The low-carbon and resources resilient transitioning of the European economy is creating new investment opportunities and products. Lucrative deals are starting to emerge in the market where investors support companies to green their operations and remain successful in a future society, while leveraging on EU financing to become available under the Clean Industrial Deal (CID).

The European Union (EU) economy has been facing two key security challenges: energy and resources (critical raw materials). The ‘European Green Deal’ in 2019 aimed to address these challenges through an ambitious strategy to “transform the EU into a modern, resource-efficient and competitive economy”.

The Green Deal started a new trend in the market, where non-financial matters (known as ESG) became core to every conversation. Companies and investors tried to understand the ESG topics, their impact on operations, their value drivers and how to integrate them in decision making. However, as EU mainly followed the course of compliance to implement the Green Deal, ESG was merely treated from risk, compliance and disclosure requirements perspectives. The business transformation value was missed.

The EU recognized the shortcomings of its approach, and recently published a new proposal, the ‘Clean Industrial Deal’, shifting focus from compliance-driven to investment stimulation in two key areas: decarbonization and resource efficiency. The CID highlights where value is created, paving the way for value-chain-wide investments and innovations.

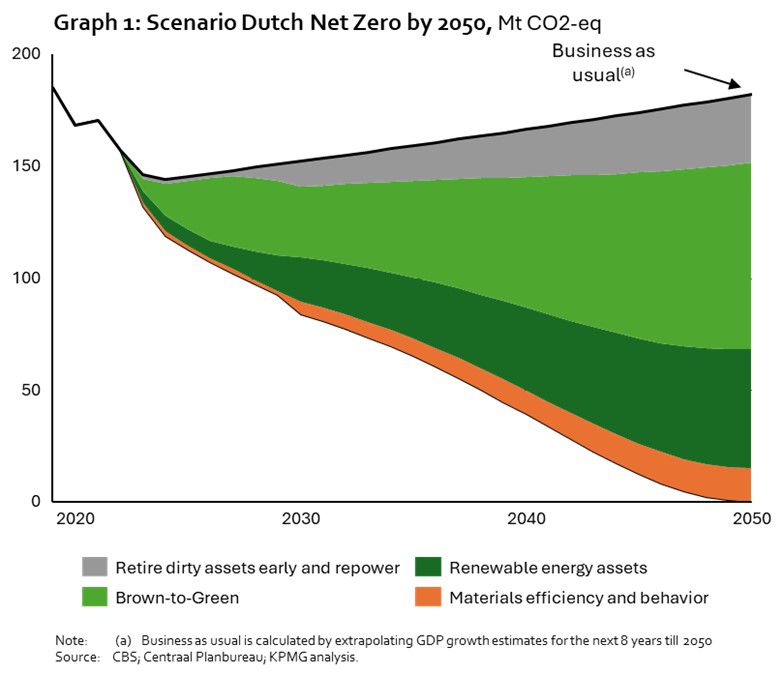

Enabling the transition requires significant financing to transform EU today’s brown assets into future green ones. If we consider for example the Dutch economy, greening brown assets is the largest contributor to achieving the energy transition and net zero targets, besides ongoing investments into renewables and energy storage – see graph 1.

Contrary to a green investment, where the target already is a green asset, a brown-to-green investment targets a conventional (grey) asset with the aim of transforming (parts of) its operating model around the climate-circularity nexus. In practice, this means investing in electrification, zero- and low-carbon technologies, process optimization, energy efficiency measures, and alternative raw and packaging materials to lower the carbon footprint of any company. This positions the transformed asset competitively within its industry, and ensures value creation over the longer term by improving the cost base, expanding topline opportunities as well as terminal value or exit multiples.

While the decarbonization and circularity levers across sectors are known, and many are economically viable options, brown-to-green investment remains an untapped opportunity that investors are starting to explore. This type of investment tends to require higher capital expenditure, knowledge and expertise to realize the potential economically. Our clients have been reaching out to understand where opportunities can be seized and value created as the economy transitions towards low-carbon and resource-resiliency. At KPMG, we are supporting all types of investors across the deal cycle with dedicated services, such as:

- Understanding and quantifying the achievable levers for both carbon/resource transition and financial returns;

- Determining realistic ambitions, and developing the relevant investment strategies;

- Designing frameworks for pre- and post-investments to generate and monitor the desired impacts;

- Developing processes and criteria to integrate financing strategies into the investment cycle;

- Exploring the investible universe;

- Supporting the preparation of business cases and communication materials.

If you are interested in capturing value from new investments opportunities while supporting the economy transition, then simply contact us to guide you through your investment strategy and deal-making journey.