In today's rapidly evolving business environment, the importance of Environmental, Social, and Governance (ESG) data cannot be overstated. ESG data has become a core element of corporate strategy in shaping brand reputation, influencing investors’ decisions and driving long-term visions. The first step towards driving real progress, in terms of mitigating risks and seizing opportunities, is ensuring the right data is gathered and correctly governed.

As organizations strive to get more insights into their ESG data and try to meet requirements for reporting ensuring the data is accurate and reliable is non-negotiable. An ESG data domain with a robust ESG data governance framework is no longer a nice-to-have but essential for building trust, enabling transparency, and driving sustainable impact.

In this article we explore the importance of establishing an ESG data governance framework for a dedicated ESG data domain. We highlight the key challenges it addresses and outline essential steps to build a framework that ensures ESG data is reliable and transparent.

Improving ESG data quality through effective data governance

ESG data and the ability to ensure its high quality for purposes such as reporting are inherently complex. Organizations must embed ESG data governance into existing business data domains and processes to take a strategic approach to sustainability. This integration presents challenges to any organization with a sizable Data & IT landscape.

Despite recent uncertainties regarding the degree to which the Omnibus regulations will be enforced, ESG data governance should be implemented, to ensure reliable ESG data and robust reporting. Recent research on Omnibus has shown 88% of organizations are continuing with their ESRS implementation (KPMG, 2025). The main reasons cited include:

- Strategic relevance of sustainability reporting to satisfy investors’ information needs and access to capital.

- Using this proposed extra time for focusing on no-regret moves, carbon accounting, climate risk and resilience analysis, transition plans, and internal governance systems.

Despite the uncertainty raised by the Omnibus announcement, the importance of a well-governed ESG data domain remains indispensable to navigate the complexities of ESG data. ESG data typically comes from many departments, each with its own priorities. To ensure ESG data is accurate, consistent, and reliable, both technical knowledge and business knowledge are required to understand the data originating from different domains and sources. Therefore, a logical allocation of responsibilities through a governance framework is a key success factor for enabling high-quality and trustworthy ESG data.

Why ESG data needs its own data domain

Setting up a centralized ESG data domain with clearly defined ownership is essential for organizations to gain a comprehensive view of ESG data. Yet, many organizations struggle with implementation. How come?

ESG data originates from various parts of the organization and often includes external sources. Internally, departments such as HR, Finance, and Sustainability teams contribute data, ranging from employee diversity metrics to energy consumption figures. Externally, suppliers may provide data on their emissions. This fragmented nature makes ESG data fundamentally different and more challenging compared to most other business data, for which ownership is typically well-defined within the respective data domain. Moreover, because ESG data comes from diverse internal and external sources, definitions are often unclear or inconsistent. Sometimes even multiple interpretations exist within the same organization, making alignment and governance significantly more complex.

To effectively manage this fragmented and challenging nature of ESG data, it is crucial to understand how ESG data products relate to the existing data domains within an organization. For instance, a sustainability report might integrate HR data for employee metrics and Operations data for energy usage.

Delivering trustworthy ESG data products requires clear ownership within each contributing data domain, supported by an ESG data domain governed under an ESG data governance framework. This setup enables organizations to centralize ESG data, coordinate responsibilities, and ensures consistent integration and governance of data from different data domains.

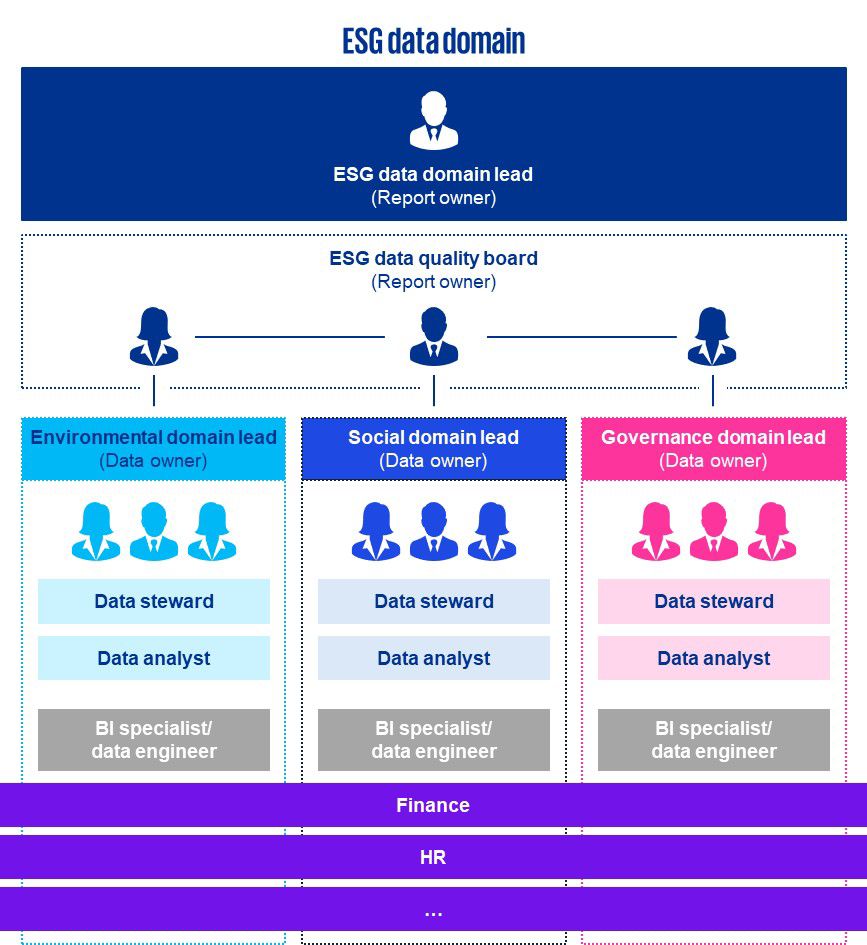

Figure 1: illustrative example of the setup of an ESG data domain.

By defining clear ownership for ESG data, organizations enhance accountability, embed ESG data into business-as-usual processes, and improve the accuracy and reliability of ESG data products. Without clear ownership and a dedicated ESG data domain, ESG data remains fragmented and less reliable. Therefore, establishing a dedicated ESG data domain with a strong data governance framework is essential to centralize ESG data, clarify ownership, improve quality, and use ESG data effectively for developing ESG data products.

By defining clear ownership for ESG data, organizations enhance accountability, embed ESG data into business-as-usual processes, and improve the accuracy and reliability of ESG data products. Without clear ownership and a dedicated ESG data domain, ESG data remains fragmented and less reliable. Therefore, establishing a dedicated ESG data domain with a strong data governance framework is essential to centralize ESG data, clarify ownership, improve quality, and use ESG data effectively for developing ESG data products.

Setting up an ESG data domain: roles, ownership, and key actions

Establishing a dedicated ESG data domain with an effective data governance framework is essential for maintaining the trustworthiness of ESG data, from data collection to the generation of reliable insights. However, this is a significant challenge for many organizations. For setting up an ESG data domain, we identify five key actions:

- Uniform data definitions

Setting up and documenting uniform data definitions for all ESG data points, be it for reports or analyses, streamlines data collection, processing and reporting. This is a combined effort of the data producer and the data consumer. The producing party knows which data it sends, and the receiving party should be able to work with the data. Therefore, it is key that they discuss the data definitions together, so transparency is enhanced and internal coordination and communication across units are improved. - Mapping the current data governance structure

Assess the current data governance structure and identify where changes or adjustments are needed to support an ESG data governance framework. This facilitates the integration of representatives from all relevant business units under a unified approach. Ultimately, ESG data should be governed as part of the business-as-usual data governance model, rather than being treated as a separate or stand-alone element. - Clear roles and responsibilities for ESG data

Assign roles such as ESG data owners, data stewards, and a central ESG data domain lead with well-defined responsibilities. These roles ensure accountability and coordination across the ESG data landscape. Designing the operation model: centralized, hybrid or decentralized

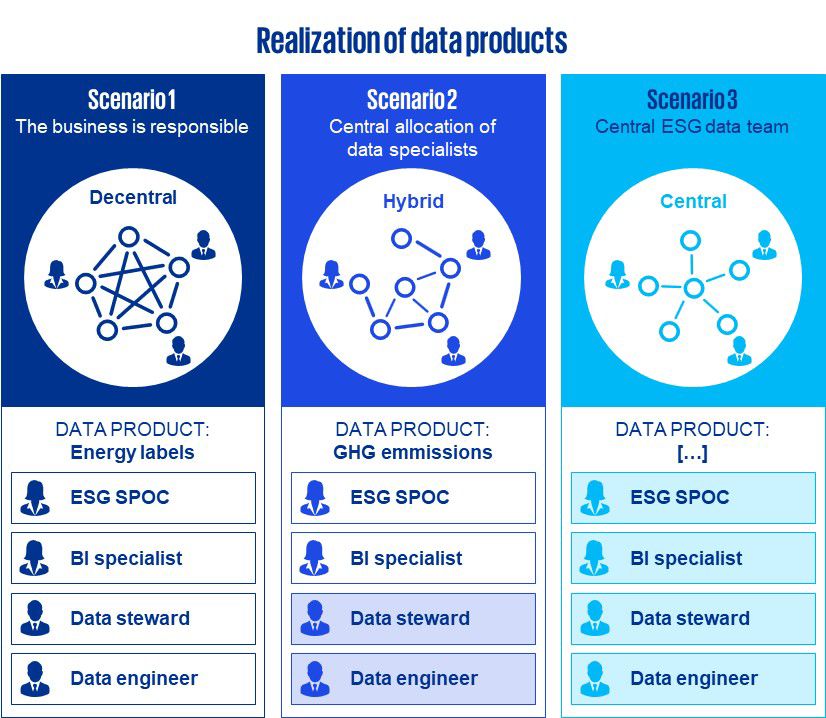

Determine how ESG data governance will be managed. In a decentralized model, ownership remains within individual business units. A hybrid model combines business ownership with central support, while a centralized model places ownership entirely within the ESG data domain. The choice between these models depends on factors such as available resources, complexity of the Data & IT landscape and organizational priorities. There is no one-size-fits-all solution. Each organization should make sure its choice fits its policy and strategic objectives.

Figure 2: illustration of the three operating models, including the distribution of ownership among them.

- Supporting technology and tools

Leverage tools that enable ESG data collection, processing, and quality monitoring. This leads to more accurate, complete, and consistent data. Examples include data catalogs for discovery, data quality tools to ensure consistency, and data lineage tools to improve traceability. These technologies help to reduce rework and clarify accountability.

Establishing these governance processes lays the foundation for high-quality and reliable data, which is essential for the successful alignment of ESG initiatives. Clear accountability and transparency foster confidence in the accuracy of data and support informed decision-making.

ESG data governance as part of your ESG journey

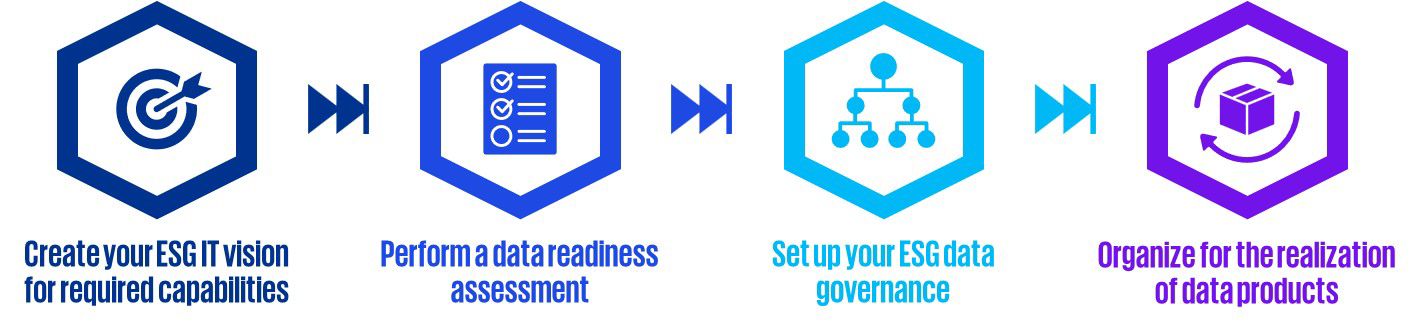

While the steps to establish an ESG data domain with a governance framework are clear, many organizations face challenges during implementation. From difficulties in tracking the data lineage to a lack of ownership and accountability, these pitfalls can slow progress and undermine data quality. Below, we outline some main challenges with tactical strategies to overcome them and how you can best shape your ESG journey:

Adjustments to existing solutions

ESG data needs to be embedded within the existing business structures, which makes it difficult to pinpoint the capabilities required. Start by identifying which capabilities already exist in the business. Create an ESG IT vision and determine which capabilities you need. This will help clarify where time and effort should be invested.Data is immature

To generate reliable insights or meet reporting requirements, ESG data must be prepared for the requested metrics. Often, data is immature because of manual data collection, a lack of systematic audit trails, and unstandardized data transformation. A data readiness assessment can help by evaluating ESG data across seven maturity dimensions, each with its own score, to identify areas for improvement. When you start, there is no wrong in handling immature ESG data, as long as you identify shortcomings and set the right KPIs for the right people within your data governance framework since you will slowly but surely improveESG data having different sources

As mentioned earlier, ESG data originates from multiple internal departments and external sources, and both technical knowledge and business knowledge are required to truly understand the data. The challenge lies in bringing this data together in a unified and measurable way. This is not only about centralizing data but also about ensuring consistency in definitions across sources. Without this consistency, comparisons and reporting become unreliable. Clear roles and responsibilities are essential to set up your ESG data governance. Employees must know who is responsible for which data within their domain to ensure all ESG data is centralized effectively. An overarching ESG data domain and ESG Data Quality Board with roles such as Environmental, Social and Governance domain leads can help ensure high-quality ESG data is collected, consistently defined, and properly governed.Ownership not well-defined

Organizations often struggle to assign clear ownership for ESG data products. Even when data is ready and has a suitable maturity level, unclear ownership can delay finalization of the data products. Start with an easy rule of thumb: whoever produces the data owns it. Anyone who touches the data afterwards is entrusted with stewardship and should communicate the requirements on that data.

Figure 3: ESG data journey.

Conclusion: building a strong foundation for ESG data governance

In conclusion, establishing a dedicated ESG data domain supported by a data governance framework is essential for organizations aiming to improve ESG data quality, meet regulatory requirements, and drive sustainable impact. By recognizing the fragmented nature of ESG data, embedding governance into existing structures, and defining clear roles and responsibilities, organizations can overcome common challenges and ensure their ESG data is accurate, consistent, and reliable.

To truly succeed, ESG data governance must be supported by the right operating model and enabling technologies. These foundations not only improve data transparency and accountability but also empower organizations to make informed decisions and report with confidence. If you want a tailored approach to building, implementing and embedding such a framework in your organization, reach out to KPMG’s ESG Tech & Data experts.

This article was written by Myrthe Smith, Jasper Taling and Kevin van Vliet.