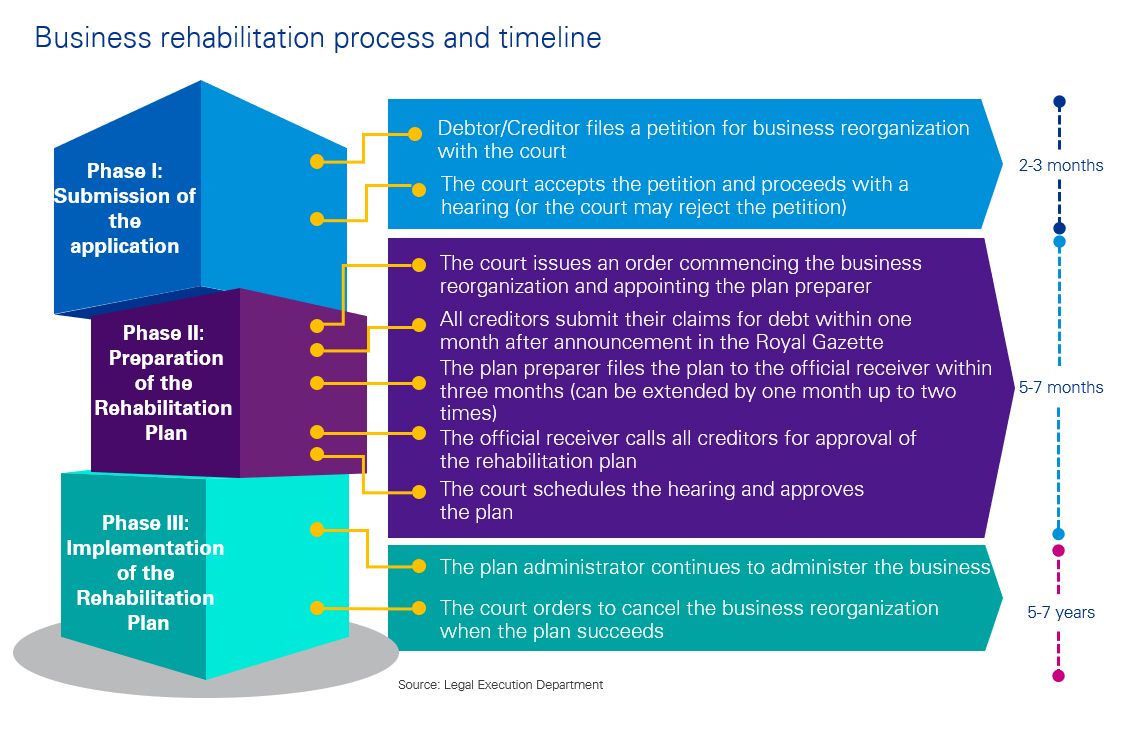

Business rehabilitation is a court administered process for companies that are unable to repay their debts and need to restructure these financial obligations in order to continue to operate. Under the Thai Bankruptcy Act B.E. 2542, the debtor can continue to operate under an approved plan, which seeks to provide a better return to creditors than liquidation of the business and assets.

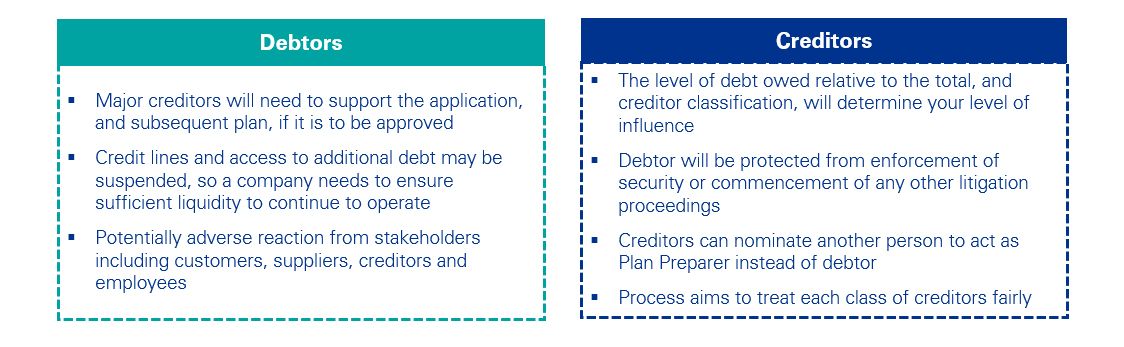

Key considerations for debtors and creditors

The decision to proceed with a business rehabilitation application should not be taken lightly and should be undertaken after careful assessment of the risks and benefits and, in many cases, after consultation with key creditors who will need to support the application. Advice should be sought from experienced legal and financial advisors who can provide an independent view of the best option available to you.

Reasons for taking this option vary. Taking recent high-profile cases as an example, Thai Airways is a complex case with multiple domestic and international creditors and a need to fundamentally restructure the business operations. The business rehabilitation process has provided structure, and time, to the business to form a plan and communicate with all creditors.

Whilst this is an extreme example, the presence of multiple creditors that need to be renegotiated with for the business to survive is the most common factor for a business to apply for rehabilitation.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia