Are you considering going public?

Taking your company public (like an IPO or Bond offering) is a significant event that can help unlock new markets and significant growth. With the right preparation and the right guidance you can have confidence in a smooth and efficient IPO process. Preparing early, before you face undue time pressure from the offering process, will offer you a good start, reduce your risks and avoid significant surprises.

Important IPO challenges

An IPO requires intensive preparatory measures that demand a lot from a company and often has to be carried out under considerable time pressure. Although companies face different challenges in their IPO process, experience teaches us that the common themes are:

Extent of resources

The IPO process requires intensive effort over extended periods of time with tight deadlines. You also need to focus your attention on running the business. It is extremely important to have sufficient additional resources to meet the ‘business as usual’ requirements and additional workload associated with the IPO process.

Information

The IPO preparation process involves identifying, reviewing and processing a lot of information to be provided to the support deal team and forming part of the relevant IPO documents. This demands a lot of analyses and time from your company. Your current teams may not have the capacity and skills needed to handle this.

Relevant skills

Given the complexity associated with an IPO, you will need a range of skilled employees or professionals to support your IPO process – for financial reporting, tax, legal, internal controls, investor relations, etc. Hiring all of these skills and creating an internal team may not be feasible in the short term.

Coordination

By using a seamless preparation process, the deal team can ensure that its numerous workflows are streamlined. Solid project management is a must to ensure a successful and timely completion of all required tasks and to avoid duplication of work. With these challenges and complexity in mind, you need a reliable, independent IPO advisor who can guide you through the entire process and support you on your IPO journey.

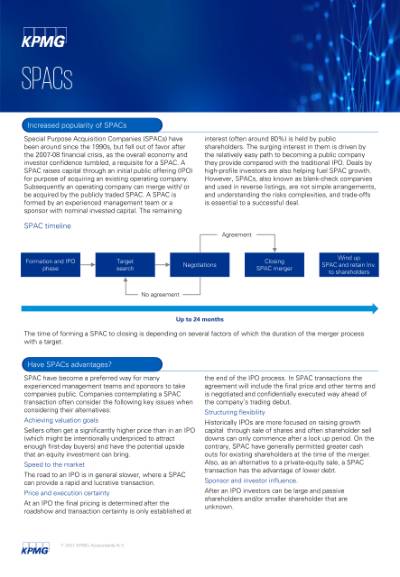

SPAC

SPAC has become a preferred way of listing companies for many experienced management teams and sponsors. Attached you will find our flyer and brochure with information about a SPAC transaction and how we can assist you in such a process.

How can KPMG help

The KPMG Capital Markets team provides a full range of services to assist you with your public offering or alternative strategies, including:

- performing a comprehensive IPO readiness assessment to identify your needs and any gaps and providing actionable recommendations to support the IPO process efficiently and cost effectively;

- addressing the cross-functional impications of structural changes that may arise from the registration process and new requirements for internal controls, corporate governance, tax, and financial reporting;

- guiding you throughout the offering process to implement the necessary requirements to build a sustainable approach to meet the needs of a public company;

- providing assistance in the preparation of the necessary financial statements and the content of the offering document, including an audit trail and support in the (approval) process with the regulator;

- providing assurance by means of a comfort letter.

Capital Markets & Accounting Advisory Services (CMAAS) comprises a dedicated team of professionals providing accounting and financial reporting advice on a wide range of transactions and events, including adherence to new or revised accounting standards and assistance during (Capital Market) transactions. Due to our technical knowledge, industry experience and project management skills, we are well equipped to assist you in a variety of projects.