In the reporting year 2024, a first wave of companies in the Netherlands had to report their sustainability information for the first time in accordance with the ESRS1. Reporting in accordance with ESRS will increase comparability and provide investors with information on the companies’ performance regarding their identified sustainability impacts, risks and opportunities. The focus of this article is on requirement ESRS 2 48(d) which requires that companies provide information on the current financial effects of their identified risks and opportunities.

A first analysis identified that these disclosure requirements proved very challenging for the 26 large (mainly listed) first-wave CSRD reporters. Companies provided limited and only very implicit information on current financial effects, therefore offering limited information for investors as well as decreasing the comparability of the sustainability statements. Furthermore, in many cases there was a disconnection between the information within the current financial effects disclosures and the related financial statement information.

Preparers of CSRD reporting would benefit from improved transparency on their current financial effects reporting by:

- reporting more explicitly on their current financial effects, including the size of the effects;

- increasing the value for investors by being more transparent on the financial risk management process;

- creating a clear connection between the sustainability statements and the financial statements.

Introduction to current financial effects

The purpose of this analysis was to understand how a group of 26 large companies in the Netherlands (mainly AEX-listed companies) have approached the current financial effects disclosure for the first wave of ESRS reporting. From a financial materiality perspective, companies reporting on the financial effects of their risks and opportunities is critical information for users of the sustainability statements2 to understand the financial impacts of these risks and to make a financial assessment of the company’s current and prospective situation. In this article, a deeper-dive analysis is performed on the current financial effects disclosures, as these are highly relevant but proved difficult for Wave 1 ESRS reporting in the Netherlands.

What is requested in the ESRS 2 48 disclosure?

ESRS requires that if a company identifies a risk or opportunity as part of the financial materiality assessment within their Double Materiality Assessment (DMA), under Disclosure Requirements (DR) ESRS 2 48(d) and (e), it must disclose the financial effects (current and anticipated) on its financial position, financial performance and cash flows (‘financial information’). This disclosure requirement is specifically important, as it provides relevant information for investors and other users to understand how actual and/or potential sustainability matters can impact the financial position, financial performance and cash flows. This offers clear insights for investors and other users of the sustainability statements.

This article focuses on the current financial effects and not on the anticipated financial effects due to this being a phased-in DR per the ESRS (ESRS 1, Appendix C). Furthermore, as part of the Omnibus Package, this specific DR is understood to be phased in until 2027 and therefore not required to be disclosed in FY2025 and 2026.

The (proposed) revised ESRS standards released on 25 July 2025 continue to require information on current financial effects.

It is emphasised that current and anticipated financial effects reporting is part of the wider disclosure on creating a better understanding of the interactions between the company’s material impacts, risks and opportunities and its strategy and business model. This also includes the element of resilience of the strategy and business model to address material risks. The standard for climate change (E1) includes some more detailed requirements on current and financial effects in relation to physical and transition risks from climate change.

Deep-dive analysis into Wave 1 reporting of current financial effects in the Netherlands

This analysis focused on reviewing the current financial effects disclosures of the 26 selected companies across four categories:

- E1 Climate change

- Other environmental topics (E2-E5)

- Social topics (S1-S4)

- Governance (G1)

The purpose was to deep dive into how companies met the current financial effects disclosure in their first CSRD reports.

- Explicit disclosure of ‘current financial effects’ (i.e., did the company use the ESRS terminology ‘current financial effects’; or synonymous language);

- Location of current financial effects disclosure (i.e., where in the Annual Report were current financial effects disclosed); and

- Nature of the current financial effects disclosure (i.e., details included in the disclosure)

Observations from deep-dive analysis

The analysis highlighted that it appears challenging for companies to determine the current financial effects of their material risks. We identified three key observational themes from our deep dive:

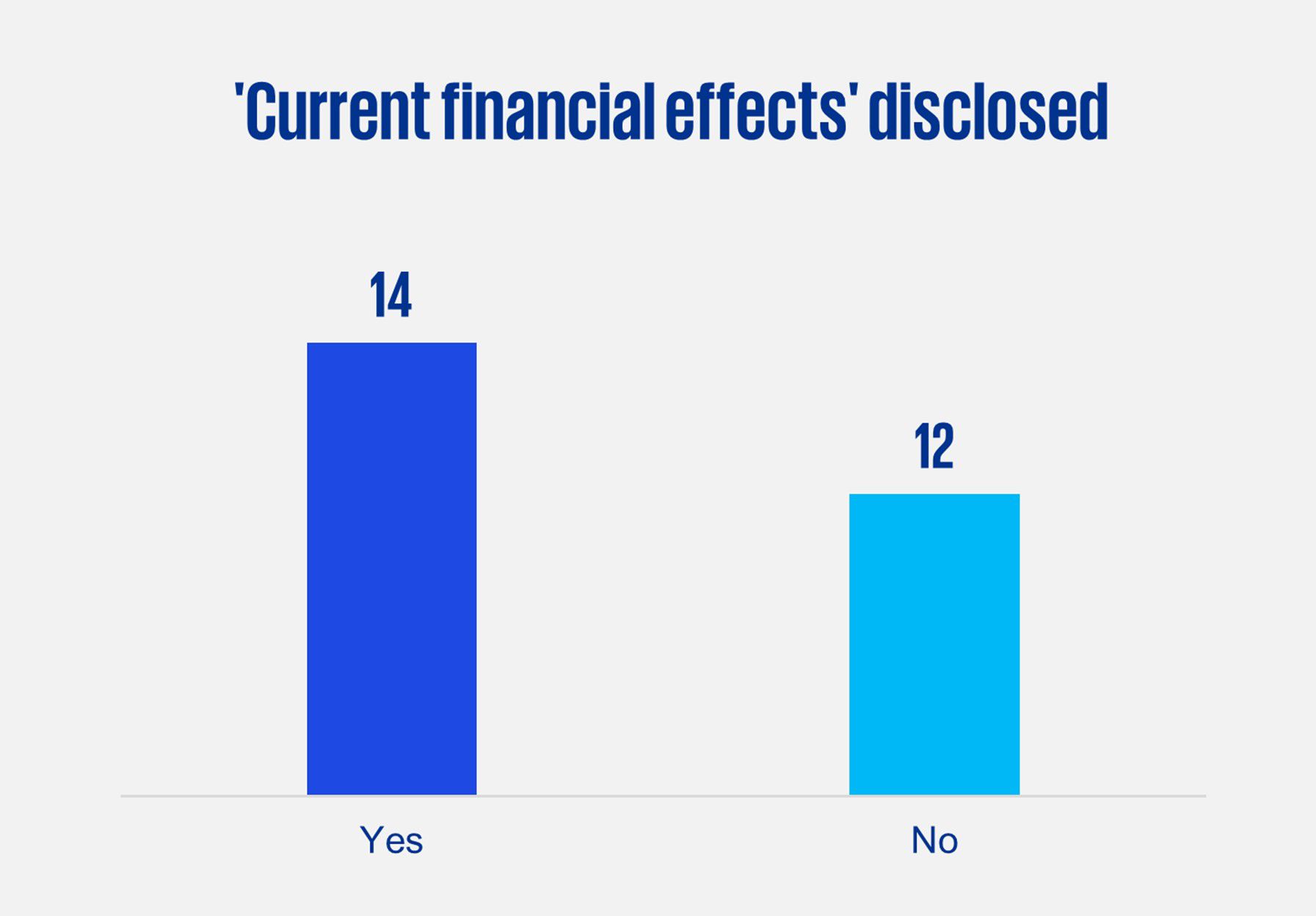

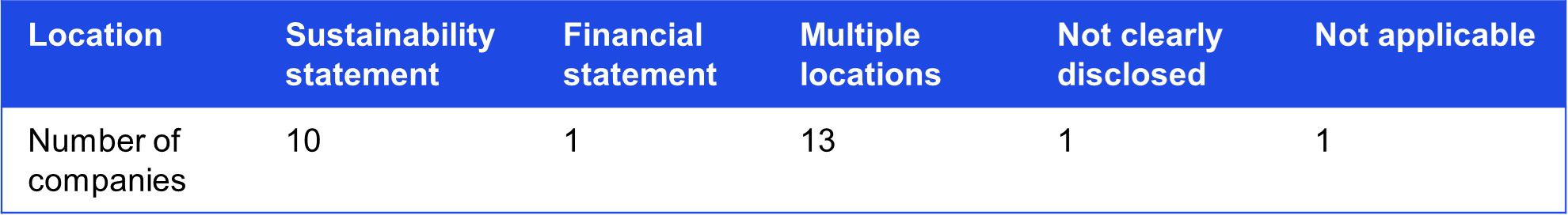

- The current financial effects disclosures were rarely separately identifiable or explicitly referenced. Only 14 of the 26 companies explicitly applied the ESRS terminology of ‘current financial effects’3 regarding their material risk disclosures. Refer to Figure 1 below.

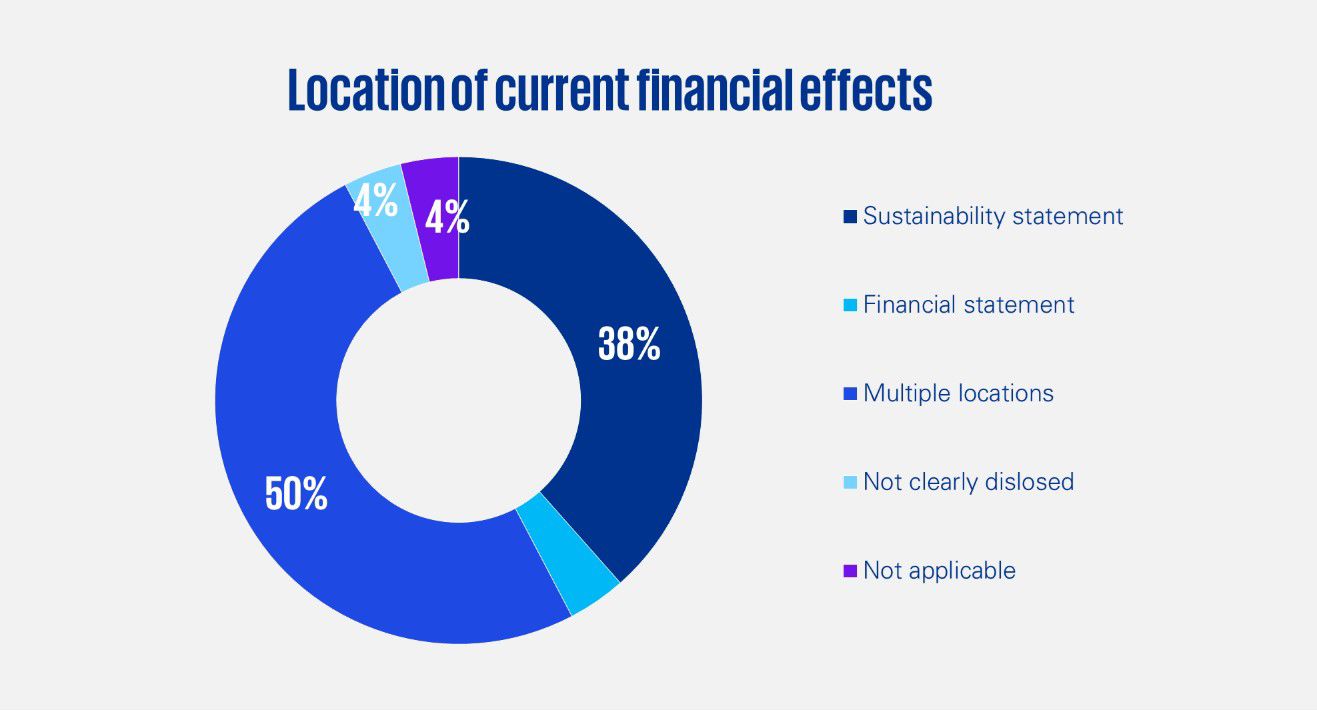

- In Figure 2, we present the location of the current financial effects disclosures, taking into account that some companies implicitly reported on their current financial effects. We observed that the disclosures were often disconnected in multiple locations of the report, which was seen in 13 of the 26 companies that appeared to disclose their current financial effects in multiple locations without an obvious trail linking the relevant disclosures or with implicit use of incorporation by reference.

- The implicit nature of the disclosures can make it difficult for the reader of the report to locate the relevant disclosures, especially because the disclosures on financial effects are often fragmented across different sections of the sustainability statements or elsewhere. Subsequently, this may limit comprehensibility.

Figure 1. The figure shows the companies that used explicit ESRS terminology in their disclosure. For this analysis, we assessed for disclosure of current financial effects or synonymous language

Figure 2. The figure shows the location of companies’ current financial disclosures (implicit and explicit) as interpreted by KPMG. ‘Not clearly disclosed’ means that it could not be identified.

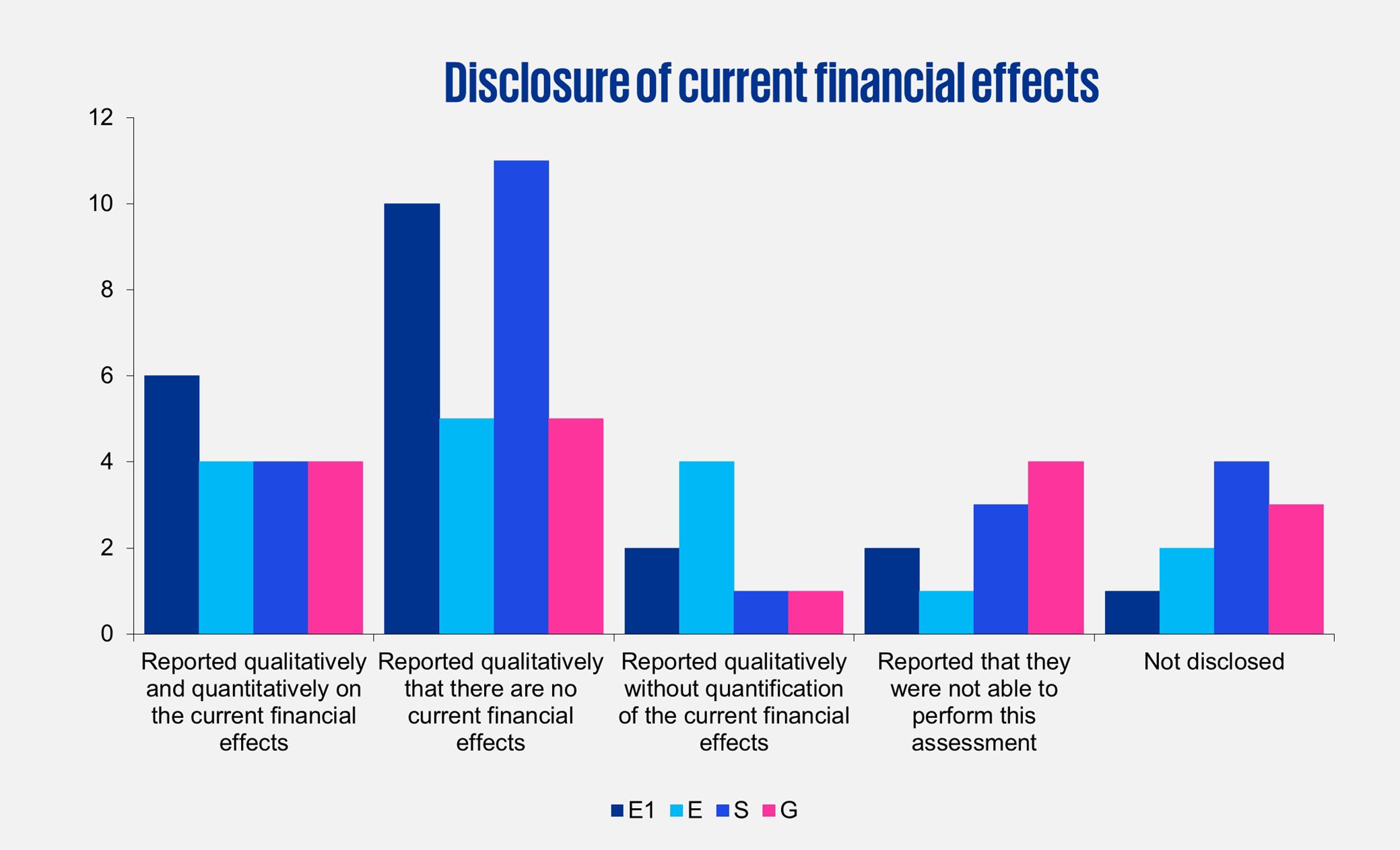

- Less than 25% of the companies disclosed a quantified financial figure to meet the current financial effects disclosure. This highlights that it currently appears challenging for companies to quantify the current financial effects of their material risks. Refer to Figure 3 below, which presents that the topic with the highest number of companies disclosing a quantitative figure for the current financial effects disclosure was E1 Climate change with six companies.

- Only two of the 26 companies assessed disclosed the quantitative threshold used internally to determine if a financial effect is material and requiring disclosure.

- The absence of both qualitative and quantitative thresholds in current financial effects reporting can diminish the reader's understanding of how financial materiality intersects with a company's sustainability risks. Although the ESRS do not mandate the disclosure of a quantified threshold, incorporating such a framework in accordance with ESRS 1 DR 31 (assessment of material information) could be beneficial. It would provide clarity to both the reporting entity and readers by outlining the financial parameters used to assess current financial impacts.

- Furthermore, there was limited detail disclosed of the underlying assessment and process performed to determine the current financial effects of the risks and opportunities. As can be seen in Figure 3, the predominant approach across all the topics from companies was to disclose qualitatively that there were no current financial effects, with minimal further substantiation for the assessment performed to reach this conclusion. This creates a lack of insight for the reader to understand:

(a) how financially impacted the company is by its sustainability risks and opportunities; and

(b) how the company is managing its risks and opportunities given the financial effect on the organisation.

Figure 3. The figure shows how companies have reported on the current financial effects disclosures.4 The graph illustrates whether current financial effects have been reported on qualitatively and/or quantitatively, not at all, or by emphasising that the entity was unable to disclose current financial effects. This assessment has been carried out across various topics: E1, Other E topics, S and G. Note: More risks were reported under E1 and S, resulting in significantly higher graph values for these categories compared to the other E topics and G. This should be considered when interpreting the data. For more details, please see the table below.

Total number of material risks and opportunities

| Topic | Risks | Opportunities | None |

| E1 | 60 | 20 | 3 |

| Other E topics | 46 | 47 | 5 |

| S | 112 | 26 | 2 |

| G | 37 | 6 | 2 |

- The disclosures were often implicitly embedded within other disclosures (e.g., scenario analysis, financial statement considerations of climate-related risks). This was observed mainly for the E1 topics, where climate-related risk reporting is more advanced due to voluntary frameworks such as the TCFD5. For other ESG topics, the disclosures were significantly less reported on, especially for S and G.

- Reporting in specific locations of the annual report is allowed under ESRS with appropriate referencing via the ‘incorporation by reference’ protocol. However, without clear referencing or consistent application of this function, this leads to a disconnection between the sustainability and financial information, which is critical for this disclosure.

- There was no consistent approach to disclosure of the specific financial information assessed (e.g., financial position, financial performance, cash flows). Companies often used broad terms to describe the qualitative impacts that could arise due to their material risks, without concretely linking these to specific financial information or their identified risks.

- Under ESRS 1 DR 124; 125 direct and indirect connectivity with the financial statements via the disclosure of monetary amounts or other quantitative datapoints requires either direct reference to the relevant financial statement information or an explanation of the connection to the most relevant financial information.

Recommendations for companies moving forward

Moving forward, companies can implement the following recommendations to respond to the challenges identified in our three key observational themes:

- Disclose using explicit ESRS terminology ‘current financial effects’ and clearly identify with appropriate referencing to the relevant disclosures when using incorporation by reference.

- Plainly state where in the sustainability statement your current financial disclosure is positioned. This could be included in the content index table.

- Determine an approach for assessing current financial effects at the appropriate level for your company and disclose the approach accordingly.

a) Enhance your approach to addressing the current financial effects disclosure requirement.

This includes:

- building capacity to quantify the financial effects of the material risks and opportunities;

- embedding this assessment into the overall risk management strategy;

- disclosing greater information on this process to inform users of the sustainability statement;

- integrating a financial threshold into the financial risk assessment within the DMA to ensure that identified material risks and opportunities are appropriately selected as material topics requiring quantification of their financial effects on the company in the short, medium, and long term to inform the reader on what is considered a material financial effect; and

- leveraging this knowledge for future assessments of anticipated financial effects risk and opportunity analysis, given these requirements will be required in the near future.

a) Clearly identify the financial information affected including explicit referencing to notes in the financial statements with section references, page numbers and hyperlinks to facilitate the connection between the financial and sustainability information.

Important questions to be asked in order to improve the financial information reported in the ESRS

- Have we used a financial threshold linked to our existing risk management processes within the financial materiality assessment component of our DMA? How does this threshold translate into our revenue or other financial information?

- Have we integrated sustainability risks & opportunities (identified in the DMA) into our existing risk management processes? If so, how were these integrated and assessed within these processes?

- Have we developed an approach for assessing current and anticipated financial effects at the appropriate level for our company?

- Where and how do we want to report on current financial effects? To what extent will we be making use of cross-referencing throughout the report?

Conclusion

Our view is that the importance of current financial effects reporting and connecting the financial information with the sustainability risks is fundamental to best practice sustainability/risk reporting. The observations in this analysis highlight that first-wave CSRD reporters in the Netherlands found this requirement particularly challenging. Despite the uncertainty that the Omnibus proposal presents for the future of the CSRD, the usefulness of integrated financial and sustainability risk reporting and the consequences of disconnection are topics that require appropriate attention from companies moving forward. The insights above can be used to strengthen company approaches to this critical reporting requirement in order to better understand current material sustainability risks to their business and to build a platform for developing forward-looking insights that connect their financial and sustainability information. Ensuring a robust link between financial and sustainability information that is readily available and reported on consistently will ensure that companies are better prepared from a strategic and resilience perspective to plan for their sustainability challenges in the short, medium, and long term.