The Rulebook on changes and amendments of the Rulebook on the Form of tax returns for determination of personal income tax, paid based on tax assessment (hereinafter: the Rulebook) has been published on 15 March 2016. The Rulebook came into force on 16 March 2016.

The Rulebook prescribes that annual tax return (Form PPDG-2R) can be submitted:

- in electronic form or

- in hardcopy.

Electronic submission

The annual tax return can be submitted in electronic form by using the online electronic service of the Tax Authorities. Please note that in order to file the annual tax return qualified electronic certificate is required in order to access the online electronic service of the Tax Authorities „E-Porezi“ or authorize another person via the PEP form to perform this.

Hardcopy submission

The annual tax return can be submitted in hard copy directly to the Tax Authorities or by postal service. The tax return must be submitted to the organizational unit of the competent Tax Authorities based on the place ofresidence of the taxpayer. The hardcopy of the annual tax return can be submitted by the taxpayer personally or by individual who is authorized to submit the tax return and perform other operations that are related to the process of submission.

Reminder with deadlines and tax brackets

The deadline for submission of annual income tax returns for income generated in 2015 is 16 May 2016.

Individuals whose total net income in 2015 exceeded

RSD 2,201,220 are obliged to file annual tax return.

Tax residents of Serbia declare worldwide income, while tax non-residents of Serbia declare income generated on the territory of Serbia.

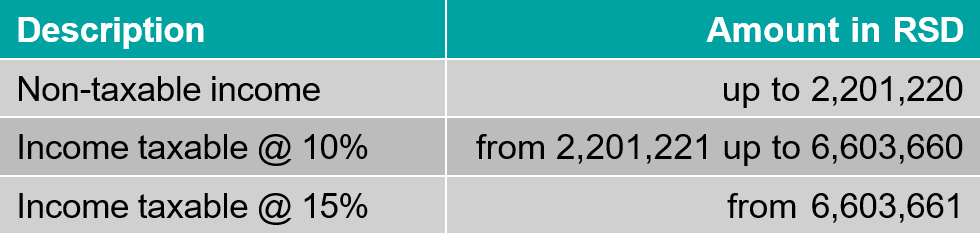

Tax brackets are presented below:

Taxable income is reduced for the prescribed personal deductions:

- for the taxpayer: RSD 293,496

- for each dependent family member: RSD 110,061

Total amount of personal deductions may not exceed 50% of the amount of taxable income.

Submission of Annual Personal Income Tax Return for 2015 possible in hardcopy

Download and save the PDF version of this Tax Alert

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Tax Alerts

Our regular newsletter provides you with updates on the latest changes of tax and accounting regulations as soon as a new rule is being approved.