Artificial intelligence is transforming the world of finance. It is no longer seen as hype, but is a priority today for auditors and organizations.

Just as with other business processes, artificial intelligence is transforming corporate finance. In the past, financial activities have stereotypically been seen as time-consuming and monotonous exercises, requiring statistical sampling methods and manual checking of financial data. But AI is dramatically changing that.

How far will this transformation go? What does this transformation mean for the role of the auditor? And what steps should you take as an organization to be ready for this transformation?

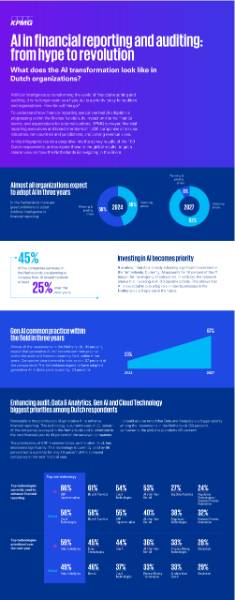

Previous research from April 2024 already did shed light on these important questions. Last September 2024 further research was carried out to see what had changed.

Key findings

Transforming finance through AI

AI is spreading from the accounting group — which includes financial reporting — into other functions within finance. Seventy-one percent of companies are now using AI in finance, and 42% of them are using AI to a moderate or large degree. Seventy-eight percent companies are piloting or using AI for accounting and financial planning. Overall, most companies report that the ROI on using these technologies is meeting or exceeding expectations — an outcome that will propel AI usage across industries in the future.

How AI leaders drive ROI

Nearly three times as many AI leaders as others use AI in finance. This wide gap is present in every finance area. On average, AI leaders have six use cases for AI while other have three to four. Leaders lay the groundwork for AI in finance by investing nearly twice as much as others in enterprise-wide AI activities as a proportion of IT budgets (13% of their budget vs. 7% for others)

Overcoming barriers

Given the sensitivity of financial data, the top barriers to AI adoption are potential data security and privacy vulnerabilities created by using AI. All financial executives see many of the same barriers and concerns when drawing on AI — but leaders take more measures, and in greater numbers, to overcome them. For example, nearly three-quarters of leaders have developed principles and guidelines on the responsible use of AI. By doing so, AI leaders provide the guardrails that allow their organizations to safely innovate and learn.

Key recommendations to transform with AI

Companies should follow the example of AI leaders in our study by implementing a wide range of use cases.

These plans should include actively testing and refining use cases that leverage the power of Gen AI, such as composing financial reports and summaries.

While AI is currently most commonly used in accounting and financial reporting, its use is spreading across finance.

Using AI to improve the productivity,engagement, and retention of staff should be top of mind.

Act early to establish AI guidelines and governance mechanisms, create digital processes to meet regulatory requirements, and shift to modern IT platforms that facilitate AI. Crucially, financial teams should pilot AI initiatives to validate ROI and ensure effectiveness before scaling these solutions across the department.

Transparency is a common blind spot that, if left unattended, could lead to a loss of trust and accountability. Sustainability is another area often overlooked: an increase in AI-driven data consumption can push up carbon footprints

To help ensure an effective control environment, including assessing AI governance maturity and providing third-party attestation over the use of AI. Auditors should be advanced in using AI themselves, such as for data analysis and risk detection in the audit.

Discover the AI maturity of your organization

Is your organization a leader, implementer, or beginner? KPMG has developed a benchmarking tool designed to help organizations assess their progress in the AI transformation journey. Take our quick assessment to see where your organization stands.

This will identify strengths and weaknesses based on your answers — and highlight areas for prioritized action based on your industry.

The vision of our experts

Research report April 2024

In April 2024, earlier research was conducted on the role of AI within financial reporting. The survey of 1,800 financial reporting executives worldwide shed new light on these important questions - and concluded that we are on the eve of a real revolution in financial reporting: we are moving from the “digital age” to the “AI age". View the research report or the infographic, focused on the Dutch market, with the research results from April 2024.