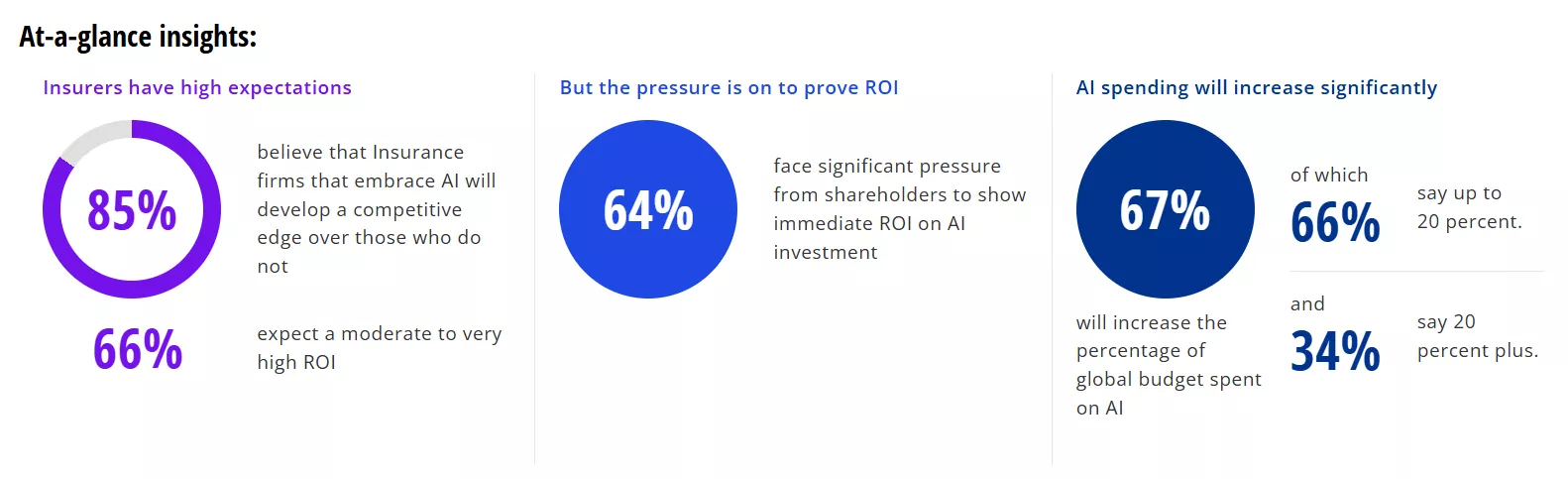

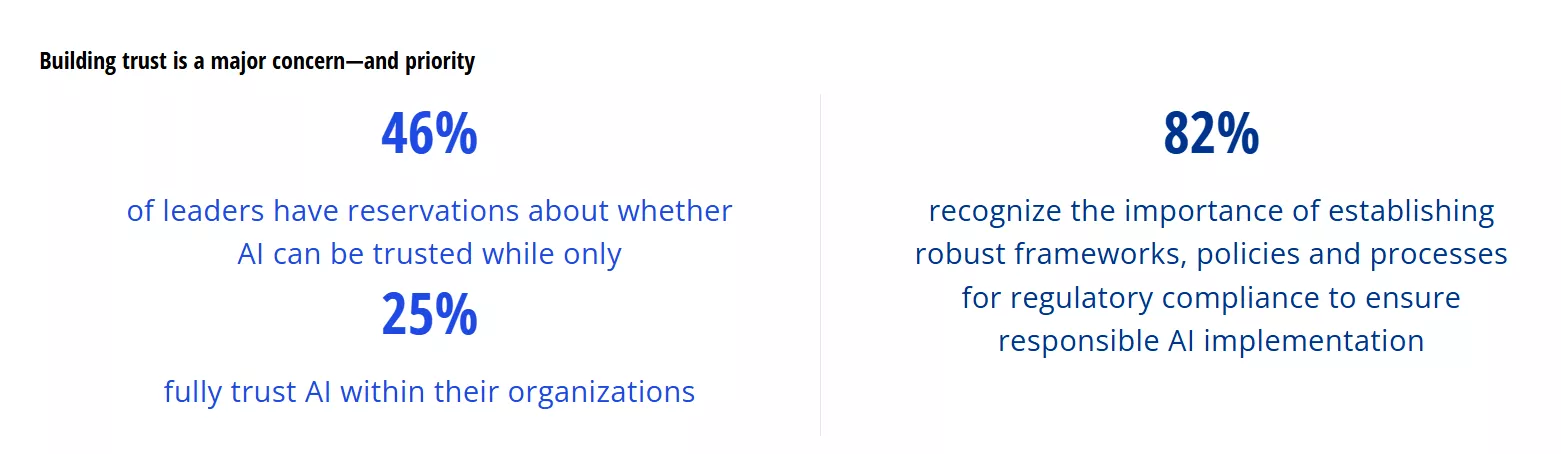

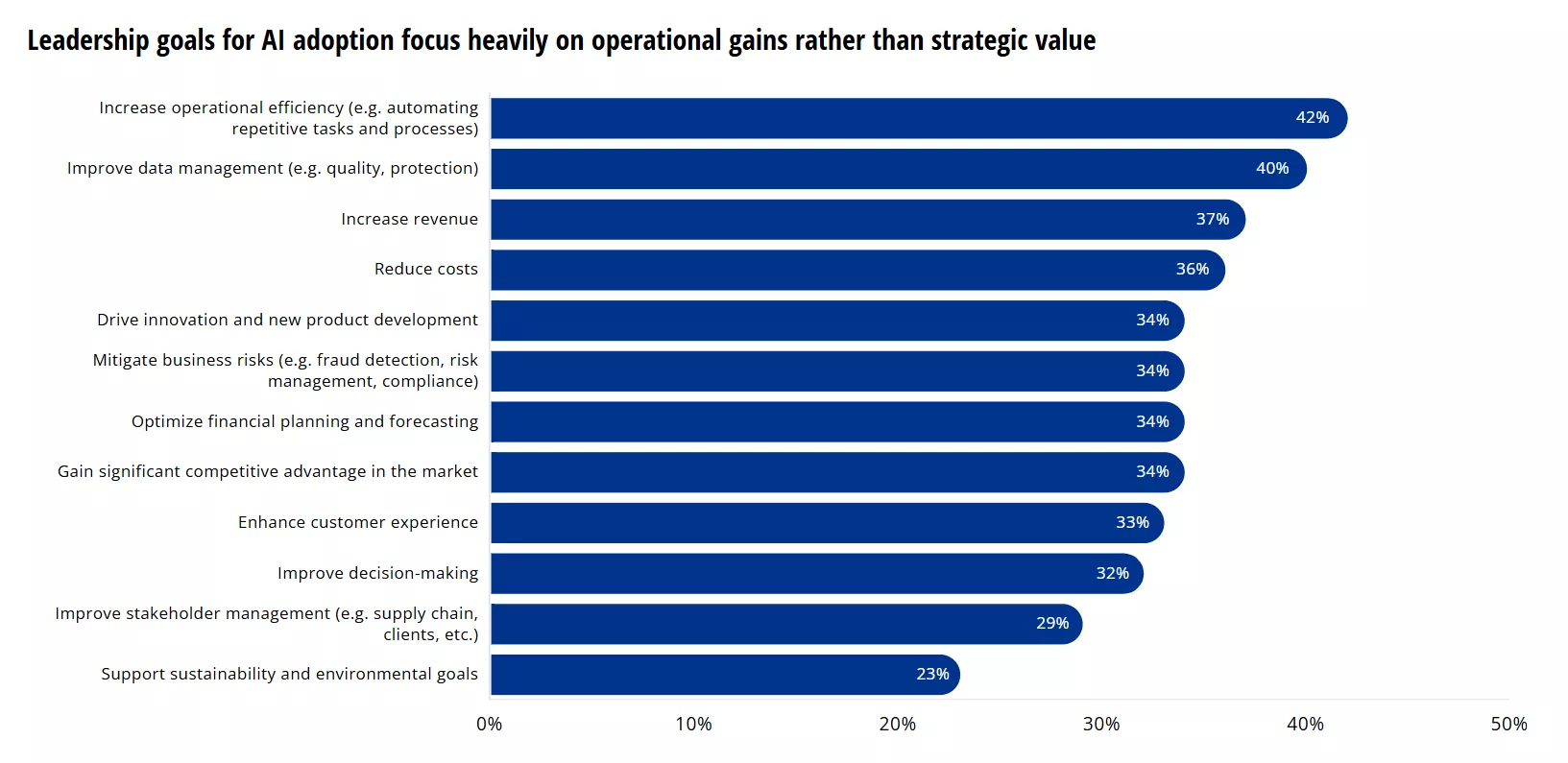

KPMG conducted an extensive research program, interviewing executive leaders across eight key global markets to understand the impact of AI on the insurance industry. The emergence of generative AI, along with the next wave of autonomous and agentic AI systems, is unlocking entirely new possibilities for innovation across the sector. Our research provides a detailed blueprint for insurance organizations to harness AI’s potential value.

How to realize value from your AI transformation journey

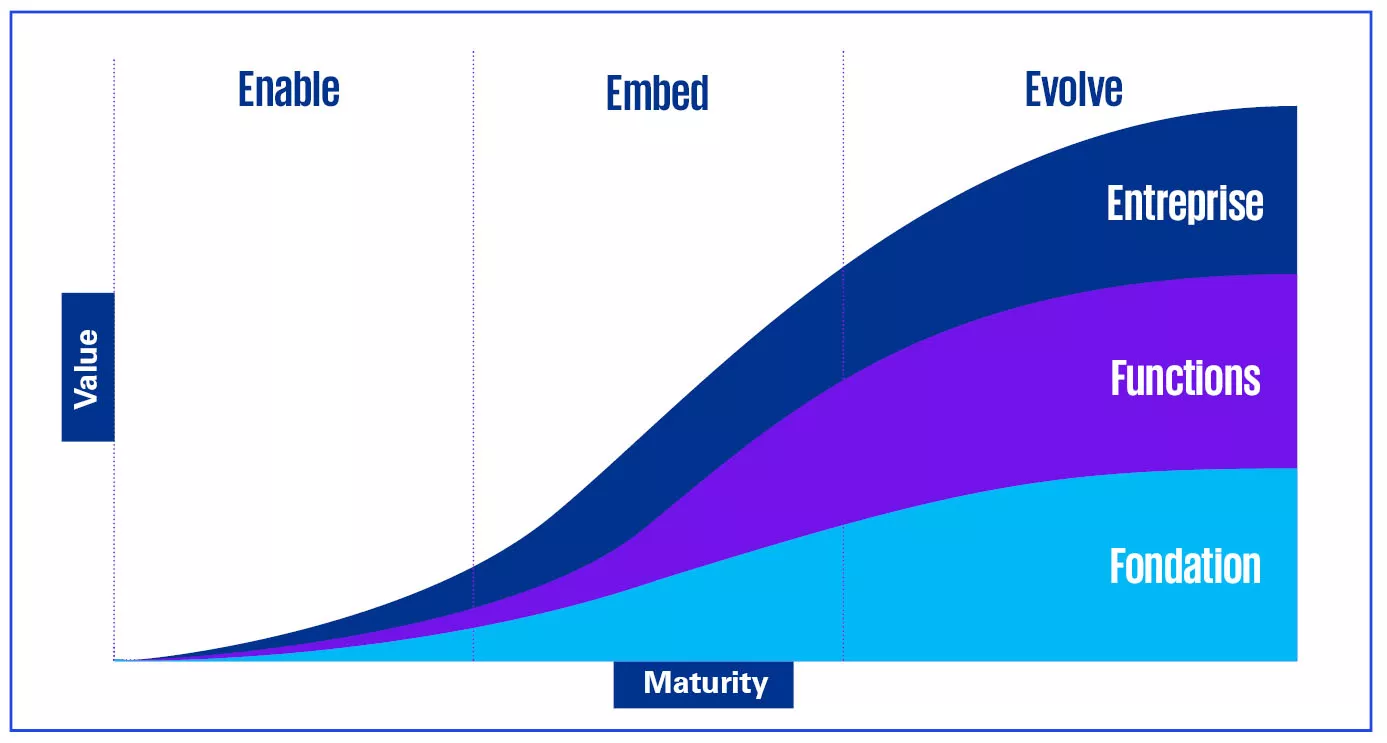

To address these challenges, KPMG introduces the three phases of AI value — a framework designed to guide insurers through the AI adoption journey. This phased approach provides a structured roadmap, helping insurers prioritize investments, align initiatives with business goals, and position themselves effectively in the age of AI in insurance. Click on each of the phases below to find out more.

Enable

The Enable phase focuses on enabling people and building AI foundations. Organizations appoint a responsible executive, create an AI strategy, identify high-value use cases, boost AI literacy, align with regulations and establish ethical guardrails. AI pilots are launched across functions, while cloud platforms and pre-trained models are leveraged with minimal customization.

Embed

The Embed phase integrates AI into workflows, products, services, value streams, robotics, and wearables, delivering greater value. A senior leader drives enterprise-wide workforce redesign, re-skilling and change, embedding AI into operating models with a focus on ethics, trust and security. AI agents and diverse models are deployed, supported by cloud and legacy tech modernization, while enterprise-wide data enhances operations.

Evolve

The Evolve phase evolves business models and ecosystems, using AI and frontier technologies like quantum computing and blockchain to solve large sector-wide challenges. AI orchestrates seamless value across enterprises and partners. Emphasizing ethics and trust with real-time security, this phase uplifts human potential with broad and deep workforce training, fostering a creative, innovative and value-driven future.

We help clients harness the power and potential of AI. From strategy to implementation. Small steps to solve seemingly unsolvable problems. Based on trust. Learn more by contacting us below. It's possible with AI. It's possible with KPMG.