Where we are now

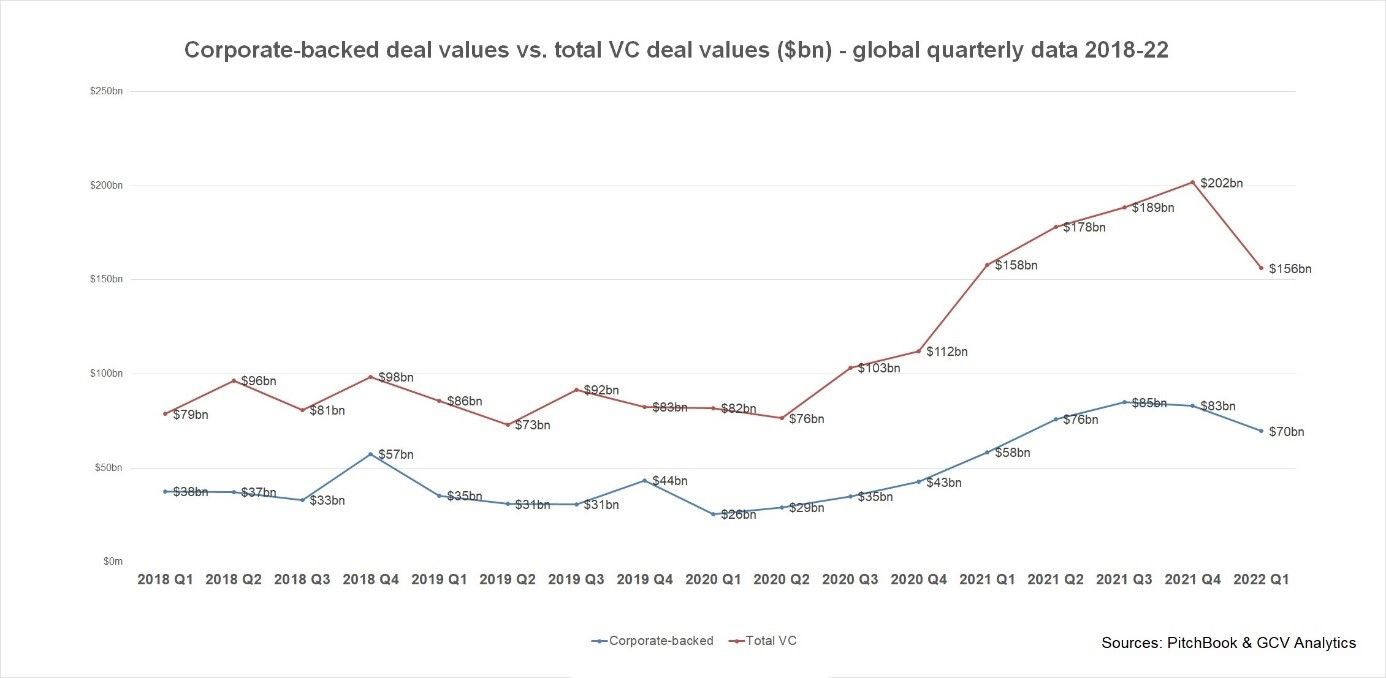

Undeniably, macro-economic indicators and geopolitical turmoil cause very significant concern for the near-term. Where does that leave you, as a corporate venture capitalist? Our investment management specialists teamed up with our product management colleagues and our commercial excellence experts, to give you a brief 360 degree view of what we’re seeing. First, we note that in previous downturns CVC has pulled back more strongly than traditional venture capital firms At the same time, a significant number of extraordinary companies actually had their inception in economic troughs like the dot-com crisis and the global financial crisis (Airbnb, Github, Okta, Square, Twilio, Uber, and others). Lower competition and a heightened awareness to be even more scrappy have undoubtedly been factors in this. Ultimately, survival of the corporate (parent) organization is naturally the company’s most primary objective. But if times are not so dire that this alone is hard enough, corporate decision makers should take into account the costs of rebuilding a CVC capability before significantly scaling it down. The latest industry data from Global Corporate Venturing shows that at present the traditional VC firms have retreated relatively more than corporate venture capital.

Crunchbase, an industry resource, notes that thus far valuations have not come down yet for series A through C during the second quarter of 2022. Should deal size go down rather than deal activity though, lower valuations would favor strategic investors such as CVCs over financial investors like traditional VCs. As governments have regularly intervened in financial & other markets the past two decades, it can also be beneficial to take national discrepancies into account. For example, the Netherlands has long seen relatively little capital being deployed through ticket sizes at the outer-range limits on both sides of the funding landscape. With social and/or political pressure building to strengthen certain sectors locally, this might mean the winds in certain ecosystems could change.

Corporate alignment is key

The nature of CVC is oftentimes not necessarily 100% the same as that of the corporate’s going concern. This is ok, if we remember that in volatile times extra alignment, and potentially refinements on the investment strategy, will play a greater role to ensure continuity. The attractiveness of using of non-monetary resources from general business lines for joint purposes with the CVC unit may change in periods like these. Crafting a plan together on how to handle this in the most effective way will prove its worth, especially since CVC value creation can depend on managing investments as well as on operations that may involve the corporate parent (e.g. joint sales efforts). Should assistance or simply a reflective discussion on this be of potential interest to you, we are happy to share our experiences.

Refine & sharpen strategic objectives

Cut down to the essentials. If the corporate parent continues to show strong support for Horizon 3 long term plays, that’s great. If the overarching objectives increasingly turn to quarterly results though, then activities on the ‘further out’ side of the portfolio should not take the shape of a cost center. At the very least not one for which there is no communicated and agreed upon solution planned. An emphasis on those portfolio companies whose products and/or services have the potential to yield relatively short-term results for the parent company may be preferable. In that case, operational assistance with a very pragmatic execution oriented plan is favorable over traditional investment management analyses. Clarity towards the start-ups and/or scale-ups, as well as joint operational roadmaps where applicable, will help everyone in their focus and resource allocations. Needless to say, technology and temporary outside assistance can help you manage these challenges efficiently. Importantly, most of what is described here likely also holds true for other venture investors. Taking inventory of their considerations, either through a third party or direct, may yield unconventional opportunities for success. Finally, we emphasize the reputational aspect of your business. Sharpening your CVC position will not bring favorable outcomes to all, but leaving radically different market circumstances unchecked will cause more harm and prevent you from seizing the opportunities that do arise in times of change.

Like you, we cannot predict the exact scenario that will unfold. What is certain though, is that now is the time for revisiting earlier plans. Laying out the opportunities and threats of today’s new reality will help you to most effectively weather this storm. We are here to help and would look forward to an insights-sharing conversation.