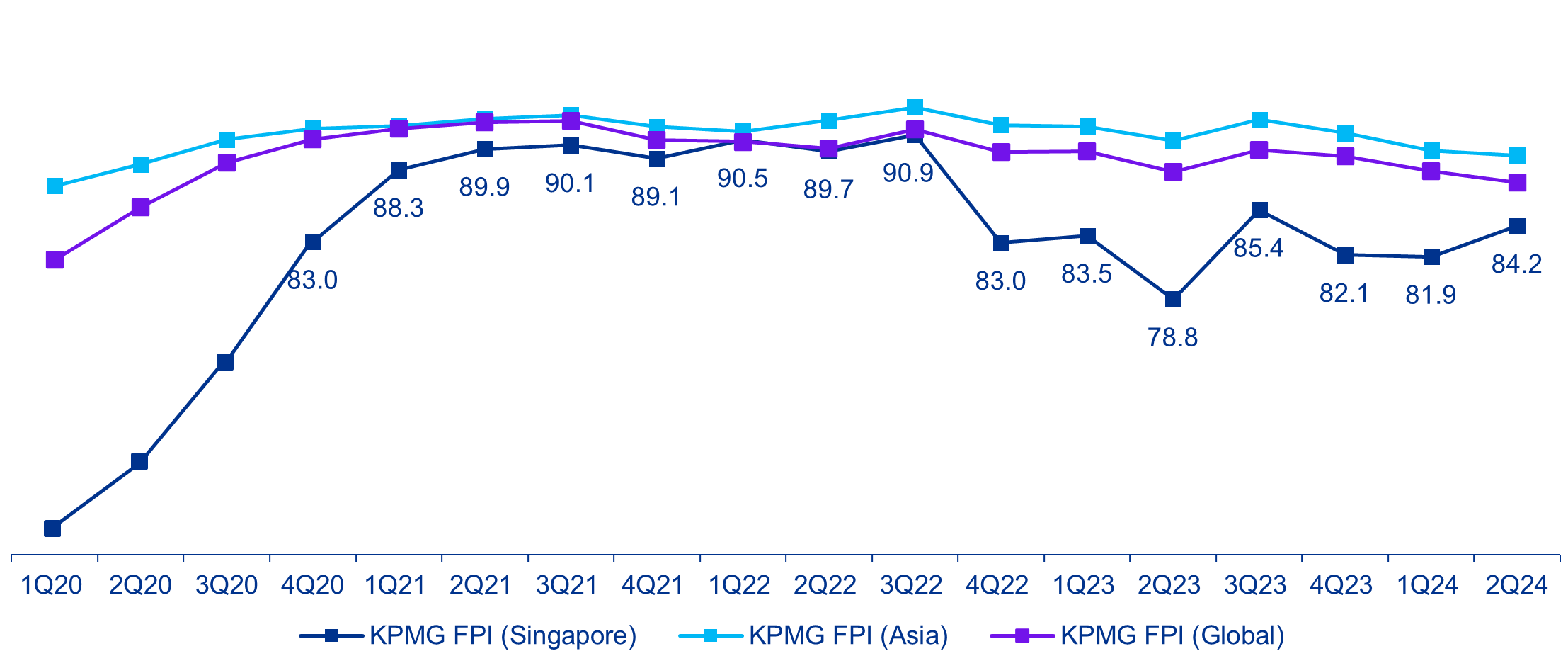

We are pleased to share with you the second edition of our quarterly KPMG Financial Performance Index (FPI) publication. This publication provides insights into the changing state of corporate health across all companies listed and headquarter in Singapore across all sectors, following the end of the reporting season for the three months to June 2024. KPMG FPI data is refreshed on a quarterly basis. For more information, visit the KPMG FPI page.

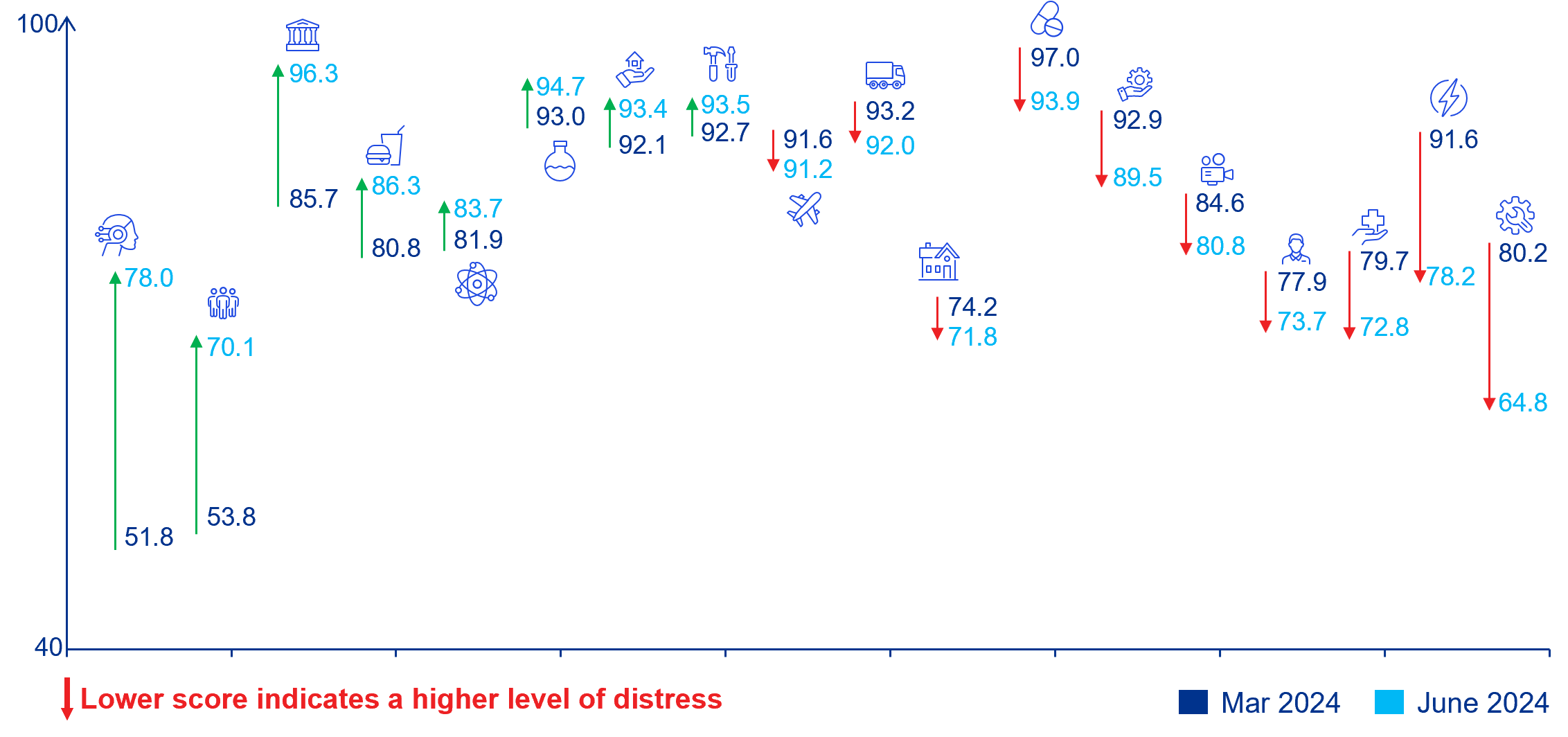

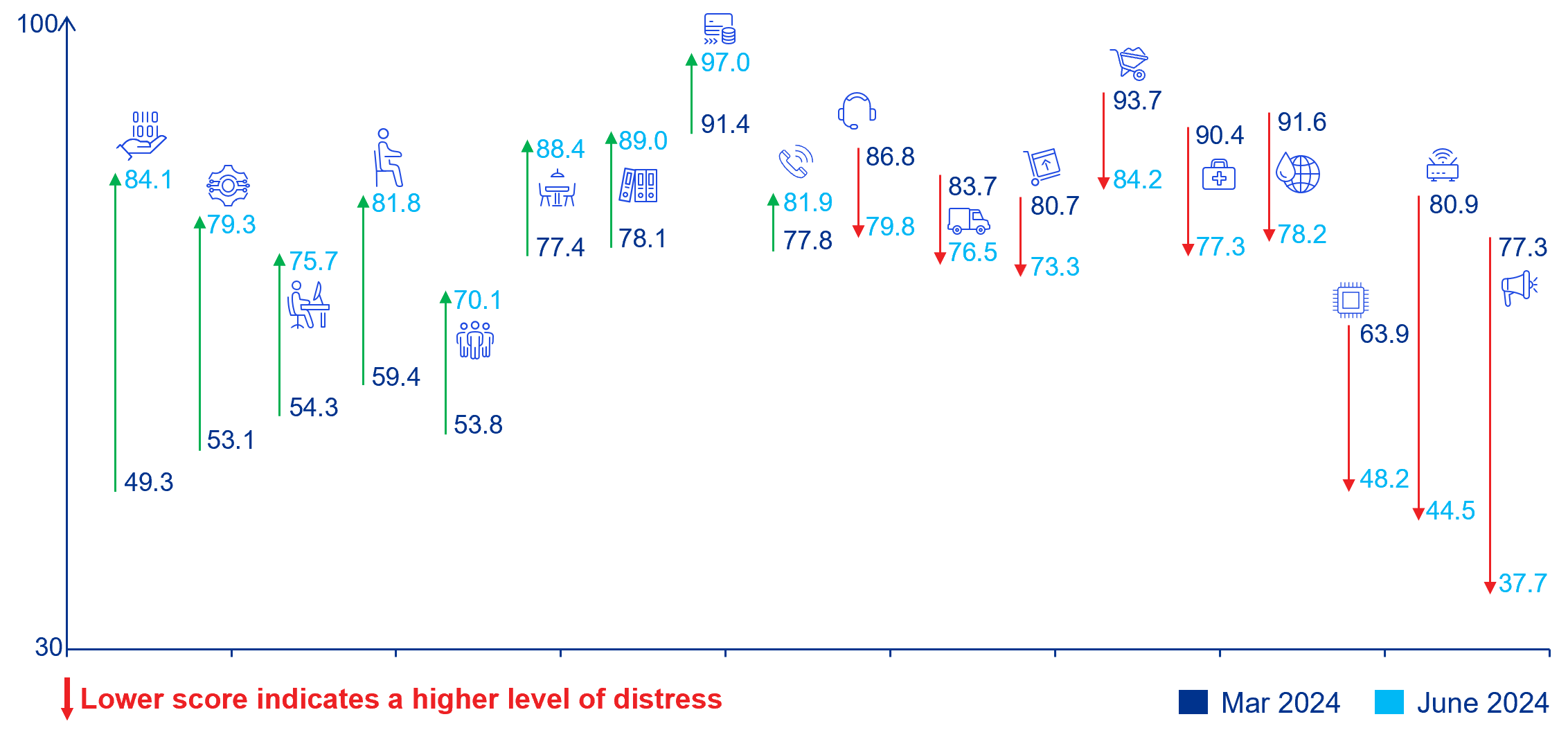

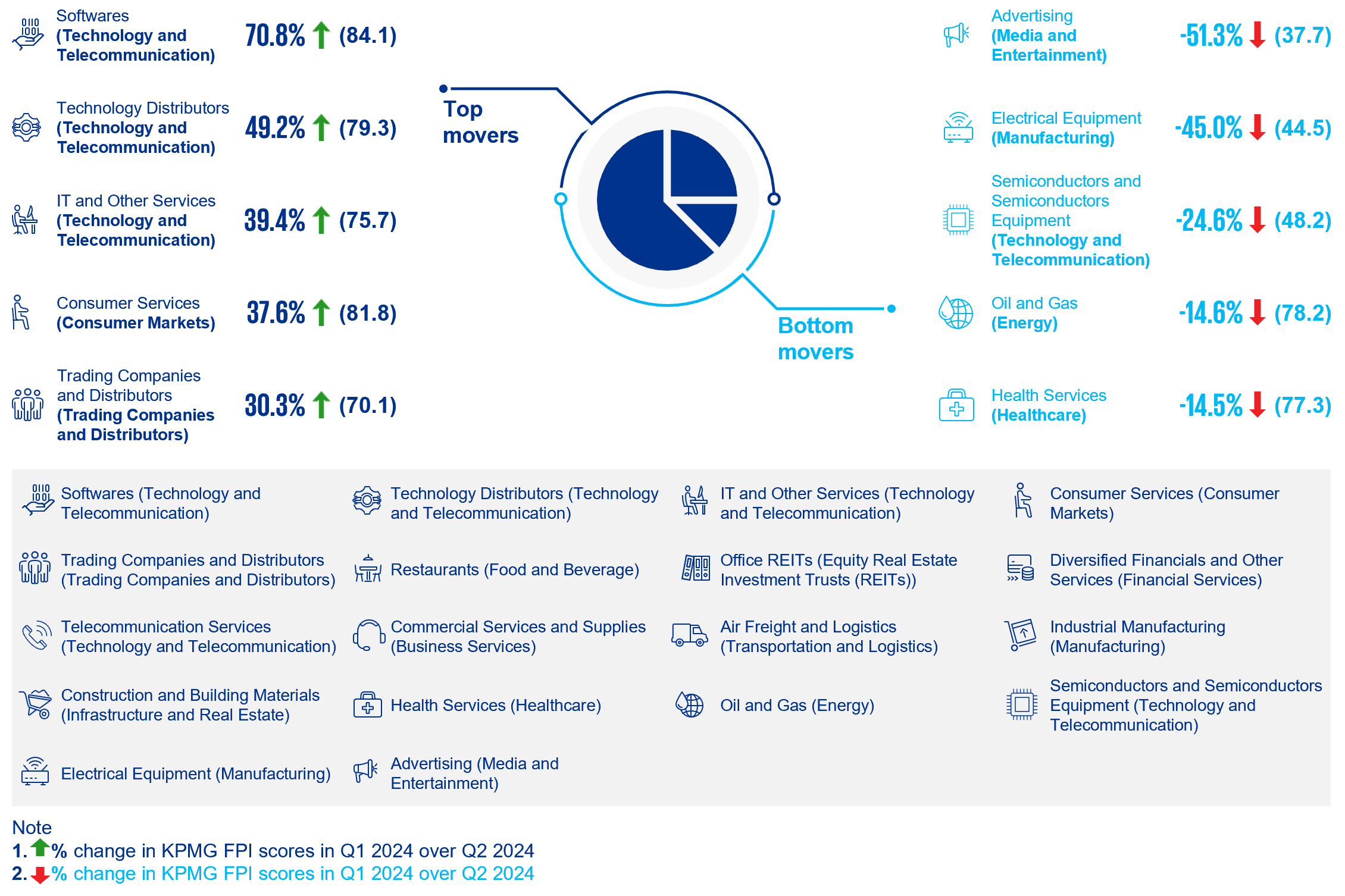

From March to June 2024, Singapore’s financial corporate health showed a slight improvement with FPI scores rising from 81.9 to 84.1. Out of the 18 sectors assessed, notable gains were seen in Technology and Telecommunication (51.8 to 78.0), Trading Companies & Distributors (53.8 to 70.1), and Financial Services (85.7 to 96.3) by the end of June 2024. Conversely, the Manufacturing (80.2 to 64.8) and Energy (91.6 to 78.2) sectors declined.